The Match Out: Healthcare finds some form ahead of the RBA tomorrow

- The ASX 200 finished up +19pts/ +0.28% to 6997

- The Healthcare sector was best on ground (+1.47%) while Consumer Discretionary (+0.62%) and Utilities (+0.54%) also did well.

- Energy (-0.97%), Industrials (-0.16%) and Communications (-0.10%) underperformed.

- MM is looking for Michele Bullock to leave the RBA Cash Rate at 4.1% on Cup Day, but it’s a close call, and we are against ‘consensus’ on this view– equities are likely to struggle for a few days if they hike.

- Westpac (ASX: WBC) +1.95% rallied on a broadly inline result v bearish positioning but a $1.5bn on-market buyback helped.

- Goodman Group (ASX: GMG) -0.41% reconfirmed FY24 guidance at their Q1 update this morning.

- Iress (ASX: IRE) +8.25% rallied on a positive note from JP Morgan – they see deep value in this turnaround play.

- Gold stocks enjoyed the session, Evolution (ASX: EVN) +5.13% a standout while Northern Star (ASX: NST) +3.18% was also solid – we own both.

- Consumer Discretionary caught our eye, interesting to think the RBA is odds on to hike tomorrow yet the retailers are rallying, Lovisa (ASX: LOV) +5.14%.

- Growing concern around the risks associated with Ozempic has helped Resmed (ASX: RMD) +3.11% today – sentiment is slowing turning back in their favour. We remain patient.

- Whispir (ASX: WSP) +61.67% ripped on a takeover from Soprano Digital pitched at 48c, closing today at 48.5c – the ex-Appen (ASX: APX) CEO behind the deal.

- Weebit Nano (ASX: WBT) +2.05% was higher, although finished a long way off highs after the $750m company recorded its first-ever revenue of $US100,000.

- Treasury Wines (ASX: TWE) +4.26% was up as the PM touched down in China.

- Magellan (ASX: MFG) -0.43% saw another $800m leave in October, although it seems like performance was okay for the period.

- Iron Ore was 0.5% higher in Asia, and miners were largely flat.

- Gold was higher over the weekend but gave back gains during Asian trade, -$US9 higher at $US1983

- Asian stocks were up to varying degrees, Hong Kong +1.5%, Japan +2.6% while China edged up +0.74%.

- US Futures are flat.

ASX200

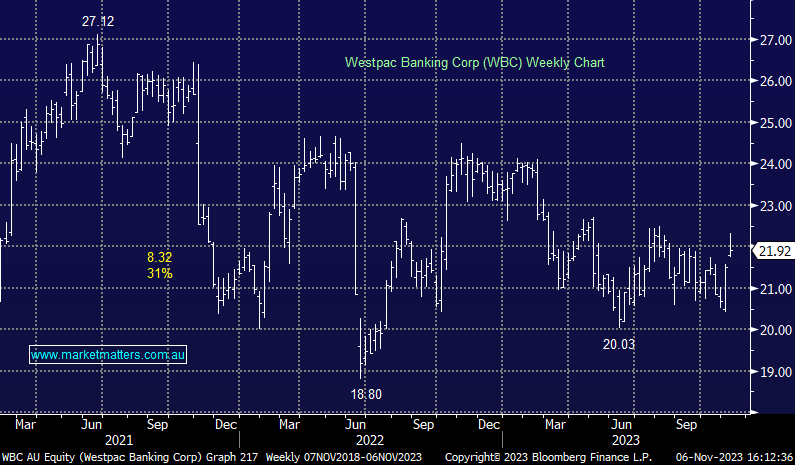

Westpac (ASX: WBC) $21.92

WBC +1.95%: Rallied today after delivering a largely inline FY23 result, although the $1.5bn on market share buy-back announced was a positive surprise while they also made better progress on costs. Net Income of $7.2bn was up +26% YoY, a shade below consensus of $7.33bn while the 2H dividend of 72cps was ahead of expectations. Margins improved to 1.95% while a lot of focus was on the cost side, thexpense-to-income ratio of 49.4% vs. 55.1% last year was better than many of the pessimistic assumptions and shows they are now heading in the right direction. Capital is very strong with the Tier 1 ratio at 12.4% vs. 11.3% last year and above estimates of 12.1%, this has underpinned a solid share buy-back.

While earnings headwinds persist, a strong capital position and diligence on costs are supportive.

Westpac

Goodman Group (ASX: GMG) $21.95

GMG -0.41%: the global industrial property company was out with a 1Q update which was largely as expected, though shares were slightly lower up against a small gain for the broader Real Estate sector. They completed $1b of work in the quarter, Net Property Income was up 4.9% on a like-for-like basis and occupancy remained strong at 99%. Goodman maintained FY24 guidance of operating EPS growth of 9% and total distributions of 30cps. The update included more commentary on their plans for a push into data centres, seeing unprecedented demand in the space. Their industrial portfolio has been performing well and Goodman’s low gearing could see them well placed to pick up over-leveraged, distressed assets on the cheap to further support growth.

Goodman Group

Broker Moves

- APM Human Services Rated New Buy at Canaccord; PT A$2.65

- Integral Diagnostics Raised to Equal-Weight at Morgan Stanley

- Integral Diagnostics Cut to Neutral at Jarden Securities

- Integral Diagnostics Raised to Buy at CLSA; PT A$2.50

- Iress Raised to Overweight at JPMorgan; PT A$7

- CSR Raised to Add at Morgans Financial Limited; PT A$6.75

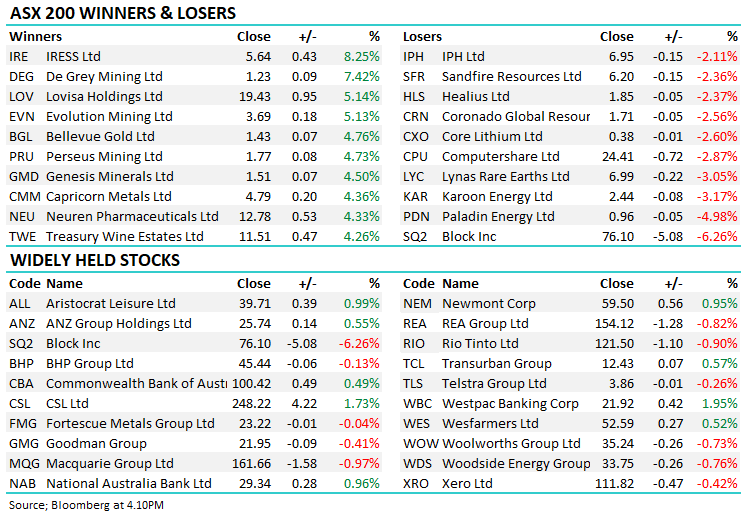

Major Movers Today

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

12 stocks mentioned