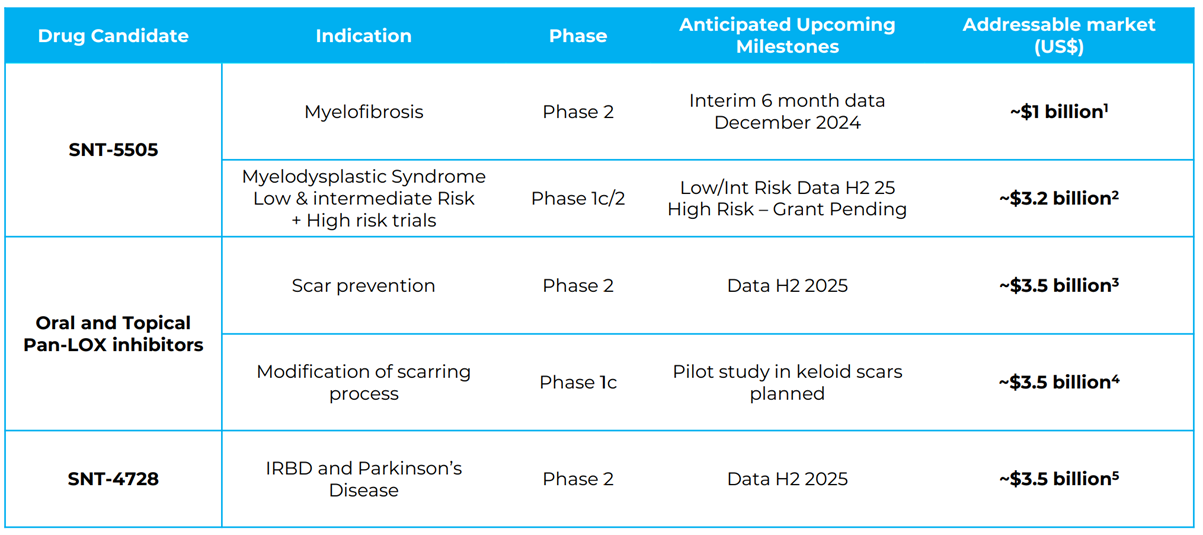

The ASX-listed Biotech set to unlock significant value

Syntara is not your typical ASX-listed biotech. This small company with a market cap of just ~A$60 million is equipped with a world class in-house drug discovery engine that has produced five lead candidates for disease with high unmet need with a shareholder base of mostly institutional investors including Australian and US specialist healthcare funds.

Focused on rare and underserved diseases like myelofibrosis (MF), Syntara is advancing three promising compounds into Phase 2 clinical trials, supported largely by non-dilutive funding. With an estimated ~US$3 billion market opportunity for MF in the U.S. alone, key clinical milestones on the horizon, a highly differentiated product pipeline, a potential accelerated path to market, and with comparable acquisitions in MF at ~50x larger than Syntara, Syntara is positioned as a biotech company with significant upside potential and one to watch closely.

Transformation and Evolution: From Pharmaxis to Syntara

Syntara has a long history. The company’s origins trace back to 2001, when it was first listed as Pharmaxis on the ASX with a goal to develop Bronchitol, an innovative treatment for cystic fibrosis (CF). This journey was challenging, with notable setbacks, including two FDA rejections. After years of efforts, the company finally received FDA approval in November 2020. Unfortunately for Pharmaxis, the treatment landscape for CF had shifted significantly over the 20+ years it took to reach this milestone and Bronchitol no longer held a central role in CF treatment.

During this lengthy journey, the management team did not sit idle. Pharmaxis quietly built expertise in a specific area of drug chemistry focused on amine oxidases. This drug discovery platform has since produced five lead drugs, three of which have now entered Phase 2 trials. This is a remarkably productive platform considering the level of resourcing. A significant achievement came in 2017, when Pharmaxis licensed a drug to Boehringer Ingelheim (BI) for A$39m upfront. While the drug was eventually returned back to Pharmaxis, the company generated A$87m from this deal, proving that the management team could successfully execute major licensing agreements.

In 2023, Pharmaxis completed its transformation by selling Bronchitol and its manufacturing facility, which reduced operating costs by A$14 million per annum and downsized the team from around 75 to just 25 members. With this shift, Pharmaxis rebranded as Syntara, a company focused on internal drug discovery and development with a unique position on the ASX, comparable only to CSL in this regard. Most other biotech firms on the ASX license or acquire drug candidates rather than develop them in-house, making Syntara’s approach rare and particularly valuable.

Investing at the Value Inflection Point

Syntara has now been listed for 23-years on the ASX. At KP Rx we focus on identifying and investing only at key inflection points – moments when we believe material value creation is imminent, maximising returns for our investors. Similarly with Neuren, Karst Peak Capital first invested in 2020, 15 years after the company IPO’ed on the ASX.

We believe that Syntara’s time has finally come and we acquired our first major stake of the company on 23rd September and Hashan is a Non-Executive Director on the Board of Syntara. There are a number of near-term catalysts as we outline below that make us extremely excited about this company and we believe that there remains significant upside from current levels.

Syntara’s Core Focus: Targeting Rare Diseases and Skin Scarring

Syntara is currently running three Phase 2 clinical trials with another three due to start next year, mostly funded by nondilutive capital. This is truly incredible for a company with a market cap of just ~A$60m.

Given that SNT-5505 is the most advanced asset and the pressing need for new treatment options in MF, our primary focus in this piece will remain on this critical indication.

Both the drugs for skin scarring (SNT-6302) and for MF, however, share the same biological target – an enzyme called lysyl oxidase (LOX). LOX is a key enzyme in fibrosis or scar tissue formation and is involved in crosslinking of collagen. Fibrosis is a part of the natural healing process however excessive scar tissue builds up in various diseases, including cancer and rare autoimmune conditions. In both MF and skin scarring, inhibiting LOX could have a meaningful impact, and insights from one indication could affect the probability of success in the other.

What do we mean by this? To clarify our view, we can use Syntara’s drugs as an example of the diligence questions we typically look to answer when evaluating a new drug investment:

1. Is the drug bioavailable?

Syntara has demonstrated that, when taken orally, SNT-5505 is highly bioavailable – meaning it’s effectively absorbed and ready for action in the body. For skin scarring, SNT-6302 is applied directly to the scar, allowing it to target the site directly.

2. Once absorbed, does the drug reach the intended site and have the desired action?

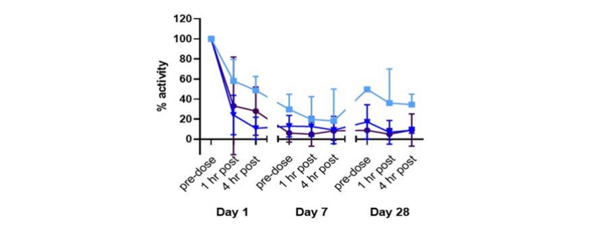

Syntara’s data shows that oral administration of SNT-5505 results in over 90% inhibition of the LOX enzyme, demonstrating strong activity against the target (see here).

For skin scarring, SNT-6302 is applied directly to the scar, with Syntara’s data showing that it inhibits LOX at the site with minimal effects elsewhere in the body.

3. Is the drug safe?

Current safety data is encouraging, showing that SNT-5505 is well tolerated with no dose limiting toxicities reported so far. This safety profile is significant as it suggests the drug could be used long-term, which is important for diseases like MF. While SNT-6302 did not cause any severe side effects, there was a reaction at the site of administration that required an adjustment to the dose.

4. Does the drug achieve the intended biological effect?

Normally, when we are investing in a biotech, this question is not answered. Our investment is funding the trial that will answer this question. For Syntara specifically, what this means is, does binding to and inhibiting LOX cause a reduction in fibrosis?

In this instance however, this question has already been answered thanks to the skin scarring trial (see here). Syntara has shown in a randomised, blinded, placebo-controlled trial, that administration of the topical LOX inhibitor (SNT-6302) resulted in a 30% (p<0.01) reduction in collagen content. This was a remarkable result for 2 reasons:

- Firstly, these patients had long-standing scars averaging 12.8 years, which are typically less responsive to treatment than new scars.

- Secondly, the dosing regimen was not optimal. SNT-6302 was applied 3 times a week resulting in mean reduction in LOX activity by 66% compared with over 90% with oral administration.

This leaves the final question.

5. Does this biological effect lead to symptomatic improvement or disease modification?

Given that the hallmark of MF is the strangulation of the bone marrow by fibrosis, we would be truly shocked to find that reducing fibrosis through SNT-5505 does not cause a disease modification in MF patients.

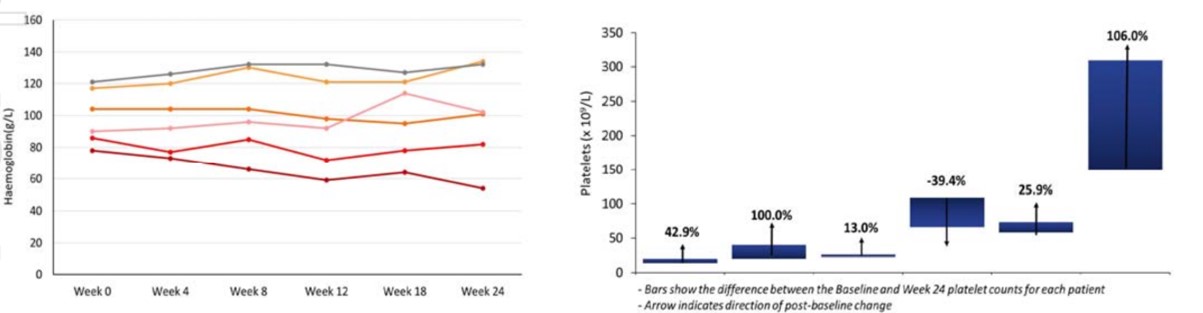

Results from the Phase 2a monotherapy trial suggest that SNT-5505 could impact disease progression in MF (see here). In this group of end-stage patients who had ceased Jakafi, the standard of care (SoC), SNT-5505 demonstrated improvement in fibrosis in 5 out of 10 patients, 7 had stabilisation or improvement in blood counts and 4 had 20% or more improvement in symptoms as measures by the Total Symptom Score (TSS) scale.

The figure below shows interim data where five out of six patients had stable or improved blood counts (haemoglobin and platelets).

This trial recruited patients who had become intolerant to the SoC JAK inhibitor for MF, Jakafi. The positive results in this group are particularly significant given that the median overall survival (mOS) for this population is typically around 11-14 months.

Following on from the monotherapy trial, the current Phase 2a combination trial will provide insights into SNT-5505’s potential as a combination therapy in MF. This trial is recruiting patients who are on a stable dose of Jakafi however are having a ‘suboptimal response’ with the primary focus being on assessing safety of combining the two drugs. Results from this trial will be presented at the American Society of Hematology (ASH) Annual Meeting on 7-10th of December. Syntara’s data has been selected for the highly sought after oral presentation at the conference (see here).

What does good look like?

In this trial we are especially interested in how patients respond to the combination of SNT-5505 and Jakafi. Our primary focus will be on improvements in the TSS, as we know this is highly valued by regulators, clinicians and patients. Additionally, we are monitoring for reductions in spleen volume and improvement/stabilisation in blood counts, though given the mechanism of SNT-5505, these effects may take longer to manifest.

Given the poor tolerability of JAK inhibitors themselves and other drugs currently in development for use in combination with JAK inhibitors we also need to pay attention to the safety and tolerability of SNT 5505 in this first data from its use in combination with a JAK inhibitor. A clean profile will be highly valued by patients and clinicians.

In this patient population there have been four similar trials conducted in the past.

|

Company |

Agent |

Phase |

TSS50 (%) |

SVR35 (%) |

Side effects (grade 3/4) |

|

|

Incyte |

Parsaclisib + Jakafi |

2 |

9% |

16% |

54% |

|

|

Morphosys (acquired by Novartis) |

Pelabresib + Jakafi |

2 |

20% |

37% |

63% |

|

|

Abbvie |

Navitoclax + Jakafi |

2 |

27% |

30% |

85% |

|

|

Kartos |

Navtemadlin + Jakafi |

2 |

38% |

31% |

46% |

|

Parsaclisib was taken all the way through Phase 3 trials by Incyte for myelofibrosis however the Phase 3 trial was discontinued after the independent data monitoring committee advised that the study was unlikely to meet primary endpoint (see here).

Pelabresib was taken all the way through Phase 3 trials by MorphoSys and was acquired by Novartis for US$2.9b. Subsequent to the acquisition, Novartis has delayed the NDA submission, potentially by years due to a safety signal. The Phase 3 trial saw a higher rate of patients developing acute myeloid leukemia (AML) in the pelabresib arm (see here). In addition to the safety signal, the Phase 3 data did not show a significant improvement in TSS50.

The navitoclax + Jakafi combination has generated promising efficacy data however navitoclax in monotherapy is a very toxic drug and when combined with Jakafi, which also has an unfavourable tolerability profile, tolerability becomes a major concern (see here). We do not see a use case for this combination outside of end-stage patients if Abbvie chooses to pursue further clinical development.

Navtemadlin has the most promising results in this patient population (see here) however the combination’s tolerability profile may limit its use. Kartos has initiated a Phase 3 trial in this population with results expect late 2026/early 2027.

From these studies, we can see that other therapies have generated ~30% improvement in TSS50 and SVR35. Our conversations with key opinion leaders in myelofibrosis indicated that they would like to see 20% for SVR35 and 30% TSS50 as the benchmark for a ‘good result’ in this patient population.

Another very important measure of efficacy is transfusion burden. In these patients, due to the destruction of their bone marrow and Jakafi’s negative effect on blood cells, patients can become reliant on blood or platelet transfusions. These transfusions dramatically reduce patients’ quality of life and are a significant burden on the healthcare system.

What is MF?

MF is a rare cancer of the bone marrow affecting ~18,000 people in the U.S. The disease is thought to be caused by mutations of bone marrow stem cells that leads proliferation of these cells and eventually to fibrosis which results in death of the normal bone marrow and impairment of blood cell production. As the bone marrow becomes fibrotic, the body compensates by producing blood cells in the spleen, causing spleen enlargement—a painful and debilitating symptom.

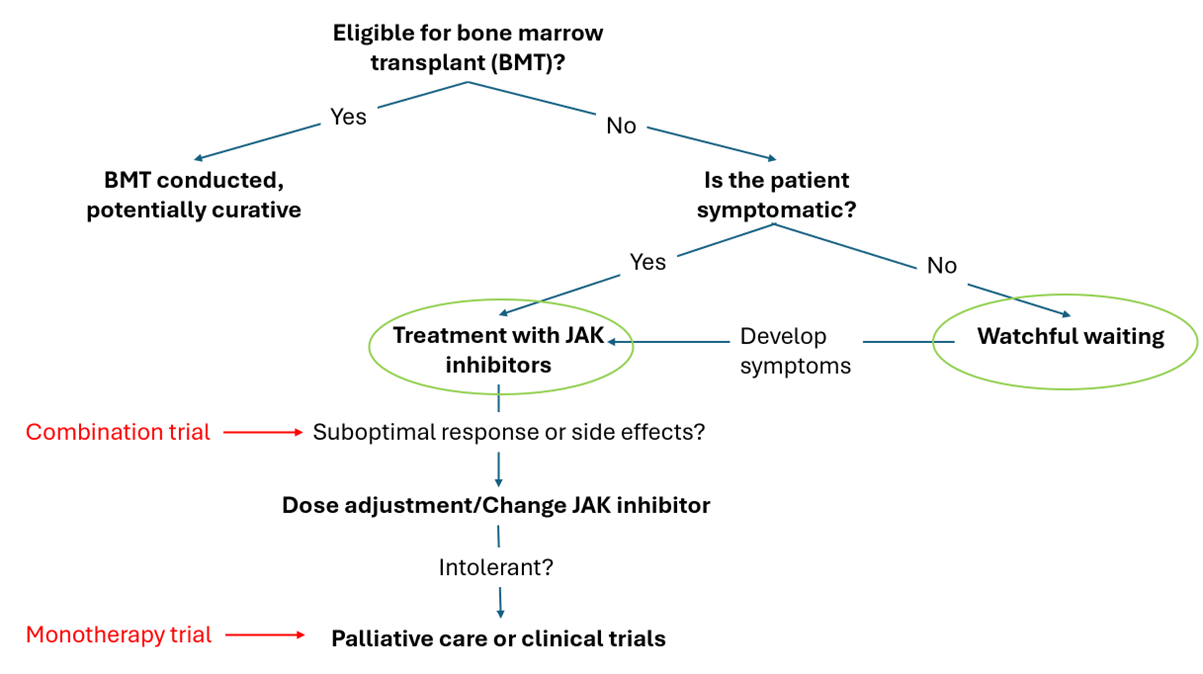

At initial diagnosis patients are assessed for suitability of bone marrow transplantation (BMT), the only curative treatment for this illness. If ineligible for BMT, patients are treated with a JAK inhibitor once they develop symptoms, as these drugs only manage symptoms without modifying the disease. Unfortunately, a side effect of JAK inhibitors is worsening blood counts, are poorly tolerated, and only minimally improve survival, which ranges from 1.3 years for high-risk patients to 6.9 years for those with intermediate risk. ~20% of patients go on to develop leukemia.

MF treatment protocol

As the above treatment protocol shows, if a MF patient is ineligible for a BMT, they are only treated once symptoms develop. That is, patients have to wait until their disease progresses to the stage where there is substantial physical discomfort and enlargement of the spleen before starting therapy. Current treatments, such as Jakafi, are focused on symptom relief and do not extend survival. Thus, administering Jakafi to an asymptomatic patients would likely cause side effects without providing any benefit. As a result, a substantial group of diagnosed MF patients are left waiting for their disease to progress before receiving treatment.

Generally, in drug development, the most common path is to start with end stage patients and move up the treatment protocol as the drug is shown to be safe. As such, Syntara’s Phase 2a monotherapy trial recruited patients who had ceased taking Jakafi and the current Phase 2a combination trial is in patients who are ‘sub-optimally’ managed on Jakafi but have been on a stable dose.

Given that SNT-5505 has a very good tolerability profile and is potentially disease modifying, we see potential for its use earlier in the patient journey (green circles in the figure above). Syntara could focus on combination treatment of naïve symptomatic patients about to start treatment with Jakafi or go even earlier to the group of patients who are newly diagnosed but waiting for disease progression. As discussed earlier, these newly diagnosed asymptomatic patients have no treatment options with very few options in clinical trials as well. If SNT-5505 is shown to work in this patient population, this would mean that SNT-5505 becomes the backbone treatment or SoC for MF patients. However, the primary efficacy endpoint would likely be ‘time to treatment failure’ or ‘disease progression’ which would result in a lengthy clinical trial. We believe the fact that this option is viable for SNT-5505, dramatically increases its commercial appeal to potential partners.

The MF Treatment Market?

Currently, only three drugs are approved for MF in the U.S. – Jakafi, Vonjo and Ojjaara, all of which are JAK inhibitors focused on managing symptoms rather than modifying the disease itself. Jakafi is the SoC with Vonjo and Ojjaara recently receiving FDA approval. Novartis’ was expected to submit a New Drug Application (NDA) for pelabresib, a new class of drug, in 2024 however, to the best of our knowledge, has yet to do so. As such, treatment options for MF patients remain limited, with no disease-modifying therapies available – there is a significant unmet need.

The high level of recent acquisition activity in this space underscores big pharma’s strong interest in MF. Over the past 12 months, three substantial acquisitions – momelotinib/Ojjaara (US$1.9 billion), pacritinib/Vonjo (US$1.7 billion), and pelabresib (US$2.9 billion) – demonstrate the intense demand for innovative treatments, even those focused primarily on symptom management.

The current population of patients in the US is estimated at around 18,000. Based on Jafaki’s list price of ~US$170,000, this represents a market size of about US$3 billion (A$4.7 billion). Should SNT-5505 continue to show promising results, especially as a potential disease-modifying therapy, it could command a significantly higher price – perhaps closer to other rare disease therapies like Neuren’s trofinetide, which is priced at ~US$575,000. Considering the recent acquisition values outlined above, if SNT-5505 is proven effective as the only disease-modifying therapy for MF, a similar acquisition would represent over 50 times Syntara’s current market cap, indicating substantial potential upside based on SNT-5505 in myelofibrosis alone.

SNT-5505: A “Pipeline in a Pill” for Fibrosis-Driven Conditions

Fibrosis, the buildup of scar tissue, is a factor in many diseases, especially as the body tries to heal from injury. SNT-5505 has potential beyond MF, especially in conditions like solid tumours, rare disease such as scleroderma, lung diseases and more acute conditions like burns, heart attack and radiation injury. The potential list of diseases where SNT-5505 may have an effect is long. We see this with investigator initiated trials in burns and myelodysplastic syndrome already in progress

Certain aggressive cancers, such as pancreatic and liver cancers, develop fibrotic barriers to shield themselves from both immune cells and drugs, creating a high-pressure environment that makes treatment more challenging. Immunotherapies like Keytruda, which harness the immune system to target cancer, have been ineffective for these cancers, partially due to these fibrotic barriers.

In addition, fibrosis plays a key role in the spread of cancers (metastasis) by the development of fibrotic “niches” that allow cancer cells to grow in distant organs. For example, breast cancer cells “terraform” a distant organ by first creating a fibrotic niche that allows these cancer cells to survive in another organ. Extensive evidence now shows these niches may be essential for metastasis, particularly in breast cancer.

As such, SNT-5505 might play a key role in the treatment of solid tumours either as a combination product in directly treating the cancer or as a long term monotherapy to prevent metastasis. While the prevention of metastasis is very interesting and definitely worthy of future investigation, the trial required to demonstrate this would be very large and take a very long time. We do not believe a company the size of Syntara has the ability to fund and run such a trial.

Outside of oncology, fibrosis is the hallmark of many diseases such as scleroderma—a rare autoimmune condition where excess fibrosis affects skin and organs—and idiopathic pulmonary fibrosis, where for unknown reasons the lung tissue is effectively replaced by fibrotic tissue which results in severe complications and death. While further studies would be needed to confirm these applications, SNT-5505’s potential across many fibrotic diseases makes it an exciting drug.

Summarising the Key Catalysts

Syntara is approaching a series of significant value-unlocking catalysts that we believe make it a compelling investment opportunity at this stage of its lifecycle:

- Phase 2a Combination Trial Results – 10th Dec: The results from the Phase 2a combination trial of SNT-5505 in MF will be presented at the ASH Annual Meeting in December. This trial could demonstrate SNT-5505’s disease-modifying potential in a patient population with limited effective treatment options, providing critical validation for the compound.

- Feedback from FDA – mid 2025: Syntara intends to meet with the FDA to discuss the next clinical development steps for SNT-5505 in myelofibrosis following the completion of the Phase 2a combination trial. We see this as a key catalyst as this may provide the roadmap to commercialising this drug.

- Robust Phase 2 Pipeline providing readouts over 2025 and 2026:

- SNT-4728 in iRBD trial currently recruiting patients.

- SNT-5505 in 2 Phase 2 trials for myelodysplastic syndrome expected to commence recruitment in 2025.

- SNT-5505 in burns is currently recruiting patients.

- Announcement of the clinical development plans for the topical product in scars.

We see the results from the Phase 2 trial and the following feedback from the FDA as the two critical inflexion points of value creation in the short term.

Key Risks

1. Clinical trial risk: As with any R&D-stage asset, there remains a significant risk of clinical trial failure despite the positive early data. SNT-5505’s compelling safety profile and the clear biological rationale for targeting LOX provide a solid foundation for continued clinical success. In addition, SNT-5505 has potential use in multiple indications and Syntara has a deep pipeline allowing for multiple shots on goal. Syntara is also experienced in navigating drug development and the robust design of its ongoing trials mitigate some of this risk in our view.

2. Execution risk: The high unmet need in myelofibrosis has spurred the development of other assets, some of which, if approved, could alter the SoC and potentially diminish SNT-5505’s value proposition. We have conducted a comprehensive review of competing assets in development and remain confident in SNT-5505’s competitive positioning. Its unique mechanism of action targeting fibrosis and its promising safety and efficacy signals differentiate it from current and pipeline therapies. Furthermore, Syntara’s focus on demonstrating disease modification – a gap in the current SoC – bolsters its potential value, even in a shifting landscape.

3. Competition in development: The high level of trial activity in myelofibrosis, driven by the unmet medical need, introduces challenges such as increased difficulty in patient recruitment and the risk of a shifting SoC during SNT-5505’s clinical development. However, Syntara’s strategy to position SNT-5505 as a combination therapy mitigates this risk. Additionally, the company’s strong safety data and potential for use earlier in the patient journey provide a compelling case for its adoption, even in a competitive landscape.

Conclusion

Syntara stands out as a unique and innovative force in the biotech space. With its robust drug discovery platform, Syntara is targeting high-impact areas like MF and fibrosis-related conditions where the unmet need is substantial, and competition remains limited. SNT-5505, the company’s lead compound, aims to be the first disease-modifying treatment in a ~US$3 billion market in the US, with the potential to reshape the standard of care for MF patients who currently lack transformative options.

The catalysts ahead – such as upcoming trial data, a well-supported Phase 2 pipeline, and the potential for significant market expansion – positions Syntara for an inflection point in the company’s lifecycle. The recent acquisition activity in the MF market underscores the strong interest in this space, especially for innovative therapies like SNT-5505 that address disease progression. With a market cap of just A$60 million, Syntara presents an opportunity with considerable upside.

5 topics

4 stocks mentioned