The Match Out: Market bounces back, Resources the main target, lots of quarterlies out today!

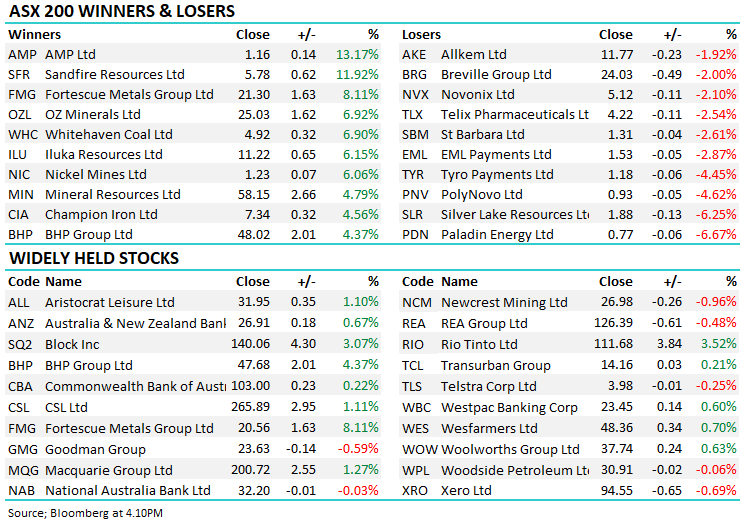

The bulls re-emerged today with a focus on the resource stocks pushing the Material sector up by 3.5% in aggregate with strong gains across Iron Ore, Copper, Coal, Nickel & Mineral Sands – pretty much right across the board (bar Uranium, Gold & Lithium). US Futures moved higher throughout our session and that prompted a nice bottom left top right sort of day for the market with the ASX200 back up above 7300.

- The ASX 200 finished up +95pts/ +1.32% at 7329

- The Material sector (+3.52%) was best on ground while Energy (+0.96%) & Industrials (+0.89%) were also strong.

- Communications (-0.10 %) the only sector to fall while Real-Estate (+0.24%) and IT (+0.31%) were underperformers.

- The IT space was frustrating even though the Nasdaq Futures rallied +1.7% during our time zone – the sector still just can’t attract a bid.

- BHP +4.37% and Fortescue (FMG) +8.11% typified strength across the materials while Whitehaven Coal (WHC) +6.90% is back trading at all-time highs.

- Paladin (PDN) -6% fell after Sprott failed to get its US listing – more on that below.

- Audinate (AD8) +6.21% rallied on a better quarterly with the worst of their supply chain issues behind them.

- AMP +13.17% sold its international infrastructure business.

- Sandfire (SFR) +11.92% up on a strong quarterly particularly relative to its last one! A long way to catch up to Oz Minerals (OZL).

- HALO (HAL) -14.77% - what a joke! The IPO spun out of AAIG who are also behind the Australian Stock Report, Apsec and a bunch of other brands closed at 75c having listed at $1.20 on Tuesday – losing 37.5% in 3 trading sessions. We discussed the IPO Here following a question from a subscriber.

- Oz Minerals (OZL) +6.92% positive on a broker upgrade.

- Newcrest (NCM) -0.96% weighed by a weaker Gold price however their quarterly update today was solid.

- Iron Ore was ~2.5% higher in Asia.

- Gold was down at ~US$1882

- Asian stocks were strong Hong Kong up +1.09%, Japan up +1.82% while China was up +0.42%

- US Futures are all up, the Nasdaq +1.7% the best of them.

ASX200

Weekly video update

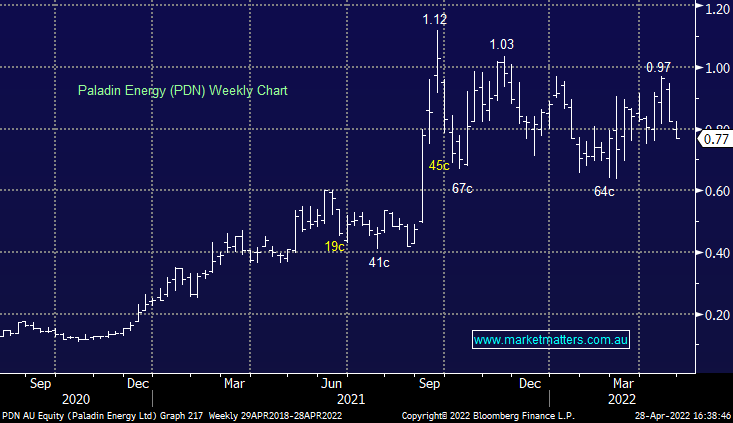

Paladin (PDN) 77c

PDN -6.67%: Out with their quarterly activity report this morning however more importantly for the sector was news overnight from Sprott Asset Management that the SEC has rejected its US listing application for the Sprott Physical Uranium Trust (TSX: U.UN). This follows the news earlier in the week the company had closed its acquisition of the Sprott Uranium Miners ETF (NYSE: URNM), which was previously known as the North Shore Global Uranium Mining ETF, the largest uranium equities ETF in the US. While the news is not a total shock given the delayed timeframe that had transpired with the listing having previously been intended for 3Q21. The market took this as a negative today however we do not have a strong view one way or the other regarding how the SPUT US listing affects the commodity in the short-mid-term – we doubt it will have a big bearing. The reason to own PDN is for exposure to a resurgence in Nuclear Power which we think will play out over the coming years.

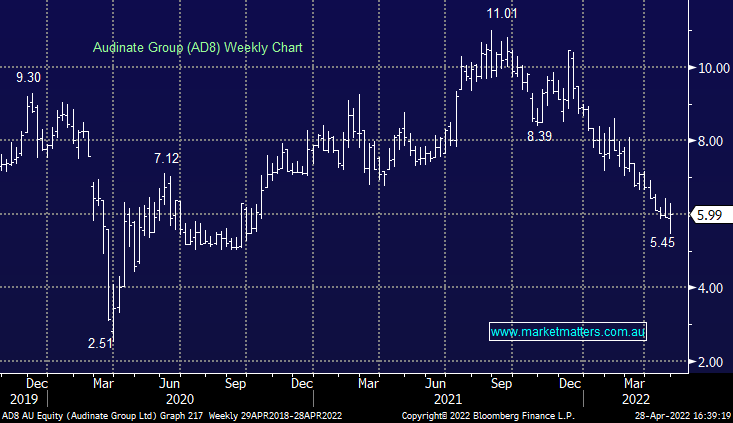

Audinate (AD8) $5.99

AD8 +6.21%: the audio-visual technology company provided a positive surprise in their quarterly update aftermarket yesterday. Revenue for the seasonally weak 3Q was $US6.5m, now strongly placed to beat FY estimates. They noted chip supply issues had started to ease after peaking early in the quarter, gross margins had been maintained above 75% and they have managed to push through price rises of around 25%. With revenue of $US21.3m so far this year, Audinate are well placed to exceed the top end of broker estimates at $US29m for the full year given they still have their seasonally strongest quarter yet to be booked.

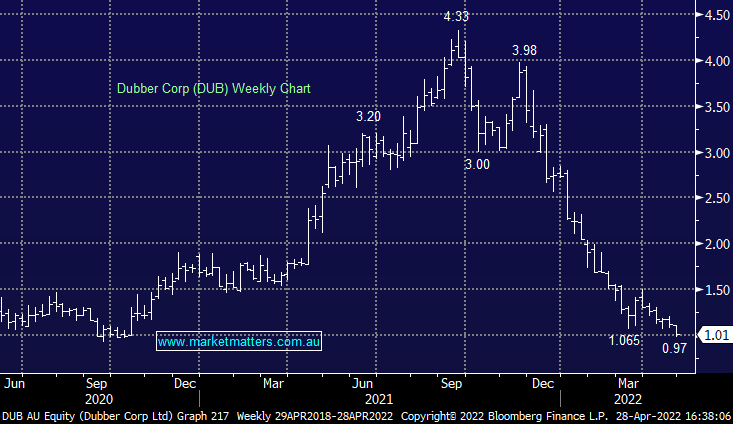

Dubber (DUB) $1.01

DUB +1.51%: The call recording and communications intelligence business was choppy today on the back of their 3Q update. Average Reoccurring Revenue (ARR) was up 62% YoY to $55.1m while revenues for the 3 months came in at $9.25m, up 9% on the previous quarter. Penetration continues to build with more than 540k subscribers now using their products. With ARR now over $55m and costs running around $5m a month, the core business is approaching cash flow breakeven, a key catalyst for the software company.

Broker Moves

- OZ Minerals Raised to Buy at Bell Potter; PT A$27.53

- Ramelius Raised to Buy at Argonaut Securities; PT A$1.66

- Whispir Cut to Hold at Canaccord; PT A$2

- City Chic Raised to Positive at Evans & Partners Pty Ltd

- Secos Group Cut to Speculative Buy at Canaccord

- Iluka Raised to Outperform at Credit Suisse; PT A$13.20

- Sigma Healthcare Cut to Underweight at Morgan Stanley

- 29Metals Cut to Equal-Weight at Morgan Stanley; PT A$3.20

- Star Entertainment Cut to Neutral at Goldman; PT A$3.75

- Northern Star Raised to Overweight at JPMorgan; PT A$11

Major movers today

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

14 stocks mentioned