The Match Out: ASX up, Energy and Golds the standout as the LA Rams win the Superbowl

There was some nervousness this morning following a big weekend of negative news around the potential Ukraine invasion, no doubt amplified by many of us forgetting Valentine’s Day, however after a weaker open, stocks were well bid led by Gold and Energy shares while the banks were also well supported. Overall, a solid, somewhat surprising session on a day where the LA Rams won the Super Bowl.

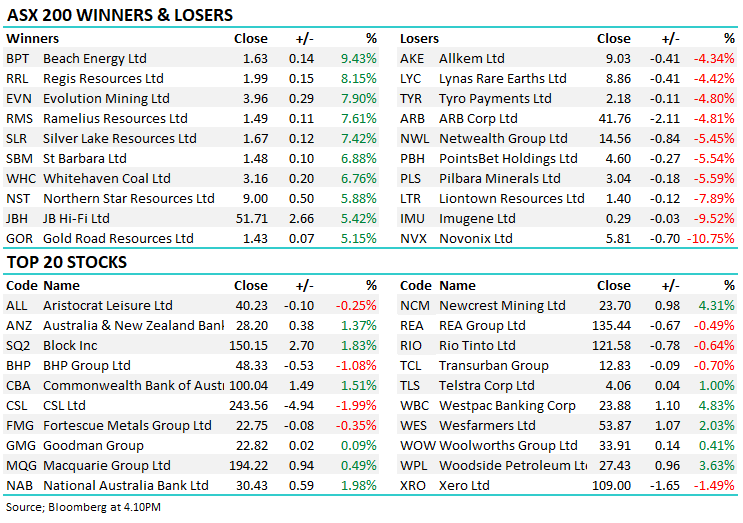

- The ASX 200 finished up +26pts/+0.37% at 7243.

- The Energy stocks put in a good effort up +3.36%, supported by Utilities (+1.92%) and Financials (+1.54%).

- Dragging the chain was Healthcare (-1.37%) as CSL (ASX:CSL) -1.99% confirmed the completion of their retail entitlement offer which was priced at $253.57, which is looking a touch high relative to today's close of $243.56 – we didn’t participate.

- Earnings really ramp up this week with a huge day on Thursday, overall things are looking reasonable with over 25% of companies being upgraded post results versus 5% being downgraded (thanks to UBS research).

- Golds were in the spotlight today, Regis Resources (ASX:RRL) and Evolution (ASX:EVN) up ~8%, even Newcrest (ASX:NCM) rallied +4.31% as spot gold traded at $US1853.

- Beach Energy (ASX:BPT) +9.43% the standout confirming production numbers while Santos (ASX:STO) +4.04% and Woodside (ASX:WPL) +3.63% enjoyed Crude Oil strength – we own STO.

- Whitehaven (ASX:WHC) +6.76% punched up through $3.00 today and looks strong, coal prices remaining well supported and we’re seeing strength in coal stocks overseas – we remain long and bullish WHC.

- Two of our Emerging Companies reported today, namely Praemium (ASX:PPS) -13.88% and Audinate (ASX:AD8) -3.75%, margins an issue for both, more so PPS with Harry covering below.

- Iron Ore was weak in Asia today, down around 6%.

- Gold was higher overnight before tracking lower in Asia today, settled $US1854 at our close.

- Asian markets were lower, Japan -2%, Hong Kong -1.24% while China fell -0.61%.

- US Futures are mostly higher, the S&P up +0.20%.

Crown Resorts (ASX:CWN) $12.64

CWN +2.02%: On its 4th attempt, Blackstone looks to have gotten over the line on its takeover for Crown at $13.10, having lodged the first offer at $11.65. The deal is still subject to regulatory approval hence the prevailing discount to the bid price however there is a high probability the deal will complete. We have little doubt this will prove to be a good buy for Blackstone as they separate out the operating business and the property portfolio and shrug off the ESG discount being applied in the market.

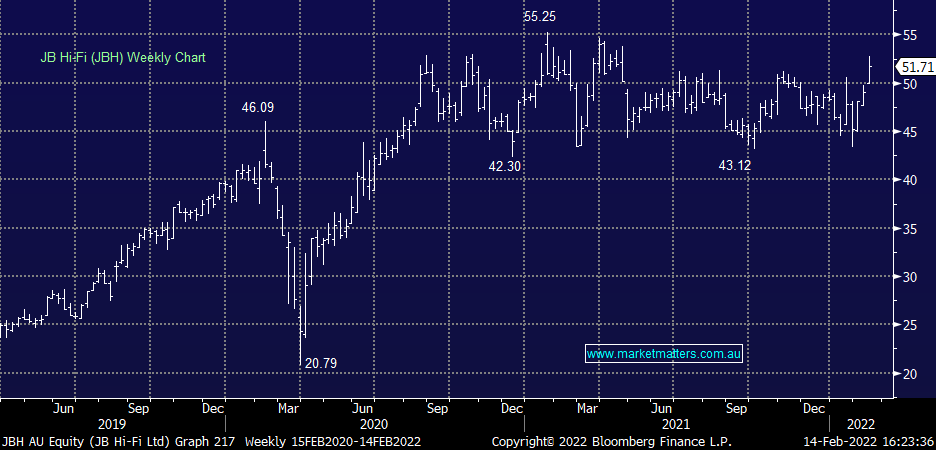

JB Hi-Fi (ASX:JBH) $51.71

JBH $5.42%: Reported 1H22 earnings this morning that were down 2% on last year but very much inline with market expectations – not surprising given the result was pre-released. However what was a surprise was a $250m off market share buy-back while they also talked up sales strength in January. While no guidance was given due to COVID (this was expected), a good start to the calendar year and confirmation the business is performing well (tight inventory management resulting in good cash conversion).

MM remains neutral JBH around $52.

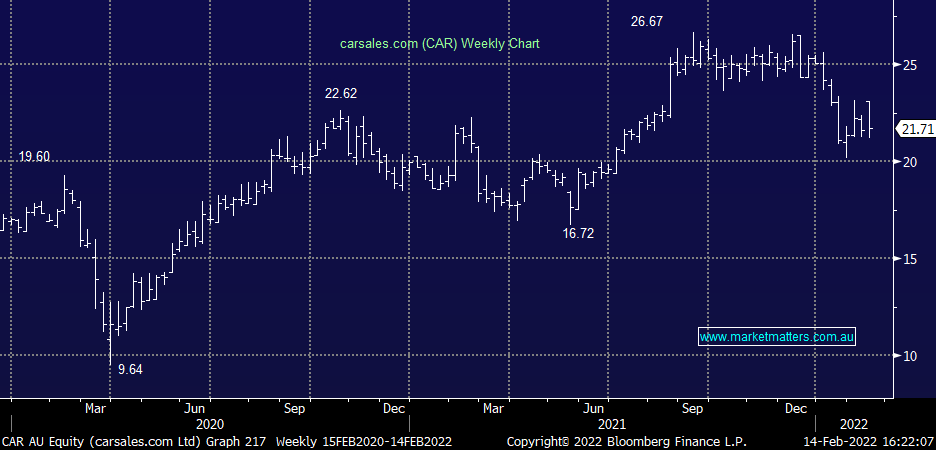

Carsales (ASX:CAR) $21.71

CAR +0.56%: A volatile session for CAR after delivering a ‘beat’ to 1H22 earnings today with the stock opening well before tapering off throughout the session. Profit was up 20% on the same time last year while in terms of guidance, they said “we expect to deliver strong growth in Group Adjusted1 revenue, solid growth in Group Adjusted1 EBITDA and strong growth in Group Adjusted1 NPAT in FY22.”

MM is bullish CAR.

Praemium $1.055

PPS –13.88%: fell to 4-month lows today on the back of a soft 1H result. Revenue at $39m was a touch behind, but margins fell and EBITDA of $7.5m was around a 15% miss to expectations. The lower margin Powerwrap business is having a bigger impact on group margins than originally expected while costs are also creeping higher with operating costs up $7m in the half. This has also weighed on guidance which was provided for the first time. Praemium expect FY22 EBITDA to come in between $16.5-18.5m, 15% below consensus at the midpoint. While today’s result has clearly reset expectations, the outlook remains positive. Praemium seeing significant inflows which should lead to operating leverage. There is also the interest from competitor Netwealth (ASX:NWL) which made an offer late last year. I suspect we haven’t seen the end of that story just yet and another bid is likely given the consolidation in the space.

MM remains long PPS in our Emerging Companies portfolio.

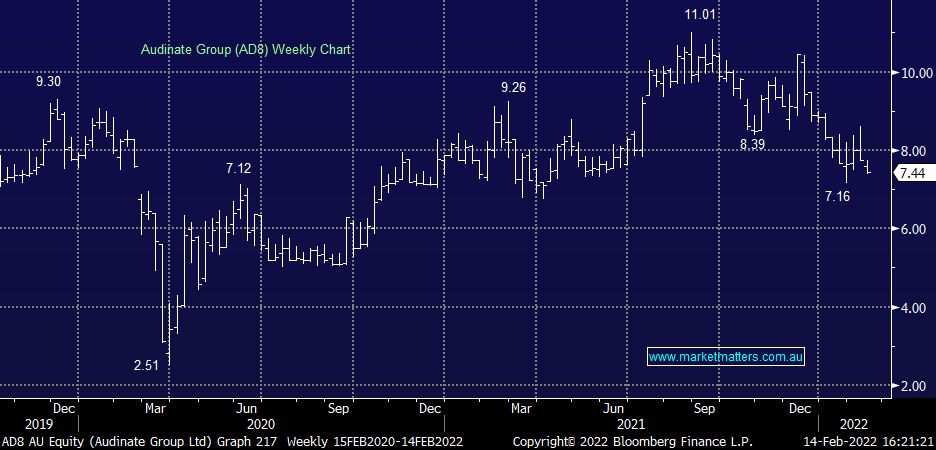

Audinate $7.44

AD8 -3.75%: first half numbers for the audio visual technology company were out this morning. The top line was in line with expectations, printing revenue of $US14.8m in the half, up 33%. EBITDA ($2m) and profit (-$2.1m) were slight misses to expectations however these are less of a focus. The hardware side of the business maintained its dominance in the space with 42% revenue growth on 1H21, now 19x its nearest competitor in terms of number of products. The volume growth shows that Audinate doing well to manage supply chain issues, though the outlook statement's cautious. We believe the headwinds facing Audinate at the moment will pass and the business is set to see a strong tailwind of demand as mobility picks up.

MM liked AD8 into current weakness around $7.40.

Broker Moves

- Insurance Australia Cut to Hold at Morgans Financial Limited

- ASX Raised to Neutral at Citi; PT A$84.70

- Platinum Asset Reinstated Sell at Bell Potter; PT A$2.22

- WiseTech Rated New Overweight at JPMorgan; PT A$51

- Inghams Cut to Neutral at Goldman; PT A$3.75

Major Movers Today

Enjoy your night

The Market Matters Team.

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

12 stocks mentioned