The 20 biggest gainers (and losers) of ASX reporting season

Across February, the ASX 200 gained +0.23%, making this the fourth consecutive monthly rise, on the back of the following monthly moves for the index:

- January +1.18%

- December +7.1%

- November +4.52%

The Small Ords was up +1.46% for February, also following three good rises in prior months:

- January +0.90%

- December +7%

- November +6.92%.

A few of the big gains in the ASX 200 were among some of the most shorted stocks, including:

- Liontown Resources (ASX: LTR), up +31% shorts at 7.6%

- Pilbara Minerals (ASX: PLS) {$4.20; 3; 0.72%} up +17%, shorts at 21.1%

- Nickel Industries (ASX: NIC) {$0.71; -1; -1.40%} up +18%, shorts at 4,1%

- Chalice Mining (ASX: CHN) {$1.13; -13; -10.32%} up +12.87%, shorts at 10%

- Bellevue Gold (ASX: BGL) {$1.53; 7.5; 5.15%} up +11.7%, shorts at 5.7%

- Mineral Resources (ASX: MIN) {$66.69; -102; -1.51%} up +11.81%, shorts at 5.5%

- Sandfire Resources (ASX: SFR) {$7.59; 1; 0.13%} up +10.93%, shorts at 5.2%

- Core Lithium (ASX: CXO) {$0.21; -0.5; -2.33%} - up +11.84%, shorts at 11.6%.

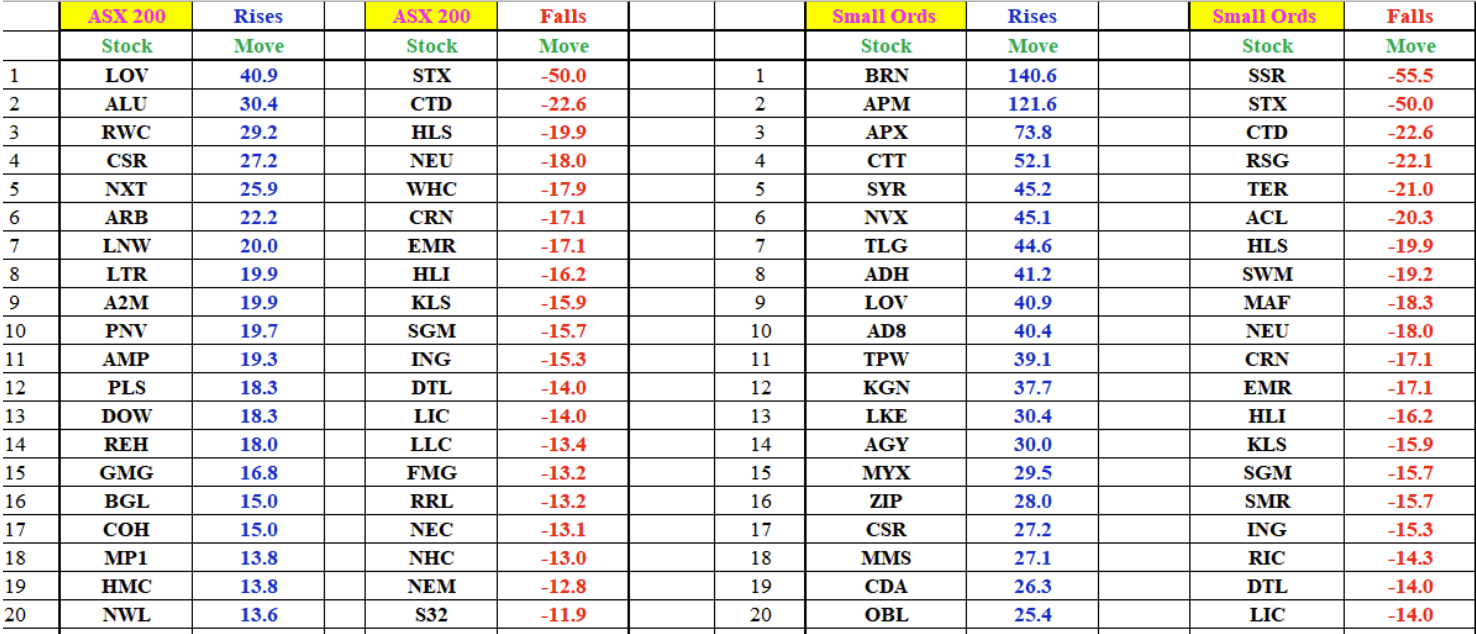

The top 20 rises and falls on the ASX and Small Ords in February 2024

Additions to the Australian Small Cap Index in February:

Deletions:

- Calix (ASX: CXL)

- Chalice Mining (ASX: CHN)

- Core Lithium (ASX: CXO)

- Integral Diagnostics (ASX: IDX)

- Sayona Mining (ASX: SYA)

- Select Harvests (ASX: SHV)

- Seven Group Holdings (ASX: SVW) - moving into the large-cap index.

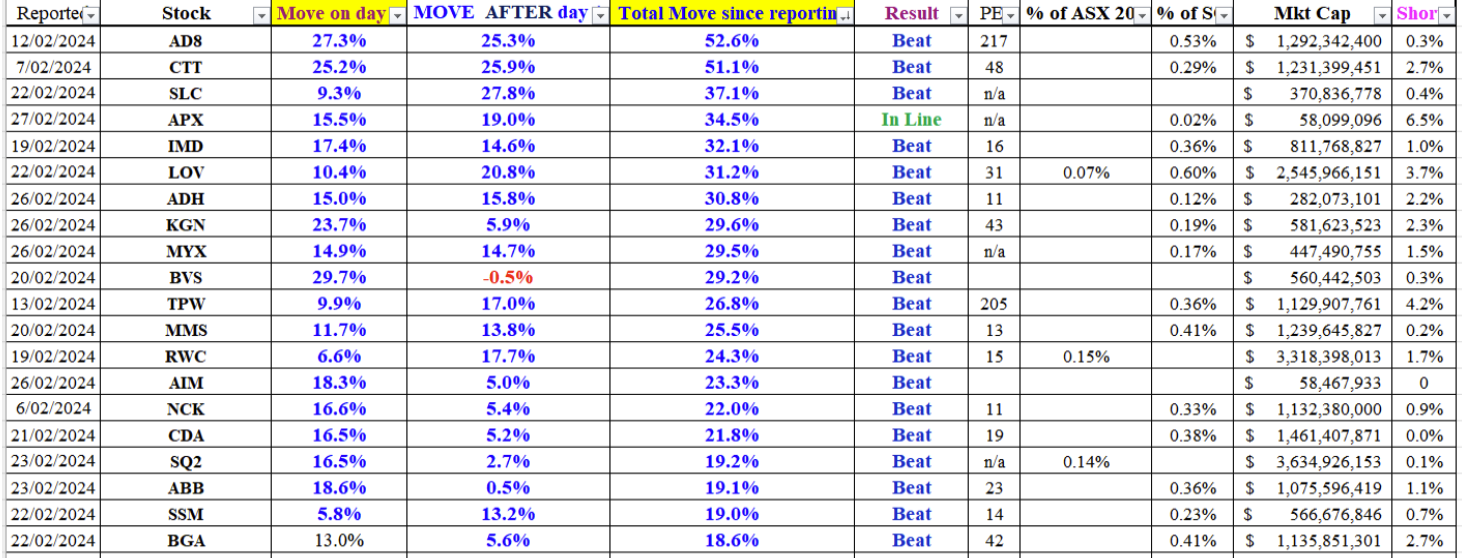

The 20 biggest gainers this reporting season since they reported

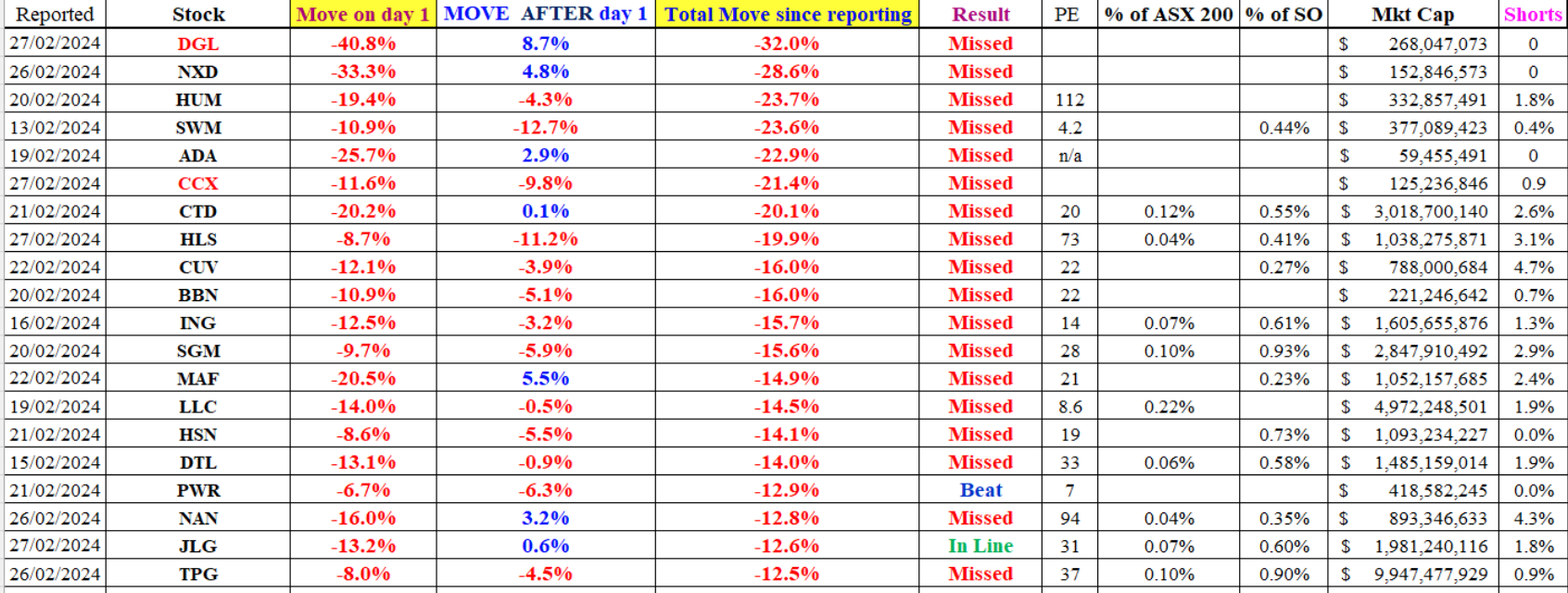

The 20 biggest losers this reporting season since they reported

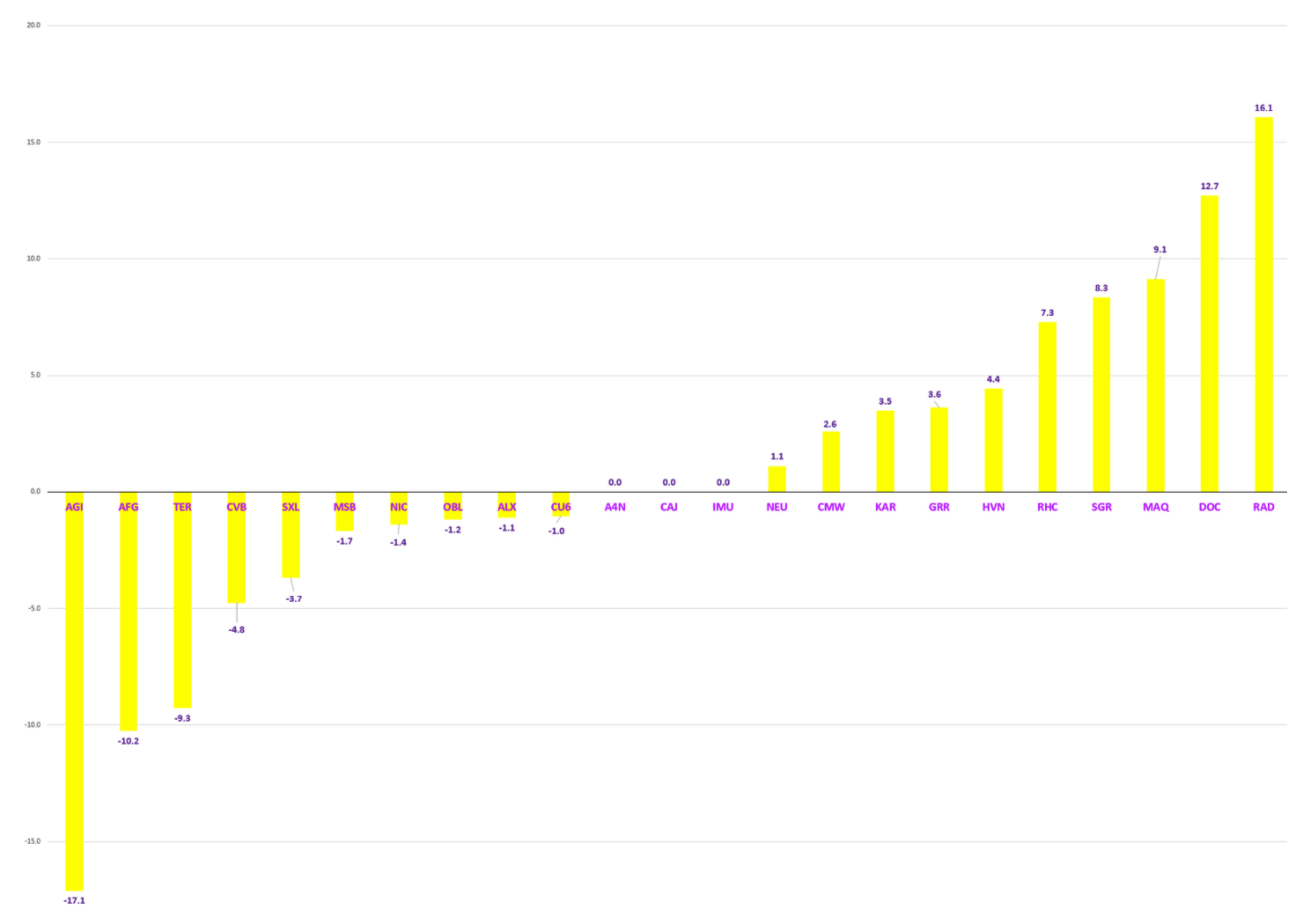

Stocks that reported yesterday – the worst and best movers

Key figures from several of the most notable companies that reported yesterday, and commentary on a few of these, include:

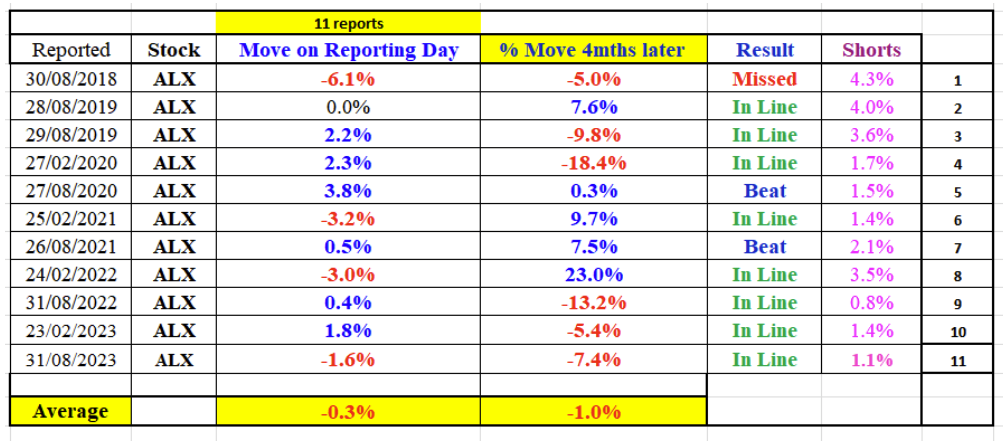

Atlas Arteria (ASX: ALX)

- FY23 revenue up 13% to AU$134 million; EPS of AU$0.177

- Revenue up 13%; EPS Declines

- FY revenue A$134.0 million, up 13% on year

- FY net profit A$256.3 million, up 6.3% on year.

How Atlas Arteria has traded on reporting day, then four months later

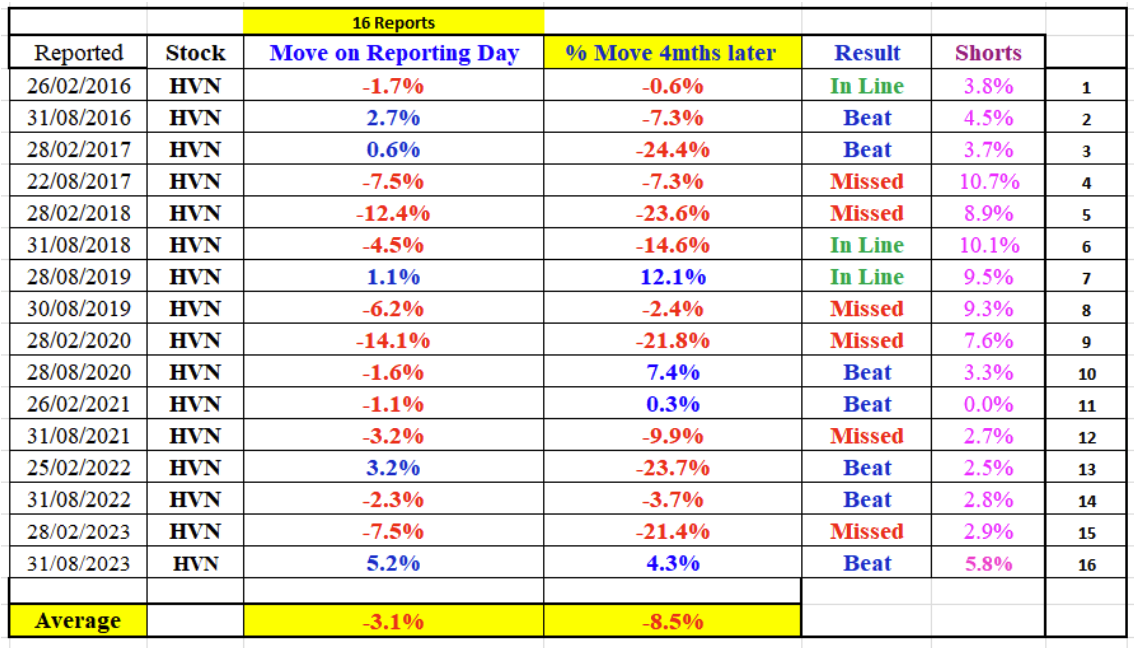

Harvey Norman (ASX: HVN)

- H1 FY24 consolidated revenue down 8.2% to AU$2.15 billion; EPS of AU$0.1602

- Retains plan to have 80 stores in Malaysia by end-2028

- Malaysia like-for-like sales up 2.5% at local FX in January

- Singapore like-for-like sales Up 9.7% at local FX in January

- Ireland like-for-like sales up 1.8% at local FX in January

- Slovenia, Croatia like-for-like sales up 2.8% at local FX in January

- New Zealand like-for-like sales down 7% at local FX in January

- Australian franchisee like-for-like sales up 0.6% in January

- Interim dividend 10c

- Revenue A$4.64 billion, down 6.7% on year

- 1H net profit A$200 million, down 45% on year.

How HVN has traded on reporting day, then four months later

Before today - their record has been:

- Six MISSES in the last 16 reporting seasons (RS) BUT also seven BEATS

- Closed lower on reporting day on 11 of the last 16 RS

- Closed lower on reporting day seven out of the last nine RS.

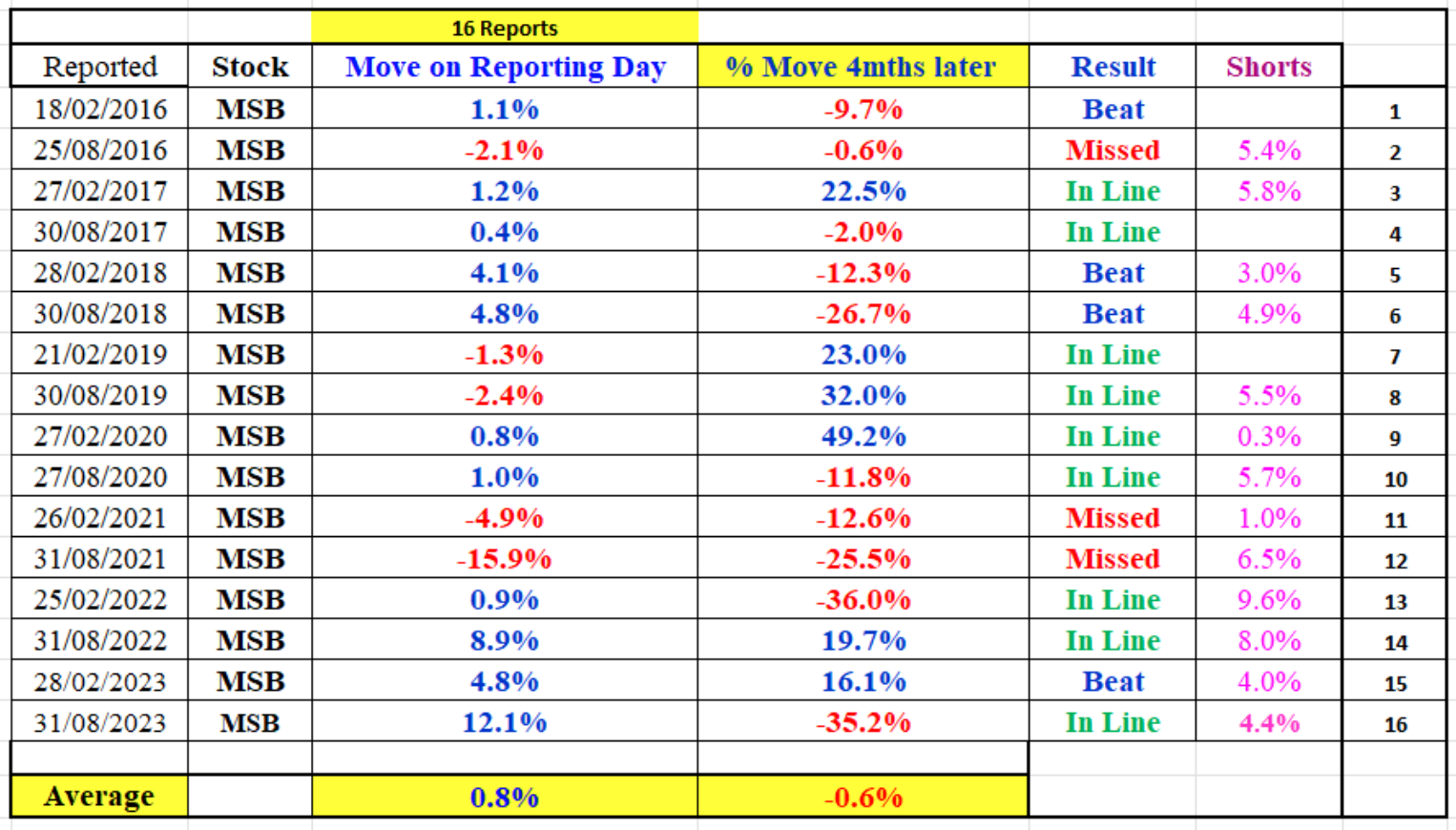

Mesoblast (ASX: MSB)

- Management reported a loss of $0.0382c from the prior-year period's $0.0564c

- Revenue was $3.39 million, inching down from $3.42 million a year earlier.

- No dividend.

How MSB has traded on reporting day, then four months later

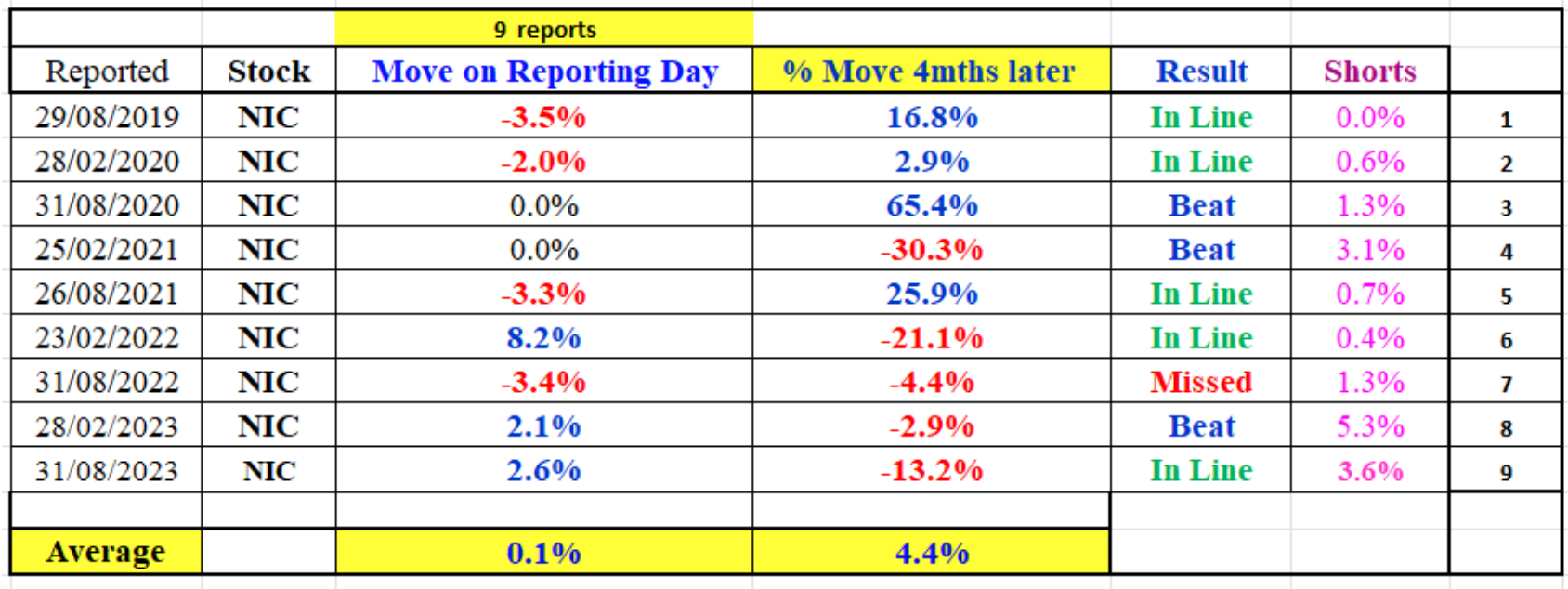

Nickel Industries (ASX: NIC)

The CY24 financial result was a good one in a tough market, according to David Coates, senior resources analyst, at Bell Potter. His key insights include:

- NIC has released its CY24 financial result which was slightly ahead of our forecasts and consensus at the EBITDA line but a miss at the NPAT lines due to higher D&A, withholding tax and finance expenses.

- The highlight of the result was the strong EBITDA growth driven by record production which offset a materially lower nickel price and an inflationary cost environment. The demonstration of NIC’s ability to make money through the cycle is key. EBITDA margins, while lower, were 21% (from 29% last year).

- An increased dividend and US$100 million share buyback (announced with the December quarterly) was also a highlight, with NIC lifting its final dividend from 2 c/share to 2.5c/share.

- If there is a negative, it is probably lower NPAT lines, which were lower year on year due to higher tax, finance and (non-cash) D&A charges. However, given the market conditions, we view profitability as a positive in itself.

- The result has demonstrated the strategic advantages of NIC’s diversified product mix and exposure across the nickel value chain.

How NIC has traded on reporting day, then four months later

Ramsay Healthcare (ASX: RHC)

- Ramsay Health Care posts 14% rise in H1 FY24 revenue

- H1 FY24 revenue up 7.8% to AU$8.09 billion; diluted EPS of AU$0.328

- Reviews portfolio after 1H net profit fall

- A range of strategies being assessed to unlock value

- Focus on improving performance and returns of Australian and French hospital businesses

- Margin recovery slowed by cost pressures not fully reflected in reimbursement rates

- Expects earnings to be weighted to 2H

- Continues to expect net profit growth in FY 2024

- Interim dividend of 40c

- 1H net profit from continuing operations A$135.5 million, down 40%

- 1H EBIT A$512.3 million, down 4.7%

- 1H EBITDA A$1.04 billion, up 2.9%

- 1H revenue A$8.16 billion, up 11%

- 1H net profit A$758.5 million.

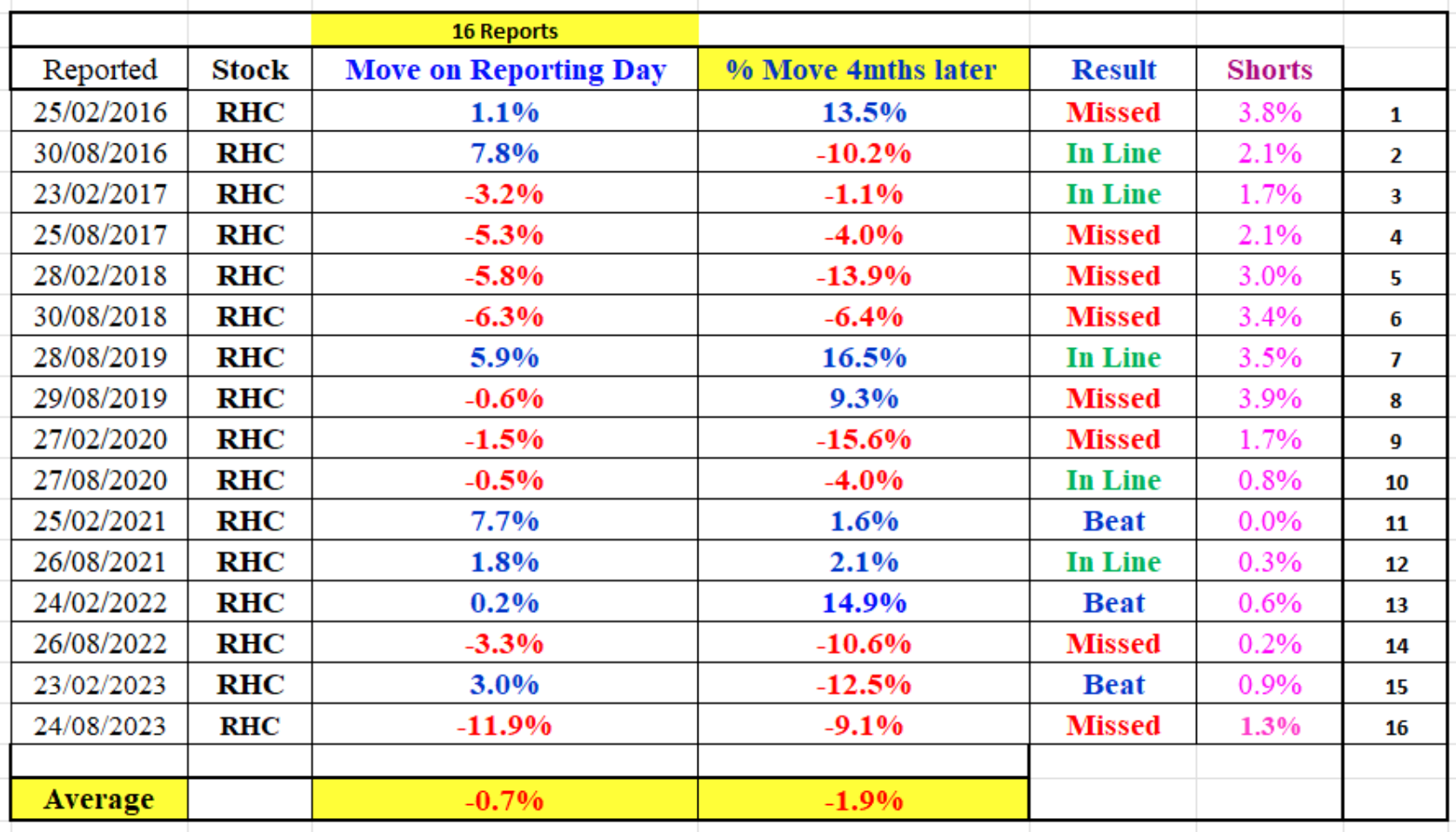

How RHC has traded on reporting day, then four months later

Star Entertainment (ASX: SGR)

- Expects FY24 capex of $80 million - $100 million

- Expects $45 million in FY24 remediation costs

- January EBITDA down 6.5% on year

- Early 2H revenue, EBITDA broadly consistent with 1H

- Had net cash of $171 million on Dec 31

- No debt maturities until FY 2028

- 1H net profit ex-significant items $25 million versus $43.6 million

- All old debt cancelled; new debt secured on more favourable terms

- 1H normalised EBITDA $114 million

- Did not declare a dividend.

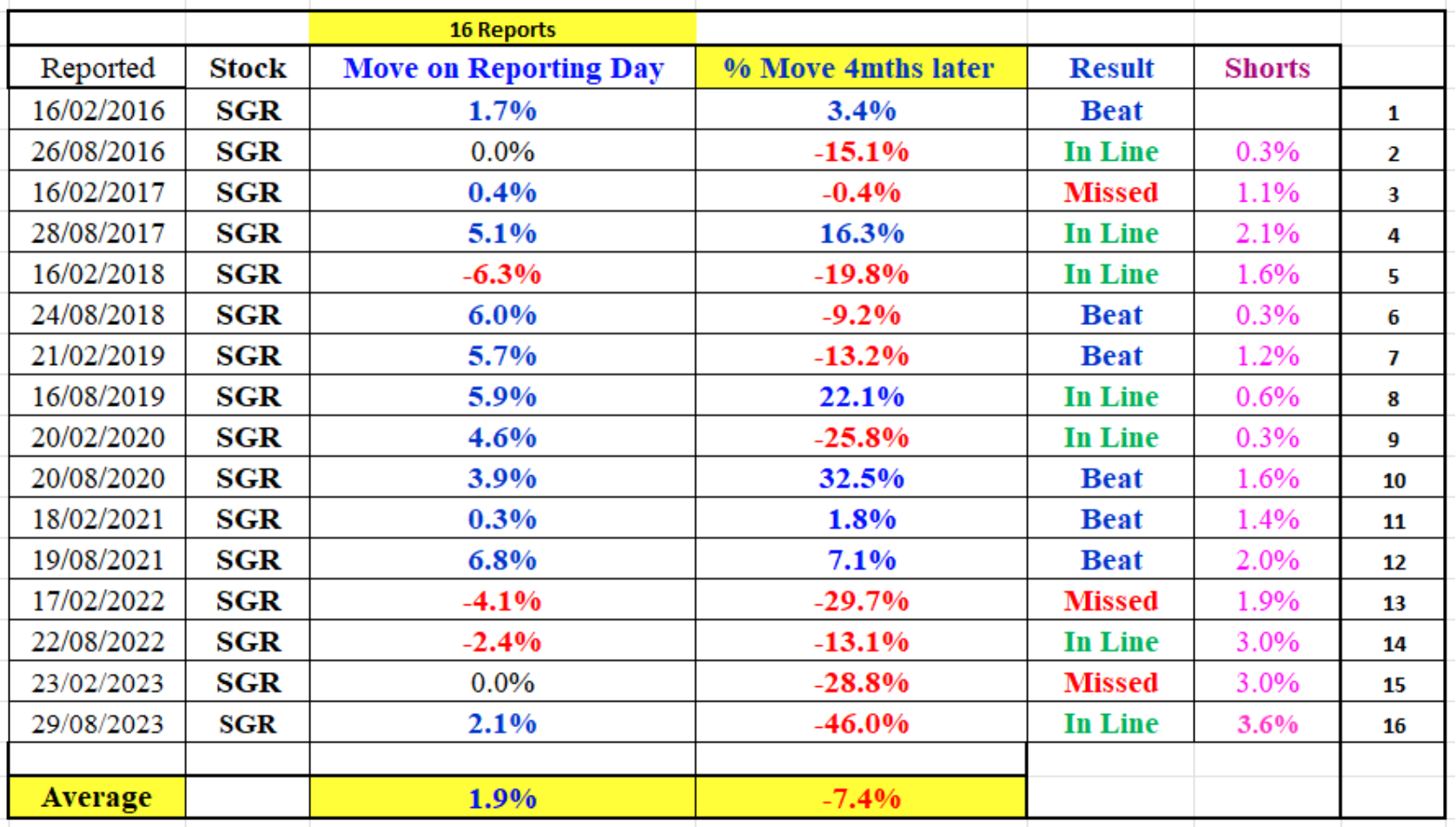

How SGR has traded on reporting day, then four months later

Get more insights from the insto desk in the Coppo report

This article is an excerpt from The Coppo Report contributed to Livewire by Richard Coppleson, director - institutional sales and trading, Bell Potter. You can find out more here.

You can also stay up to date with the latest news by hitting the ‘follow’ button and you’ll be notified every time I post a wire.

3 topics

20 stocks mentioned

1 contributor mentioned