The boom of Zoom. Work tools flying high in the work from home era.

Who would have thought the world could materially operate under shelter in place conditions with millions if not billions of employees working from home (WFH)?

Remote work has been an emerging theme, especially across the technology sector. Still, many corporates held the traditional view that the corporate office ensures productivity, fosters culture, and enables hallway bonding, thus being the modus operandi until now.

With the imposed WFH conditions implemented globally, businesses of all shapes and sizes have been catapulted into new workplace practices, mostly requiring usage of critical technology cloud-based "work tools".

These work tools have emerged as leading technology platforms out of necessity, thus providing the infrastructure and utility to enable communication, collaboration, and productivity in this restricted environment.

You know the type, virtual ping-pong between Zoom meetings, constant pings from co-workers on Teams, or Slack or tasks shared on Asana with no corresponding info. Learning how to utilise these tools best has been jarring and by no means a smooth transition yet the longer we operate within them, the more accepted they become and the more effective we get at adopting them in our working lives.

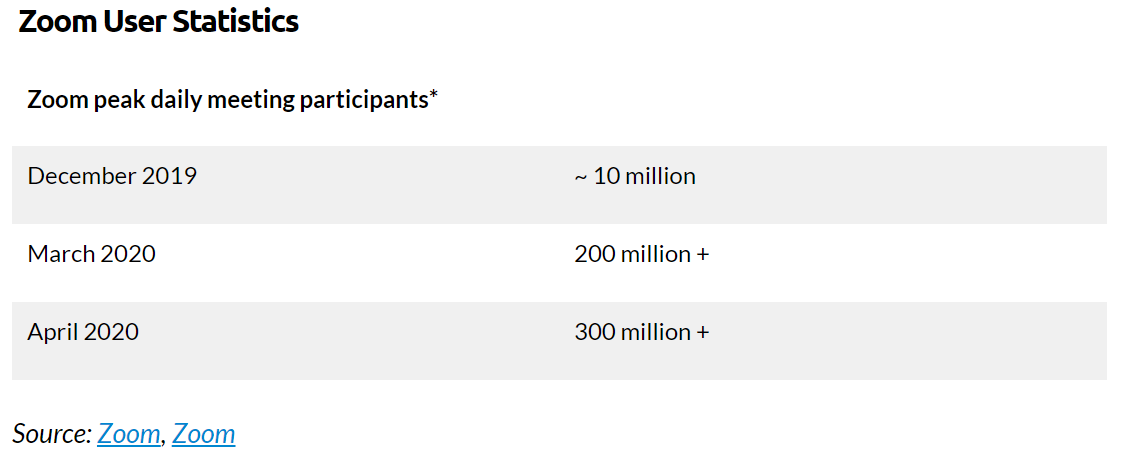

The fantastic thing about technology platforms and cloud usage is their inherent ability to scale to meet demand. On the major platforms, adoption of these tools is staggering, for example, Zoom has increased its daily meeting participants from 10 million (Dec'19) to 300 million+ (Apr'19) in just four months.

Source: https://www.businessofapps.com/data/zoom-statistics/

Microsoft Teams has surpassed 75 million active users at the end of April, adding over 31 million in the preceding month. Microsoft has one of the largest (maybe the largest) platforms, and thus the roll-out and subsequent adoption of a tool can be rapid as evidenced below.

.png)

Source: https://www.statista.com/chart/20028/daily-active-users-of-slack-and-microsoft-teams/

How are investors responding?

We've all witnessed the continued strength of technology stock on the market, Zoom itself is up 144% YTD. There have been some great pieces on Livewire about other recent technology stock picks like Atlassian and Afterpay.

The recent sentiment of both public and private markets seems to be more uncertainty, doom and gloom, rather than boom and Zoom. However, venture capitalists and angel investors are looking at the likes of previous 'unicorn' successes of Airbnb, Spotify, Stripe and Uber which were founded around 2008 (GFC) and Zoom (2011) during times of financial strife for the next opportunity to get in at the groundfloor with the hope of exiting at the penthouse in the next decade.

The post-GFC generation of companies often followed the trend of digitising and adding convenience to daily interactions outside of the workplace. In contrast, some of the current generation of recent unicorns ($1bn+ companies) have focussed on something we are more familiar with lately, remote work, online collaboration and productivity.

There is a definite appetite from venture capitalists to support the category with emerging companies closing recent deals such as flexible workspace app Notion (founded 2013) pocketing US$50m at a US$2 billion valuation after 'quadrupling' in a year and a carbon copy deal of US$50m at US$2 billion for design tool Figma (founded 2012) who've set out to build the 'Google Docs of design'. We use both extensively in our workplace.

The work tool and workplace collaboration sectors are heating up with innovation across video-conferencing, messaging, voice-technology, calendar & AI-assistants, project management and workflows, virtual offices, low-code / flexible platforms, etc. See below the explosion of tooling that's emerged in recent years to enable better work.

.png)

Source: Mapping Workplace Collaboration by Merci Victoria Grace

Australia has also held its own with technology companies such as household name Atlassian (dev tools), Canva (online design), Clipchamp (online video editing), Drawboard (engineering collaboration), Qwilr (online sales presentations), SafetyCulture (process), Notiv (meeting assistant) and others [Disclosure: We are investors in a few of these]. The beauty of product-led tools such as these is that they don't require direct salesforces which opens up their addressable market extensively and allows them to be globally-focussed from day one.

It's our view that the world has changed, some folks will convert to the new world and way of work, some will revert. What's clear is that work tools, online collaboration, connectivity, and the forcing hand of COVID-19 have opened our eyes to what's possible. We expect this trend of online work to continue to expand throughout companies big and small around the world and the emergence of global technology winners that help facilitate it.

Investing in jets, not steam engines.

TEN13 is an investment product that gives Sophisticated Investors access to venture capital investment opportunities into private technology companies. Started by Steve Baxter (Pipe Networks, Shark Tank).

Hit the follow button on my profile below to be first to receive our insights on the emerging opportunities in venture capital.

3 topics