The Match Out: Market gives up early gains, defensives back in favour

An average day for the ASX with the market giving up an early advance after a solid session in the US overnight, US futures turning lower during our time zone, and weakness throughout Asia didn’t help.

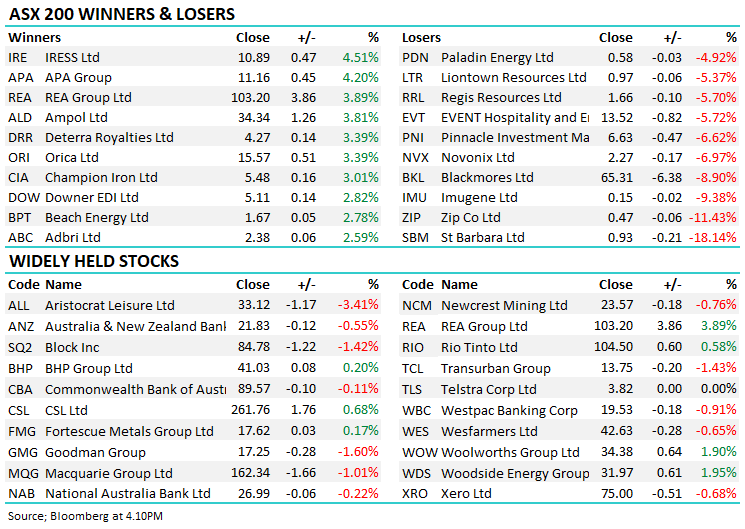

- The ASX 200 finished down -15pts/ -0.23% at 6508

- The utilities sector was best on ground (+2.05%) while Energy (+1.52%) & Staples (+0.53%) were also strong.

- IT (-1.52%) and Consumer Discretionary (-1.36%) the weakest links.

- Market Matters Weekly Video Update - Click Here

- Graincorp (GNC) -1.36% held an investor call today and said they were preparing to receive a third consecutive bumper harvest from eastern growing regions this season.

- Fletcher Building (FBU) +2.25% forecast Ebit before significant items for the full year of about NZ$750 million, with an underlying Ebit margin of about 9.5%.

- Copper stocks flat/lower despite the Chilean-based Codelco saying workers will strike, protesting a decision by the state copper company to close one of its smelters over environmental concerns.

- Core Lithium (CXO) -15.42% hit despite saying its Finniss Project near Darwin is “progressing well” and is set to send its first shipment of spodumene concentrate to companies including Tesla by the end of the year. Director selling here weighing on the SP.

- Lake Resources (LKE) -13.4% also fell sharply in the Lithium space showing just how edgy the sector still is.

- Zip Co (Z1P) -11% fell after an update this afternoon, talking up their prospects and saying that they had enough capital to see them through to cashflow breakeven in FY24.

- Ive Group (IGL) +6.9% had a solid trading update and reconfirmed guidance, there was some concern creeping in here (MM included) however today's update was solid.

- St Barbara (SBM) -18.14% to 92.5c after announcing a strategic review about whether to proceed with a project to extend the life of its Simberi mine in Papua New Guinea.

- Iron Ore was down another 5% in Asia today.

- Gold was trading down ~US$7 to US$1825 at our close.

- Asian stocks were weak, Hong Kong down -2.02%, Japan -0.50%, and China was off 1%.

- US Futures are all down more than 1%.

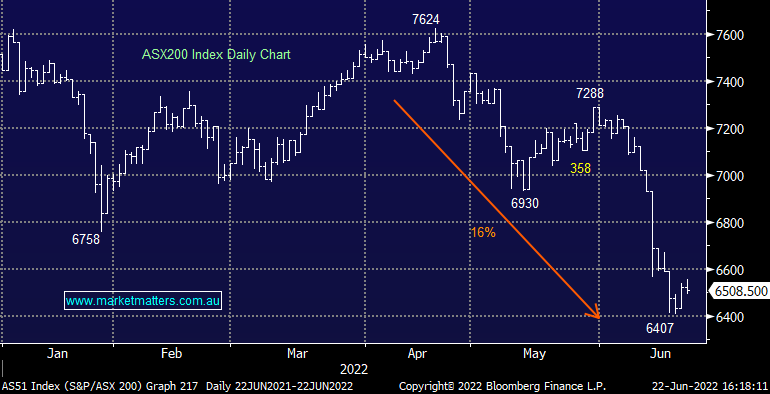

ASX 200

IVE Group (IGL) $1.705

IGL +6.9%: the integrated marketing business was out with a positive trading update and solid guidance. A strong first half carried over into the back end of the year. While trading conditions have become tougher, IVE Group appears to have executed well despite broader market issues.

Revenue is expected around $750 million, and EBITDA around $98 million for the full year, in line with previous guidance and consensus expectations. Net debt is expected to climb slightly with some put towards additional inventory to ensure customers were not disrupted as a result of supply chain issues.

Overall, we think it was a solid update from IGL when the market was starting to think times were getting tougher for the business.

Zip Co (Z1P) 46.5c

Z1P -11%: fell despite talking up their prospects and saying that they had enough capital to see them through to cashflow breakeven in FY24 which is a positive, however more interesting was the point that a 25bps increase in the base rate. This increased costs of funds on a per transaction basis by 2bps.

Margins are already slim here + rising rates increases costs on one side and also hurt bad debts on the other. We’ve got this totally wrong, unfortunately, with our only solace being we cut it from our Flagship Growth Portfolio and reduced the position size in our Emerging Companies portfolio nearer ~$6, but overall, it’s been a terrible position.

Broker Moves

- Adairs (ADH AU): Cut to Hold at Canaccord; PT A$2.30

- Collins Foods (CKF AU): Cut to Hold at Canaccord; PT A$8.60

- Commonwealth Bank (CBA AU): Raised to Buy at Jefferies; PT A$104

- OFX (OFX AU): Rated New Positive at Evans & Partners Pty Ltd; PT A$2.62

Major Movers

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice-daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

2 stocks mentioned