The Match Out: ASX ends higher after a challenging week, Calix up on new patent, Enjoy the weekend

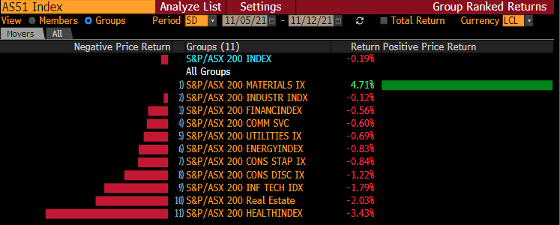

It was a good way to end a volatile week, the ASX up around 0.8% and despite a few large swings and the feeling of a tough week, the market only ended at 7443, down 0.19% - around 30 points below key resistance. Healthcare, Real-Estate and IT stocks were the three laggards, which is understandable given the backdrop of higher rates, though all sectors except Materials finished in the red. Resources had a great week, underpinned by a resurgence in Gold and a bounce in Iron Ore. We also saw continued strength in battery metals, the sector up nearly 5%, which is encouraging given our large tilt towards this space.

- The ASX 200 finished up +61points / 0.83% at 7443.

- Materials ended a strong week up another +2.28% supported by IT and Energy, while Healthcare struggled down 0.18%.

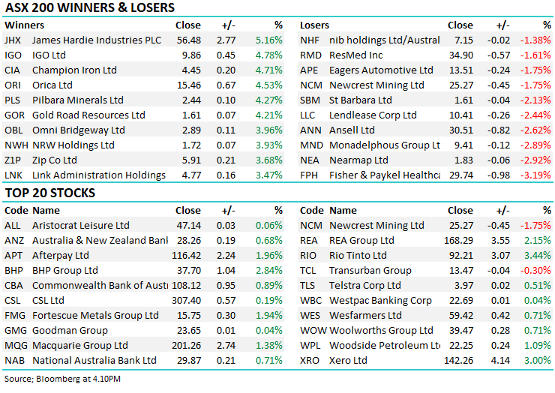

- Iron Ore stocks were higher again, Fortescue (ASX: FMG) +1.94% and BHP Group (ASX: BHP) +2.84%. Aluminium prices also jumped as supplies tighten, Alumina (ASX: AWC) putting on 2.16% after a tough period.

- Zip Co (ASX: Z1P) +3.7% on news that it has completed its acquisition of European buy now, pay later provider Twisto Payments.

- Lithium stocks were hot today, our two holdings – Independence Group (ASX: IGO) +4.78% and Pilbara Minerals (ASX: PLS) +4.27% – doing well.

- Gold was strong earlier but tapered off later in the day, Newcrest (ASX: NCM) actually closed down -1.75% while our recent purchase of Northern Star (ASX: NST) ended largely flat – quite a reversal from early highs.

- Spot Gold was a touch higher in Asia, hovering around $US1858 at our close.

- Asian markets were stronger, The Nikkei in Japan +0.95%, Hong Kong +0.31% & China +0.02%.

- US Futures are all trading marginally higher.

ASX 200 chart

Calix (ASX: CXL) $7.34

CXL +19.93%: shot up today after filing for a patent, the company looking to use its technology to produce a zero-emission steel option, which would allow mills to reduce operating temperatures and use renewable power in steel manufacturing. The technology will move on to testing next but it’s just one of the many applications of the kiln technology that could change the game in various manufacturing processes

.

We remain long and bullish in our Emerging Companies Portfolio.

Calix

Sectors this week (Source: Bloomberg)

Stocks this week (Source: Bloomberg)

Broker moves

- Orica Cut to Hold at Morgans Financial Limited; PT A$15.26

- Ramsay Health Cut to Neutral at Evans & Partners Pty Ltd

- JB Hi-Fi Cut to Neutral at Citi

- Metcash Cut to Neutral at Citi

- Coles Group Raised to Buy at Citi

- Uniti Group Raised to Accumulate at Ord Minnett; PT A$4.21

- Shaver Shop Raised to Accumulate at Ord Minnett; PT A$1.25

- Qube Raised to Outperform at Credit Suisse; PT A$3.55

- Xero Raised to Neutral at JPMorgan; PT A$130

- Ansell Cut to Hold at Jefferies; PT A$34.50

Major movers today

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

9 stocks mentioned