The lifecycle of a biotech

Earlier in the year, we found that Australia's best performing sectors of the past decade were healthcare and technology. They are both fan favourites given their ability to swiftly generate mountainous returns. However, with this comes risk of rapid deterioration: one wrong approval, regulation or competitor could send shareholder value crashing.

At the intersection of these (but only by name) is a species of stock known as biotech. Companies in this space create medicine and products from living organisms. On the other hand, traditional pharmaceutical companies derive their products from chemical bases. Breaking into the US market is the Holy Grail for any of these companies, however with this comes huge degrees of scrutiny and a rigorous approval process from the Food and Drug Administration and similar regulatory bodies. We have seen before our very eyes former Livewire favourite Mesoblast hit towering highs followed by stark drops after selective releases of trial results were met by legal action.

Given the complexity of the process and various stages of approval required before commercialisation can even commence, I reached out to three experts to shed some light on the key milestones to watch as a prospective biotech investor:

- Claire Aitchison from Independent Investment Research

- Kanish Chugh from ETF Securities

- Dr Bianca Ogden from Platinum Asset Management

5 key steps to look out for

Claire Aitchison, Independent Investment Research

Treatments being developed by biotech companies are subject to a number of hurdles to ensure that the treatment is safe and effective for its intended purpose. Every country/region has its own regulatory authority, in which treatments are required to get approval from. In Australia, treatments are required to be approved by the Therapeutic Goods Administration (TGA). In the US, the Food and Drug Administration (FDA) is the regulatory authority. Companies frequently seek approval from the FDA as the US is often the largest market for drug developers and manufacturers.

The life cycle of a drug's development typically goes through 5 major phases:

- Pre-clinical phase: The drug is tested in the laboratory to determine the potential for the drug to work;

- Phase I: Studies typically conducted in healthy volunteers to determine the safety of the treatment;

- Phase II: The treatment is trialled in a small group of people with the disease or condition to determine its effectiveness;

- Phase III: If deemed safe and effective on a large scale, the Phase III trial is undertaken. This trial seeks to gather additional data to the Phase II trial, studying the safety and effectiveness of the treatment in different populations and different doses as well as potential combinations with other drugs;

- Marketing approval: This is the formal application for the regulatory authority to approve the drug for sale.

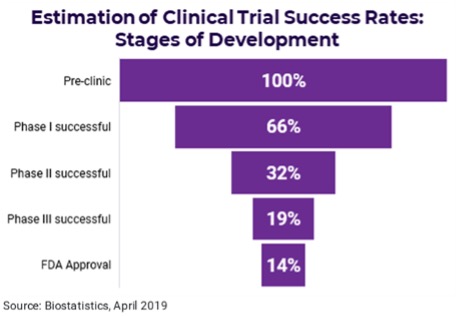

FDA poses the world's hardest test: 14% success rate

Kanish Chugh from ETF Securities

In the US, where the guts of the money is, the government agency that approves new drugs is called the FDA. The FDA is held in high regard because of its foresight to see off disasters such as thalidomide (which was approved in Europe with known consequences but rejected in the US).

The FDA’s drug approval process is strict and long in most cases. On average, it takes 10 years for a new drug to go from early trials to complete approval. And only a small minority of new drugs get approval.

The two key phases for FDA approval are phases 2 and 3, outlined on the FDA’s website, where drugs begin animal and human testing. Phase 3 trials are especially important and are typically the most expensive - The average cost of developing a new drug is estimated at more than US2.1bn.

Pay attention to the foundation

Dr Bianca Ogden, Platinum Asset Management

The biotech industry is fragmented, ranging from tools and diagnostic companies to therapeutic biotechs. It all starts with a hypothesis, which is followed by validation in the lab. In the case of lab tools, commercialisation follows; for diagnostic tests, validation has to be done in a real-time clinical setting prior to regulatory approval.

For therapeutics, following validation in the lab (in vitro), the new drug has to be tested on animals and subsequently clinical trials on humans follow (generally three phases). Following approval, companies will conduct various post-approval studies to tease out certain advantages (or at times disadvantages) of the drug or show long-term outcome benefits. Throughout this process you have to continue to market the product, so each stage is incredibly important when gauging the future success of a biotech.

Conclusion

We all know about the success stories: CSL is arguably Australia's greatest export (aside from AC/DC) and continues to flourish on the global stage. But our experts have highlighted the gruelling nature of approval and importance of being diligent at every step of the way. For the biotechs that can appease regulators, they can continue to scale with a 12-year uninterrupted moat in the form of a patent, so being first and being right is crucial; much easier said than done.

Join myself and our guests in parts two and three of this collection, where we will explore the key steps in conducting a fundamental analysis of stocks in the sector, before discussing the allure of the space and their tip for the next big discovery.

Stay up to date with this series

Make sure you "FOLLOW" my profile to be notified of the upcoming entries in this series.

If you enjoyed this wire, please click like and comment below the biotechs you have on your watch lists and where they are in their lifecycle.

4 topics

2 stocks mentioned

2 contributors mentioned