The case for the world heavyweight in equities: China

Livewire Markets

Investing in China is an appealing concept - what's not to like? From Shenzhen to Shanghai, there's a veritable goldmine of stocks to choose from, a burgeoning middle class that is keen to spend, and the sheer size of the population is a growth opportunity unto itself. But, as tempting as this bull case is we wanted to know where the real growth lies and how to sidestep some of the inherent risks in this market.

In this series, Livewire Markets has sought out three top-tier experts in investing in China. In part one, we explore why there is a compelling case for investing in China right now. Next up, we look at some of the inherent risks (and myths!) about investing in the Chinese market and how to mitigate them. Lastly, we ask our experts to uncover the hidden gems that are unexpected or under-researched.

Our responses are from:

- Mary Manning, portfolio manager, Ellerston Capital

- Stephen Kam, Investment Director, Asia ex-Japan equities, Schroders, Hong Kong

- Nicholas Yeo, Director and head of equities - China, Aberdeen Standard Investments

Tech winners in the land of growing opportunity: Mary Manning

These are the four traits Manning said will make China the reigning world champion in the equities market: size, growth, valuation and diversification.

Size: With a consumer market of 1.41 billion people, 400 million of which are in the still-prized millennial age bracket, China is classed as a heavyweight on size alone. And it doesn't stop there.

Growth: China has a rapid growth trajectory. Manning pays particular attention to China's solid COVID-recovery without the need for "an outsized level of monetary stimulus".

"The good news for investors is that this growth is translating into earnings growth at Chinese companies," Manning told us.

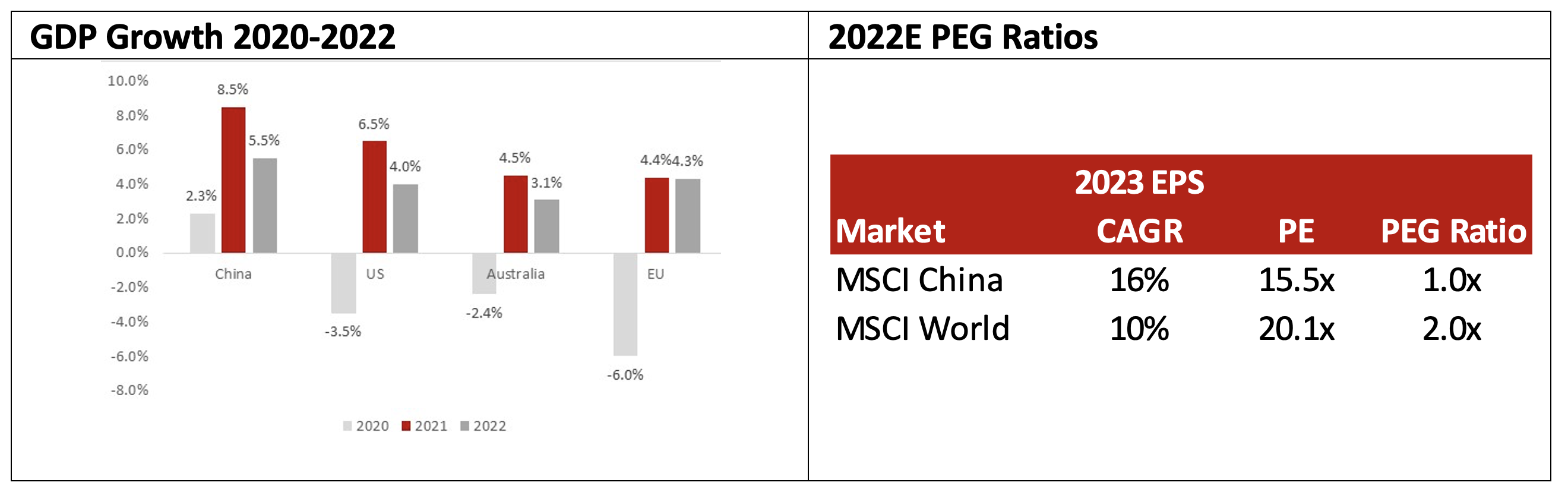

Valuation: Compared to the MSCI World index, China is trading at much lower PE multiples.

Caption: The 2-year CAGR for MSCI China is 16% and the market is trading at only 15 times PE. The MSCI World is trading at 20.1 times PE and has a 2-year CAGR of 10%. This means the PEG ratio is much lower for China. Source: Supplied.

"So on average, investors are paying roughly half the price per unit of growth in China as they are on a global basis," wrote Manning.

Diversification: The last point Manning makes is the strength of the Chinese tech sector.

"China is increasingly dominated by mega-cap technology stocks", Manning told Livewire Markets.

"Given the paucity of large-cap technology option in the domestic market, China provides an attractive avenue for sector diversification."

Combine the growth opportunity of tech stocks with the compressed valuations and you'll find some stocks which are ripe for the picking.

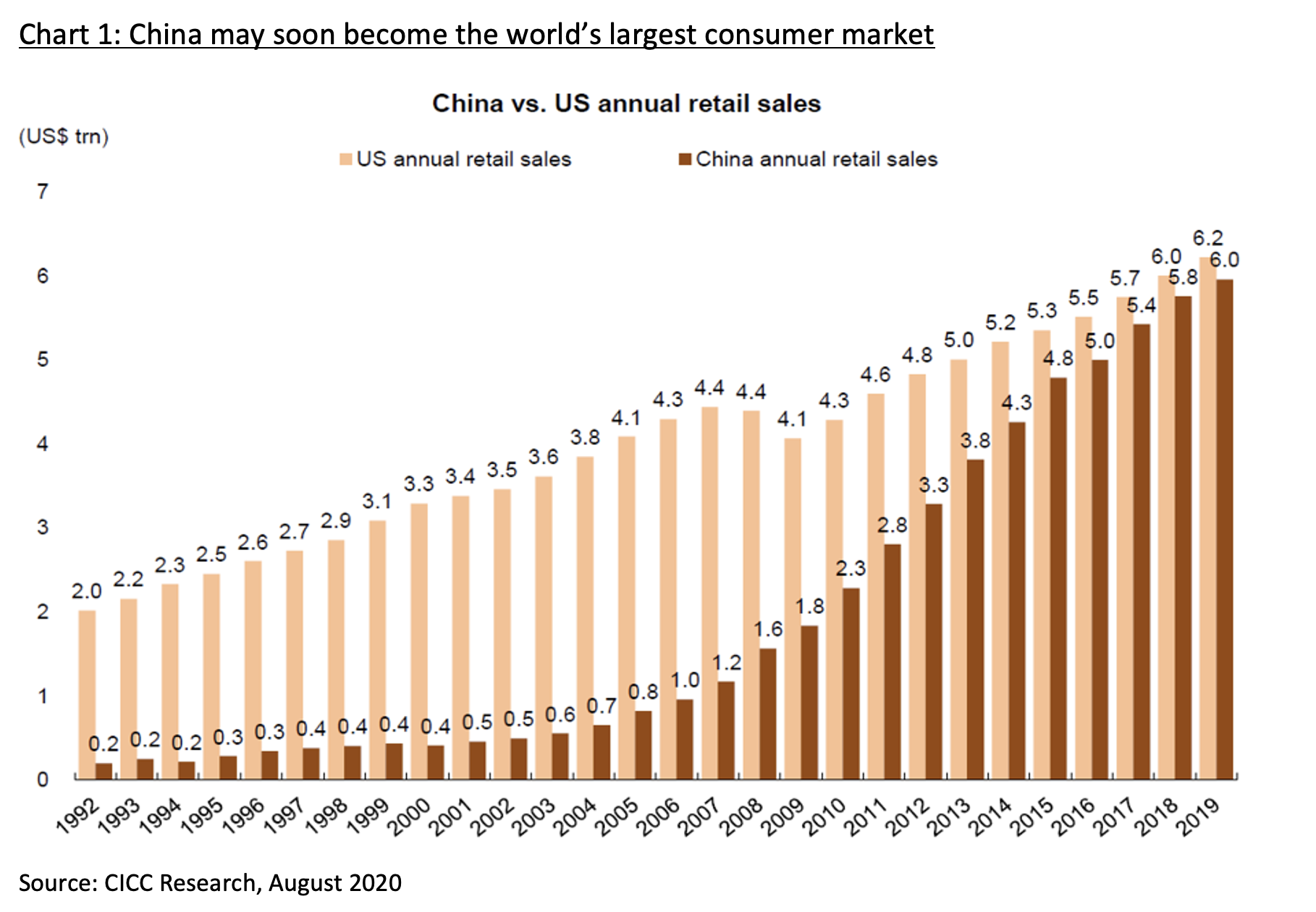

China's consumer market will soon overtake the US: Stephen Kam

While Kam takes a more risk-aware outlook, he cannot deny the growth projections for the China economy.

China had a very strong start to this year with elevated retail trading.

Source: Supplied.

In the medium term, Kam sees a positive outlook for the continued rise of wealth in China. He points to what he calls a "consumption upgrade" theme (also known as premiumisation) which has seen increased spending on higher quality and higher-priced goods and services.

However, his caveat is not to assume that strong economic growth will result in positive returns.

"Economic growth helps to provide a tailwind to company earnings, but it is important to invest in high-quality companies with strong management teams that can lead a business through economic cycles," he told Livewire Markets.

Who benefits?: Nicholas Yeo

According to Yeo, there are a lot of beneficiaries to the tailwinds of China's future growth trajectory.

- Domestic tourism

- Online deliveries

- Health-care products

- Wealth management services and insurance

- Luxury goods and services

- Cloud computing, data centres and cybersecurity

- Renewable energy and battery supply chains

- Electric vehicles and related infrastructure

It's a whirlwind list of sectors but there are a few key themes underpinning them all:

"Policymakers are steering China's economy away from dependence on industrial manufacturing and exports, towards growth powered by domestic consumption and services," said Yeo.

This domestication trend and the rising middle class will specifically fuel China's long-term growth. But there are also broader global trends where China is leading the way, especially from a policy stance. China's commitment to carbon neutrality by 2060 is giving some sectors a "bright future", said Yeo. Decarbonisation and electrification are big drivers for a number of the sector Yeo is optimistic about. While the pandemic has accelerated existing trends, like digitalisation which Yeo said would see "structural growth drivers such as the adoption of 5G and artificial intelligence remain intact".

Conclusion

A big recovery runway, lots of diversification and the "consumption upgrade" thematic to provide future tailwinds. It sounds like there is resounding optimism from our bulls in a China shop, but how do they maneuver the market without breaking things?

Our next article will dive into the risks inherent to the Chinese market and how a savvy investor can learn to avoid them.

Related articles:

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

Four reasons to register for Livewire’s 100 Top-Rated Fund Series

Livewire’s 100 Top-Rated Fund Series goes live on 1 June 2021. Register now if you want:

· To get first access to a list of Australia’s 100 top-rated funds

· Detailed fund profile pages to help you compare performance, fees, and philosophy

· Exclusive in-depth interviews with expert researchers from Lonsec, Morningstar and Zenith.

· One-on-one videos and articles with 16 of Australia’s best fund managers

3 topics

5 contributors mentioned

Mia Kwok is a former content editor at Livewire Markets. Mia has extensive experience in media and communications for business, financial services and policy. Mia has written for and edited several business and finance publications, such as...

Expertise

Mia Kwok is a former content editor at Livewire Markets. Mia has extensive experience in media and communications for business, financial services and policy. Mia has written for and edited several business and finance publications, such as...