The biggest theme of the digital revolution (and 3 ways to play it)

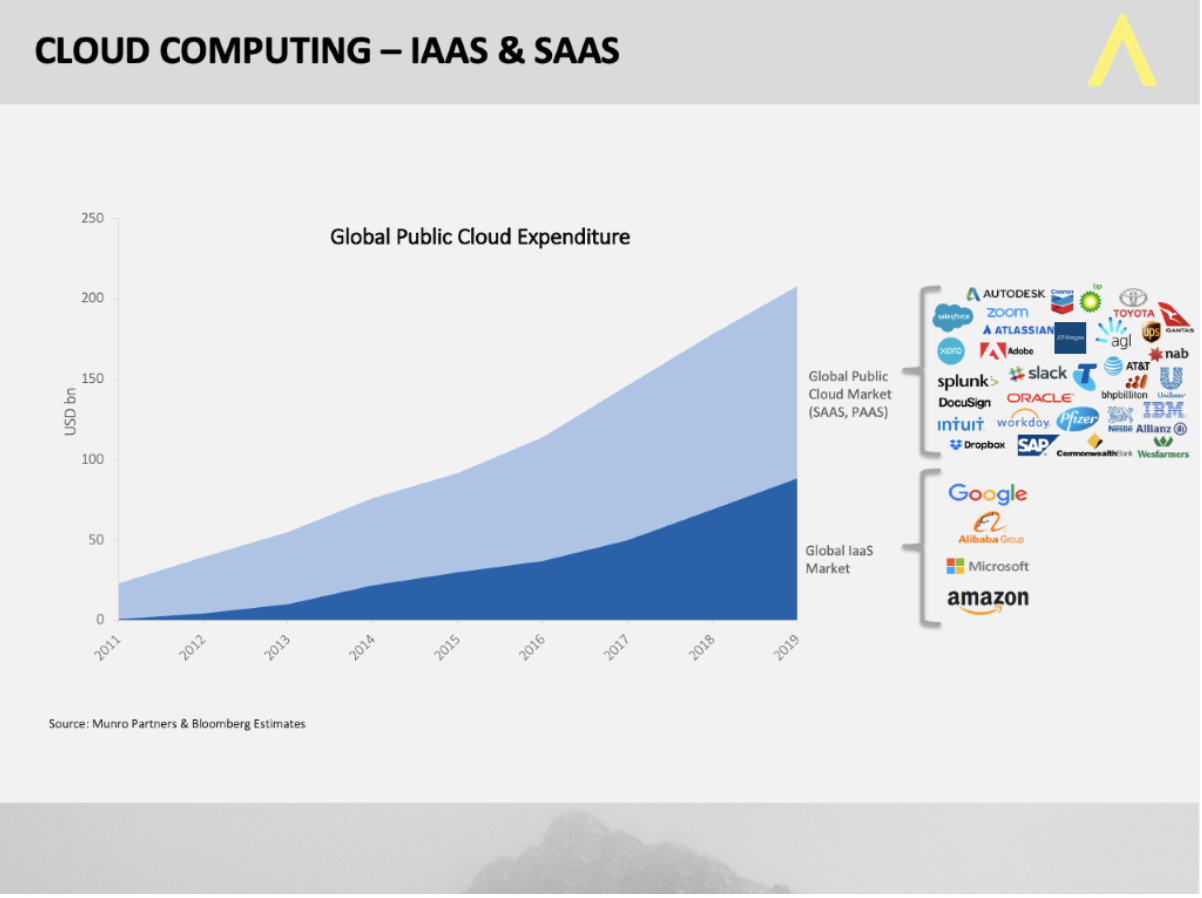

The cloud computing ecosystem includes Infrastructure-as-a-Service (IaaS) and Software-as-a-service (SaaS).

IaaS is a form of cloud computing that provides virtual computing resources over the internet. The key advantages of using IaaS are lower cost, flexibility and scalability. In simple terms, they are akin to the railroads of the industrial revolution, but in this instance, providing the infrastructure, speed and compute power without geographical constraints and much, much faster than any railroad can be built.

Software-as-a-service (SaaS) is the application layer of cloud computing. Where the software is hosted in the cloud, the end user can access the application anywhere, anytime over the internet. These are the locomotives; using the modern-day railroads to deliver their product (software) to consumers and business alike.

We explain in this exclusive wire why cloud computing is the biggest theme of the Digital Revolution, why its growth is accelerating, and three stocks we like in the theme.

Very long runway of growth ahead

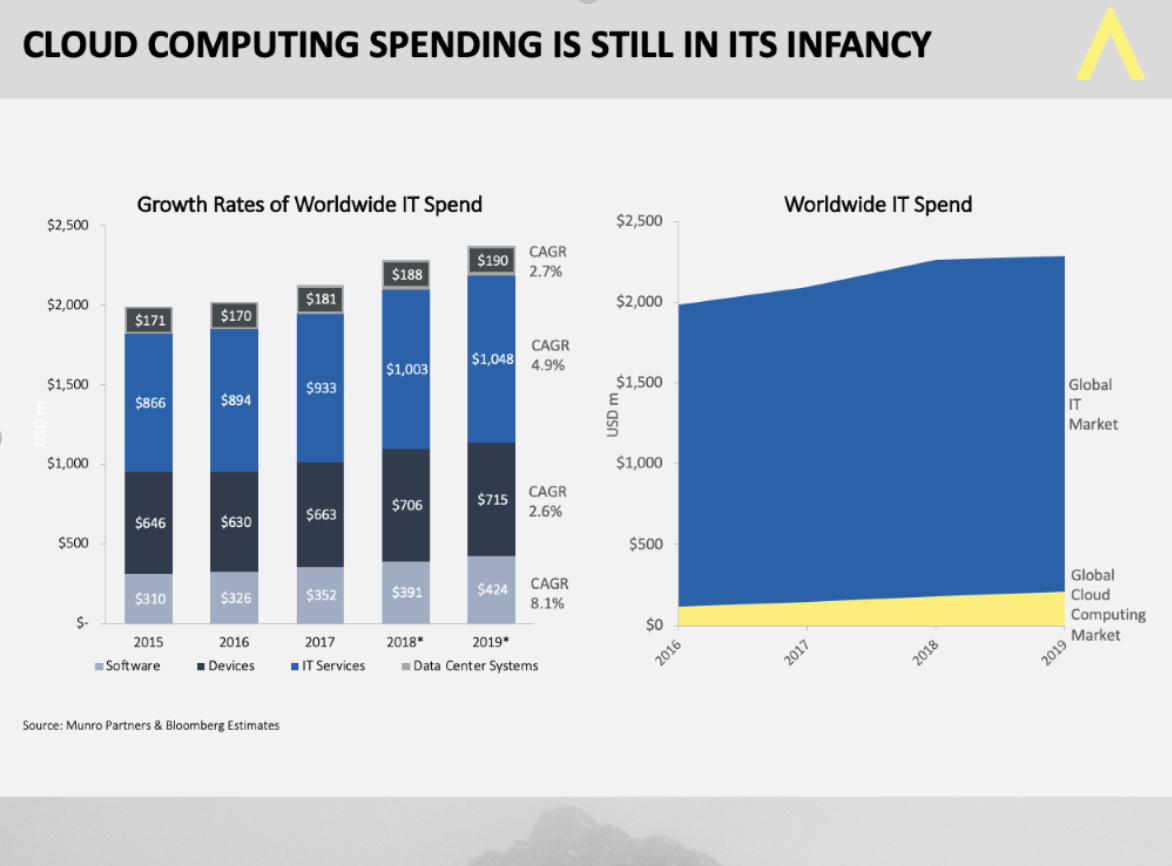

Worldwide IT spending is a $2.1 trillion per annum industry - split by software, devices, IT services, and data centres. We are seeing a structural change developing – with three of the big IT spends of software, IT services and data increasingly being stored in the cloud. A clear example of this in practice is a Microsoft 365 subscription.

However, cloud computing expenditure as a percentage of total IT expenditure is still in its infancy at about 5%-6%, so there is a very long runway of growth ahead on their respective S-curves.

The reason they are growing strong is that most consumers find it a far more simple, secure and cheaper solution than traditional methods of software deployment and IT infrastructure. Cloud computing is a one-stop shop and is continuing to take a bigger share of an increasing IT spend market.

In addition, the underlying cloud computing providers are growing strongly and they have fantastic business models: high margins (gross margins can be >90%); very scalable; highly recurring revenue (churn is very low and many customers are on long-term subscriptions) and working capital (they are paid in advance of providing the service).

The key thing to note is most of the SaaS providers are outsourcing the core computing to the IaaS providers. The IaaS players provide hosted cloud storage and compute at highly discounted rates in what is a race to scale to leverage cost and security advantages.

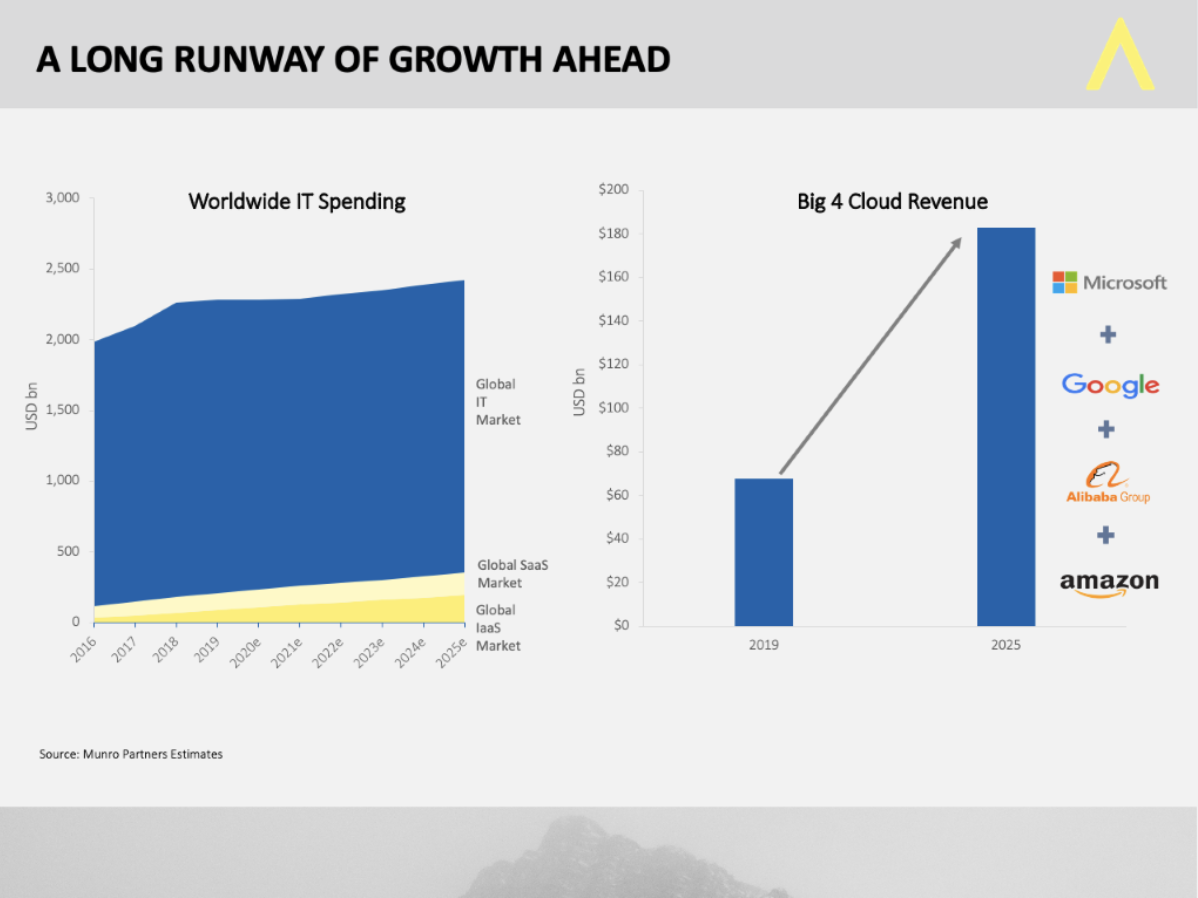

Anecdotally, almost all the companies we meet are migrating to the cloud in some form and via the big IaaS vendors in Google, Microsoft, and Amazon, and in the developing world, Alibaba. These four companies provide scalable, commoditised computing power, via their network of data centres and servers. These are the big 4 winners, accounting for 94% of the global IaaS market.

For software companies and corporates all over the world, this provides discernible benefits: they can run virtually any application or operating system on this infrastructure and can easily scale their use of the service, both up and down, depending on demand.

In addition, the scale of the big IaaS vendors drives the cost down and hence accelerates the transition to the cloud. To provide this infrastructure reliably and with increased performance in a global context, these companies need to be really, really big. Hence, why there are only four.

As the Big 4 IaaS players continue to benefit from the migration of workloads to the cloud over the next five years, they could see a doubling of their cloud infrastructure revenues. We would also expect many of them to continue to improve margins as they enjoy the benefits of scale, which will ultimately contribute to sustained earnings growth.

The headline risk around the public cloud companies is the potential impact of government regulation. These companies have dominant positions and it manifests in concerns about data protection, security and/or anti-competitive practices. Another risk is a wider economic slowdown. While the migration to the cloud from corporates is expected to increase, businesses may choose to delay in the short term.

Huge acceleration in Digital transformation

Recent announcements from the CEOs at the forefront describe the changes they have seen:

- Satya Nadella, CEO of Microsoft “we’ve seen two years’ worth of digital transformation in two months”. An example was more than 200 million Microsoft Teams meeting participants generating more than 4.1 billion meeting minutes, in a single day.

- Shantanu Narayen, CEO of Adobe, "the mandate to digitally transform has taken on heightened urgency”. An example of this was the 175% increase in usage of their cloud-based e-signature solution since the start of their fiscal year and mobile usage exploding with Acrobat Reader installations increasing 43% year-on-year and Adobe Scan installations up 66% year-on-year.

- Peter Gassner, CEO of Veeva “doctors are telling us they find digital meetings effective and they look forward to a mix of in-person and digital interactions once things get back to normal”. In Veeva’s case, US remote meetings between pharma and doctors with Veeva Engage - are up more than 30x from February to April – are here to stay, even after the economy reopens.

The big players in this theme

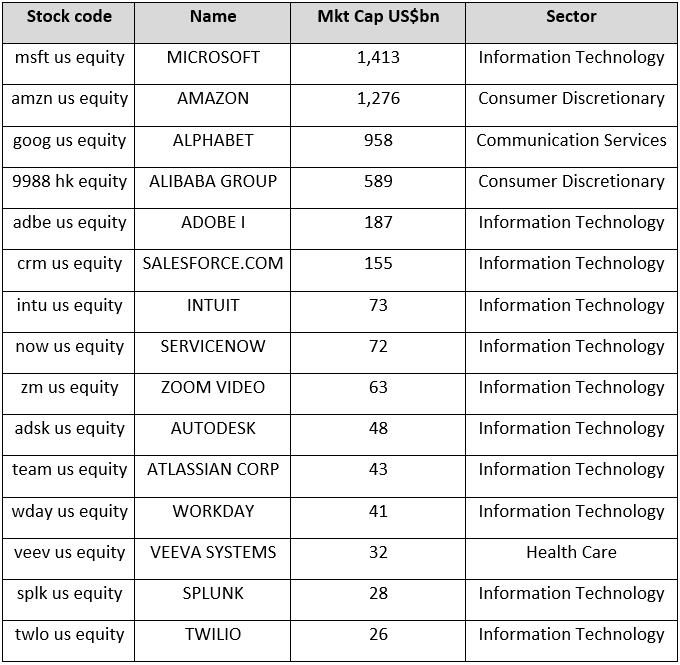

It's difficult to access this theme in Australia with the largest reasonable-sized cloud computing ASX listed stocks being SaaS vendors, Xero and Wisetech. However, the largest market cap IaaS and SaaS names globally include the following:

Our current preference for our clients to benefit from this theme is through the large IaaS vendors (Microsoft, Amazon, Alphabet and Alibaba) along with selective SaaS providers such as ServiceNow, Atlassian and Freee.

Atlassian, based in Sydney, is the global leading collaboration software used by developers and IT teams more broadly. The company’s revenues are growing above 30% p.a. and it has an extremely efficient go-to-market strategy, enabling the group to have a lower sales and marketing spend per dollar of revenue than its peers. This allows the company to invest significantly in R&D, whilst generating a free-cash-flow margins in excess of 30%. The Corona virus impact has led the company to shift to offence, with increasing hires and the offer of free product trials to help customers out during this crisis. Such measures should see an acceleration of growth in one, two or three years out.

Freee, is a Japanese cloud-native accounting software, is penetrating a very large and nascent domestic market. In Australia, 62% of small businesses use cloud-based accounting software (with Xero being the market leader). In Japan, the market is much more nascent, with just 14% of small businesses using cloud-based accounting software. The market is also very large, particularly in the mid-market where average revenue per user (ARPUs) will be significantly higher than Xero. Should Freee execute on the opportunity, they could have a similar market cap to Xero (US$8.4bn) vs. their current US$2.4bn in future years.

ServiceNow, is a cloud-based company that provides software for technical management support. The company specialises in IT services and has built out an impressive platform of tools used to support customers from services to security. The company is growing revenues above 30% p.a. with close to a 30% free-cash-flow margin. High growth rates look sustainable given the recent release of a premium version of their core IT Services Management product. This comes with significantly enhanced features of artificial intelligence and machine learning, coupled with a 50% uplift in price and already gaining good traction.

Munro Partners has owned Microsoft, Google, and Amazon since the establishment of the Munro Global Growth Fund in 2016 and owned them for many years prior at our previous firm. While China’s Alibaba was added early in 2019, our clients have benefited from strong absolute and relative returns as this thesis has played out.

Want to learn more?

Munro focuses on identifying and investing in companies that have the potential to grow at a faster rate and on a more sustainable basis than the peer group. To find out more, hit contact below.

2 topics