The anti-Walmart effect

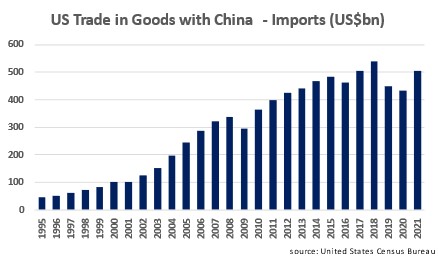

China’s entry into the World Trade Organisation in 2001 saw an explosion of Chinese imports into the US (see chart). It is estimated that between 2001 and 2006 Walmart accounted for approximately 9.3% of total US imports from China. The concept of importing goods, exporting jobs and the associated impacts on local economies became known as the ‘Walmart Effect’. This served to keep wages low and suppress inflation.

Due to a host of geo-political reasons, the opposite (de-globalisation) is currently happening.

As an example, last week President Biden signed into law a bill that includes US$52 billion of incentives for US companies to produce semiconductors and invest in chip making. Semiconductors are an essential component of electronic devices including cars, household appliances, smartphones, computing, medical equipment and internet communications. Manufacturing these components in America will increase their cost. How much will this impact the price of an iPhone? Or a washing machine?

This example is the tip of the iceberg as America seeks to reduce its reliance on other countries - at a time when their unemployment rate is at multi-decade lows.

The inflationary pressures of de-globalisation

will play out gradually over the next 5-10 years. Despite rising interest

rates, a return to the low inflation era of the 2000s and 2010s is highly

unlikely.

2 topics