The Match Out: ASX down ahead of a long weekend in the US

A weaker session today for the ASX with much of the weakness coming late (as the intra-day chart below shows) however given the uncertainty on the geopolitical front, the market falling 1% was a reasonable effort, particularly into the weekend + the US is on Holidays Monday. Gold was the standout however there was also some interesting moves from a stock perspective with two stocks we hold in our Income Portfolio, namely Smart Group (SIQ) and Magellan Financial (MFG) rallying +11.65% and +18.45% respectively. On the sector front, the Materials were relative performers (down only -0.17%) while the Utilities were down -4.07% & Healthcare was off -3.07% after a good week.

- The ASX 200 finished down -74pts/71.02% at 7221

- The Materials held up relatively well (down-0.17%) however all sectors finished down on the session as 131 stocks in the ASX 200 fell.

- A milder day on the reporting front, although there were still some big moves….

- QBE Insurance (ASX: QBE) -8.7% fell after earnings missed the mark, a profit of $1.04bn up from a loss of $1.5b not enough to overcome an increase in their allowance for natural disasters.

- Smart Group (ASX: SIQ) +11.65% delivered strong CY21 profit plus a special (30c) dividend, while they said the start of CY22 was positive.

- Magellan (ASX: MFG) +18.45% was a standout in terms of price, the 1H22 profit was inline while the dividend of $1.10 was a beat, however that was always going to be okay given the bulk of FUM outflows happened after the period. An interesting option deal the driver whereby shareholders will receive 1 free option for every 8 shares held with a strike price of $35 and an expiry in 5 years. Back us, and we’ll back you the message while they also launched a good retention strategy for staff along the same lines. Harry and I discuss in the video below.

- Whitehaven (ASX: WHC) +3.97% rallied after yesterday’s result, upgrades flowing through this morning and while our analyst ‘Rocky’ at Shaw’s is drinking the WHC cool-aide with a bullish $5 target, he’s not alone, Evans at $4.80, Credit Suisse at $4.70 are also drinking from the same jug – we remain long and bullish.

- Iron Ore was down in Asia today, around 1.15%

- Gold was down ~US$7 at $US1891 at our close, after a strong session overseas

- Asian stocks were mixed, Hong Kong +0.39%, Japan -1% while China was flat.

- US Futures are higher – between 0.6-0.8%

- US markets are closed on Monday evening for Presidents Day

ASX 200

Market Matters weekly video update

A busy week = a late video and today Harry and I discuss our learnings from the bunch of property companies that reported this earnings, Magellan (MFG) & Smart Group (SIQ) after todays update and the ‘vibe’ from the reporting period thus far.

Sectors this week – Source: Bloomberg

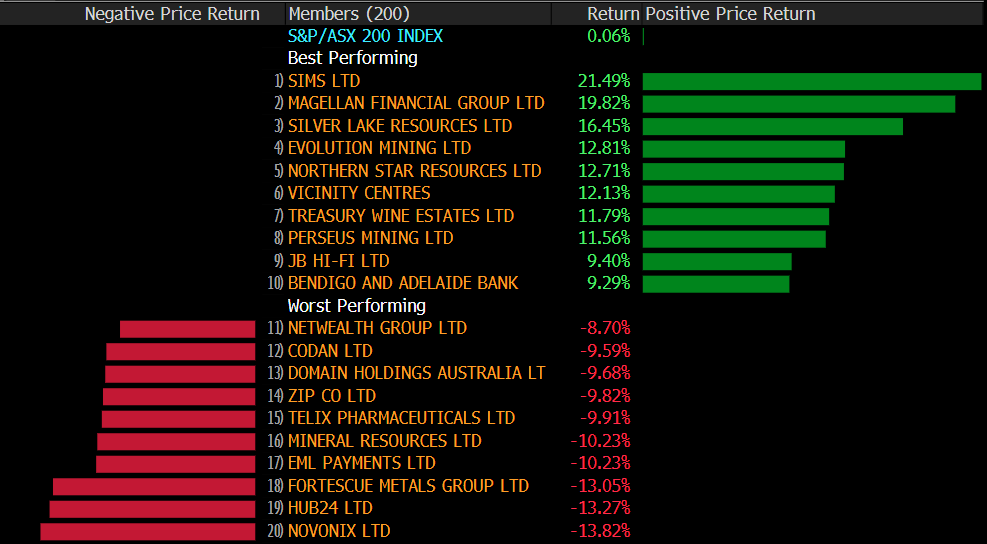

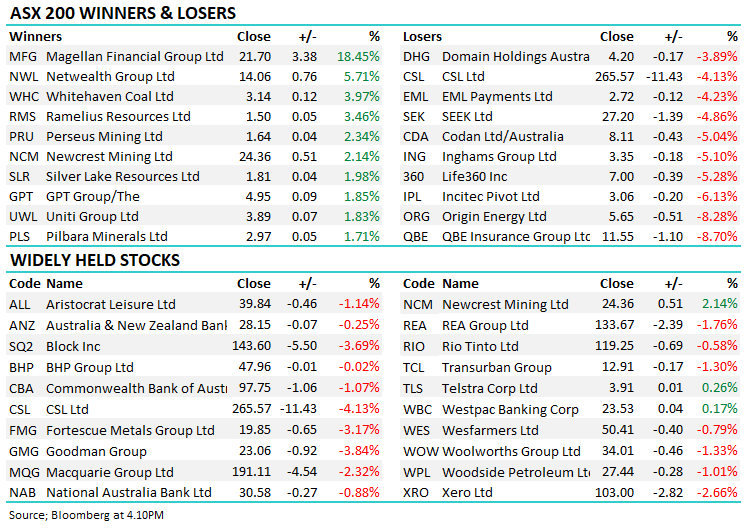

Stocks this week – Source: Bloomberg

Broker Moves

- Growthpoint Raised to Outperform at Macquarie; PT A$4.45

- Growthpoint Raised to Buy at Moelis & Company; PT A$4.56

- Judo Capital Raised to Buy at Citi; PT A$2.20

- Netwealth Raised to Buy at Citi; PT A$15.25

- Origin Energy Cut to Neutral at Credit Suisse; PT A$6

- Goodman Group Cut to Neutral at JPMorgan; PT A$25

- Cleanaway Raised to Positive at Evans & Partners Pty Ltd

- Origin Energy Cut to Underweight at JPMorgan; PT A$5.50

Major Movers Today

Have a great weekend.

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

6 stocks mentioned