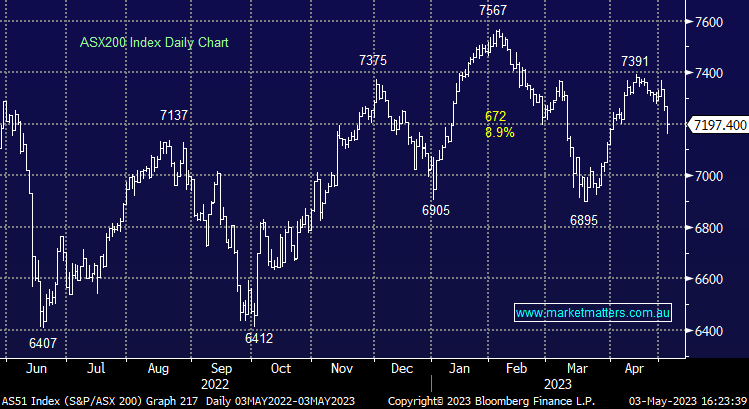

The Match Out: ASX continues to slide on higher rates, Ramsay (RHC) back growing, just not by enough

- The ASX 200 finished down -70pts/ 0.96% at 7197

- The Communications sector was best on ground (+0.27%) while Staples (+0.05%) also finished higher.

- Energy (-2.13%) and Financials (-1.52%) the weakest links.

- Gold miners were the standout today as Gold trades comfortably (sort of) above US$2000/oz, Evolution (ASX: EVN) +3.74% and Newcrest (ASX: NCM) +1.82% both positive.

- Ramsay Healthcare (ASX: RHC) -4.83% talked up revenue growth for the first 9-months however it was below market expectations.

- Amcor (ASX: AMC) -9.53% hit after it downgraded full-year guidance, the market was already at the lower end, however, the adjustment still represents about a 5% miss to consensus plus they also talked to a tougher outlook around margins – seems further downside a strong chance.

- JB Hi-Fi (ASX: JBH) +1.95% said that 3Q Australia Same-Store Sales were down 0.1% YoY – not a surprise and the market was pricing a bigger hit – James discussed this on Ausbiz this morning as the results were dropping.

- Ooh! Media (ASX: OML) -23.93 hit hard as they lost share of a weaker ad market – a double whammy!

- Nine Entertainment (ASX: NEC) Flat despite providing EBITDA guidance for the first time which fell short of expectations. They are picking up market share which shows they’re doing (relatively) well in a tough environment.

- ARB Corp (ASX: ARB) -5.69% fell despite saying that their order book is ‘inline with FY22’, consensus was for sales to be flat YoY.

- Iron Ore still closed in Asia

- Gold was little changed in Asia at -US$2016 at our close.

- Asian stocks were weaker Hong Kong down -1.63%, Japan -0.93% while China remains closed.

- US Futures are all up, around +0.20%

- The US Federal Reserve is expected to raise rates a further 25bps when they meet tonight – this is well and truly factored into markets with surprises rare from the Fed (unlike the RBA). Commentary around a pause will be the key driver of markets.

- Of stocks we own, Barrick Gold (NASDAQ: GOLD) reports tonight while Apple (NASDAQ: AAPL) reports on May 5.

ASX200

Video Update

Lead Portfolio Manager James Gerrish discusses JB Hi-Fi (JBH), Woolworths (WOW) & Gold stocks this morning.

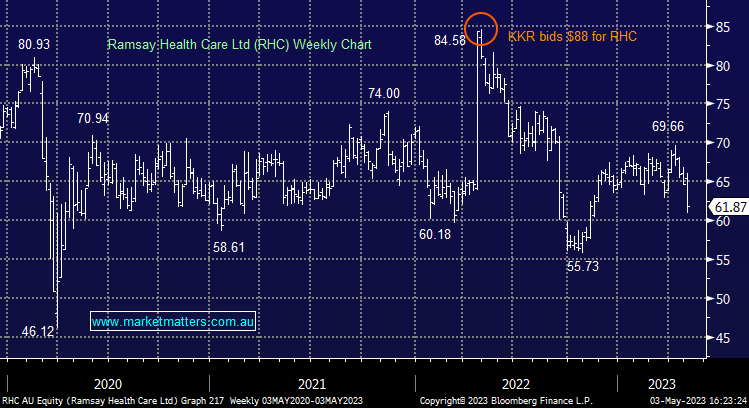

Ramsay Healthcare (ASX: RHC) $61.87

RHC -4.83%: The private hospital operator was sold down today despite what seemed to be positive headlines around revenue growth of 10.9% for the first 9-months of the year. That level of growth, while pleasing, was below where MM and the broader market expected it to be with consensus forecasting FY23 revenue growth of 13.6%, leaving them a lot to do in Q4. Furthermore, reported Earnings Before Interest & Tax (EBIT) of $751m for the 9 months, implies they did $202m in Q3 while they need to do more like double that in Q4 to meet the current consensus – which is highly unlikely. While the commentary is positive and the trends are heading in the right direction, the re-adjustment from the market today is warranted.

Ramsay Healthcare

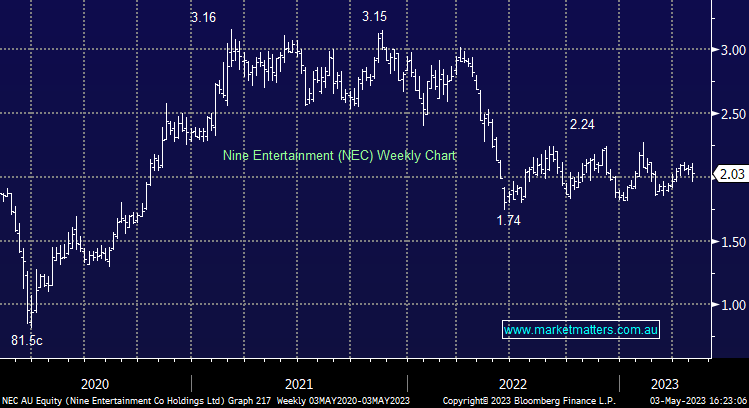

Nine Entertainment (ASX: NEC) $2.03

NEC flat: one of many to present at the Macquarie Conference today, providing EBITDA guidance for the first time which fell short of expectations. The company said the advertising market declined 15% in the 3rd quarter, but they managed to pick up more than 2.5% in market share. They also expect a similar result in Q4 with a weak market partially offset by gaining market share across each of their platforms against their traditional rivals. Overall they expect to see EBITDA between $590-600m for the full year, ~5% below consensus. Despite the miss, Nine remains exceptionally cheap and shares outperformed the broader market today.

Nine Entertainment

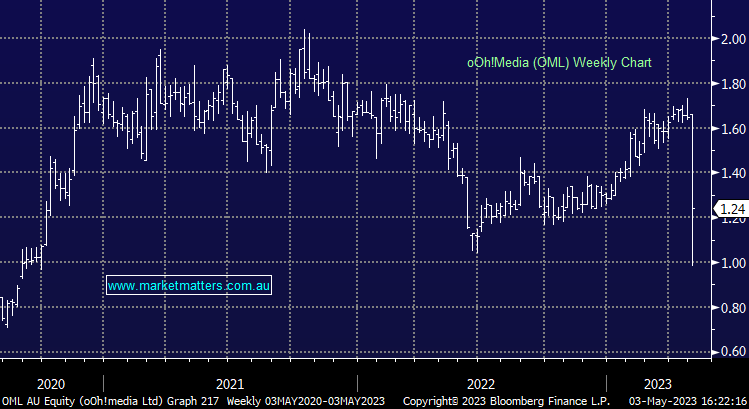

oOh!Media (ASX: OML) $1.24

OML -23.93%: the advertising media company briefly fell to 2-year lows today after showing a drop in market share at an investor presentation. The slides used at the Macquarie Conference showed a noticeable shift in trends since mid-March. Market share in the Street segment, which is ~30% of the company’s revenue, dropped 2%, and management blamed the fall on a competitor’s new offerings in Sydney, though that market share drop seems excessive. Media was particularly soft in April, 10% below pcp though a rebound is playing out in May & June. Reading between the lines OML has struggled to start the year with little opportunity to improve performance before the 1st half is up.

oOh!Media

Broker Moves

- Culpeo Minerals Rated New Speculative Buy at Red Cloud

- Computershare Raised to Buy at CLSA; PT A$25.40

- PolyNovo Raised to Reduce at CLSA; PT A$1.75

- Healius Cut to Underperform at Jefferies; PT A$2.60

- Seven West Raised to Neutral at JPMorgan; PT 40 Australian cents

- Medibank Private Cut to Hold at Jefferies; PT A$3.70

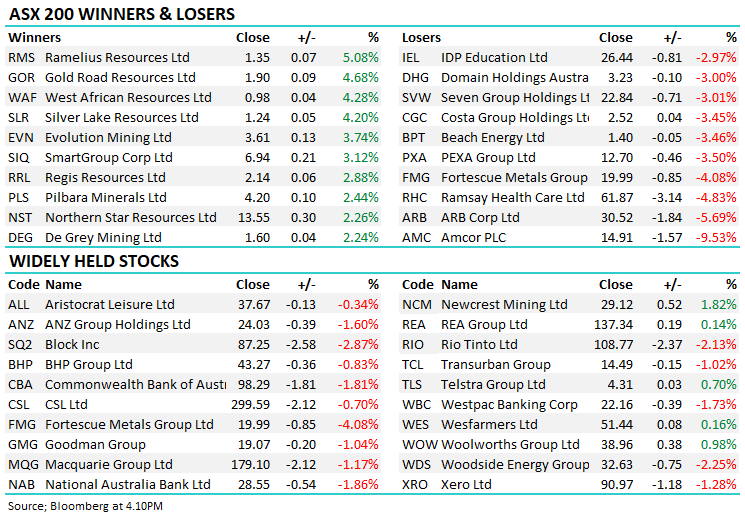

Major Movers Today

Have a good night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

10 stocks mentioned