The Match Out: ASX's worst week in two years, Can’t hide in the banks, Xero bucks the trend

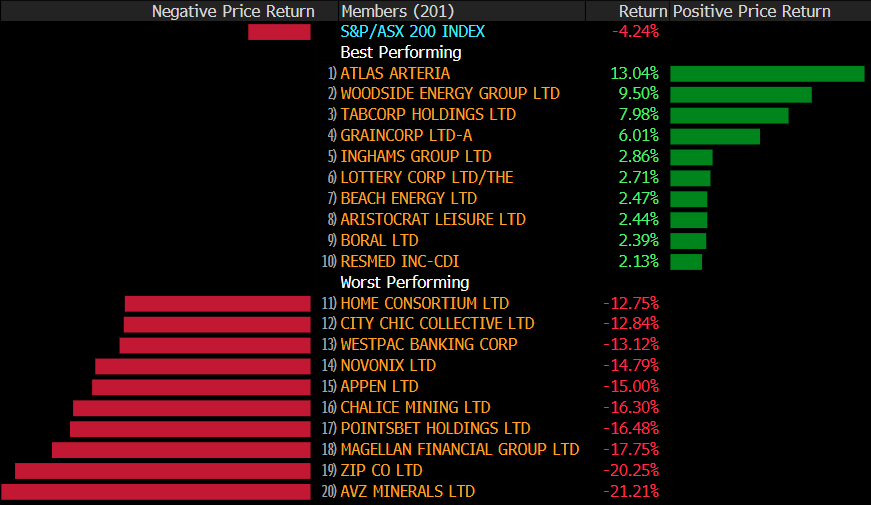

The week ended on a sour note today with the ASX following the US market’s lead with inflation fears being the main driver. Banks found some support early in the day but ended near their lows as traders took risk off into a long weekend. Interest rate-sensitive sectors of Real Estate and the discretionary retailers took the brunt of the selling. The end result saw the market down -4.24%/-307 points for the week, the worst performance since April 2020.

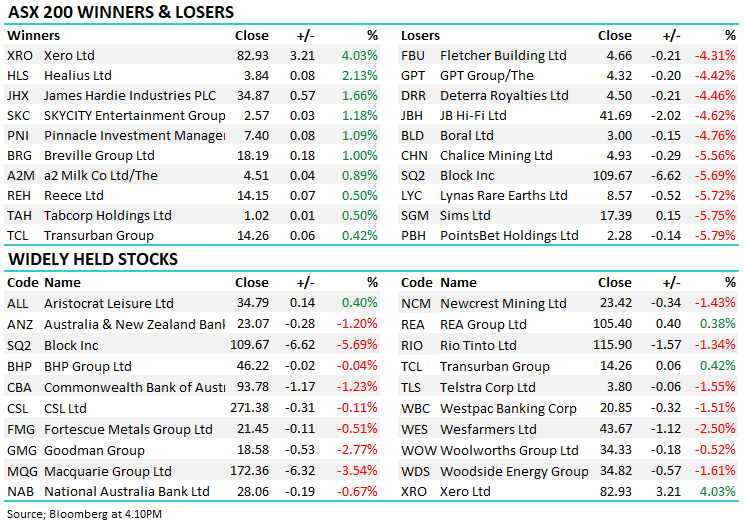

- The ASX 200 finished down -87pts/ -1.25% at 6932.

- All sectors closed in the red but Healthcare (-0.26%) and Industrials (-0.38%) felt the least pain.

- Real Estate (-2.85%), Consumer Discretionary (-1.69%) and Energy (-1.64%) were the hardest hit – a rarer day in the red for the energy stocks.

- Alumina (ASX: AWC) -3.94%, hit on a Goldman’s downgrade, the investment bank raising a red flag around margins - they now have a SELL on the stock

- Banks were down again today – they tried to rally but the negative sentiment towards the sector prevailed, Westpac (ASX: WBC) the worst of them down -1.51% while National Australia Bank (ASX: NAB) held up best, down by -0.67%

- Xero (ASX: XRO) +4.03%, bucked the negative trend today to rally, they increased prices this week across the board. Its worthwhile thinking about tech stocks as either discretionary or non-discretionary, XRO in our view is non-discretionary which adds significantly to its appeal/

- We highlighted Aristocrat (ASX: ALL) +0.40% yesterday & again this morning – we think this looks poised to rally from here – ditto for Resmed (RMD) +0.34% today.

- Iron Ore was -1% lower in Asia today which actually resulted in the bulk miners outperforming the broader index – buyers of BHP into the dip this morning an obvious trend.

- Gold was down -US$4/-0.21% in Asian trade today, settled $US1844 at our close.

- Asian stocks were a mixed bag today, Nikkei the laggard falling -1.49% but Hong Kong +0.13% & China +0.63%

- US Futures are all up, S&P +0.25%, Nasdaq +0.4%

ASX 200 chart

Sectors for the Week (Source: Bloomberg)

.png)

Stocks for the Week (Source: Bloomberg)

Broker moves

- Lifestyle Communities Raised to Buy at Jarden Securities

- Regis Resources Cut to Sell at Citi; PT A$1.90

- Alumina Cut to Sell at Goldman; PT A$1.60

- Allkem Rated New Buy at Clarksons Platou; PT A$16

- Maas Group Rated New Outperform at Macquarie; PT A$5.20

- Home Consortium Cut to Hold at Jefferies; PT A$5.76

Major movers today

Have a great weekend,

The Market Matters team.

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

5 stocks mentioned