The markets are expensive and it doesn't matter!

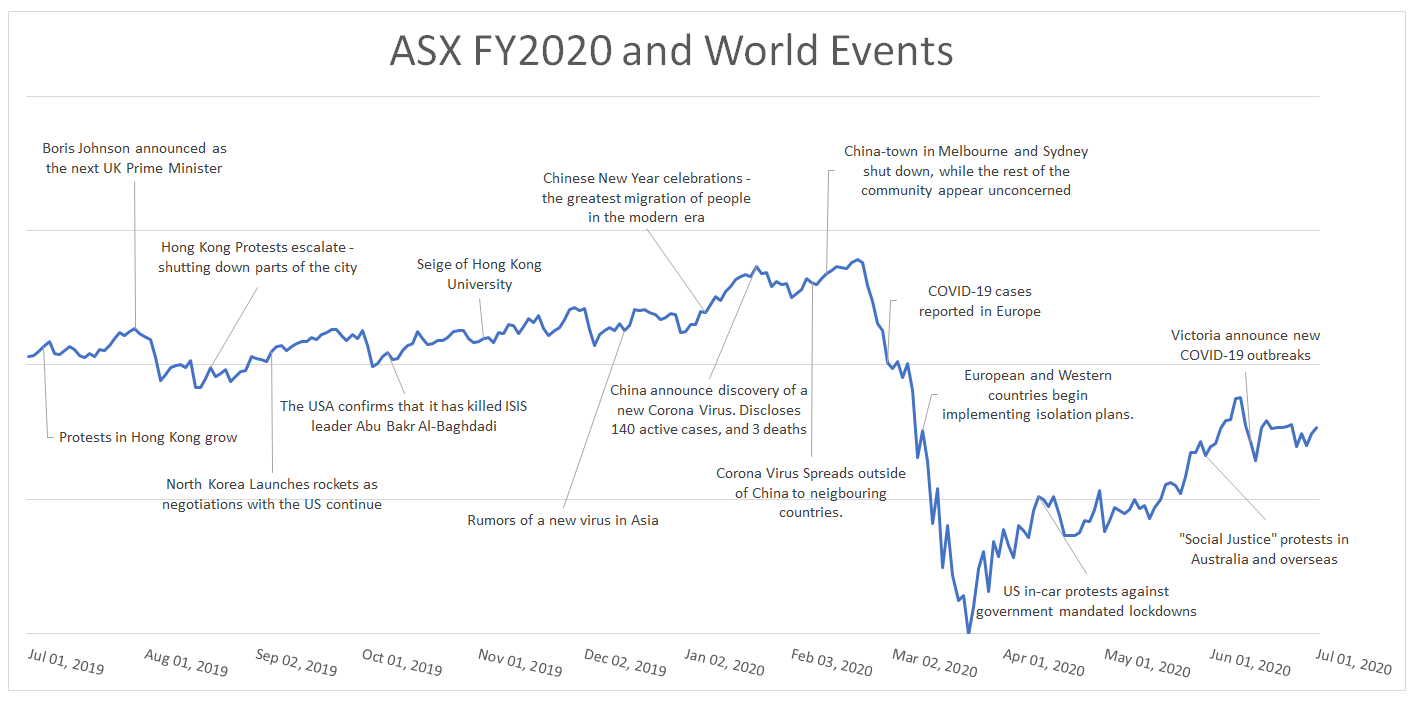

The 2020 Financial Year certainly

threw up some challenges. To think the

biggest global issues investors were contemplating only 12 months ago included

the UK’s dealing of Brexit and the transition of the Prime Ministership from

Theresa May to Boris Johnson! Six months ago, the world was enthralled and

slightly wary as the USA and North Korea continued to negotiate as North Korea

tested its missile capabilities. Petty disagreements and general political

unrest seemed to dominate the headlines.

Uncertainty seemed to abound, but as we were about to discover, we

hadn't seen nothin’ yet.

The most we can hope for is the perception of certainty. In truth, all times are uncertain.

Markets started off the financial year rather strongly, but it wasn't to last. Instead, we are experiencing the first global pandemic in over 100 years.

Nations and their economies have been shuttered, and the implications for company earnings have in many cases been catastrophic. If it were not for the unprecedented (and I generally hesitate to use that word out of context) government support both locally and abroad, there is little doubt that the rate of bankruptcy brought upon by the forced closures of business would have been so great as to require a generation to recover. Instead, governments recognised the dire situation and have rightly implemented programs for companies (that would have otherwise thrived in normal circumstances) to survive the Coronavirus lock-downs.

Interestingly, a sense of community and the greater good have seen private enterprises and major corporations step up and support those effected. Landlords around the country have deferred and/or reduced rents for tenants facing hardship, while the local banks have all implemented mortgage holidays for 6 months already, and have promised to roll some of that relief over for another 6 months.

It will certainly be interesting to see how the debt being used to fund these programs will be repaid, and it will be a study in human resistance as incentives and cost breaks are rolled back. Nevertheless, at this time the focus has been and remains on all the efforts necessary to get the economy through the next 6-12 months.

Given all the challenges we currently face, it is unsurprising that the markets have struggled. Not only did the ASX face the fastest 40% correction in its history, but it has followed it up with one of the fastest recoveries as well. Investors could be forgiven for wondering what on earth is going on.

We don’t know how the future will play out but we are confident that uncertainty will provide us with opportunity. And, given our a substantial cash position, we are excited by the prospect of what markets might offer us over the coming year.

Market Volatility

As previously mentioned, the Covid Crash and subsequent share market recovery are without historical precedent.

More than the velocity of the moves, the question of what drove them continues to be an area of interest for us and for other fund managers and capital market professionals we are in touch with.

Consensus appears to be that the crash was appropriate (albeit quicker than expected) given the previous expensive state of the market and the mountain of debt that has fuelled asset prices over the last few years.

We saw COVID-19 not as the cause for the correction, but instead a catalyst for a long overdue normalisation of markets.

The true surprise for our team has been the speed at which markets have recovered, and with that recovery the numerous stock stories that simply seem unbelievable.

Why in the face of a near certain global recession, and the first in Australia for 29 years is the market so prepared to pay a premium for listed companies?

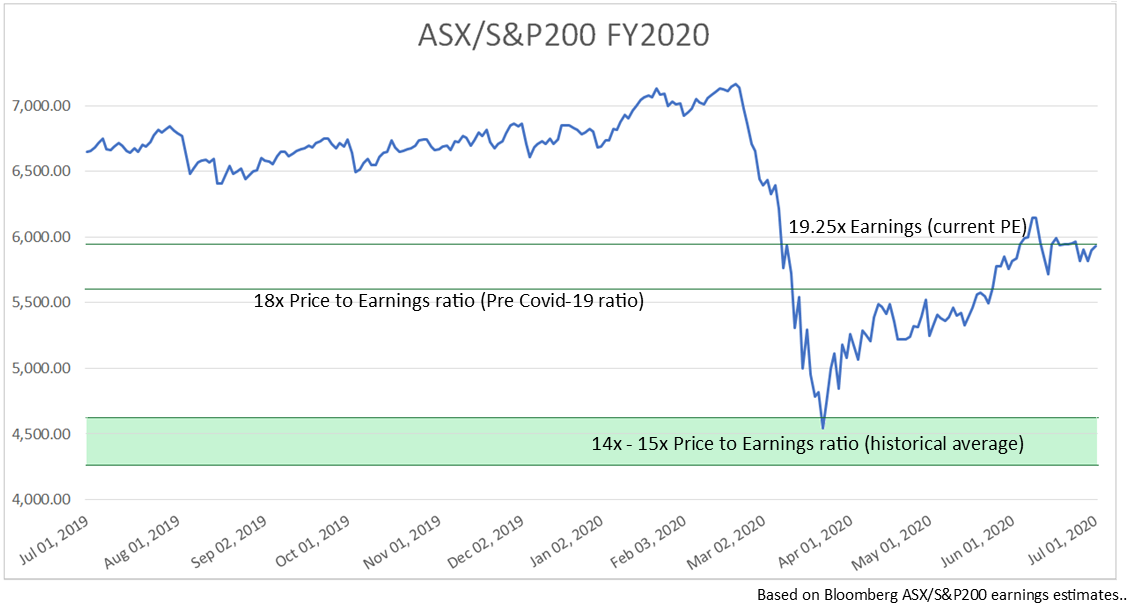

In the March we discussed that markets had fallen from 18x earnings down to 13x. At the time I pointed out that while that shift was good news for value investors, that 13x was probably still too expensive if we were in fact heading into a recession.

On re-based earnings (which is an imprecise calculation given that many companies have withdrawn guidance and are yet to reissue a revised forecast), markets are now trading at 19x earnings - making them even more expensive than before the crash.

Retail Money:

One of a couple of prominent explanations for the rapid recovery of the share market is the activity from retail investors.

Where retail investors were once the dominion of Baby-Boomers and their spare change, the popularity of self-directed investments through big ticket super fund providers and SMSF’s has seen what was once a trickle of activity transform into a torrent.

But it doesn't end there (not even close). Online trading platforms that offer free brokerage, and phone apps that behave in much the same way as social media platforms have opened stock ‘trading’ to an entire generation of Millennials looking for a way to get rich quick.

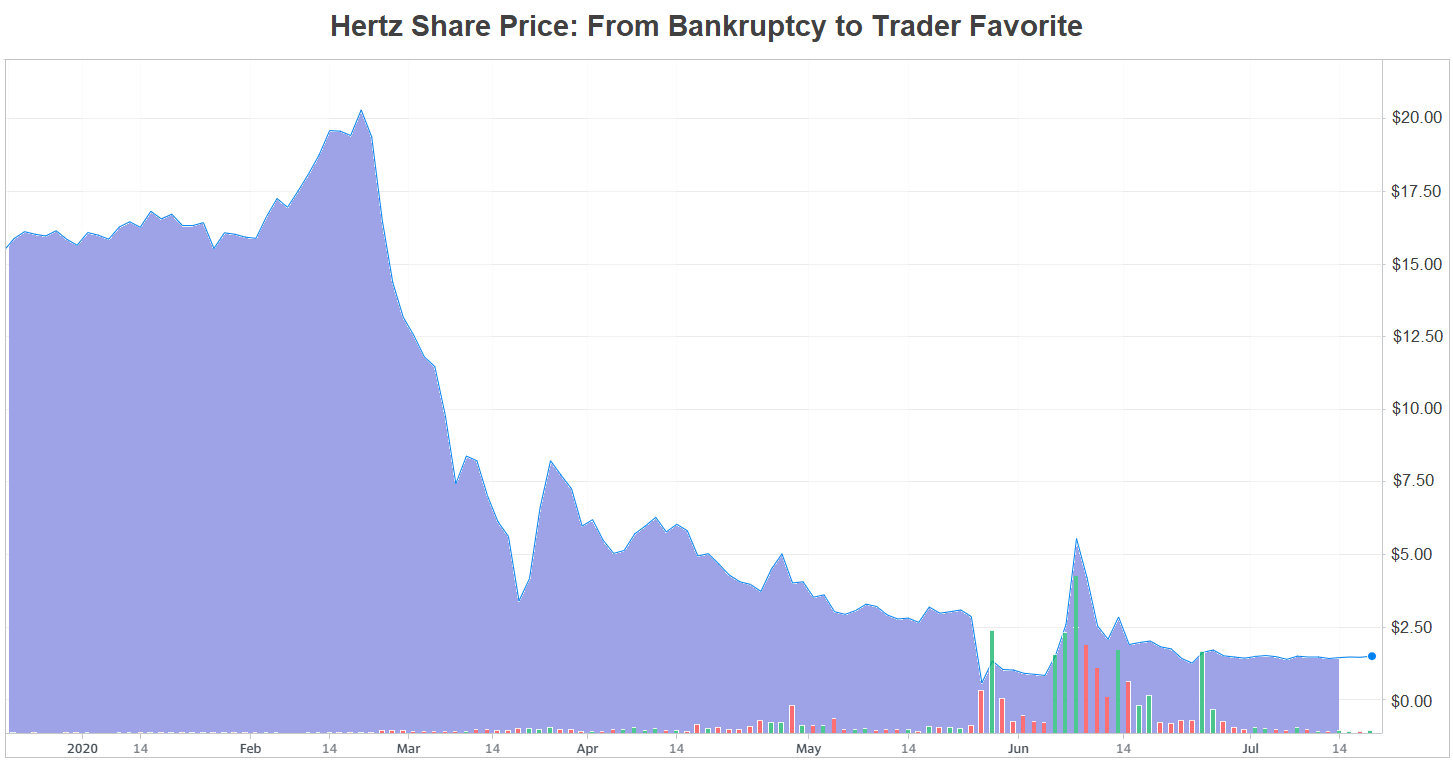

A perfect example of the kind of market and behavioural insanity that concerns us is the curious case of Hertz (US:HTZ) and the trading platform Robinhood.

Hertz: By way of background, Hertz declared Chapter 11 (the US version of calling in the administrators) in May. As recently as February, the company’s share price was $20, with a market cap of almost $3billion. On declaration of Chapter 11 the share price fell to as low as 56c (which is when the adventure begins).

Robinhood is a phone app that allows traders to buy and sell shares free of brokerage. The app is especially attractive and addictive to users as it promotes ‘most traded’ stocks, and investors can follow what a certain other investor is doing, or what traders across the platform as a whole are doing. In providing these details (in an attractive and interactive form), many investors express a sense of fear of missing out when their app alerts them to a ‘moving stock’.

Having declared bankruptcy, Hertz’s share price fell from circa $4 down to 56c (market cap of $80m) as institutional investors exited their positions in anticipation of the administrators declaring that the business was near worthless. This was not surprising. The surprising part was what happened next: Some Robinhood traders began buying in the anticipation that ‘things couldn't be that bad’. As those early traders got themselves set, the app informed other platform members that there was an uptick in activity on HTZ shares, and so a second wave of investors followed suit into Hertz - gradually moving the share price higher. Once that had happened, the app provided a wider alert that not only was there an increase in activity in the purchase of HTZ shares on the app, but that the share price was ‘breaking out’. And so, wave after wave of mostly uninformed retail investors followed blindly into a bankrupt company because their app and friends were suggesting that everyone else was.

The share price exploded by 1000% over the next fortnight.

It will come as no surprise that there was an unhappy ending for many of the 160,000 Robinhood traders who ‘invested’ in Hertz, but the very fact that such a platform could have so meaningful an impact on a share price was surprising.

For some context, the market cap of Hertz went from circa USD$80m to approximately USD$800m (and back again) in the two weeks that retail investors were excited about it.

So sensational was the share price drive, that Hertz considered launching a capital raising geared towards the new investors before the Securities Commission allegedly talked them out of it.

Ultra Low Interest Rates/FOMO:

Another possible explanation for the impressive recent equities moves is a combination of extremely low interest rates, combined with the biggest money managers fear of missing out.

In an environment where the alternative to risk investments (be it property, equities, or any other non-cash deposits) is cash at zero or near zero percent, institutions are motivated to allocate capital to wherever they believe a return can be made. This consideration makes sense in ordinary circumstances, and has driven asset prices materially higher for a number of years. However, given the already expensive state of the market, we wonder if many of those institutions that are investing at the moment aren't doing it for fear of generating a return too different from the market and their peers, with an additional concern that if they sit on the sidelines while markets rally, they will lose mandates due to underperformance.

In essence, we wonder if some institutional investors are behaving in much the same way that retail Robinhood investors are.

Markets are expensive:

As previously suggested, our view is that markets are expensive. Not only does the current lock down mean that determining corporate earnings for this year is difficult to predict, but an unwinding of Job Keeper, and a winding back of Job Seeker could see a significant reduction in spending in the next 12 months - thereby potentially affecting next year’s earnings as well.

Why it doesn't matter:

For the vast majority of individual investors, markets are expensive and it doesn't matter.

As an investor, we do not invest in ‘the market’. Instead we invest in individual companies. While I concede that this may appear like splitting hairs, for a value investor it is one of the most important facts to keep in mind.

Markets are made up of many companies (depending on the index, between 10 and 2,500). Some of those businesses will perform well while others will struggle. Some of those prospects are obvious, while others are less so. For example, if an investor were to buy the ‘market’ in March, it would have included Virgin on the brink of collapse. The market would have thus been impacted by Virgin calling in the administrators, but presumably a savvy investor would have avoided such an investment.

When most investors think about adding capital to the market, they think about adding money to the companies they like. It should make no difference to an investor what the prospects of the wider market are, only what the prospects are for their own companies.

Collins St Value Fund View

Despite our concerns for the wider market since as far back as 2017, we have found several areas of interest in which to invest. Investing specifically in companies we like ensures that we avoid the risks of the broader market that concern us, yet remain exposed to sectors or companies that we believe will generate a return.

The greater the uncertainty, the greater the opportunity

For those investors able to identify the "value ideas" from the "value traps", a great deal of money will be made. At Collins St Value Fund, we’ve positioned our portfolio defensively for some time now. In doing so, we’ve weathered the recent challenges well, but it’s our cash position and the prospect of new investments among the uncertainty that makes us the most excited.

"Best results are achieved when one invests at the point of maximum pessimism". Sir John Templeton.

Never miss an update

Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia's leading investors.

5 topics