The Match Out: ASX ticks lower, resistance holds, NAB bounces 4%

The ASX was again looking optimistic early on, as SPI Futures debunked overseas weakness. But true to recent form, key resistance – as detailed on the daily chart below – provided an impenetrable wall that capped the market's gains. And as US Futures tapered off, we simply trickled lower throughout the afternoon.

- The ASX 200 finished down -10pts/-0.14% today at 7423.

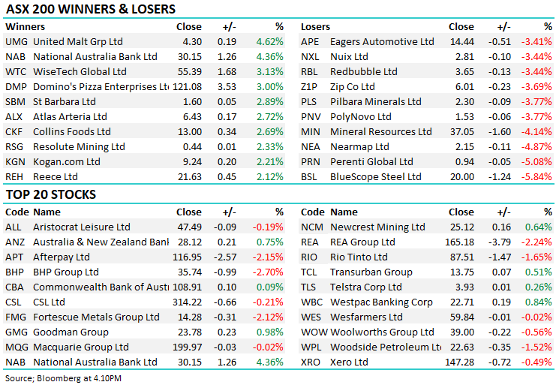

- Utilities were up +0.74% to be the best on the ground. A rebound of around 4% from NAB underpinned the Financial sector, Materials were the biggest drag as Iron Ore Futures fell around 7% in Asia.

- In this week’s Market Matters Video Update, Harry and I discuss six stocks held across the Market Matters Portfolios – three duds (for now) and three that are shooting the lights out. Click Here To Watch.

- Macquarie upgraded Alumina (ASX: AWC) today to a buy-equivalent – the stock still fell.

- PWC says banks are in the best shape in ages, and we tend to agree. But a lot is already built into their respective prices, particularly for Commonwealth Bank (ASX: CBA).

- Iron Ore miners were weak again today, BHP Group (ASX: BHP) led the declines down 2.7% to $35.74, Fortescue (ASX: FMG) fell 2.1% to $14.28, and Rio Tinto (ASX: RIO) dropped 1.7% to $87.51. Iron ore sub $US90.

- Gold was lower in Asia, trading down $US7 to around $US1,824 at our close.

- January Iron Ore Futures were down around

7% in Asia.

- Asian markets were mostly lower, Nikkei -0.61%, Hong Kong -1.01% while China was off -1%.

- US Futures are down around 0.30%.

ASX 200

Weekly Video Update

This week, Harry and I discuss six stocks held across the Market Matters Portfolios – three duds (for now) and three that are shooting the lights out. As always, please ‘like’ the video (if you do) and remember to subscribe to the Market Matters YouTube Channel, new content is added weekly.

Pushpay (ASX: PPH) $1.55

PPH -13.41%: the donation management company took a hit today after downgrading guidance at the half-year result. Pushpay, which has developed software to manage donation payments, administration and engagement in the faith and non-profit sectors, saw total volumes bounce back in the second quarter to post 8% revenue growth for the half at $93.5 million. While margins improved, Pushpay flagged higher than expected labour costs with wage pressures being felt, leading to a downgrade of fiscal year EBITDAFI guidance to between US$60 million and US$65 million, around 6% below previous expectations.

Pushpay

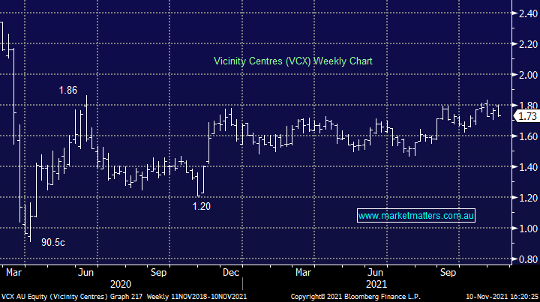

Vicinity Centres (VCX) $1.73

VCX -2.26%: the metro shopping centre owner/operator hosted their AGM today which came with a softer than expected first-quarter update. Occupancy remains strong at 98.1%, however, rental collections came in at 74% in the first three months with missed payments largely contained to NSW and Victoria. Leases remain under pressure with average prices on new leases down 7.2%, though this was an improvement of -12.7% in FY21. There are signs of a rebound, foot traffic picking up considerably since lockdowns have been lifted with visitations in Sydney centres now down just 10% from the same week last year. The company also noted shoppers were spending more per visit, in another positive sign for retailers.

MM is neutral VCX.

Vicinity Centres

Broker moves

- Alumina Raised to Outperform at Macquarie; PT A$2

- Perpetual Rated New Neutral at UBS; PT A$37.65

- Pendal Group Rated New Buy at UBS; PT A$7.95

- Platinum Asset Rated New Sell at UBS; PT A$2.55

- CSL Raised to Outperform at Macquarie; PT A$338

- Kathmandu Cut to Hold at Canaccord

- Coronado Global GDRs PT Raised to A$1.55 at Benchmark

- Sims Raised to Hold at Jefferies; PT A$13.50

- Scentre Group Cut to Hold at Jefferies; PT A$3.26

Major movers today

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

5 stocks mentioned