The ASX company defying macro uncertainties

Heightened market volatility either serves to cause pain or opportunity for investors. The opportunity for investors comes from identifying companies that continue to demonstrate strong fundamentals, growing their sticky customer bases to expand market share in the face of competition and macroeconomic challenges.

One such example in the Australian smaller companies universe is Netwealth (ASX:NWL).

Netwealth added $2.6 billion in net flows to its platform in the March quarter alone: up 16% versus the corresponding period last year.

Although this points to a deceleration versus previous quarters, it has to be taken in the context of heightened global market volatility undoubtedly distracting many of Netwealth’s financial planner clients in transitioning to Netwealth’s platform.

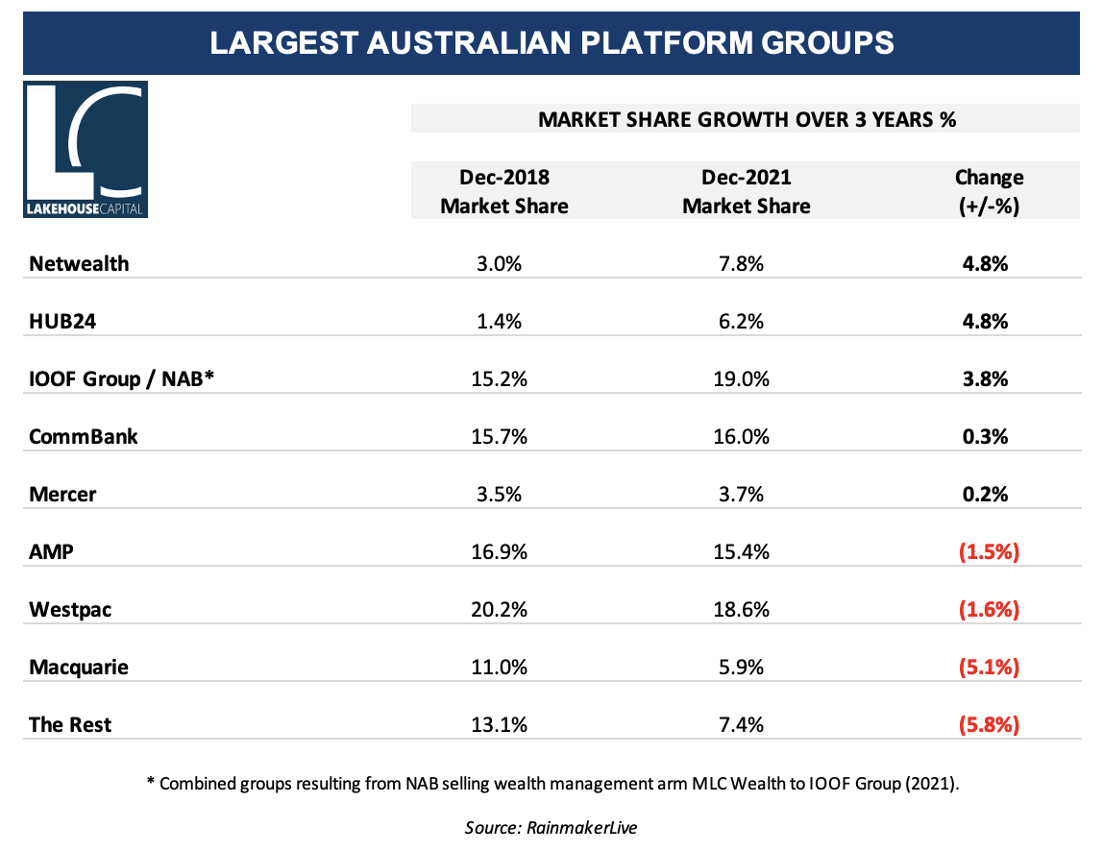

According to both Plan for Life and RainmakerLive, Netwealth continues to be the fastest growing platform provider by net fund flows in Australia, adding around 1.2% in market share in 2021, or 4.8% over 3 years (Table 1.1); impressively, it has been achieved organically, unlike some of its peers. This growth is in spite of incumbent platforms holding substantially larger market share, leaving Netwealth plenty of runway for future growth.

Zooming from quarterly out to a 12-month view; Netwealth’s total funds under administration grew 37.6% to $57.6 billion over the last year, and that’s despite a -$1.7 billion negative market movement headwind during the March quarter.

We are attracted to this strong underlying organic growth, delivered by a deeply aligned and long-term focused management team. Add to this growth thesis the earnings buffer that capped-fees provide against falling equity markets – as was highlighted during the COVID-selloff of 2020.

Also, Netwealth stands to benefit from rising Australian interest rates with more rises forecast following the recent 0.25% cash rate hike.

Strong organic growth, with an earnings buffer and interest rate upside makes for an attractive combination in the prevailing environment.

In our view, Netwealth’s reported profit growth has been held back recently as the company continues to take a conservative approach to fully expense its long-term growth investments.

In particular, we look forward to the imminent launch of the non-custodial administration service to deepen relationships within the high net-worth and ultra-high-net-worth market, as well as continued refinements to its mobile app. We believe both growth initiatives will strengthen long-term client retention, and profits, for the company.

Our conviction behind the thesis remains strong as the founder-led Netwealth remains highly profitable, debt-free, and with increasing optionality across the business to grow revenue as it continues to gobble up market share and benefit from rising interest rates.

Table 1.1

Take a different approach to investing

Lakehouse Capital embraces a long-term, high-conviction approach that seeks asymmetric opportunities. Hit the 'CONTACT' button below to find out more.

3 topics

1 stock mentioned

1 fund mentioned