The Match Out: ASX muted in the lead up to Easter, Magellan (MFG) sees further outflows

A nothing day for the market with stocks up early, down late, ending the session little changed. Expect no real movements either way ahead of the Easter Long Weekend where US markets are closed on Friday while in Australia, the ASX is closed both Friday & Monday, although US Non-Farm Payrolls are still being released on Friday night (+240k expected with their unemployment rate to stay steady at 3.6%). Some risk off perhaps by the close tomorrow could be sensible…

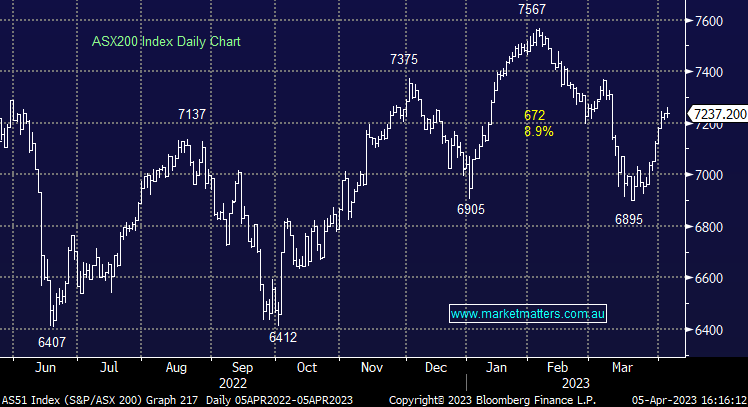

- The ASX 200 finished up +1pt/ +0.02% at 7237

- The Communications sector was best on ground (+0.78%) while IT (+0.73%) & Industrials (+0.71%) rounded our the top three.

- Energy (-0.64%) and Materials (-0.57%) the weakest links.

- Market Matters Portfolio’s had a solid March, with a video to be released tomorrow covering the outcomes achieved, the ASX 200 down 0.16% for the month.

- Flagship Growth +2.15% (+20.77% FY23 to date) , Active Income +0.64% (+9.44% FY23 to date), Emerging Companies -2.29% (+9.85% FY23 to date), International Equities +4.86% (+18.41% FY23 to date)

- Gold stocks a standout today as the precious metal traded up through $US2000/oz – we remain long & bullish, with Evolution (EVN) being our best pick here while we also own Newcrest (ASX: NCM).

- Seek (ASX: SEK) +4.17% rallied having put through a very small downgrade yesterday, it’s now up +10% from yesterday morning, suffice to say the market reaction was perplexing as highlighted yesterday, no doubt driven by quants selling a ‘downgrade’ first and asking questions later. A Macquarie upgrade to BUY & $32.50 PT helped today.

- Magellan (ASX: MFG) -4.06% saw another $3.9bn walk out the door in March, most of it from Aussie Equities, presumably a result of John Sevior retiring from Airlie.

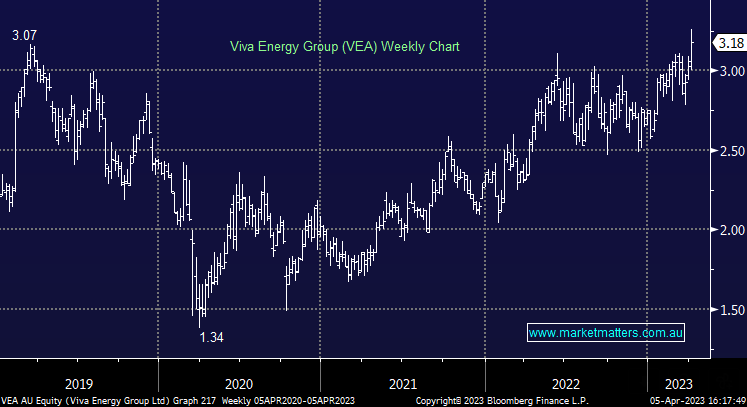

- Viva (ASX: VEA) +3.25% bought a bunch of Petrol Stations from South Australia’s largest privately owned companies – the deal looked solid.

- Transurban (ASX: TCL) +1.25% was solid today, although it was up more early. We think this is now fully valued and we’re now looking back towards APA Group (APA) as a potential alternative.

- Research Lead Shawn Hickman covered stocks that are exposed to housing yesterday morning on Ausbiz – Worth a watch for those with interest in a contrarian play which we are getting more optimistic on – Watch Here

- RBA chief Philip Lowe told the National Press Club today that“it’s not a cliff. It’s kind of a ramp up,” referring to about 880,000 fixed-loan facilities that will switch to higher-rate variable loans this year.

- Iron Ore was ~2% lower in Asia, hitting Fortescue (ASX: FMG) -1.33% & RIO -0.94%

- Gold was up overnight to ~US$2021 before edging up a further US$3 in Asian trade today, settled $US2024 at our close.

- Asian stocks were mixed Hong Kong down -0.66%, Japan -1.56% while China was up +0.49%.

- US Futures are flat.

ASX 200 Chart

Lead Portfolio Manager James Gerrish

Market Matters Lead Portfolio Manager James Gerrish spoke this morning about recent economic data and what it means for Gold, while he also discussed AGL Energy (AGL) and views on other defensive stocks.

Magellan (ASX: MFG) $8.28

MFG -4.06%: more FUM outflows today for the fund manager, significantly higher than money that was pulled in February. The company saw net outflows of $3.9b, with the majority of that coming from institutional money where as retail saw just $500m redeemed. It appears two key institutional mandates were lost on the back of Airlie’s John Sevior’s plans to leave the business later this year. Total FUM now sits at $43.2b, down ~5% since the February update with the outflows partially offset by positive performance. Still, it is a long way from the high of $118b in 2021 and investors are concerned that momentum is picking up again in redemptions.

Viva Energy (ASX: VEA) $3.18

VEA +3.25%: the fuel group has moved to bolster its convenience network with the purchase of On The Run (OTR), South Australia’s largest private company. Viva will pay $1.15b for OTR’s 205 convenience sites, 174 of which offer fuel. Also included in the purchase are a lubricants business and a number of tobacco and gift stores across the state with the group seeing around $3b of revenue per year. Viva will fund $1b of the deal with debt while the remainder, $150m, will be in equity which is subject to escrow, pricing the business on around 7x EBITDA after $60m in synergies.

Broker Moves

- Lynas Raised to Buy at UBS

- Seek Raised to Outperform at Macquarie; PT A$32.50

- Orica Raised to Outperform at Macquarie; PT A$17

- Mirvac Group Raised to Buy at Citi; PT A$2.40

- Stockland Raised to Buy at Citi; PT A$4.60

- Insurance Australia Raised to Overweight at JPMorgan; PT A$5.75

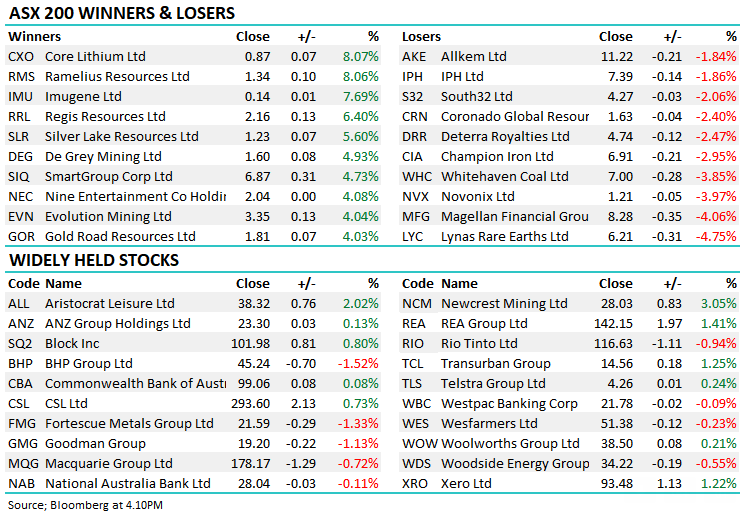

Major Movers Today

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

6 stocks mentioned