The Match Out: Market trends higher into the long weekend, BOQ weighs on the financials, Travel stocks rally

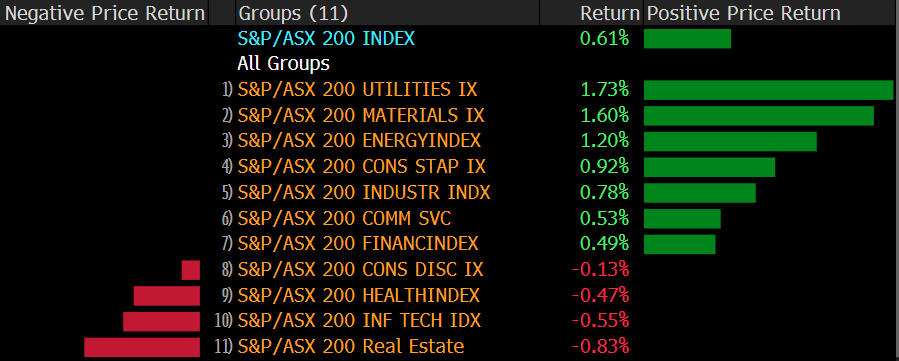

The market traded in a reasonably tight range for much of the session and importantly held firmly above 7500. Four sectors managed gains of more than 1% with tech the big surprise as yields fell despite strong price index numbers earlier in the week. The commodity focussed sectors of materials and energy were also strong performers. Financials struggled but couldn’t hold back the broader index.

- The ASX 200 finished up +44pts/ +0.59% at 7523

- The Materials sector was best on ground (+1.31%) while Tech (+1.25%) & Utilities (+1.08%) were also strong.

- Financials were the only sector to close lower (-0.26%) on the back of a soft 1H result from Bank of Queensland (BOQ)

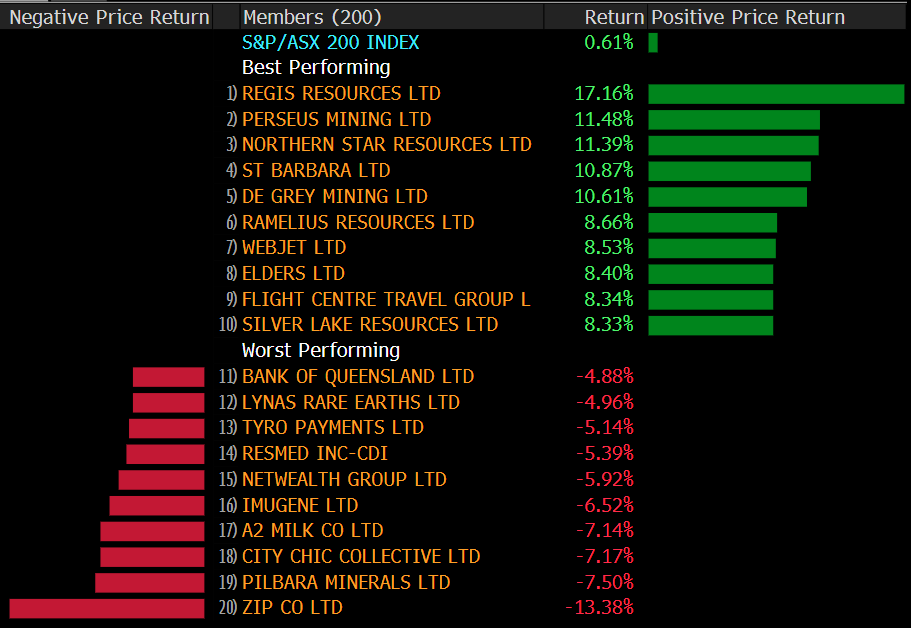

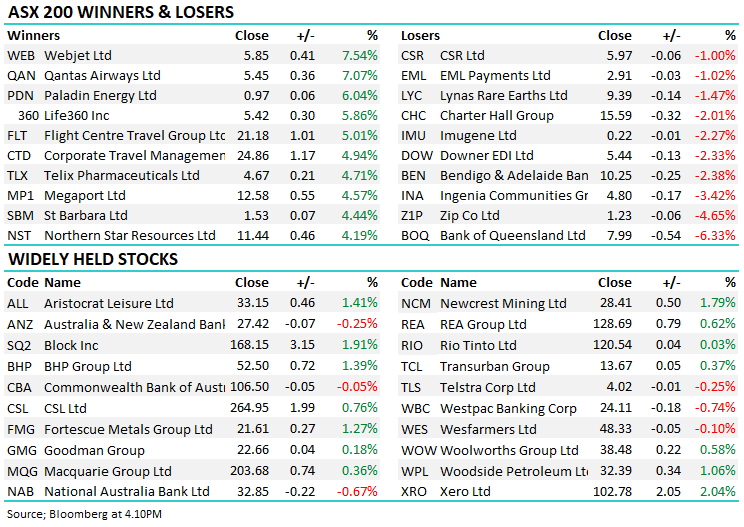

- Bank of Queensland (BOQ) was the first bank to report this period and missed expectations. Net Interest Margin (NIM) fell 12bps vs 2H21 to just 174bps, though cash earnings were higher on reserve releases. The dividend also disappointed with a payout ratio of just 52%, paying 22cps for the interim div. the result weighed on the banks as a whole

- Netwealth (NWL) released their FUA update. They noted inflows of $2.6b in the quarter though market moves weighed on the total figure and saw platform stocks trade lower today.

- Travel stocks were on the rebound today following stronger than expected bookings numbers from American Airlines (NASDAQ: AAL) overnight. Webjet (WEB) was the standout jumping +7.54%.

- Allkem (AKE), +1.96%, was out with their 3rd quarter update. Prices continue to surge with spodumene expected to double in the 4th quarter. They are targeting 3x production by 2026

- Iron Ore was marginally lower, -0.22% in Asia today

- Gold was up overnight before tracking down -US$4.50 in Asian trade today, settled $US1,973 at close.

- Asian stocks were strong Hong Kong up +0.84%%, Japan +1.22% while China was up +1.19%

- US Futures are all up, s&P +0.20% & the Nasdaq futures +0.38%

ASX200

Sectors this week

Stocks this week

Broker Moves

- Pilbara Minerals Raised to Buy at Citi

- Iluka Cut to Sell at Citi

- Incitec Rated New Overweight at Barrenjoey; PT A$4.50

- Orica Rated New Neutral at Barrenjoey; PT A$16

Major Movers Today

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

4 stocks mentioned