The Buy Side Brief: Paying a premium for certainty

Defensive sector valuations leave little room for disappointment

Nick Leitl, Senior Portfolio Manager, K2 Australian Absolute Return Fund

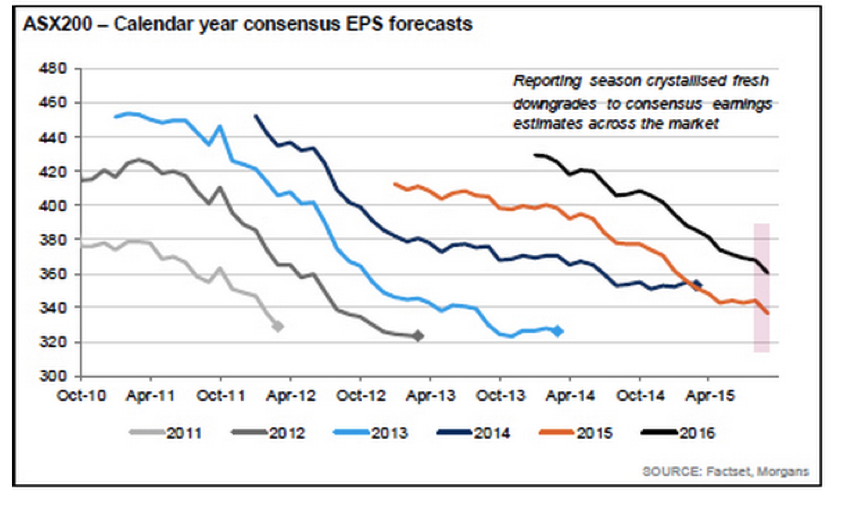

The current operating environment for Australian corporates has been one characterized by low growth, low interest rates and low inflation. While the composition of growth has shifted significantly in recent years, the overall level of growth remains below trend. Given this environment, corporates exposed to the economic cycle have generally delivered disappointing results relative to analyst’s optimistic expectations. The most recent reporting season proved to be no different, with the ASX200 Industrial companies delivering +4.6% EPS growth versus expectations of +7.2% at the beginning of the 2015 Financial Year. Given this investment landscape, investors have been willing to pay a premium for companies that can deliver earning certainty and in particular, growth. Defensive sectors such as Infrastructure, Telco’s and Healthcare have benefitted from this dynamic given their insensitivity to the economic cycle and pricing power. While this has been a rewarding investment strategy in recent times, we would highlight that valuations within these sectors have little room for disappointment.

Pockets of value in the REITs sector

John Campbell, Portfolio Manager, Avoca Investment Management

The traditional defensive sectors being REITs, Utilities, and Healthcare generally exhibit low earnings sensitivity to economic conditions. Accordingly, in this period of economic weakness where Australian GDP estimates have been revised down from 3% to 2% or less and with consumer confidence at multi-year lows, one would expect these sectors to perform relatively well. In the main, this is happening with the S&P/ASX 200 REIT index outperforming the S&P/ASX 200 by 6% post reporting period (and 9% calendar ytd), the Utilities index outperforming by 9% (and 14%), and the Healthcare index outperforming by 4% (and 9%). That said, we believe it is foolish to slavishly “buy a sector” without analyzing the underlying characteristics and valuations of the constituents. Having done this exercise, we do see pockets of attractive value within the REIT sector (some providing yield spreads to Commonwealth 10 year bonds of 3-4% with defensive growth potential), but see many Utilities as highly geared with some regulatory risk. Certain of the healthcare stocks such as RHC just look too excessively priced to warrant portfolio inclusion (PE premiums of 60-70%).

Select opportunities in the small cap sector

Ed Prendergast, Senior Fund Manager, Pengana Emerging Companies Fund

Sectors such as telecommunications, healthcare, aged care, retirement living and childcare provide revenue streams which are not heavily reliant on the economy. The smallcap market also provides investment opportunities in niche areas such as intellectual property services (IPH Ltd), automotive wholesale (Burson Group), consumer credit reporting (Veda Group) where revenue streams are relatively stable. There is a strong rationale for paying a premium for earnings certainty, as a lower level of earnings volatility makes accurate valuations easier to derive. More cyclical revenue streams are far harder to forecast, and therefore a lower quality. This premium is especially applicable in times of economic uncertainty, however cyclical stocks do present opportunities where the share price is factoring in overly bearish future outcomes.

2 topics

2 stocks mentioned