The investment theme that’s out of this world

Decades after the space race finally lapsed, it’s back in vogue. Global governments are committing in the billions to space exploration. Even locally, the Australian government established the Australian Space Agency in 2018 and is committed to growing the local industry to $12 billion by 2030. The global space economy is tipped to be worth over US$1.1 trillion by 2040, according to Deloitte.

At first glance, you might assume the space economy is simply Virgin Galactic and SpaceX tourist flights and that mission to colonise Mars – there’s far more to it, and it could touch on every sector of the market. In short, it’s a critical theme and nations who aren’t committing, risk getting left behind.

In this wire, I’ll explore what the space economy looks like and how to invest.

To infinity and beyond: The space economy

The space economy effectively spans exploring, researching, understanding, managing and utilising space. To say the least, it’s broad. On one hand, you have your space flights and mission to Mars-type activities. On the other, you have satellites for telecommunications or research activities that change the nature of how we do things on earth – like waste management or efficient water use in agriculture.

There are implications for security and defence – if you consider the use of satellites and other space infrastructure for surveillance and communications. And moving more to the realm of sci-fi – there’s tourism. After all, we’ve already seen private commercial space flights.

It’s also worth considering how space research and exploration has benefitted us in the past – and what that might mean for the future.

For example, home insulation using aluminised polymer is a result of NASA’s work to insulate spacecraft. A nutrient ingredient in many baby formulas tracks back to research exploring the use of algae to feed astronauts. Wireless headsets came from the need to support astronauts communicating inside and outside spacecraft. On a medical note, CAT scans trace back to imaging technology used to map the moon.

From that perspective, the space economy is deeply exciting and essential to ongoing progress and development. It should come as no surprise that governments have recognised the potential and the need to budget for space agencies.

The key sub-sectors of the space economy and companies to look at

There are a range of ways to categorise the space economy – but I’ll share the one I found easiest from Liberty Street Advisors.

Liberty Street points to three key segments of the space economy.

- Upstream (key inputs) – design and manufacturing of space-related hardware and technologies. Some examples include satellite hardware, orbital vehicles and lunar assets.

- Mainstream (operations) – the operation, maintenance and servicing of space systems. For example: ground products and services, space station operations, and space waste removal.

- Downstream (applications) – the collection, aggregation and application of any information, data or other uses from space. For example: satellite communication and navigation, geospatial data and analytics, and defence and security applications.

The big investment opportunities from the space race

It’s an area we may not discuss much in the Australian market, but one that US investors are actively considering and have access to in both the public and private markets. There are even a range of ETFs listed in the US on this front from the likes of ARK Invest, State Street, BlackRock and a variety of publicly listed companies.

From a private market perspective, Christian Munafo from Liberty Street Advisers highlighted the space economy as one of the significant themes he invests in. You can read more here.

The aspects of the space economy he views the most potential in are:

-

Cost-effective and sustainable space access

“Demand for space access has been quickly outpacing supply, with flight launches often booked multiple years in advance. Costs have been concurrently growing, with larger and more complex payloads,” says Munafo. Some of the exciting areas he sees in this space include 3D-printed rockets, single-stage-to-orbit and reusable rockets. -

Downstream space subsector

“Some key applications with the ability to drive future growth within the industry include space data-as-a-service, microgravity-driven manufacturing and R&D, in-space pharma and geospatial intelligence,” he says.

These opportunities can be equally applied in the public space.

How to identify investments in the space economy

As a growing, complex and innovative space with a lot of blue-sky thinking, evaluating space opportunities is far from easy.

Munafo shared the key characteristics he looks for in the private sector.

-

Industry relationships

“The space community is relatively small, close-knit, and supportive, and we have found that companies with extensive industry relationships (both commercial & government) have a leg-up regarding product approvals, government & commercial contracts, and access to funding.” -

Government grants/contracts

“Unique to space compared to traditional innovation industries, government grants have and will continue to play an important role in the space economy. Grant amount, potential for additional funding, and diversity of source funds (for example, NASA, Space Force, Air Force) are all important indicators of potential company success and validation.” -

Contract Value

“Space company financials can be difficult to evaluate if there are revenue recognition delays linked to specified milestones. In these instances, contract value becomes the focal point making note of: commercial vs. government, recurring vs. one-time, upfront payment vs. staggered, etc.”

How to invest in the space economy

There is an abundance of public and private companies that specialise in space – think SpaceX, Virgin Galactic (NYSE: SPCE), Intuitive Machines (NASDAQ: LUNR) and Rocket Lab (NASDAQ: RKLB).

Investors thinking to dabble their toes might want to think broader than companies that specialise just in space. After all, there are many established players with space as an aspect of their overall strategy.

Some global examples include:

- Amazon (NASDAQ: AMZN) which plans to send 3,236 satellites into orbit for high-speed broadband connectivity.

- Lockheed Martin (NASDAQ: LMT) which is developing early-warning weather and climate observation satellites, along with looking at defense system technologies from cybersecurity to missile defense.

- Boeing (NYSE: BA) which have joint ventures with Lockheed Martin and has developed space communications systems and satellites for military, commercial and scientific purposes. Boeing was also responsible for the development of the International Space Station, NASA’s space launch system and the CST-100 Starliner (a space capsule to take people to and from low earth orbit).

Defence companies feature heavily as those involved in the space economy - this is unsurprising given the potential of space for surveillance, along with other data measures. Investors who are hesitant about the risks of pure-play might find defence is an option for exposure.

There are also those companies that sit as part of the greater supply chain to the space economy and service other industries, such as those in 3D printing like Stratasys (NASDAQ: SSYS) or in automation like Teradyne (NASDAQ: TER).

Australia’s space industry is far smaller and less developed, so unsurprisingly most specialised listed options on this front are small and micro caps. One ASX listing was delisted this year too – Kleos Space SA.

A few companies to research include:

- Electro Optic Systems (ASX: EOS) – creates products and services for applications in the defence, space and communications sectors. Market Index’s broker consensus tool ranks it as a Strong Buy.

- Brainchip Holdings (ASX: BRN) – specialises in developing advanced artificial intelligence and machine learning hardware. Brainchip is not covered by major brokers or data in Market Index’s broker consensus tool.

-

HighCom (ASX: HCL) (formerly Xtek) – provider of protective security, tactical and forensics solutions to government, law enforcement, military and commercial services. HighCom is not covered by major brokers or data in Market Index’s broker consensus tool.

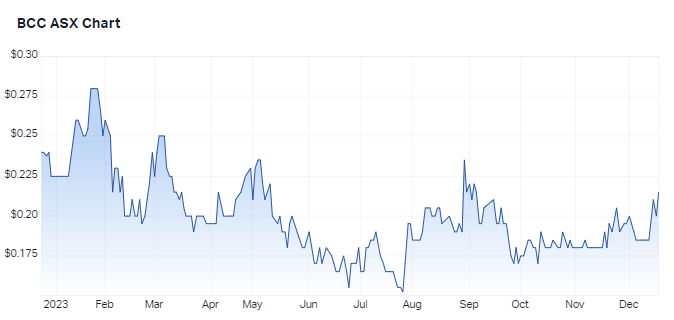

- Beam Communications (ASX: BCC) – developer of mobile satellite terminals, devices and accessories. Beam Communications is not covered by major brokers or data in Market Index’s broker consensus tool.

While a developing theme, the space economy is clearly one to watch. It's telling how many governments are committing to spending on this front and the projected growth is extraordinary.

Are you investing in the space economy? Let us know in the comments what investments you are using for exposure.

3 topics

11 stocks mentioned