The Match Out: ASX rallies, Uranium stocks lead

What Mattered Today

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

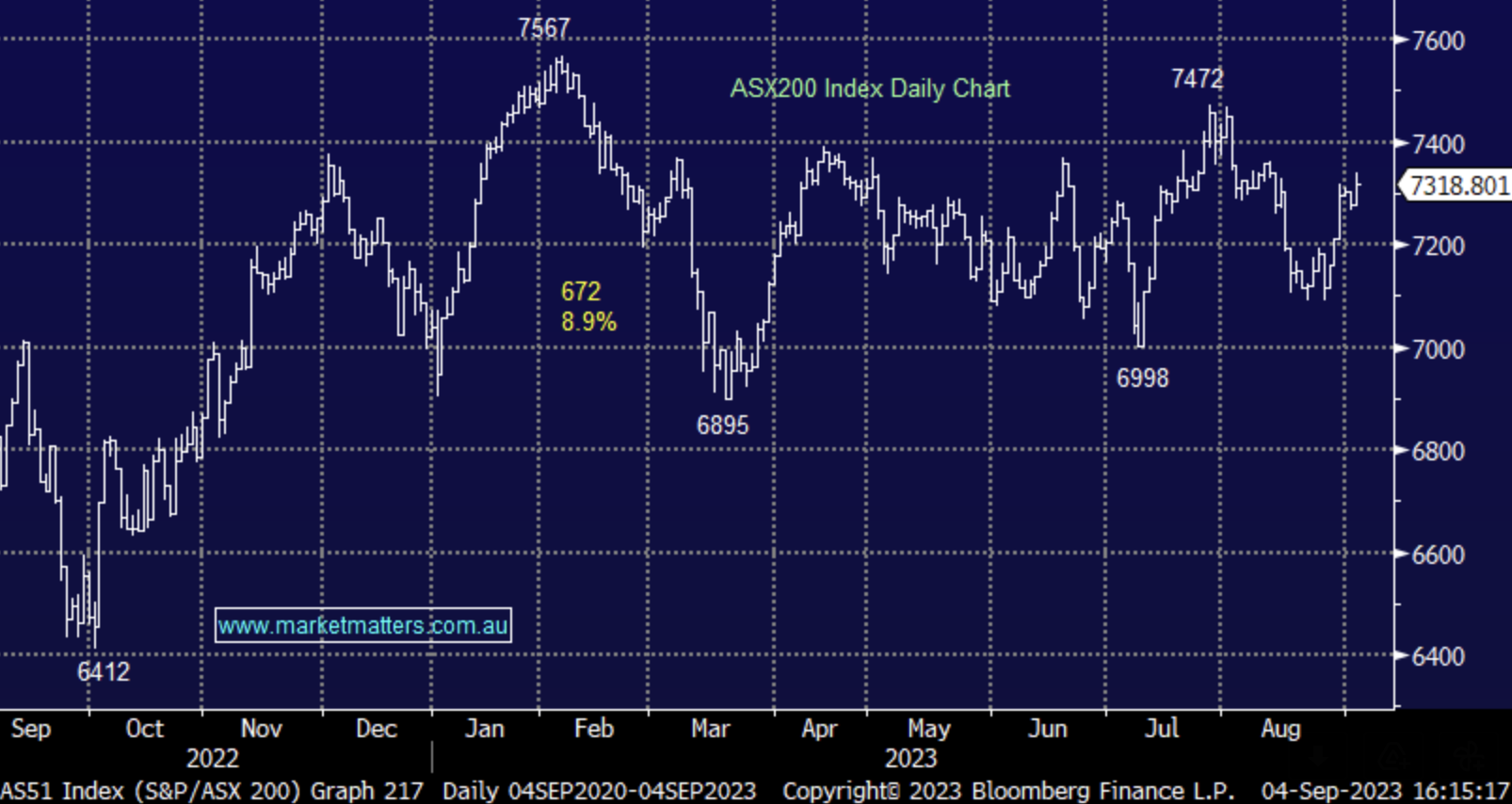

The ASX opened with a bang this morning hitting a high of 7340, up 62pts before giving back 1/3rd of the gains as the day progressed. Still, with no US trade tonight and a fairly quiet day volume-wise, the direction of least resistance continues to be up led by a resurgence in the Energy and Materials sectors.

- The ASX 200 finished up +40pts/ +0.56% at 7318.

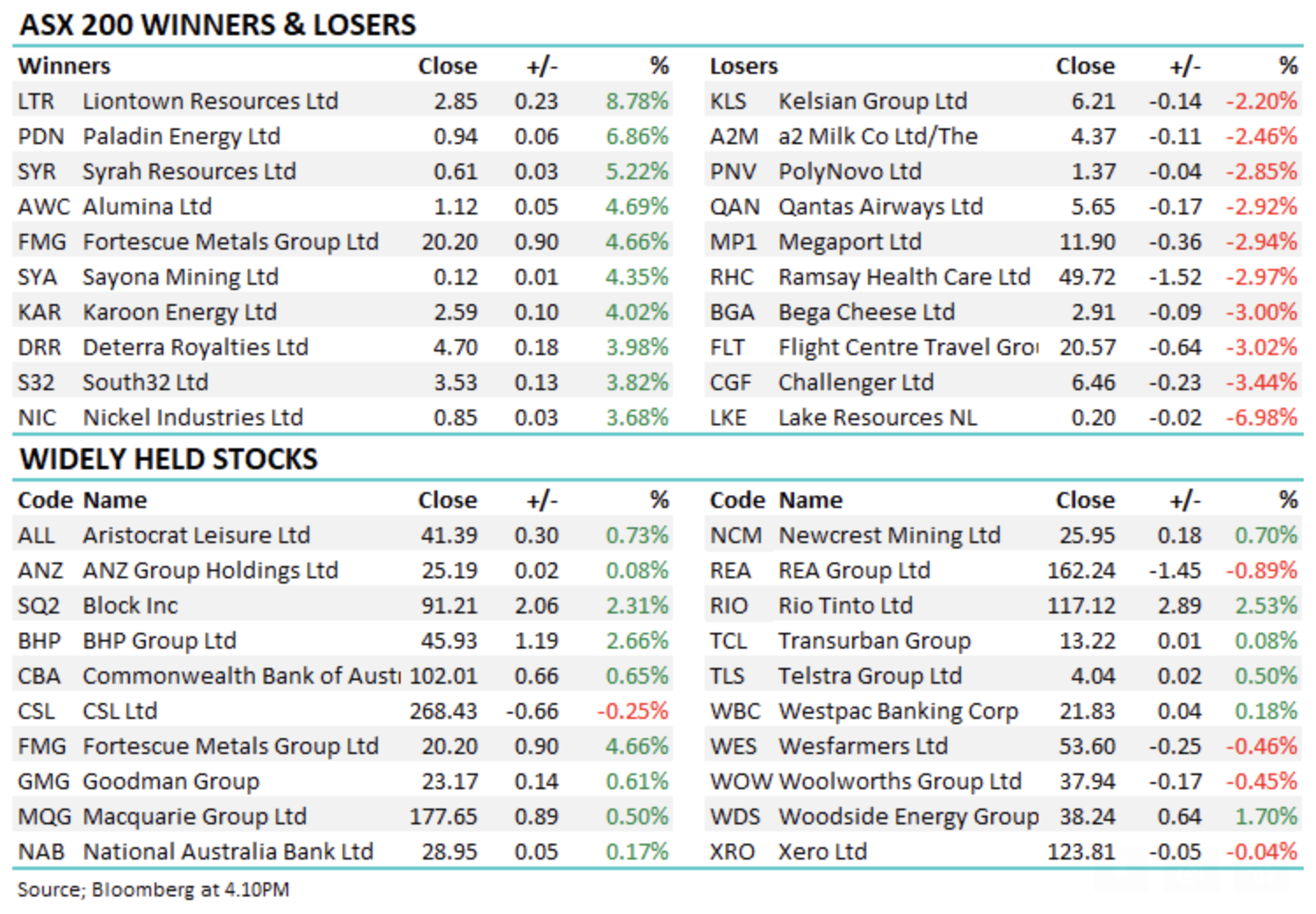

- The Materials sector was best on ground (+1.98%) while Energy (1.59%) and Property outperformed.

- Consumer Staples (-0.63%) and Utilities (-0.48%) the weakest links.

- Uranium stocks surged on news that Cameco will miss production guidance. Paladin (ASX: PDN) +6.86% & Deep Yellow (ASX: DYL) +7.1% surged.

- BHP +2.66% contributed 18 index points to the ASX 200

- Qantas (ASX: QAN) -2.92% continued to side as the media storm gains further transaction – Alan Joyce remains in the cross-hairs.

- Sandfire Resources (ASX: SFR) -1.02% fell on a broker downgrade + it’s had a good run.

- Leo Lithium (ASX: LLL) -50% halved on news that Mali’s government has suspended direct shipping ore their Goulamina Lithium project.

- Liontown Resources (ASX: LTR) +8.78% rallied as they look to have agreed to terms with Albemarle at $3 a share, in a protracted deal that started at a $2.20 bid last October.

- Mineral Resources (ASX: MIN) +2.44% is tipped to be buying West Australian lithium mine Bald Hill out of administration.

- Gold was up $US5 trading at US$1945 at our close.

- Asian stocks were solid led by Hong Kong up +2.37%, Japan +0.55% while China was up +1.16%

- US Futures are a touch higher.

- US markets are closed tonight for Labor Day.

ASX 200 Index

Paladin Energy (ASX: PDN) 93.5c

PDN +6.86%: The Uranium sector lit up today following news that Cameco (CCJ US) is having some production issues which is expected to impact its 2023 production forecast. It now expects to produce up to 16.3m pounds of uranium concentrate at the Cigar Lake mine this year which is below its previous forecast of 18m pounds. They also said that Production from the McArthur River/Key Lake operations for 2023 is anticipated to be 14m pounds down from the previous forecast of 15m pounds. This is meaningful in a market that is already tightening, and prices should clearly track higher as a consequence.

- Lower production from Cameco should drive Uranium prices higher.

Broker Moves

• SFR AU: Sandfire Cut to Hold at Canaccord; PT A$7

Major Movers Today

Enjoy the night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

7 stocks mentioned