The five best charts from the IEA’s World Energy Outlook 2023

Global fossil fuel demand is set to peak by 2030 as EV sales pick up pace and the world shifts towards cleaner energy sources like nuclear, solar and wind, according to the International Energy Agency.

This marks the first time in history where demand for oil, natural gas and coal is forecast to peak based on current government policies.

The IEA World Energy Outlook report is filled with rich insights and data. The only problem is that it’s 355 pages long. In this wire, I’ll be sharing some of my favourite charts and key takeaways.

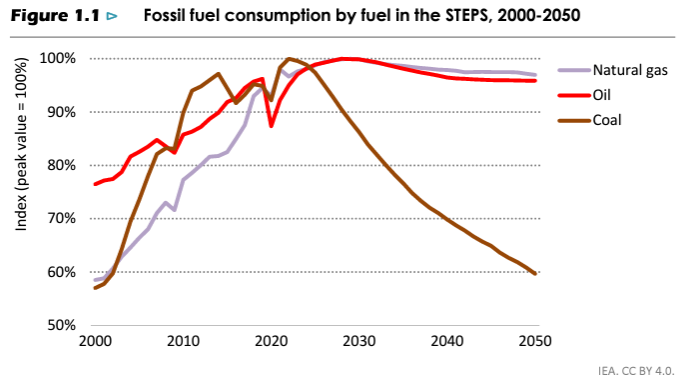

#1 Demand for coal and natural gas to peak this decade

All fossil fuels peak before the end of this decade, with declines in advanced economies and China offsetting increasing demand elsewhere (Source: IEA 2023)

For the first time ever, demand for each of the three fossil fuel categories are projected to peak by 2030. The change is attributed to:

- Downward revision in global economic outlook

- Continued ramifications of the 2022 global energy crisis

- Fossil fuel technologies losing market share to clean energy technologies across various sectors

- Fossil fuel-powered technologies have already seen a peak in sales or additions

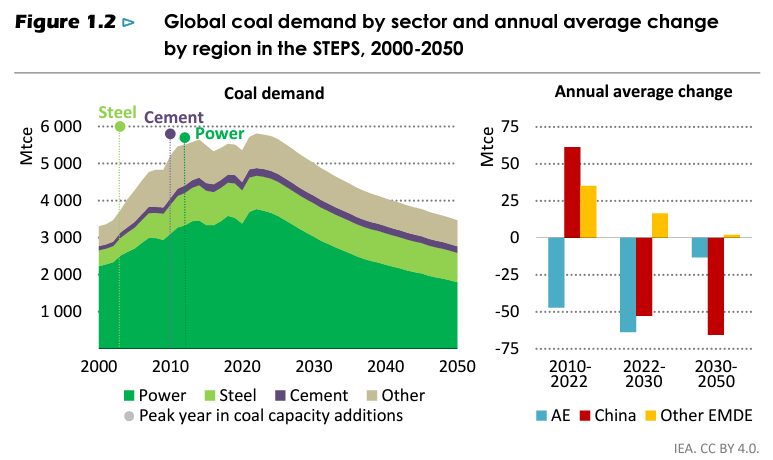

#2 Not all coal is made equal

Peaks in coal capacity additions reached in the power, steel and cement sectors are laying the foundation for global coal demand to peak in the mid-2020s (Source: IEA 2023)

The projected decline in global coal demand is expected to be primarily driven by a reduction in coal-fired power generation, which currently accounts for 65% of overall coal consumption.

“The role of coal-fired power plants has started to shift towards providing flexibility and system services rather than bulk power,” notes the IEA.

However, the chart indicates that industrial demand for coal, particularly from the steelmaking and cement industries, is likely to remain relatively stable through 2050. Any met coal bulls?

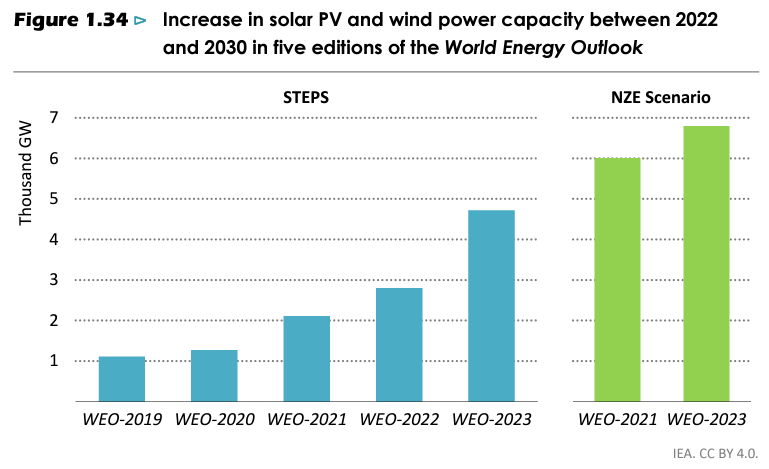

#3 An upgraded renewables outlook

Wind and solar PV projections ratcheted up as policy support increased, costs fell and manufacturing expanded, yet more is needed to get on track for net zero emissions (Source: IEA 2023)

The IEA upgraded its projections for solar and wind generation to 2030 due to:

- Policies: “The number of countries with policies that support expansion of solar PV and wind has steadily risen, and now stands at over 140.”

- Cost reductions: “Between 2010 and 2022, the levelised cost of electricity fell by about 90% for solar PV, 70% for onshore wind and 60% for offshore wind.”

- Manufacturing capacity and industrial policies: “IEA projections now fully account for developments in clean energy supply chains, which in some cases have far outpaced actual deployment and created an opportunity for further rapid increases.”

It’s worth noting that the STEPS (STated Energy Policies Scenario) is not a forecast. It’s an assessment of government policies and they’ve been getting more and more ambitious (hence the upgraded projections).

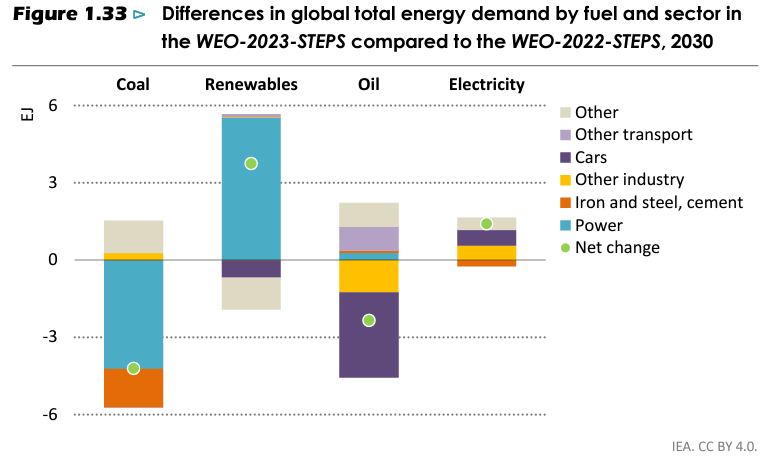

The upgrade in renewables results in less demand for coal and oil.

In this outlook, the power sector taps significantly more renewables and uses less coal than in the WEO-2022-STEPS, plus road transport is electrified faster (Source: IEA 2023)

#4 Clean energy deployment is working

Solar PV, wind power and EVs reduce emissions by 6 Gt in 2030 in the STEPS relative to the pre-Paris Baseline Scenario (Source: IEA 2023)

The deployment of clean energy technologies, spearheaded by solar, wind and EVs, is beginning to reshape the trajectory of global emissions.

- Solar is projected to reduce emissions by around 3 gigatons (Gt) in 2030, equivalent to the emissions from all the cars currently on the road worldwide

- Wind power is estimated to contribute a further 2 Gt of emissions reductions in 2030

- EVs are expected to reduce emissions by an additional 1 Gt

#5 … But we must go faster

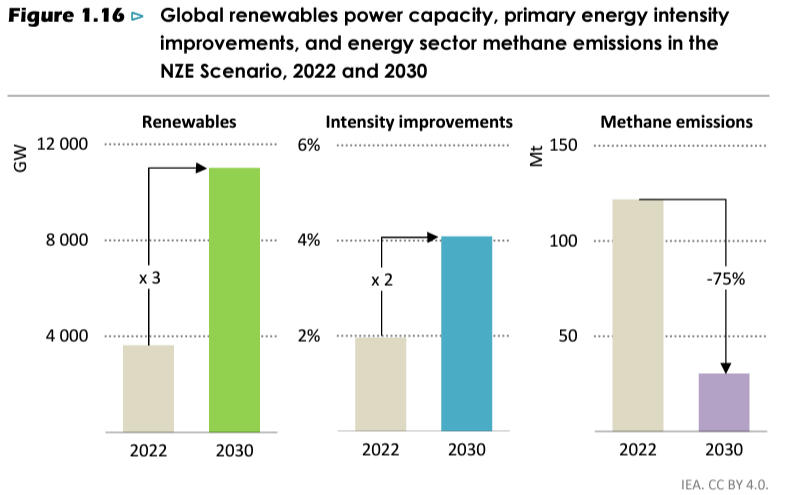

Renewables, energy efficiency and methane emissions reduction options are available today and crucial to reducing near-term emissions (Source: IEA)

The IEA’s net zero emissions scenario calls for the tripling of installed capacity of renewables and doubling the rate of energy intensity improvements.

“Current trends are encouraging; repeating the growth rate seen over the last decade would be sufficient, and current policy settings already put advanced economies and China on track to achieve 85% of their contribution to this global goal,” the report said.

4 topics