The Match Out: ASX down, QBE rallies on good guidance

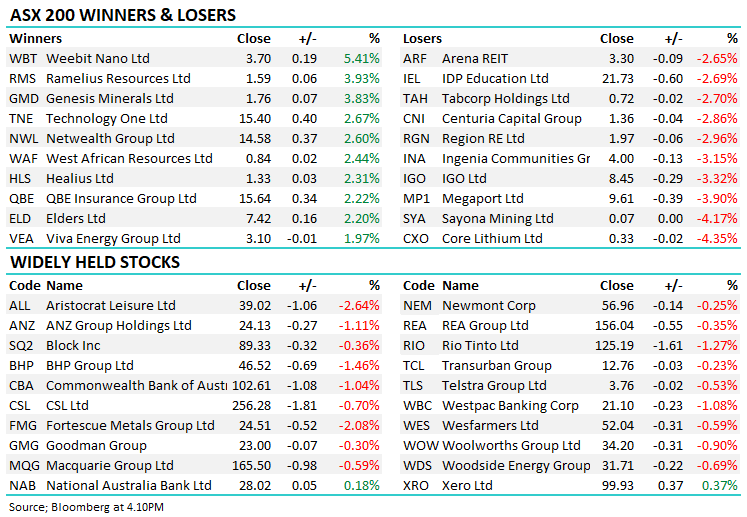

A poor session to kick off the new trading week with the ASX seeing the best of it early before broad-based selling took hold, pushing the main board ~70pts below the early highs, as ~65% of stocks lost ground.

- The ASX 200 finished down -53pts/ -0.75% to 6987

- The IT (+0.45%) was the only cohort to finish higher.

- Property (-1.34%), Consumer Discretionary (-1.26%) and Materials (-1.13%) were weak.

- QBE Insurance (ASX: QBE) +2.22% rallied after saying it expects gross written premium growth of around 10% for FY23 (they are a Dec year-end).

- IGO Ltd (ASX: IGO) -3.32% fell after they defended the decision to appoint Ivan Vella as CEO after RIO sacked him a fortnight ago.

- Adore Beauty (ASX: ABY) +19.25% rallied after its board rejected a cash offer of $1.25 to $1.30/sh from UK-based THG - both companies are online-facing beauty product retailers. Stock closed today at $1.115.

- Healius (ASX: HLS) +2.31% rallied on news the Chair will not stand for re-election.

- Catapult (ASX: CAT) +11.89% had a great session, finally gaining the traction it deserved on their 1H result a couple of weeks ago – a stock we own in the Emerging Companies Portfolio.

- Telstra (ASX: TLS) -0.53% is back testing lows at $3.76 – looks interesting, we covered it recently.

- Another defensive name we like here is APA Group (ASX: APA) – you can read our recent thoughts here

- Putting together some thoughts for a Market Matters Event this week- since the day the US 10-year yield hit its low at 0.5% on the 4th Aug 2020, our Active Growth Portfolio has outperformed by more than 4% pa, returning 13.8% pa since 4th August 2020.

- Active seems to have the wood on passive as conditions toughen.

- Iron ore fell, futures down 1.3% in Singapore to $US132/mt – Fortescue (ASX: FMG) -2.08% the weakest of the majors, BHP Group (ASX: BHP) -1.46%.

- Gold pushed higher, now trading US$2013/oz at our close. Evolution (ASX: EVN) +1.9% and Northern Star (ASX: NST) +1.65% are the two sticks we hold in the Growth Portfolio.

- Asian stocks were down, Hong Kong -0.87%, Japan -0.40% and China -0.70%.

- US Futures weaker, S&P -0.33%, Nasdaq -0.49%

ASX 200 Index - Intraday

ASX 200 Index - Daily

.png)

QBE Insurance (QBE) $15.64

QBE +2.22%: the insurance group released a 3Q performance update which further highlighted the tailwinds playing out in the insurance sector. Gross Written Premium (GWP) growth of 7% on the prior period and renewal rate increases of 9.6% in the quarter show the benefit of inflation on premiums. Higher bond yields have also supported investment performance with the running yield at the end of the quarter at 5%, up from 4% at the end of the first half. While claims have climbed with inflation, catastrophe events are expected to be lower in the second half thanks largely to a muted US Hurricane season. As a result, QBE has maintained FY23 guidance and outlook comments, targeting a combined operating ratio of around 94.5% with GWP growth of 10% in constant currency terms.

.png)

Broker Moves

- Chrysos Corp. Rated New Buy at Bell Potter; PT A$8.70

- Computershare Reinstated Buy at Goldman; PT A$27

- Karoon Energy Rated New Overweight at JPMorgan; PT A$2.75

- Clover Corp. Rated New Outperform at Taylor Collison

Major Movers Today

.png)

Enjoy the night

The Market Matters Team

1 topic

11 stocks mentioned