The Match Out: ASX rips higher, adds 1.25% in broad-based buying

It was a bullish session for the Australian market today, on the back of another positive night overseas, although we took a while to get going initially. The SPI Futures only pointed up +22 points this morning, which seemed underdone. This view proved correct, as the local index kicked into gear from lunchtime onwards before a late 35 point sell-off took some of the shine off what still proved to be a very good day out, which saw all sectors finish in the green.

- The ASX 200 added +91pts/+1.25% at 7405.

- Communications were top of the pops today – I haven’t seen that in a little while – +2.17%; this was followed by IT +2.15%, and Materials +2.14% – which suits our current positioning.

- Harry put through some changes in the Emerging Companies Portfolio today – view here – with the rationale being to lock in some profits on a couple of stocks that are overbought, buy one new retail stock, and add to a couple of existing holdings.

- Hamish Douglass confirmed today a split from his wife a few months ago. As suggested this morning, this is relevant given he owns 11.96% of MFG. The statement said he was fully committed to the company and neither would sell shares. But as a few colleagues highlighted on the desk today, going through a divorce (unsurprisingly) tends to be a distraction. Shares in MFG rallied +4.3% today

- Westpac (ASX: WBC) has raised rates for the fourth time in the past two months, lifting its three, four and five-year fixed rates by 0.30%

- AGL Energy (ASX: AGL) and Fortescue Future Industries ((VIEW LINK)) – which is owned by Fortescue (ASX: FMG) – has teamed up to look at a potential green hydrogen plant in the Hunter Valley at the site of AGL’s two coal-fired power stations. While management will take 12 months to review the plan, and there are no immediate positive ramifications for either, it gives some insight into where the company’s priorities lie for the future. We added AGL to our income portfolio a week ago and while this is unlikely to bear fruit in the immediate term, from an income perspective, we believe the value of the company’s asset base is not being reflected in its share price.

- Zip Co (ASX: Z1P) +10.9% rallied for a second straight day after UBS, the perennial bear on buy-now-pay-later generally, and Zip itself, specifically upgraded from a sell to a hold equivalent call. UBS cited better risk/reward at current levels. The Swiss banker was wrong for a long time on Zip, but when a bear becomes almost a bull, the market tends to listen.

- Gold was higher in Asia today up to $US5 to $US1790 at our close

- Front-month Iron Ore was flat today however there is more action happening in outer months, May Futures for instance up +2.4%, which has underpinned another +3.27% rally in Fortescue Metals today.

- BHP Group (ASX: BHP) +1.85% is interesting here, we covered it in our weekly video update today (sent out tomorrow morning), with the stock now sitting on an 8% short position, its highest in history. We are bullish BHP here at Market Matters.

- Coal prices have been fairly stable over the past week, hence the lack of movement from Whitehaven Coal (ASX: WHC), which is holding around $2.50.

- Asian markets were mostly higher, Nikkei +2.48%, Hong Kong +1.98% while China was up +0.05%.

- US Futures are up, S&P +0.32% while Nasdaq Futures +0.45%

ASX 200

Broker moves

- Zip Co. Raised to Neutral at UBS; PT A$5.20

- Judo Capital Rated New Overweight at Barrenjoey; PT A$2.50

- APM Human Services Rated New Buy at Goldman; PT A$3.60

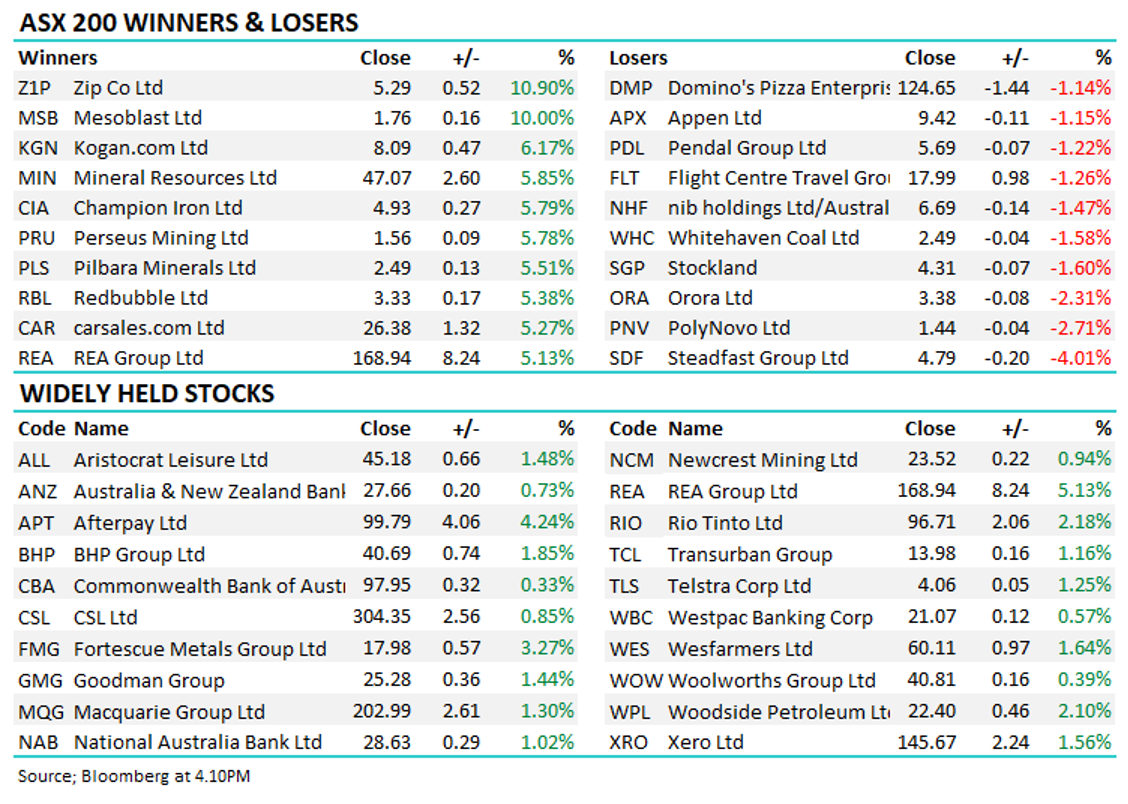

Major movers today

Have a great night,

James, Harry and the Market Matters team.

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

6 stocks mentioned