The Fed's not coming to rescue Wall Street (and 3 stocks to watch)

Welcome to Charts and Caffeine - Livewire's pre-market open news and analysis wrap. We'll get you across the overnight session and share our best insights to get you better set for the investing day ahead.

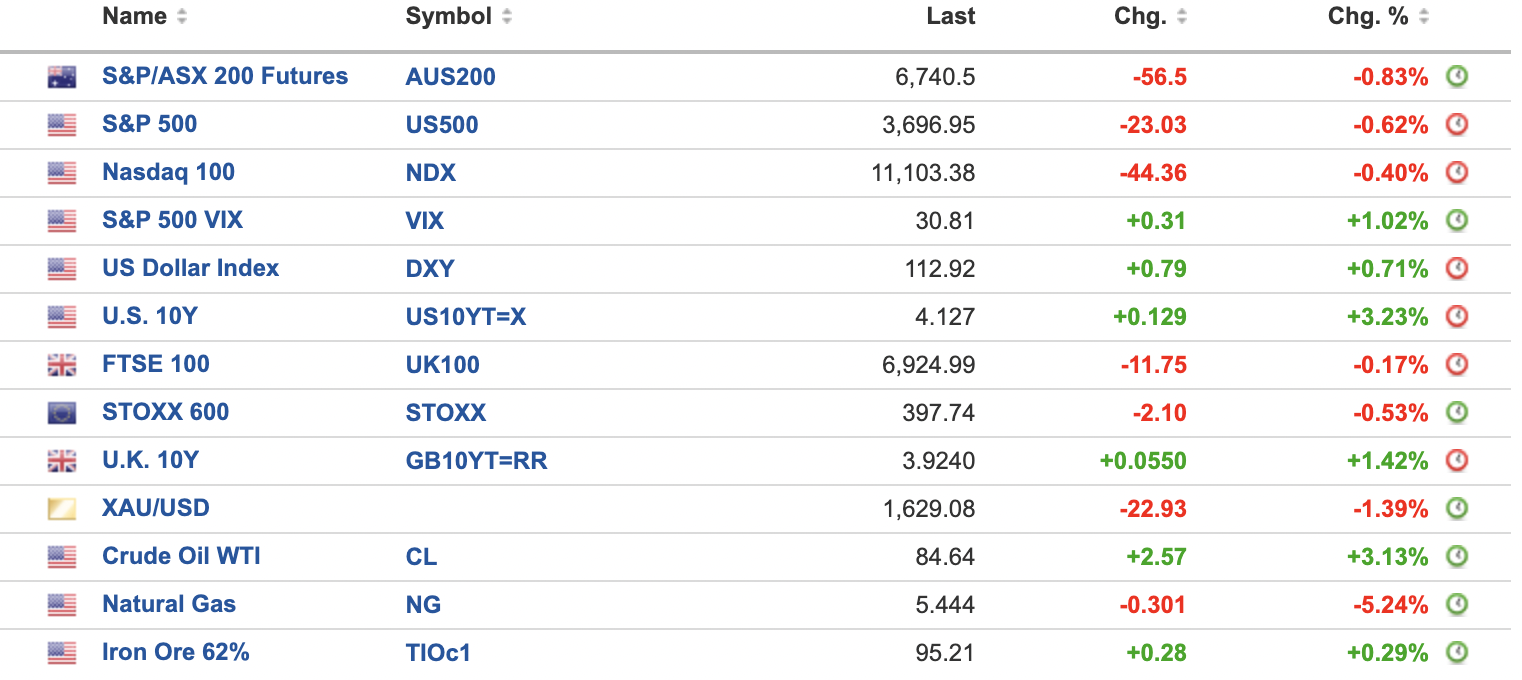

MARKETS WRAP

MAJOR HEADLINES

- BoE to begin asset sales in two weeks but exclude long-dated debt

- UK inflation moves back to 40-year high in September

- Fed officials have coalesced around a 75 bp hike at next month's FOMC meeting

- Poll suggests ECB will hike 75 bp in October meeting

- Eurozone September inflation revised down slightly, still at record high

- RBA slowdown in rate hikes reflects better wage management and indebted households

- White House orders officials to prepare for more emergency oil releases

- Russian commander says Kherson situation "difficult" as Ukraine advances

- Iran agrees to ship missiles and more drones to Russia

- North Korea says it fired artillery shots as "serious warning" over South's military drills

THE CALENDAR

First up, we need to address the elephant in the room - the Chinese GDP read from earlier this week has been delayed indefinitely. I won't speculate what this could mean, but this decision to delay is (relatively) unprecedented.

Other than that, it's all about Aussie unemployment and labour force data. The forecast is for the unemployment rate to stay at a record low of 3.5%, but the number of jobs added could be a lottery in and of itself.

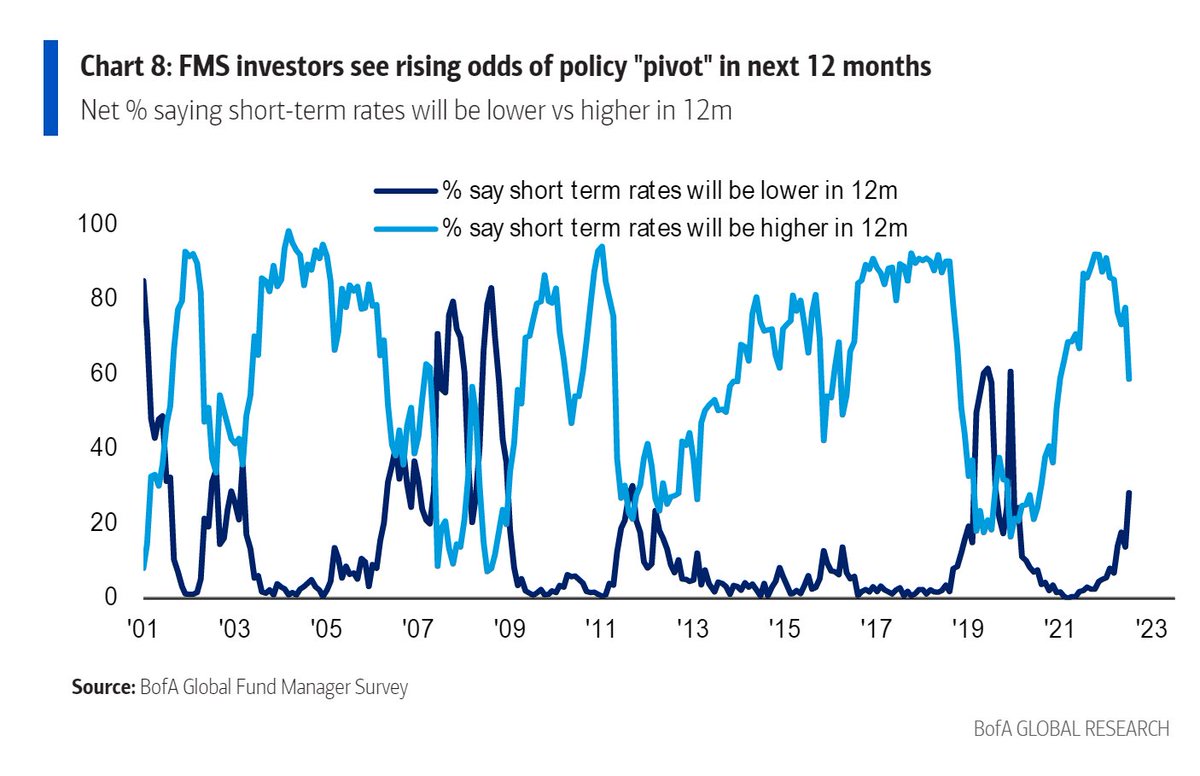

THE CHART

If you were thinking the Fed would come to Wall Street's rescue, think again. The Federal Reserve's board members have recently shut down any speculation they may pivot from their existing plan. But that's not deterring some fund managers from betting on a pivot in the next year. After all, central banks made the first mistake - what's the chance that they won't make a second?

Speaking of central bank mistakes, you can catch more on that very subject from our interview with Chris Watling of Longview Economics. You can access that interview here:

.png)

STOCKS TO WATCH

Goldman Sachs is backing two sectors - agriculture and travel/tourism - over the months ahead, pointing to stocks like Corporate Travel Management (ASX: CTD), Webjet (ASX: WEB), and Elders (ASX: ELD) as buys.

The team believes global macro concerns have seen valuations for the travel stocks descend despite momentum continuing to hold strong. They add that the corporate segment has more of a growth runway than the leisure segment. Here's the rest of their thesis:

"We remain comfortable with our strong growth outlook with full recovery to pre-COVID levels in ANZ and Americas now expected in FY24 vs. Europe and Asia being slower into FY25, in our view," Goldman Sachs said.

This, in turn, explains the buy ratings for CTD and WEB. And if you're wondering about Flight Centre (ASX: FLT), that stock has a neutral rating because of its corporate versus leisure thesis.

And in the agriculture space, the current uncertainty in agricultural markets "supports a tilt to suppliers and distributors who are better insulated from escalating costs and do not carry the same growing and execution risks of processors and producers," the investment bank said.

This explains why Costa Group (ASX: CGC) has been downgraded to neutral, leaving Elders (ASX: ELD) as the top preference in the sector.

TODAY'S TOP READ

Jamieson: We're starting to run into issues that can break markets (Livewire - Chris Conway):

My friend (and co-writer of this report) has hosted an excellent CIO Profile with Charlie Jamieson of Jamieson Coote Bonds. Listen in for his comments on zombie companies, his thoughts on the global supply chain crisis, and his portfolio strategy right now.

Hans Lee wrote today's report.

GET THE WRAP

If you've enjoyed this edition, hit follow on this profile to know when we post new content and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

3 topics

5 stocks mentioned

1 contributor mentioned