The Match Out: ASX slips on a quiet day, HUB reports strong quarterly flows

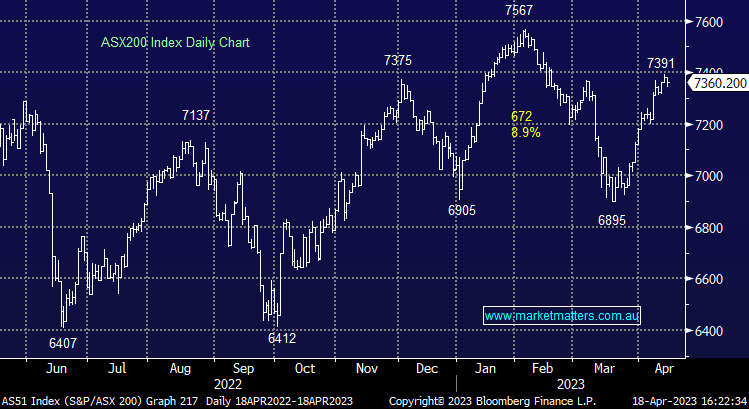

- The ASX 200 finished down -21pts/ -0.29% at 7360

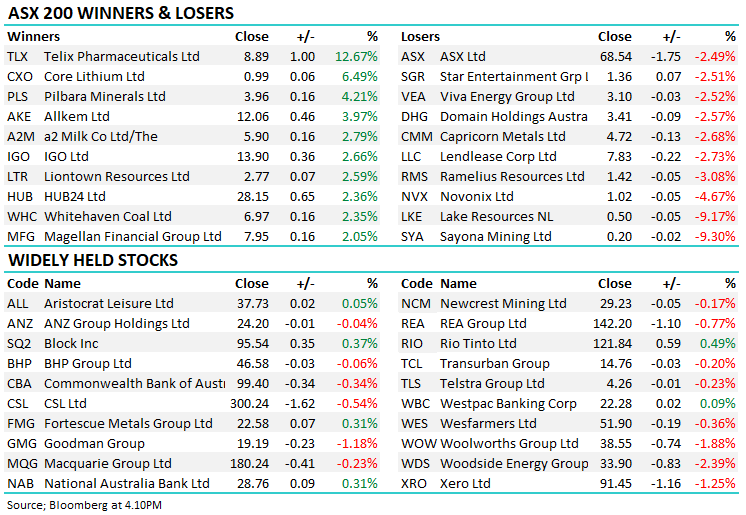

- The Utilities sector was best on ground (+0.67%) while Materials (+0.19%) also finished higher.

- Energy (-1.87%) and Consumer Staples (-1.21%) the weakest links.

- Chinese economic growth came in at 4.5% in the first quarter after Xi Jinping lifted COVID-19 restrictions which led to a rebound in factory and consumer activity.

- Commonwealth Bank (ASX: CBA) thinks the RBA will hike once more in May, although they’re now saying this is very line ball. We find it hard to see the justification for pausing for a month (April), and then going once more (in May) as the final hurrah. We think the RBA is done.

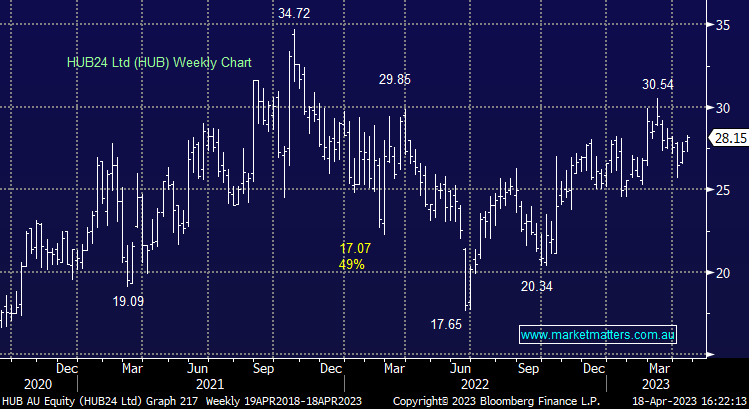

- Quarterly updates from both HUB24 (ASX: HUB) +2.36% & Praemium (ASX: PPS) out today with more on both below.

- Pilbara (ASX: PLS) +4.21% rallied on a UBS upgrade to BUY & $4.60 PT, other Lithium stocks also enjoyed the positive update, IGO Limited (ASX: IGO) +2.66% & Mineral Resources (ASX: MIN) +2% - we own the latter 2.

- Telix Pharmaceuticals (ASX: TLX) +12.67% topped the 200 after reporting a 27% increase in US sales in the three months to March.

- Energy stocks fell on reports of an LNG glut, Woodside (ASX: WDS) -2.39% & Santos (ASX: STO) -1.91%.

- Iron Ore was up ~2% in Asia, the Iron Ore coys edged marginally higher.

- Gold rebounded back up above $US2000/oz. Gold stocks were fairly muted.

- Asian stocks were mixed Hong Kong down -0.90%, Japan +0.42% while China was up +0.20%

- US Futures are all up a touch – nothing significant.

- No companies we own reporting in the US tonight, although we have Blackstone (BX US) Freeport (FCX US) & HCA Healthcare (HCA US) out later in the week.

ASX 200

HUB24 (ASX: HUB) $28.15

HUB +2.36%: Rallied today following their Q3 update that showed net flows of $1.9bn and total Funds Under Administration (FUA) of $76.9bn (+13% YoY), continuing its trajectory and number one position on net flows for the quarter across the platform space. They also flagged an agreement with EQT (ASX: EQT) for a proposed large transition of up to $4bn. Putting the flows into context, Netwealth (ASX: NWL) recently reported quarterly net flows of $1.65bn, with NWL around 45% bigger than HUB. They said platform FUA guidance of $80-89bn by FY24 remains intact. Interestingly, they saw a strong uptick in advisers on the platform, up +56 in the quarter to 3,748 which we think about as a strong lead indicator of net flow momentum with a typical ~12-month onramp. All in all, a very good update from HUB and this remains a company we like (although we have sold recently at ~$27.66).

HUB24 (ASX: HUB)

Praemium (ASX: PPS) 72.5c

Praemium (ASX: PPS)

Broker Moves

- Pilbara Minerals Raised to Buy at UBS; PT A$4.60

- Domain Holdings Cut to Neutral at Goldman; PT A$3.65

- Ramsay Health Cut to Underweight at Morgan Stanley; PT A$60.60

- St Barbara Cut to Sector Perform at RBC; PT 70 Australian cents

- Mirvac Group Raised to Overweight at Morgan Stanley; PT A$2.55

- Transurban Cut to Neutral at Citi; PT A$16.20

- Carsales.com Rated New Buy at Citi; PT A$25.80

Major Movers Today

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

11 stocks mentioned