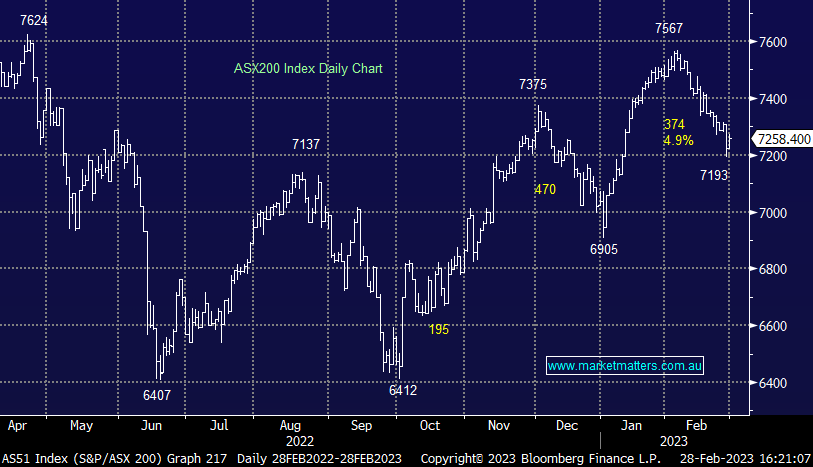

The Match Out: ASX falls ~3% in February as bond yields tickle multiple-year highs

- The ASX 200 finished up +33pts/ +0.46% at 7258

- The Materials sector was best on ground (+1.52%) while Energy (+1.49%) & Property (+1.26%) were also strong.

- Utilities (-1.27%), Healthcare (-0.56%) and Consumer Discretionary (-0.46%) the weakest links.

- Retail sales stronger than expected, up +1.9% in January versus consensus of +1.5%.

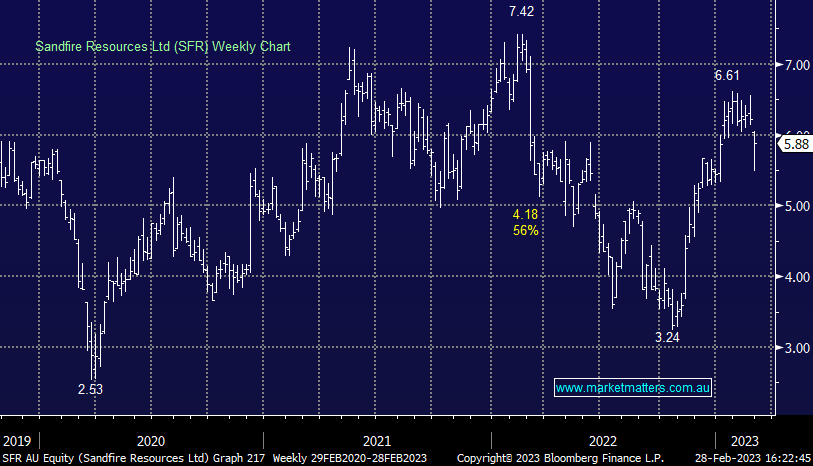

- Sandfire Resources (ASX: SFR) +1.38%: HY result for the copper miner today was a miss for the most part, however, growing confidence around the outlook helped to support shares.

- NextDC (ASX: NXT) +2.39%: the data centre operator was out with HY numbers today with revenue a small miss, however, EBITDA at $77.5m was ~7% ahead of the market

- Adbri (ASX: ABC) -7.07%: An inline result on the face of it from the building materials company, however, it was driven largely by their property division which implies the rest of the business had a few headwinds.

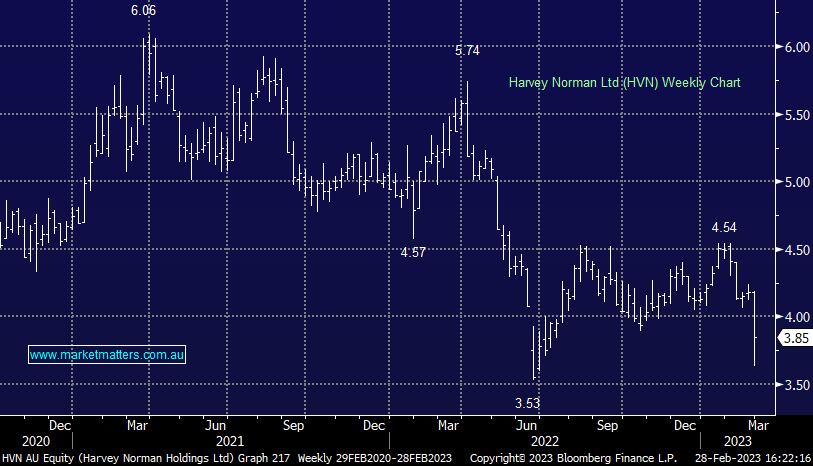

- Harvey Norman (ASX: HVN) -7.45%: Was the worst performer on the ASX200 today as 1H earnings (ex-property revaluations) were a ~10% miss to expectations.

- PointsBet (ASX: PBH) -10.31% fell after profit collapsed – losing money and not gaining meaningful traction in the competitive US market is a big issue.

- Iron Ore was ~1% lower in Asia, Coal Futures were off -3.5%

- Gold was up overnight before tracking down -US$3 in Asian trade today, settled $US1814 at our close.

- Asian stocks were lower Hong Kong down -0.58%, Japan flat while China fell -0.35%

- US Futures are flat.

ASX200

Sandfire Resources (ASX: SFR) $5.88

SFR +1.38%: HY result for the copper miner today was a miss for the most part, however, growing confidence around the outlook helped to support shares. Revenue of $US518m with EBITDA of $US135m were 5% and 8% below consensus respectively, weighed by softer copper and zinc prices in the period. Importantly the company maintained FY production and capex guidance for FY23 and FY24, but brought forward first delivery of ore concentrate from their Botswana asset Motheo to the start of the June quarter, de-risking the balance sheet and guidance.

NextDC (ASX: NXT) $10.27

NXT +2.39%: the data centre operator was out with HY numbers today which look to be tracking well toward FY expectations. Revenue was a small miss, however, EBITDA at $77.5m was ~7% ahead of the market. Importantly, both active and contracted utilization was strong, showing the strength in demand. Revenue guidance was pushed to the higher end of the prior range, while EBTIDA guidance was maintained. The market was initially concerned about the large CAPEX increase, guiding to $620-670m, up $250m from the prior range. The investment comes on the back of brought-forward investment in a number of sites which is likely to bring in profit ahead of current expectations while the company still has $2b in available capital at the end of the half.

Adbri (ASX: ABC) $1.71

ABC -7.07%: An inline result on the face of it from the building materials company, however, it was driven largely by their property division which implies the rest of the business had a few headwinds. 2H22 group revenue of $888m helped drive FY22 underlying NPAT of $118m which compared well to consensus of $105m, however, there was no real quantitative guidance given and cost pressures are still bubbling away. They did say that strong product demand in 2023 and price increases should "rebuild resilience and margin”, but that was about as firm as they got. Mark Irwin was appointed CEO from the end of his interim term and will now lead ABC until Oct 2024 at least.

Harvey Norman (ASX: HVN) $3.85

HVN -7.45%: the retailer fell to 6-month lows and was the worst performer on the ASX200 today after a disappointing 1H result. Revenue was in line with expectations at $2.3b, however, earnings (ex-property revaluations) were a ~10% miss, coming in at $416m. margins were under pressure as costs weighed, PBT margins in their Australian franchise business fell from 8.5% in 1H22 to 6.8% in today’s announcement. The outlook is also a concern with the first 7-weeks of the new year seeing Australian franchisee sales down 10% on a like-for-like basis as consumers move away from bulky whitegoods and furniture purchases.

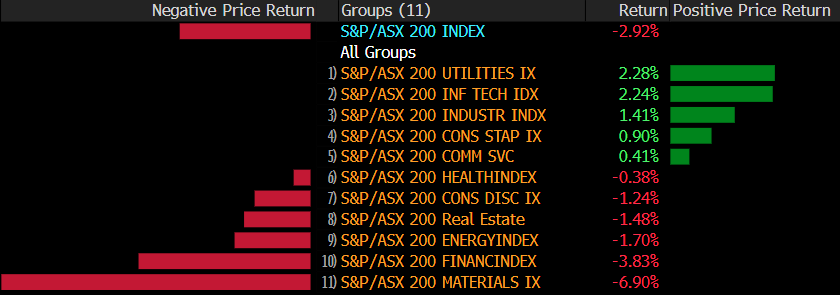

Sectors this month

Stocks this month

Broker Moves

- Australian Unity (ASX: AYU) Cut to Hold at Moelis & Company; PT A$1.80

- EML Payments (ASX: EML) Cut to Underweight at Wilsons

- Waypoint REIT (ASX: WPR) Raised to Buy at Moelis & Company; PT A$2.99

- LFG AU (ASX: LFG) Raised to Outperform at Credit Suisse; PT A$4.55

- Regis Healthcare (ASX: REG) Raised to Buy at Jefferies; PT A$2.05

- Regis Healthcare (ASX: REG) Raised to Sector Perform at RBC; PT A$1.60

- Lynas (ASX: LYC) Raised to Neutral at JPMorgan; PT A$8.60

- Healius (ASX: HLS) Cut to Underperform at Jefferies; PT A$2.60

- Bega Cheese (ASX: BGA) Raised to Add at Morgans Financial Limited

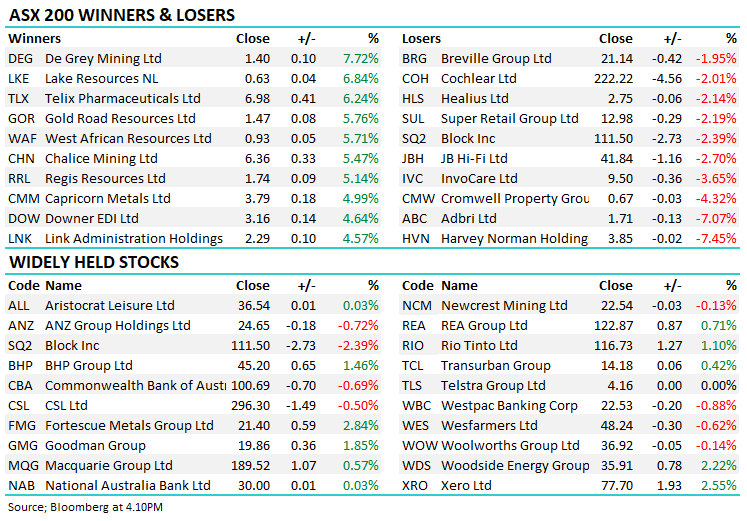

Major Movers Today

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

13 stocks mentioned