The Great Unshackling: Political Capital vs Excess Fear

Discussions on unwinding COVID-related social distancing measures have moved to the fore. Australia’s leaders have managed the crisis relatively well so far. In doing so, they have demonstrated competence and earned political capital which will help minimise the risk of subsequent disease waves and influence public attitudes. Even so, excess fear may significantly hamper our economic recovery. Whilst the government was able to close the economy, it will find it harder to order a re-opening.

In the last week, press briefings from Australian Prime Minister Scott Morrison and Chief Medical Officer Brendan Murphy have clearly moved towards the process of normalisation. A resumption of elective surgery and advice in relation to re-opening schools have been raised. Manufacturing and construction have been declared safe and the return of community sport has been flagged.

If this period will be remembered as the Great Lockdown then May 11, the date at which the current restrictions will be comprehensively reviewed by the National Cabinet, may be remembered as the dawn of our Great Unshackling.

The RBA is not our only put option

Much has been made about central bank put options since the GFC. In more recent times, we have seen them demonstrated forcefully. In the absence of exceptional central bank intervention to keep credit flowing and interest rates low, the crisis would have seen mass bankruptcies and the probable fragmentation of social cohesion. It was nothing short of that.

However, Australia also possesses another valuable put option. It will not be found on any balance sheet, but it too has grown along with our debt-GDP ratio. This asset is political capital and it is being deployed into a relatively patient, evidence-based, reversal of measures.

Hard Earned Political Capital

Australia’s COVID response has been exceptional. As a result of prior capacity building and early actions, our current situation is amongst the best in the world. This has provided the leadership with enhanced legitimacy and offers concrete evidence of their ability to manage this crisis.

To give some context, we may compare ourselves with New Zealand. Their outcome is also world leading and Prime Minister Jacinda Ardern is rightfully winning plaudits for her leadership. However, the absence of a senate or state governments to contend with could infer that executive authority is more achievable there. On the other hand, Australia is managing through the crisis via a National Cabinet which includes leaders of each state and territory, including a majority from the opposing party of the national government.

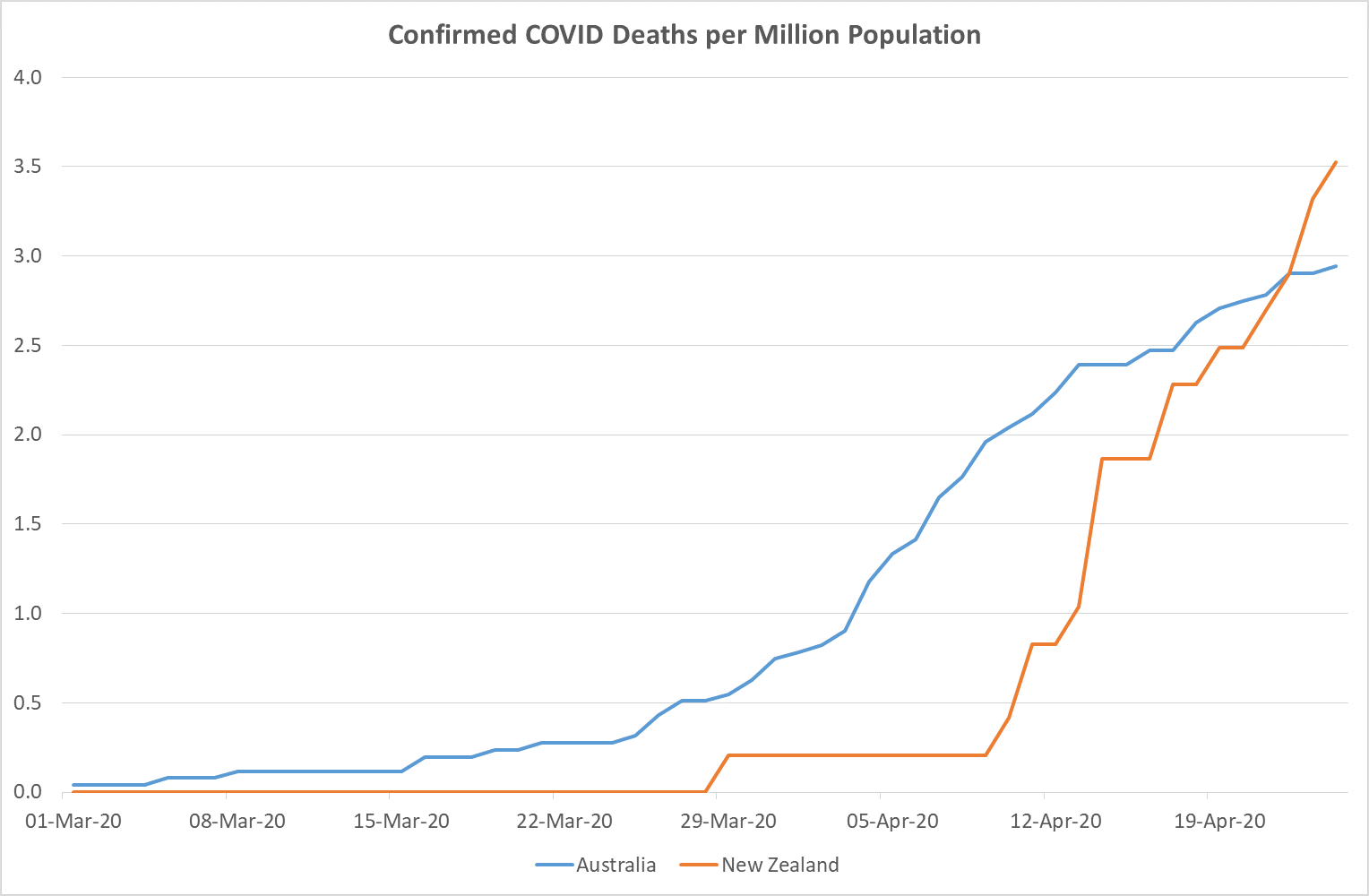

To date, the number of deaths as a proportion of population is similar for both countries:

Source: European Centre for Disease Prevention and Control

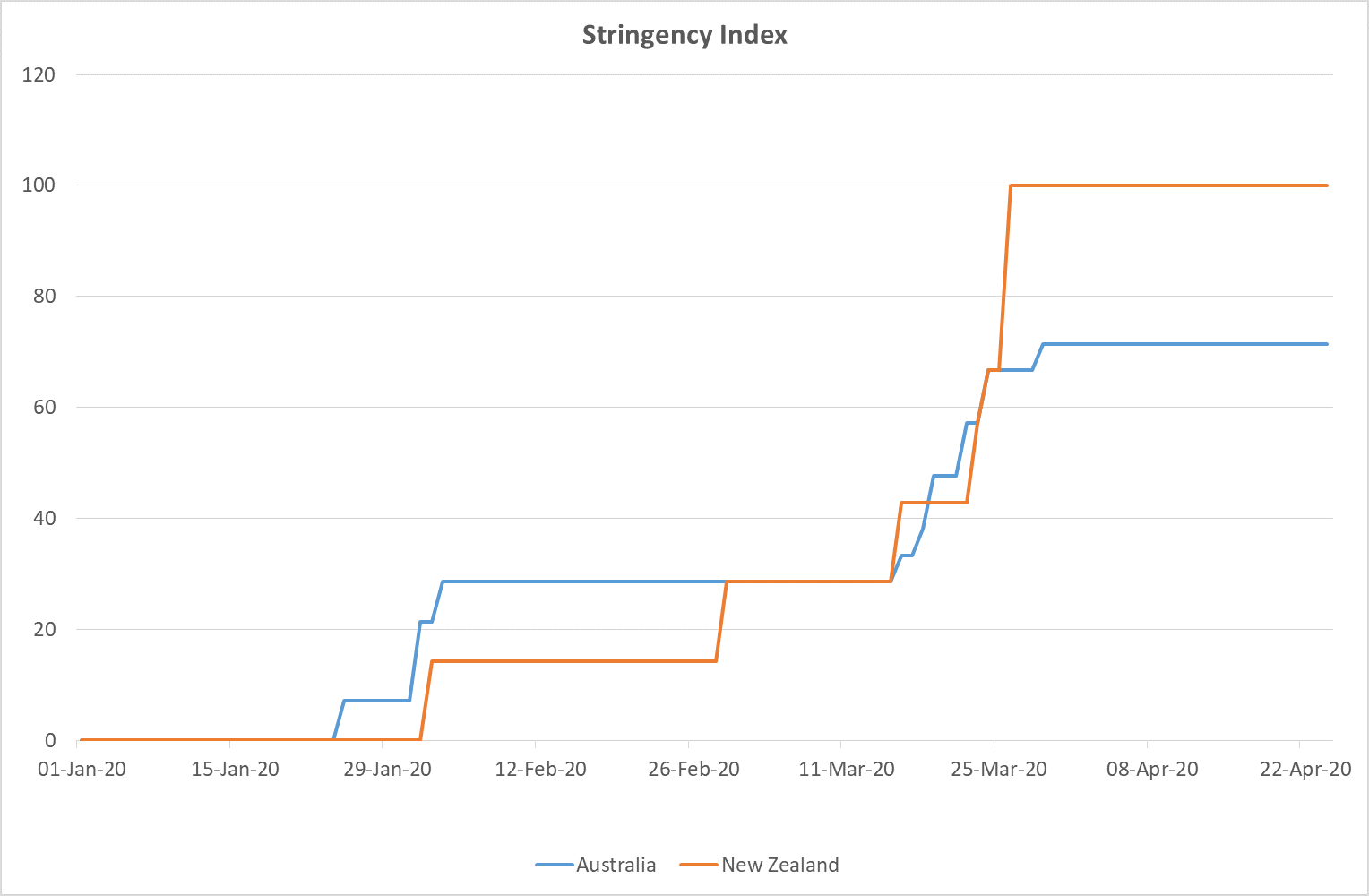

Furthermore, Australia has achieved these outcomes without imposing the same level of restraint and thereby reducing the societal cost:

Source: Blavatnik School of Government, Oxford

Could it be that Australia’s results, similarly to New Zealand’s, benefited from being an island? This may have contributed, but the United Kingdom, Singapore and Japan are not faring especially well. Concerns are highly elevated for Indonesia. Further, the American continent shares no land border with Asia or Europe and is faring poorly. In a world which is heavily interconnected via air-travel, islands were not spared from COVID.

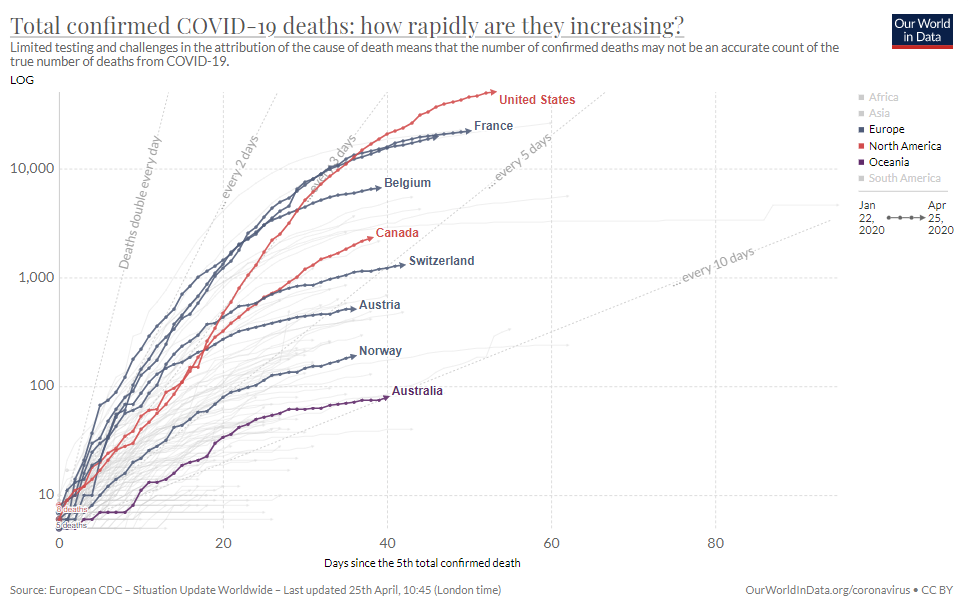

It may also be argued that Australia benefited from observing the efforts of other countries which, like Italy, were hit with the disease sooner. Perhaps this may explain the favourable outcomes thus far? Whilst this would certainly have contributed, Australia has nonetheless contained the rate of spread exceptionally well when compared with other major nations who were affected at a similar time on different continents:

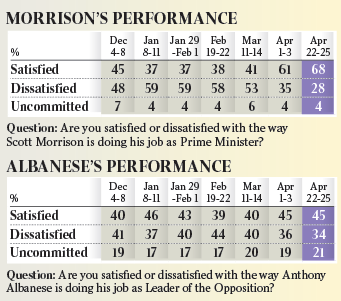

Australia’s management of COVID has been outstanding even if we allow for our natural advantages and good fortune. In hindsight, better decisions would surely have been possible. Nonetheless, Australia’s leaders have earned a jump in net satisfaction since COVID moved significantly to a domestic concern in late February. Rather than attaching these results too tightly to individuals, it is also an indication of belief in the institutional process being applied to this challenge. Political capital has been earned and the competence of the current governance arrangement has been demonstrated:

Source: YouGov, NewsPoll, The Australian

Buying time provides more clarity

By 11 May, we will have had the opportunity to learn many things which will help calibrate the extent to which social distancing measures can be relaxed. For example: Spain has re-opened manufacturing, Denmark has re-opened schools and shops are re-opening in Austria. However, Japan is providing an example of how difficult it is to bring COVID under control when it lacks the legal mechanisms to lock down the populace. This may provide some insight in to how our population may act when legal restrictions revert to advisory warnings.

Australia’s evidence based approach to managing the crisis will benefit from live and diverse data to inform its actions. The political capital currently available to our leadership provides a valuable buffer against haste.

In combination, this represents an economic, health and societal put option of significant value. Very few nations have such a powerful asset available to them. Even the Victorian Chief Health Officer, Brett Sutton, who has been the most vocal of senior health advisors advocating for more stringent actions, is no longer planning for a second wave.

Overcoming fear will be hard

The outlook for Australia’s management of COVID is vastly better than it was feared only a month earlier. However, just as beach-goers to Bondi were slow to react to the increasing seriousness of the risk, the economy will likely be slow to react to the decreasing risk we currently enjoy.

Schools provide a litmus test. The Australian Health Protection Principal Committee never advised schools to close. This decision was essentially taken out of its hands by the actions of concerned parents and state medical officers. They have now announced that social distancing measures are not required amongst students and Scott Morrison is urging schools to re-open. Yet, the community is strongly divided.

The rate at which the economy will recover will depend a lot on how safe it feels. Belief in leadership is an important part in that. The ability to reduce the risk of a second wave is also key.

Australia is currently exceptionally well placed on those fronts. There is also a reasonable likelihood that the measures put in place to carry our economic structure through this period were, fortunately, in excess to what may now be required.

Nonetheless, the RBA had been waiting for animal spirits to re-ignite for many years before it saw a gentle turning point emerge last year, only to have this comprehensively unravelled by COVID.

Emerging with a strong position

There is still a very long way to go before a significant sense of normalcy will return. Much uncertainty remains in relation to how the disease will progress and how the world will react to it. Australia is better placed than most to manage the risk of additional epidemiological waves. However, to the extent excess fear may hold our economy back from its fullest potential, it would be much worse were it not for our political capital. It has been well earned and must now be well spent.

2 topics