The generational opportunity in renewables

The Australian Energy System faces a generation dilemma, in both senses of the word. First, from an electricity generation perspective, the inevitable shut down of Australia’s coal fleet creates a “Generation Gap” that will need to be filled by a replacement form of generation. Second, from a technology perspective, a new generation of cleaner and cheaper technologies are emerging that will both complement and replace the existing system. Renewables, plus a combination of new technologies are the best placed alternative to meet this gap and serve the interests of the people, and therein lies the investment opportunity.

Why are we in this situation?

The electricity that powers both homes and industry in Australia remains predominantly carbon based, and in particular is coal based, given the cost of the fuel supply and the stated target of the National Electricity Objective of being in the “long term interests of consumers of electricity with respect to: price, quality, safety and reliability and security of supply of electricity”. In order to meet demand for electricity throughout the day, and due to their historical design and physical properties, when operational, coal plant in Australia’s National Electricity Market (the “NEM”) tend to operate on a 24/7 basis, producing significant amounts of electricity. This is typically described as supplying the “baseload electricity”. However, this will create a significant issue within the NEM over the next 25 years.

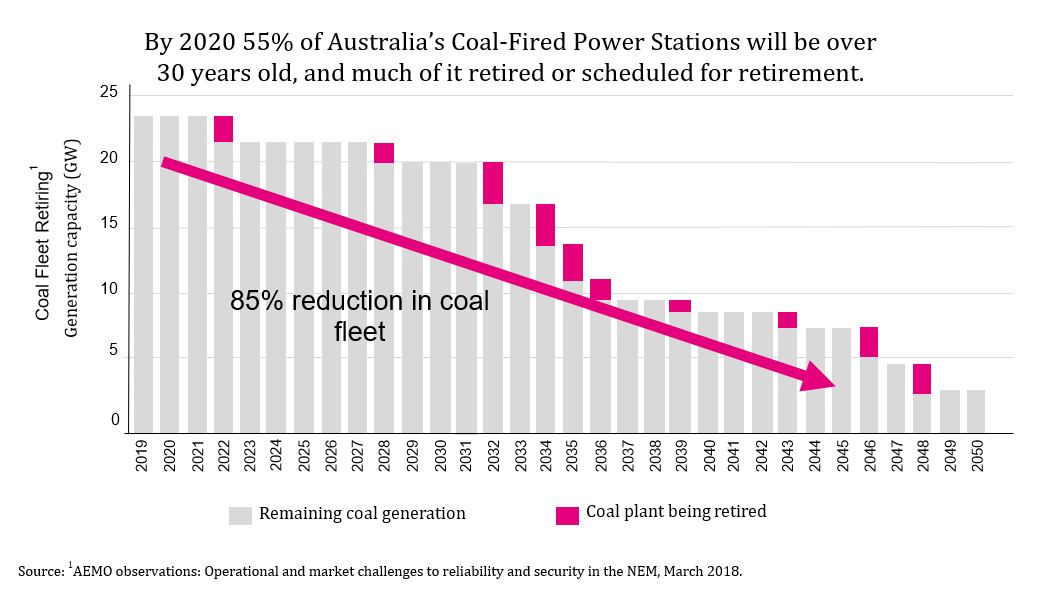

Australia’s fleet of coal fired power stations are aged and are approaching the end of their technical operating lives.

Even more pertinently, there are wider economics factors at play – given that the these generators compete in an price based market against other forms of generation, the owners of these plants, must periodically make an economic decision as to whether to keep a deteriorating asset in operation and to continue to invest in order to eek out “another couple of years”. The power station owners will need to make an investment decision with respect to both return of, and return on capital for any additional capital expenditure investments necessary to maintain and possibly extend the life of the plant. Factoring into this investment decision is the reality that as the coal fleet gets older, like any mechanical device they tend to becoming increasingly more unreliable, particularly during the times of peak load. Therefore the capital investment decision to keep such power stations open is likely to be value dilutive and baring external intervention the plant will shut down prior to the end of its technical life, further exacerbating the challenge of the Generation Gap.

There have been two closures of large baseload supplying coal fired power stations in the NEM in recent history:

- The Northern / Playford B Power station complex in South Australia in 2016, the closure of which was brought forward 12 months after the initial announcement. At the time Playford B was 53 years old (having been mothballed since 2012), and Northern was 31 years old.

- The Hazelwood Power Station in Victoria in 2017 (which at the time supplied roughly 25% of Victoria’s power requirements), the closure of which resulted in significant price volatility in wholesale energy market, and means that most of the time Victoria will import electricity from New South Wales.

The next scheduled closure is the Liddell power station in NSW. Put all the coal fleet together, the picture looks like this:

To be clear, it is not the closing of the power stations that is the precise issue – it is the manner in which they are shut down and whether or not planned investment is made to fill the resulting Generation Gap. The coal fleet served the interests of the country (at the time) well – but over the long term their closure is inevitable, and they will contribute less and less to the overall generation mix. It is also worth highlighting that the insurance that these plants have will cease to be provided post 2030. The removal of large portions of baseload, particularly in an unplanned or early manner results in significant shifts and changes in the supply / demand balance of each state. AEMO (responsible for operating the grid) and the AEMC (energy market rule maker) have taken steps to dampen this volatility effect by requiring more advance notice of generator closures, but the fact remains that these coal fired power stations have a finite remaining lifespan, and the resulting energy gap needs to be met.

At the dawn of the Electricity Era, initial power stations were built near the load centres (i.e. capital cities and large industrial areas of the country). Post World War 2, as population growth and industrialisation drove an increasing demand for electricity, it became more efficient to build coal fired generation closer to their fuel site – often a coal mine (either bituminous or lignite) or rail head to a coal mine, and then transmit the electricity via the transmission grid to where it was required.

As the generation capacity of the nation was built out, the key factors driving when, where and why coal plants were developed were:

- Supply of electricity (i.e. new power stations) had to be built out significantly in advance of demand, and had to retain sufficient capacity to satisfy “peak demand”

- Security of fuel type – Australia had large resources of coal, that was suitable to use for thermal generation

- At the time, building large coal fired power stations was the most appropriate way of producing that electricity

- Electricity, once generated, could not be stored

- Consequences of CO2 in the atmosphere and other greenhouse gases were unknown

Crucially, the building of large baseload coal fired power stations required significant state planning and investment (generators were run by state governments at that time), co-ordination between state governments and local authorities, as well as substantial amounts of time. Arguably two key developments in the 1980s and 1990s created the environment for the Generation Gap issue to arise some 30 years later:

- Some State governments, looking to fund significant budget deficits or recycle funds to invest in other areas began to progressively privatise their electricity assets, including state owned coal fired power stations; and

- The National Electricity Market was created, with the overall intention to lower prices to consumers via increased competition by installing market based mechanisms and end the vertically operated state based monopolies on energy

Whilst the electricity market in theory was meant to produce price signals that acted as investment signals to build new baseload generation, these clear signals did not eventuate to incentivise the private owners to sufficiently replace the older coal generators with newer coal generation. The “youngest” coal fired generator in the NEM is now 13 years old, with additional builds of coal fired generation increasingly unlikely.

Fortunately, given the shift in technology, an alternative, cleaner source of generation is at hand.

Where to from here?

Returning to the above key factors, but with a modern renewables lens:

- Whilst still utility scale, renewables can be built out quickly to match up with demand. In addition, the more modular nature of renewables build out means that have a better scalability factor

- Security of fuel type – Australia had large resources of sun and wind, which is suitable for renewable generation

- At the current time, on a levelized cost of energy basis, building large scale renewable generators are the most efficient way of producing that electricity

- The increasing role of batteries and pumped hydro is overcoming the storage question, and in tandem with renewables brings us closer to the goal of dispatchable generation

- Consequences of CO2 in the atmosphere and other greenhouse gases have become known – one would like to think that all other things being equal, the consumer would rather their electricity being produced on a renewable basis rather than a contributing to the country’s CO2 emissions.

Building Australia's clean energy future

Octopus Investments are investing directly into the Australian renewable energy sector and helping to provide the innovative solutions it needs during its transition to a clean energy future. Stay up to date with our latest insights by clicking follow below or visit our website for more information.

1 topic