Tariffs, tensions and turning points: Lazard's stark mid-year global outlook

Midway through 2025, the world looks very different from the start of the year. Despite the resilience of the equity markets, the economic and policy backdrop is becoming more fractured, unpredictable and fragile across many regions.

After decades spent watching markets respond to political and policy shifts, I believe we are now at a critical turning point – one that investors would be unwise to ignore.

United States

Trump 2.0 has brought about some of the most aggressive policy changes I have seen from any modern administration. Since January, the effective average tariff on U.S. imports has increased from 2.7% to 18.7%, with additional hikes already scheduled.

In my base scenario, tariffs could soon average around 20%, with sector-specific and country-level charges creating significant cost pressures throughout the economy. This could then drive core inflation back above 4% and push unemployment higher, while slowing GDP growth to -1%.

- Fiscal policy

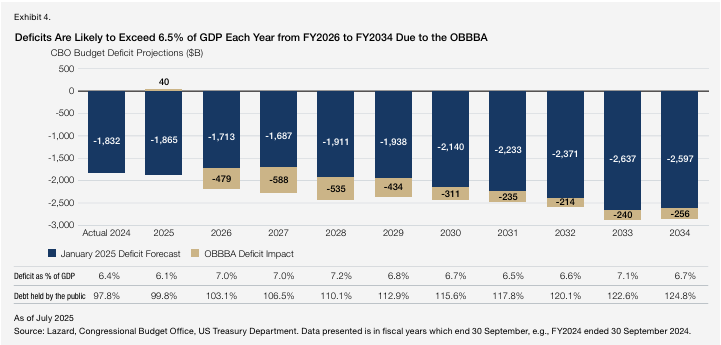

Additionally, Trump’s One Big Beautiful Bill Act (OBBBA) is driving fiscal deficits into uncharted territory. In January, the Congressional Budget Office (CBO) forecast $21.7 trillion in deficits over the next decade – now we’re likely to exceed that by an additional $3.5 to $5.5 trillion.

This combination of higher interest rates, weaker growth, and structurally higher spending presents a serious challenge to US fiscal sustainability.

Source: Lazard, Congressional Budget Office, US Treasury Department. Data presented is in fiscal years which end 30 September, e.g., FY2024 ended 30 September 2024.

- Federal Reserve leadership

Compounding these risks is a growing threat to the independence of the Federal Reserve. Trump has already hinted at the replacement of Fed Chair Jay Powell before the completion of his term in 2026.

Should a more politically malleable nominee take the helm, market confidence in US monetary policy could be shaken, putting both the dollar and US Treasuries at risk.

- Immigration reform

Trump’s immigration crackdown could exacerbate wage pressures and inflation. The administration has set a target of 3,000 deportations per day—a scale not seen since the 1950s. Sectors such as agriculture, construction, and hospitality, which heavily depend on undocumented labour, are likely to suffer from both cost inflation and labour shortages.

China

While stagflation risks impact the US, China is facing its own structural crisis. Now, in the fifth year of a deep property slump, the Chinese economy remains without a credible fiscal stimulus plan.

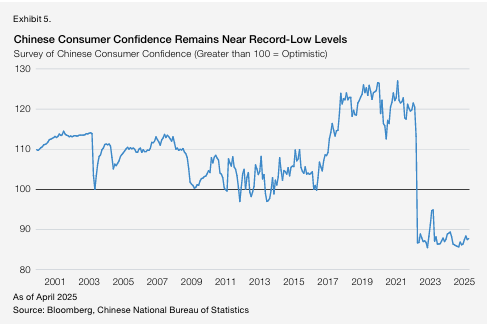

Consumer confidence remains near record lows, foreign direct investment is retreating, and the social safety net remains grossly inadequate. Despite widespread expectations, Beijing has resisted large-scale reform or spending. Without action, growth is likely to remain tepid, and deflation risks will persist.

Source: Bloomberg, Chinese National Bureau of Statistics

Eurozone

Yet, not all the news is negative. I see genuine reasons for optimism in both Europe and Japan.

Germany has broken with decades of fiscal orthodoxy, unveiling €1 trillion in planned infrastructure and defence spending, which could be a pivotal moment for the Eurozone.

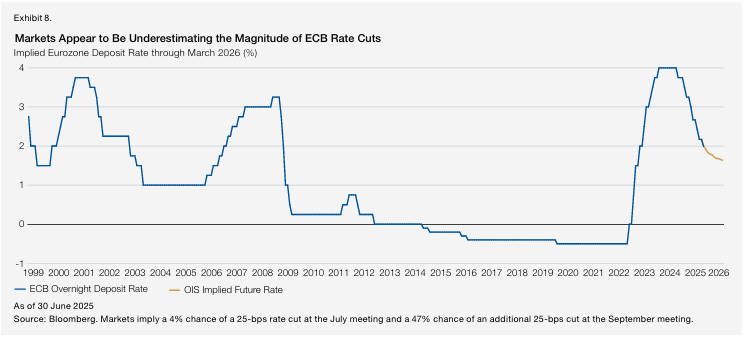

If implemented wisely, this stimulus – alongside ECB easing – has the potential not only to lift short-term growth but also to foster innovation and productivity gains, particularly if Europe can unify its fragmented defence and industrial spending.

Source: Bloomberg. Markets imply a 4% chance of a 25-bps rate cut at the July meeting and a 47% chance of an additional 25-bps cut at the September meeting.

Japan

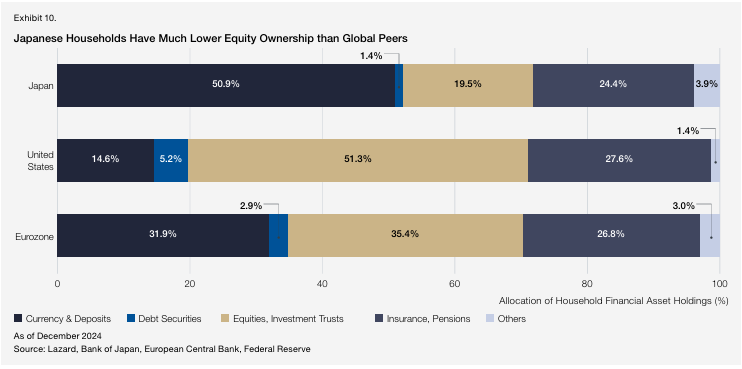

In Japan, inflation has finally taken root after decades of stagnation. Corporate governance reforms are gaining traction, and households are reallocating capital from low-return savings into equities. If this trend persists, Japan could be on the cusp of a long-term re-rating by global investors.

Source: Lazard, Bank of Japan, European Central Bank, Federal Reserve

Final comments

Stepping back, I see a world in transition. The US is becoming less predictable and potentially less competitive. At the same time, other regions – notably Europe and Japan – are quietly addressing long-standing structural issues.

Markets have held up better than expected so far. However, in my view, the consequences of policy decisions made in the first half of 2025 will become far more visible in the second half. Investors would do well to question whether the drivers of the past decade – cheap money, US tech dominance, and global policy stability – are still reliable.

We may be entering a new era of investment. It’s time to reassess what we think we know.

3 topics

.png)

.png)