The shift toward scarcity: a playbook for a new era of investing

In 1964, John DeLorean jump-started the era of the American muscle car when he fitted out a Pontiac LeMans with a V8 engine and called it the GTO. Until then, powerful engines were reserved for expensive luxury cruisers far beyond the reach of most Americans. The GTO changed all that: it had a 325-horsepower V8, hood scoops, dual exhaust, and blistering straight-line acceleration, all for about $3,000 USD, putting real performance within reach of ordinary drivers and helping spark a nationwide obsession with speed.

The success of the GTO kicked off an arms race among carmakers, each turning out cheap cars with massive engines for the everyman, made possible by cheap fuel, mass production, and minimal regulation. But when the oil shocks of the 1970s hit, the age of horsepower met the reality of scarcity. Efficiency replaced extravagance, restraint replaced indulgence, and what had once been thrilling began to look reckless. That is because values tend to shift when constraints appear.

Running on empty

For more than 30 years, investors have benefitted from an era of globalisation that delivered falling production costs, rising profit margins, and abundant capital. Asset prices rose as goods, labour, and money flowed freely across borders. This era is coming to an end. The world is shifting away from global integration toward a great separation, a period where nations compete to retain their savings and fund their own priorities.

This fight for capital is rewriting the rules of global trade and finance as supply chains shorten, defence spending rises, and governments encourage domestic investment. The abundant liquidity that once underpinned markets is being replaced by a sense of scarcity. As with the end of the muscle car era, the shift now facing investors demands a return to efficiency, discipline, and value over speed and spectacle.

The cost of debt

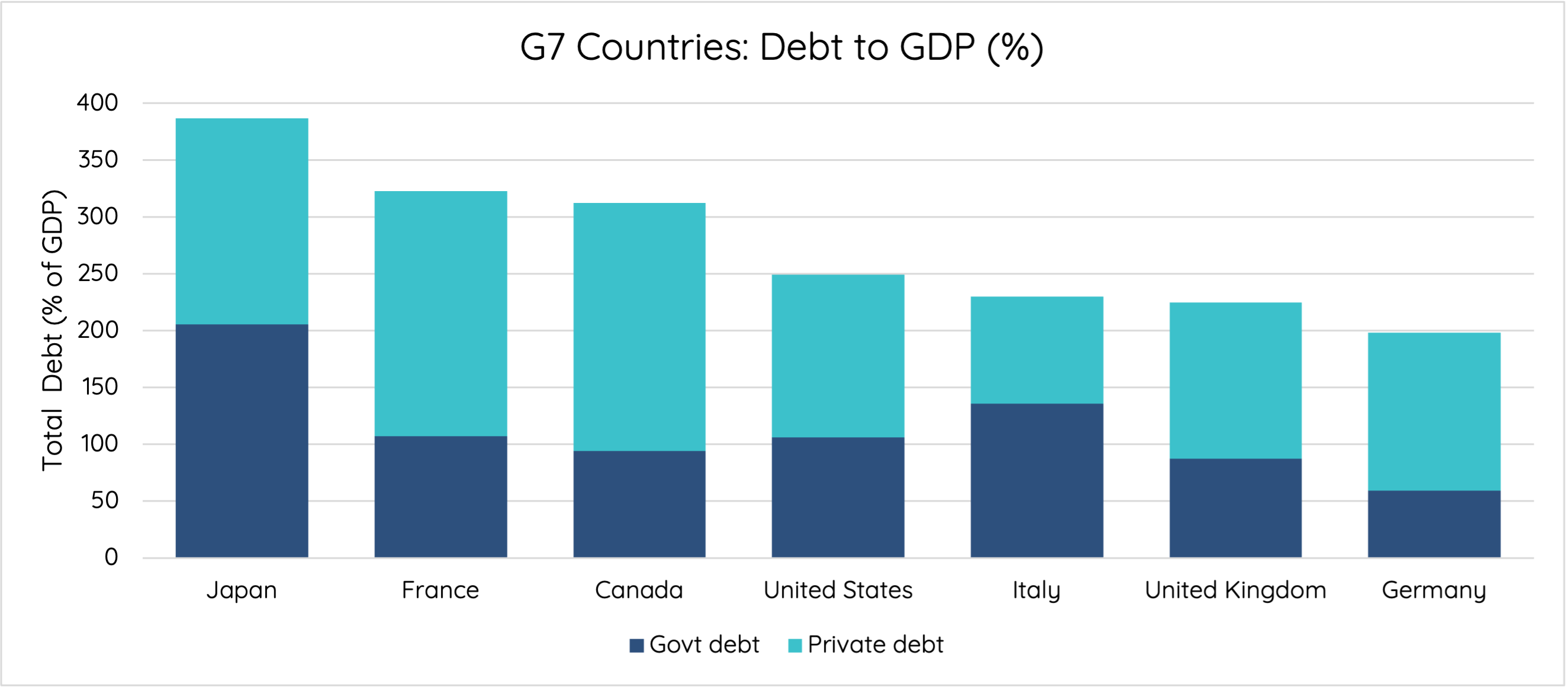

Decades of cheap money have left the global economy with an unprecedented debt burden. Some major economies, including Japan, France, and Canada, now carry debt exceeding three times their annual output. That’s far more than Greece in 2010 when it was forced to request a bailout from the EU and IMF. US debt is 2.5 times its annual output and servicing that debt has become increasingly costly as interest rates remain elevated.

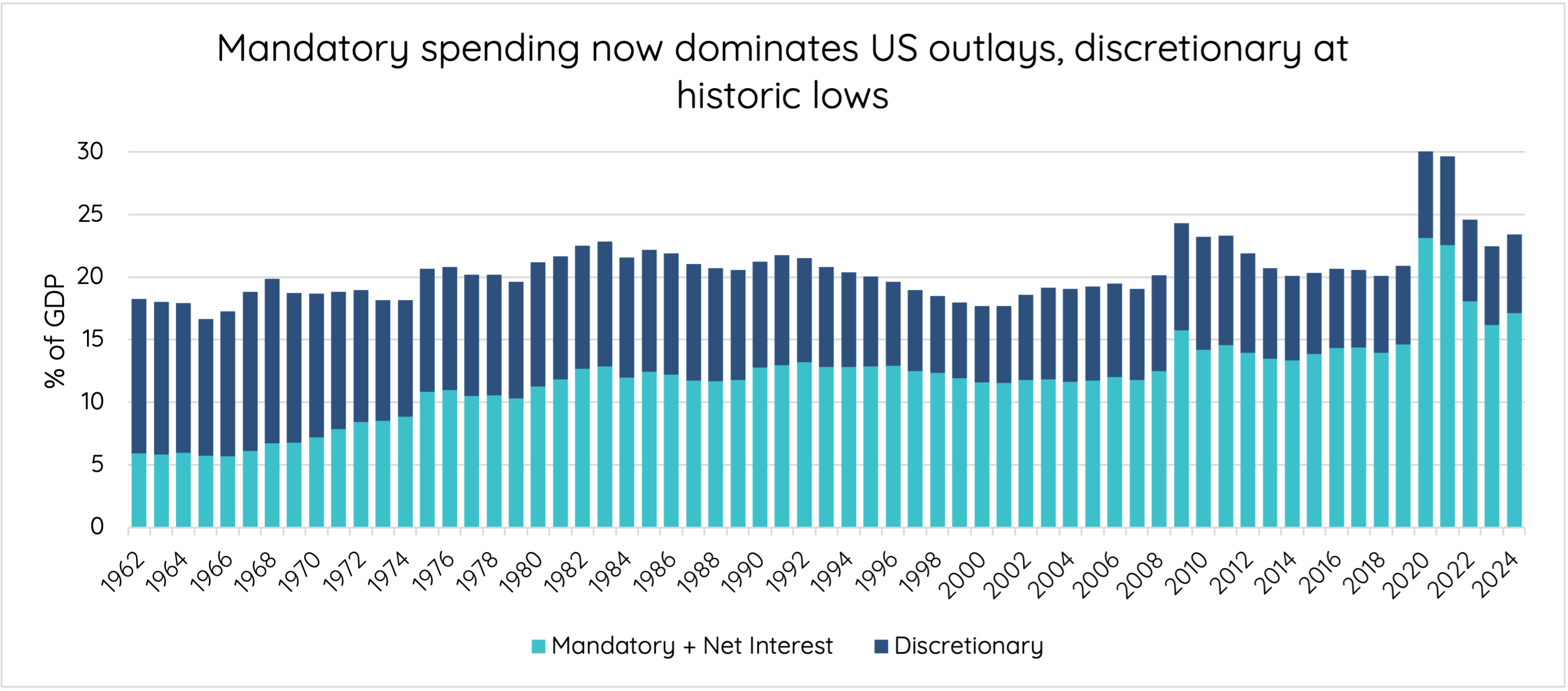

The US government’s discretionary spending (spending that policymakers have on wants rather than needs) is now less than a third of total government expenditure. Plus, with fiscal deficits still widening, the scope for stimulus is narrowing. Across much of the developed world, the same pattern applies: more debt, higher servicing costs, and less flexibility.

Playbook for a new era

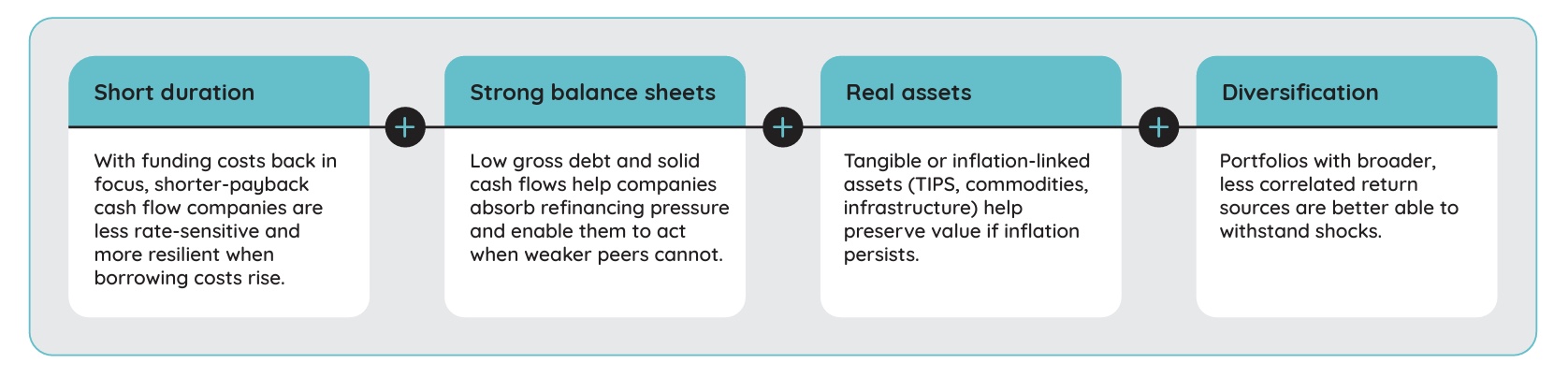

Periods of transition are rarely smooth, but they can reveal opportunities for those who adapt faster. In a world moving from capital abundance to scarcity, four principles really matter:

- Shorter duration. Investments that return capital sooner provide greater certainty in an environment of higher inflation and interest-rate volatility.

- Stronger balance sheets. Companies that can fund themselves rather than rely on external credit are likely to prove more resilient.

- Real assets. Businesses and assets backed by tangible cash flows (resources, infrastructure, and high-quality equities) offer protection against the erosion of purchasing power.

- Diversification of return sources. Income streams that are not dependent on market direction, such as the volatility-risk premium embedded in Talaria’s approach, can add stability when traditional assets are more correlated.

Valuation and opportunity

Capital once again comes at a cost. That makes discipline, selectivity, and liquidity far more valuable. Equity markets, particularly in the United States, remain near the highest valuations in history. Historically, starting from such levels has led to subdued long-term returns. Yet within the market, opportunity persists.

Companies with steady earnings and strong balance sheets are trading at their largest discount to the broader market in over fifteen years. Prudence, in other words, isn’t in fashion. For long-term investors however, that is where the best opportunities lie.

Just as the muscle-car era gave way to vehicles built for practicality, investors are rediscovering that performance can depend on durable and disciplined fundamentals, a natural shift in values as new constraints shape the road ahead.

5 topics

1 stock mentioned