The Match Out: Plenty of action for a flat session, JB Hi-Fi (JBH) falls despite record numbers, Hub24 (HUB) disappoints

The ASX snapped a 4-day winning streak today, though only ending marginally lower after a directionless session given US markets were closed overnight. Surprisingly, more than half of the sectors in the index closed higher today, lead by a strong +1.8% gain in the Consumer Staples sector, while Real Estate was also better than 1% higher. On the flip side, Utilities were the worst performer for the second straight session falling -1.25%, while Materials were the main drag on the index given its size, falling more than 1% as commodities took a breather and the USD bounced. While the large-cap index held firm, the ASX Small Ords saw heavier selling, falling -0.74% in the session.

- The ASX 200 finished down -2pts/ -0.03% at 7386

- The Staples sector was best on ground (+1.81%) while Real Estate (+1.09%), Healthcare (+0.98%) & Telcos (+0.85%) were also strong.

- The laggards included Utilities (-1.25%), Materials (-1.06%) and Tech (-0.83%).

- Hub24 (ASX: HUB) -4.47%, struggled today with a slowdown in FUA growth. More on that below.

- JB Hi-Fi (ASX: JBH) -1.25%, rallied to an 8-month high early but ultimately closed lower today despite a strong trading update. We cover the update below.

- Bapcor (ASX: BAP) -4.61%, fell on a broker downgrade today. The note outlined caution on the transformation project and macro impacts on margins. We own Bapcor in the Emerging Companies Portfolio and continue to like it, particularly given the update from Super Retail (ASX: SUL) yesterday.

- Austal (ASX: ASB) -9.41%, tumbled late in the day after warning of a potential $US41m loss based o higher costs to complete open contracts. The company is in discussions to recover some off this amount based on contract adjustments, however, this process remains ongoing.

- Rio Tinto (ASX: RIO) -1.23%, released 4th quarter production numbers which were broadly in line with guidance. The company also provided 2023 guidance which came in largely as expected with the share price weakness today blamed on the fall in iron ore.

- Iron Ore fell -1.12% in China today, weighing on FMG the most, down -1.23%.

- Asian stocks were mixed again, Nikkei was trading 1.25% higher while the Hang Seng and China indices were down more than 1% each at the time of writing.

- US Futures are all down, S&P off -0.4% and the Nasdaq pointing down -0.6%.

Hub24 (HUB) $26.70

HUB -4.47%: the investment platform business posted 2Q Funds Under Administration (FUA) numbers today which disappointed the market. They saw net inflows of $2.8b, down from $3b in the first quarter and $3.3b in 2Q22. Net inflows were 13% lower in the first half compared to the same period last financial year with the company blaming investor sentiment and macro outlook for the slowing FUA growth. They also took a small impairment on their investment in Diverger which will take $1m off the underlying profit. We recently sold HUB at higher levels in the Flagship Growth Portfolio.

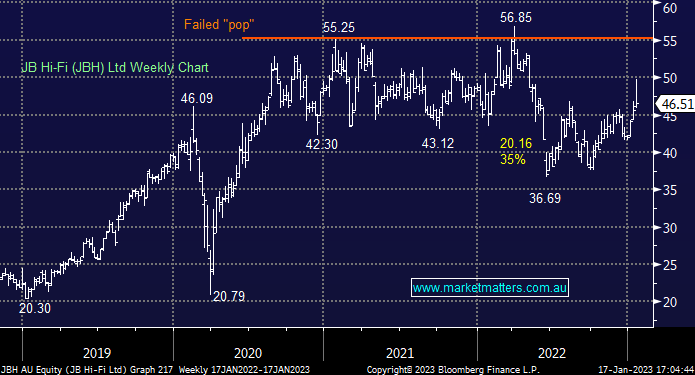

JB Hi-Fi (JBH) $46.51

JBH -1.25%: shares initially traded to 8-month highs today following JBH’s record first-half sales update. Net sales are expected to rise 8.6% to $5.3b, while Net Profit for the first half is seen at ~$330m, up more than 14% vs 1H22. The CEO said easing COVID pressures and disruptions had contributed to improved margins while solid customer demand and a well-executed promotional period boosted sales. Shares traded as high as up 18% for the YTD early on before profit takers ultimately sent the stock lower into the afternoon.

Broker Moves

- Newcrest Cut to Neutral at Macquarie; PT A$25

- Fortescue Cut to Sell at CLSA; PT A$19

- BHP Cut to Reduce at CLSA; PT A$48.50

- Rio Tinto Cut to Reduce at CLSA; PT A$117.50

- Baby Bunting Cut to Hold at Morgans Financial Limited; PT A$2.80

- ResMed GDRs Raised to Overweight at JPMorgan; PT A$35

- Core Lithium Rated New Underweight at JPMorgan

- PolyNovo Cut to Sell at CLSA; PT A$1.90

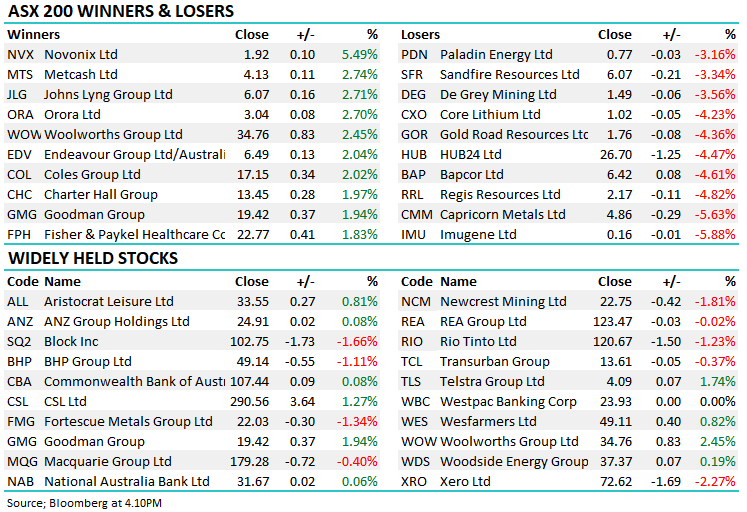

Major Movers Today

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

6 stocks mentioned