The Match Out: ASX down 10% for the year, IT stocks nearly 40% - ouch!

A fitting way to end a tough year for markets with the ASX losing ~2% to close back below 6600, and on the low of the day. For FY22, the ASX 200 is down 10.19% with a 38% fall by the IT sector the starkest of stats, while Consumer Discretionary (-23%) and Real-Estate (-16%) also fell sharply i.e. the sectors most influenced by interest rates. On the flip side, a lot of joy came from Energy (+29%) and Utilities (+24%), while the Industrials (+0.76%), Staples (-2%), Materials (-9%) & Telcos (-9%) all outperformed the broader market to varying degrees. As we suggested in yesterday’s morning missive, while it’s all doom and gloom at the moment, it’s worth remembering that the market put on over 20% last year, rewarding patient investors who stuck it out through Covid.

- The ASX 200 finished down -132pts/ -1.97% at 6568

- The Healthcare sector was best on ground (-0.19%) while Communications (-0.87%) & Industrials (-1.04%) outperformed the weak market, though all sectors were in the red.

- Utilities (-2.92%) and Materials (-2.83%) the weakest links.

- Our Research Lead Shawn was on Livewire Markets this week and the video can be seen on the MM Website – Click Here

- James was on Talking Finance with Alan Kohler & Shane Oliver yesterday – that can be accessed by Clicking Here

- CSR (ASX:CSR) -1.46% had their AGM today and talked about a challenging year, although they remain fairly upbeat about what comes next.

- Brookfield has apparently acquired a ~2% stake in AGL Energy (ASX: AGL) +1.67% stoking more discussion of takeovers.

- A rare positive report for a retailer with Barrenjoey initiating coverage on Nick Scali (NCK) with a buy-equivalent & $12 PT v $8.26 close today.

- Brambles (ASX: BXB) -1.29% said it will no longer supply plastic pallets to Costco.

- PointsBet (ASX: PBH) +10.74% topped the leader board today and looks good technically for a sustained bounce – we like PBH here.

- UBS has written a positive (sort of) report on beaten-up retailer BWX saying they should be able to weather the current storm – Harry covered the stock earlier in the week – Click here

- Iron Ore was ~2% lower in Asia today, weighing on our resources.

- Gold was flat at ~US$1816 around our close.

- Asian stocks were mixed, Hong Kong down -0.80%, Japan -1.12% while China was up +1.07%

- US Futures are all lower, Dow -300pts, S&P -1.24%, Nasdaq -1.43%, they were down at our close however have fallen away further in the last 30 mins.

CSR(ASX: CSR) -1.46%: Held their AGM today today and they talked to a challenging but ultimately successful year. They re-affirmed their previously issued guidance and also launched a $100m on market buy-back. In terms of their divisions, in Building Products, they remain confident that the strong pipeline of detached housing projects will continue in the year ahead. In Property they think they’ll do earnings of around $52 million following completion of two transactions expected later this financial year while in Aluminium they still believe an indicative EBIT range for this financial year of $33 to $49 million is achievable, although clearly lots of volatility there at the moment which shows in this guidance. Overall, they’re doing okay in a challenging environment, however, there were no new nuggets of gold at today’s AGM.

AGL Energy (AGL) $8.25

AGL (ASX: AGL) -1.67%: shares in Australia’s biggest energy retailer surprisingly finished lower today despite news that Brookfield had taken a 2.56% stake. The US private equity giant teamed up with Atlassian co-founder to launch an unsuccessful bid at $8.25/share back in March which ultimately scuttled AGLs plans to demerge its retail and energy generation businesses. AGL had recently advised the market that discussions between them and Brookfield were still ongoing, at least until May. Today’s announcement gives that news a bit more meaning and perhaps another takeover effort is in the works.

Broker Moves

- Origin Energy Rated New Underweight at Jarden Securities

- Boral Cut to Sell at Citi; PT A$2.57

- Nick Scali Rated New Overweight at Barrenjoey; PT A$12

- Tyro Payments Cut to Neutral at Macquarie

- CSR Cut to Neutral at JPMorgan; PT A$4.65

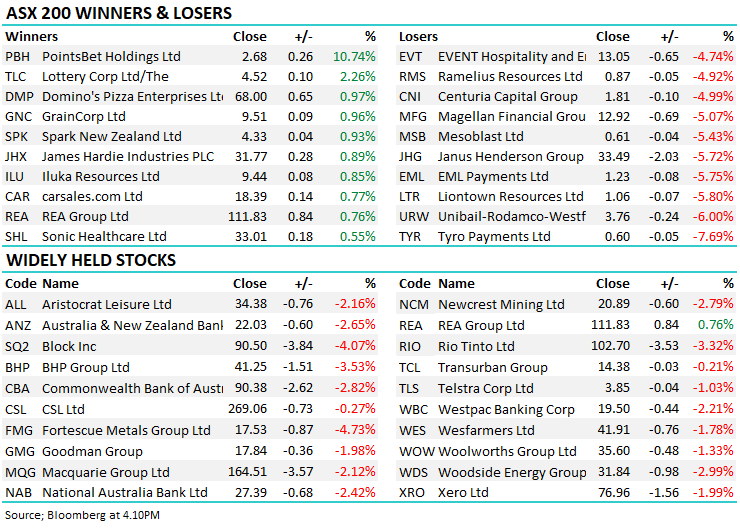

Major Movers Today

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice-daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 stocks mentioned