The Match Out: ASX down 0.5%, AGL Energy (AGL) tanks

Markets @ Midday: Listen Here

Stocks pulled back today with 70% of the ASX 200 down and all sectors finishing in the red. Results continue to flow and there is clearly some caution around what comes next from an economic perspective - stocks that have been strong leading into updates at most risk given elevated expectations.

- The ASX 200 finished down -39pts/ -0.53% at 7490

- The Industrials sector was the best relative performer (-0.10%) while Communications (-0.15%) & Consumer Discretionary (-0.18%) also outperformed.

- Utilities (-2.73%) and Property (-1.62%) the weakest links.

- AGL Energy (ASX: AGL) -10.33% hit on a weak 1H result and downgrade to full-year guidance

- Mirvac (ASX: MGR) -4.58% had a good 1H, better than expected but failed to upgrade FY23 guidance as some expected.

- Elders (ASX: ELD) +1.36% bounced back after they released an investor presentation.

- Coal stocks fell as Coal prices lost ~6% in Asia, Peabody (NYSE: BTU) in the US was down ~9% overnight. Whitehaven Coal (ASX: WHC) -5.85%, New Hope (ASX: NHC) -4.91%.

- A big line of Whitehaven (WHC) stocks went through just before the close. ~$336m worth at $7.90 which was below market – clearly seller-led, probably GQG – not many funds with such a big holding.

- Disney (NYSE: DIS) reported quarterly results post-close last night and were +5% aftermarket, they are cutting 7k jobs.

- Iron Ore was ~2% higher in Asia today, Fortescue (ASX: FMG) +0.18% & BHP (ASX: BHP) +0.04%.

- We’ve made a few portfolio changes recently, increasing cash and turning more defensive towards some sectors – we see some risk this reporting season given the market’s run hard into it.

- Gold edged higher in Asian trade today, settled $US1878 at our close.

- Coal Futures out of Newcastle we flat after losing ~6% overnight.

- Asian stocks held it together, Hong Kong up 0.96%, Japan -0.14% while China gained +0.96%

- US Futures are all up, around +0.30%

ASX 200 Chart

AGL Energy (ASX: AGL) $7.12

AGL -10.33%: Hit today after downgrading full year guidance. They had previously guided to an FY23 underlying profit in the range of $200-320 million – a range you could drive a truck through + it showed the extent of moving parts, and they narrowed this to $200-$280 million.

The main issue being is consensus was sitting at $270 million and now taking the mid-point of guidance, we land at $240 million which is an 11% downgrade. The guidance also implies a stronger 2H which may or may not play out. As we have suggested numerous times, we think believe (as many do) that the AGL assets have value, however the near team earnings will be ebb and flow in the breeze. We’ve owned AGL twice in the past 18 months or so, making money on both occasions, however, we’re now happily on the sidelines.

AGL Weekly Chart

Mirvac (ASX: MGR) $2.29

MGR -4.58%: Reported a better-than-expected 1H23 result today, however, they maintained their full-year guidance for operating EPS of 15.5c and a dividend of 10.5c which implies they think the 2H will be tougher. Given the run-up in share price leading into today’s result., clearly, there was optimism around the potential for an upgrade to FY numbers, but alas, it proved elusive and the market sold it off.

Broker Moves

- Boral Cut to Sell at CLSA; PT A$3.50

- Amcor GDRs Cut to Underweight at Morgan Stanley

- Australian Clinical Labs Cut to Neutral at Goldman; PT A$3.40

- Tabcorp Cut to Neutral at Macquarie; PT A$1.10

- BWP Trust Raised to Neutral at JPMorgan; PT A$3.90

- Boral Cut to Underweight at JPMorgan; PT A$3.50

- Dexus Industria REIT Cut to Reduce at CLSA; PT A$3.09

- Dicker Data Cut to Underweight at JPMorgan; PT A$8.50

- ARB Cut to Neutral at Citi; PT A$31.79

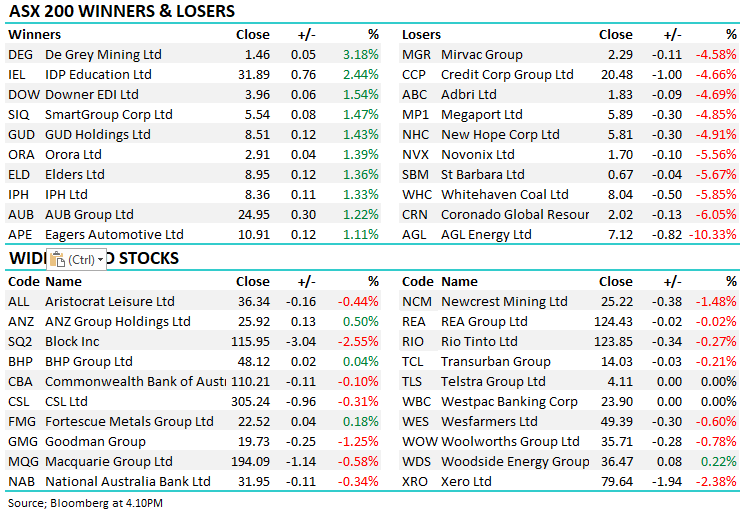

Major Movers Today

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

9 stocks mentioned