The Match Out: China stimulus supports the Aussie index, Newcrest (NCM)

Resources stocks led the charge today as signs that China is edging towards more widespread stimulus underpinned the commodity trade, while Energy also enjoyed the move. While the market was up, it wasn’t broad-based with more stocks ending the session lower. Notably, the index still managed a reasonable gain despite the highly important Financials sector down more than half a percent.

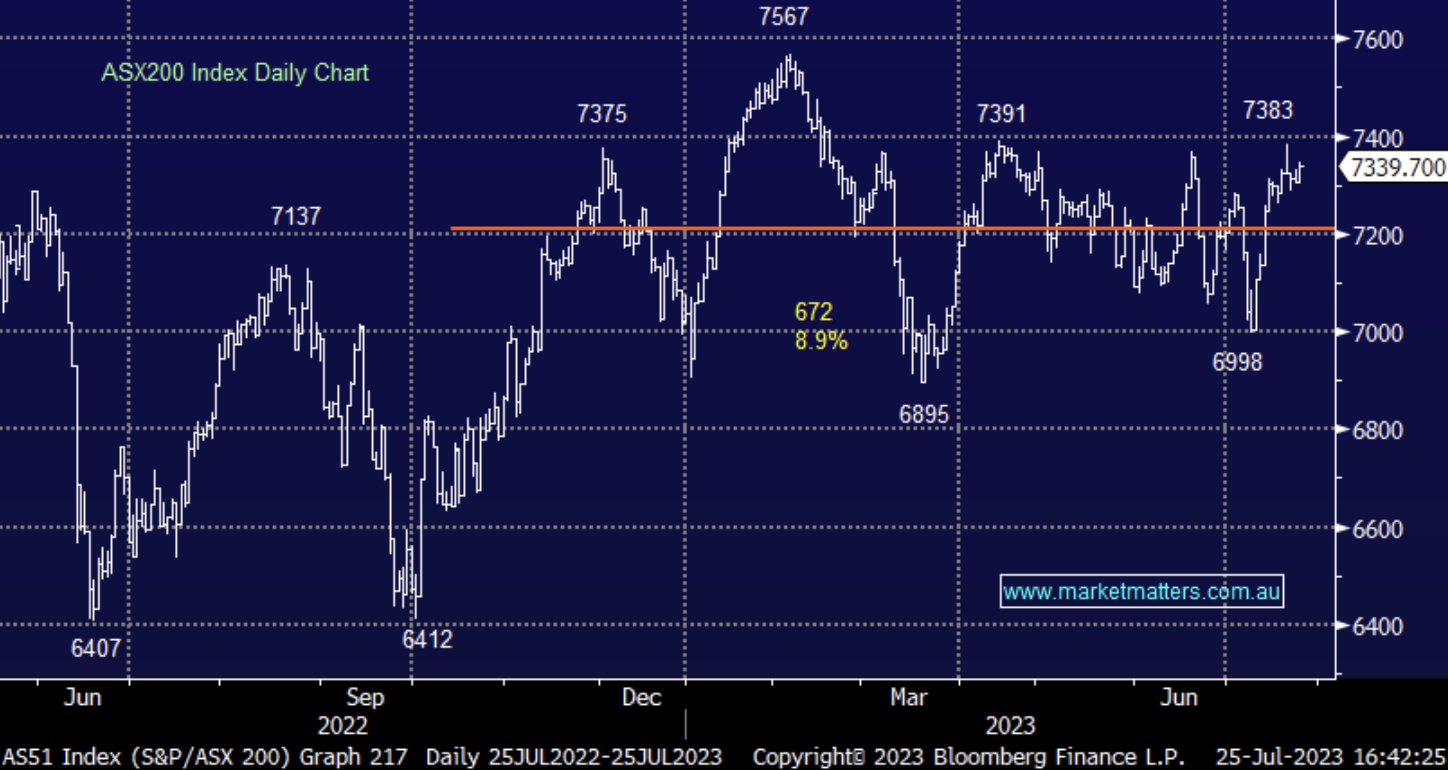

- The ASX 200 finished up +33pts/ +0.46% at 7339

- The Materials sector was best on ground (+2.74%) while Energy (+1.15%), Telcos (+0.34%) & Industrials (+0.0.03%) were the other sectors to finish higher

- Consumer Discretionary (-0.80%) and Financials (-0.51%) the weakest links.

- Resources enjoyed the rhetoric coming from China that implied further stimulus was likely. BHP Group (ASX: BHP) +3.34%, Sandfire (ASX: SFR) +4.34% & Champion iron (ASX: CIA) +4.96% were notable beneficiaries of the comments

- Most Lithium stocks bounced back today as Pilbara (ASX: PLS) released production numbers overnight, with lower pricing offset by higher volumes – we covered Lithium stocks in this morning’s note here

- While we are cautious about the sector in the near term, PLS remains our preferred pure play, as it’s a hard rock operation in a stable jurisdiction, in production, making money, and pays a dividend plus it has a net cash position of A$3.3bn (+$656m in the last quarter)

- Newcrest (ASX: NCM) +0.8% edged higher after dishing up a weak quarterly update, they just scraped through in terms of full-year gold production. More on that below.

- Dominoes (ASX: DMP) -5.04% knocked lower on a broker downgrade, Goldmans say it’s a SELL – we agree.

- Strandline (ASX: STA) flat, announced a change in management to bring more operational expertise into the fray.

- Coal stocks were strong across the board, Whitehaven (ASX: WHC) +2.21% & New Hope (ASX: NHC) +2.41% while Bowen Coking Coal (ASX: BCB) +6.9% had a strange day with a motivated seller knocking the stocks ~10% lower early before it recovered.

- Monadelphous (ASX: MND) +5.36% rallied on a good contract win, the day after JP Morgan downgraded

- Iron Ore was +0.34% higher in Asia today though the bulk commodity miners performed better – Fortescue (ASX: FMG) +4.55%.

- Gold added ~0.5% to $US1963/oz in Asia today. Most precious metal stocks edged higher as well.

- Asian stocks were strong in Hong Kong (Hang Seng +~4%) & China (+2.08%) though Japan’s Nikkei index fell marginally.

- US Futures are marginally higher, S&P500 futures pointing to a +0.1% start at this stage.

ASX 200 Chart

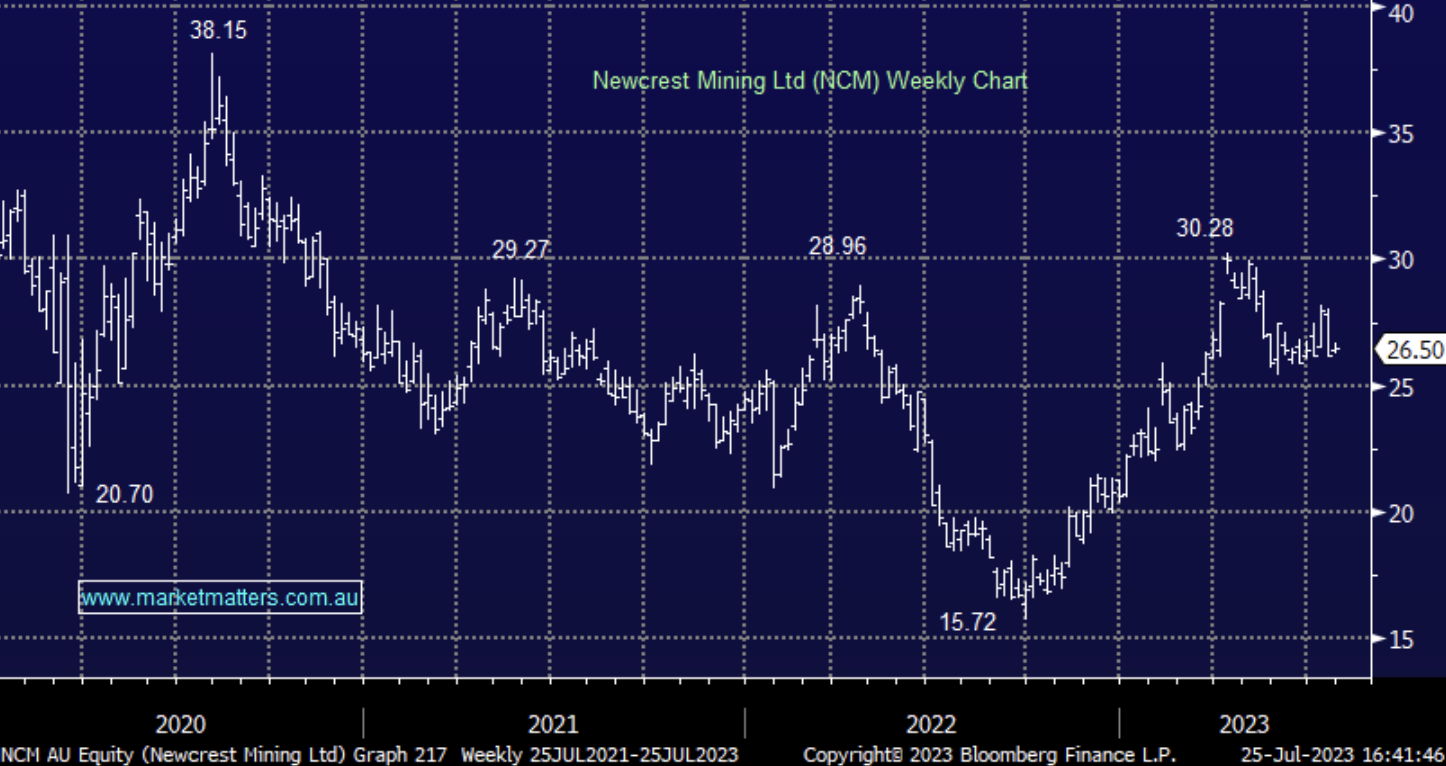

Newcrest (ASX: NCM) $26.50

NCM +0.08%: NCM reported June quarter production numbers this morning that were on the weaker side, the bid from Newmont (NEM US) looks to be somewhat of a get-out-of-jail-free card here. They produced 556koz gold in the period, ~4% below expectations which put upward pressure on costs, with an AISC of US$1,196/oz up ~US$200/oz q/q. The numbers mean they just scrapped into the low end of their FY23 gold production guidance while they just missed on copper. Importantly, the NEM deal is on track for completion before Christmas with the bid worth $27.85 per NCM as of today’s close. Continuing to hold NCM requires a view of NEM – to that end, NEM retained CY23 guidance of 5.7-6.3moz despite the June Quarter being disappointing. NCM will report FY23 results on Aug-11 and they provide FY24 guidance at that time.

Strandline (ASX: STA) 22.5c

STA flat: the mineral sands company announced they have hired a CEO to support longstanding MD Luke Graham in the operations of the business. Jozsef Patarica comes from an operations background with strong credentials in the areas Strandline has struggled with. The ramp-up of their Coburn asset in WA has seen a number of delays and has fallen well short of expectations. The main concern has been delays to the Mineral Separation Plant (MSP), part of the refining processes Strandline was aiming to have up and running by this stage, while production of the unrefined Heavy Mineral Concentrate has been slower than expected as well. Bringing in an operations specialist to the executive role makes a lot of sense, the hope being that Joszef can get Coburn back on track MD Luke can focus on expansion and growth. We are keeping an eye on progress here and the outlook for the mineral sands markets.

Broker Moves

- Breville Cut to Neutral at Goldman; PT A$22.50

- Domino's Pizza Enterprises Cut to Sell at Goldman; PT A$41.10

- Orica Raised to Buy at Jarden Securities; PT A$17.15

- Incitec Rated New Neutral at Jarden Securities; PT A$2.85

- South32 Cut to Neutral at Goldman

- Domain Holdings Raised to Buy at Jefferies; PT A$4.38

- Nine Entertainment Cut to Neutral at Evans & Partners Pty Ltd

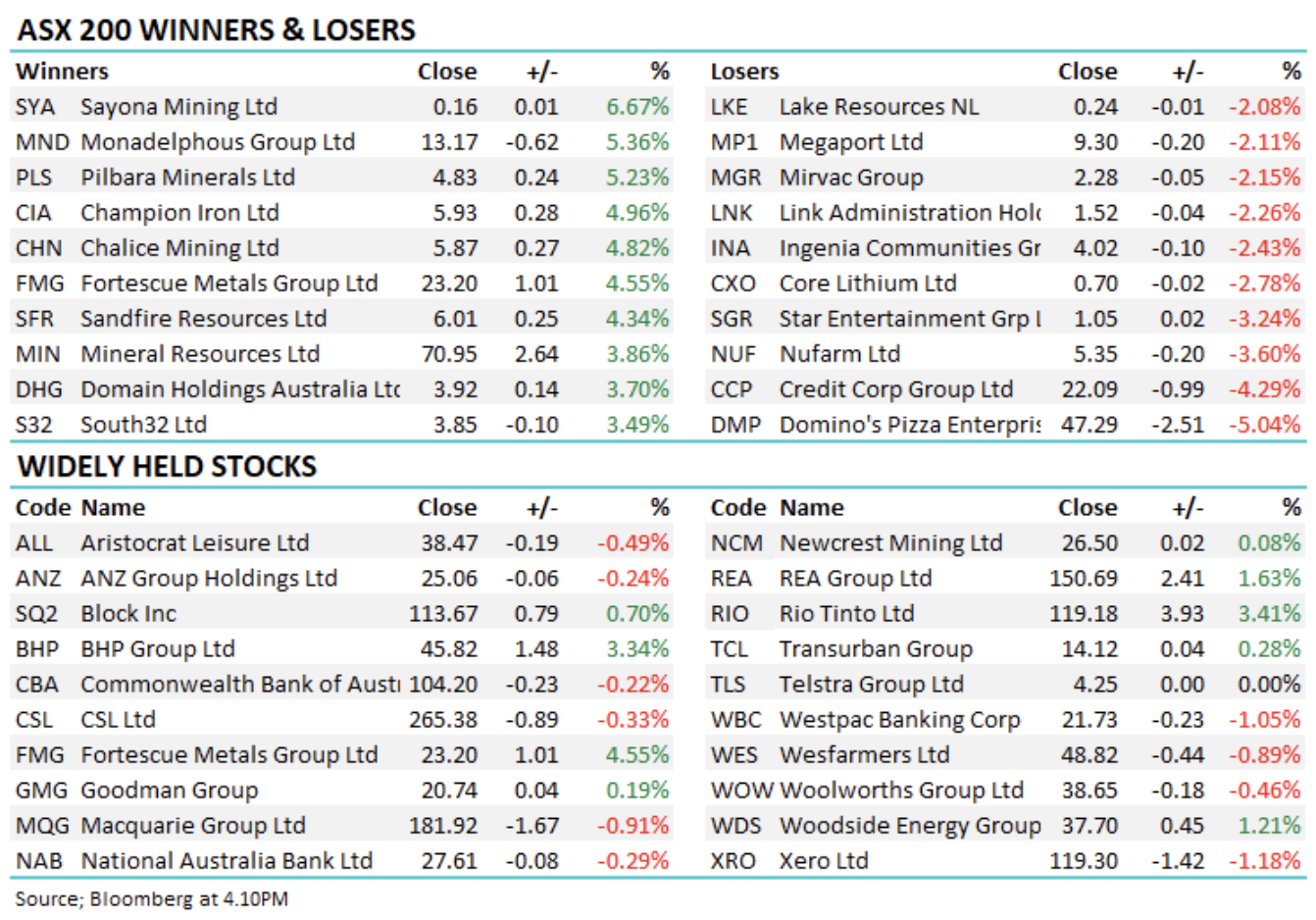

Major Movers Today

Enjoy your Weekend

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

12 stocks mentioned