The Match Out: Selling continues to weigh on the ASX, Metcash (MTS) posts FY23 beat

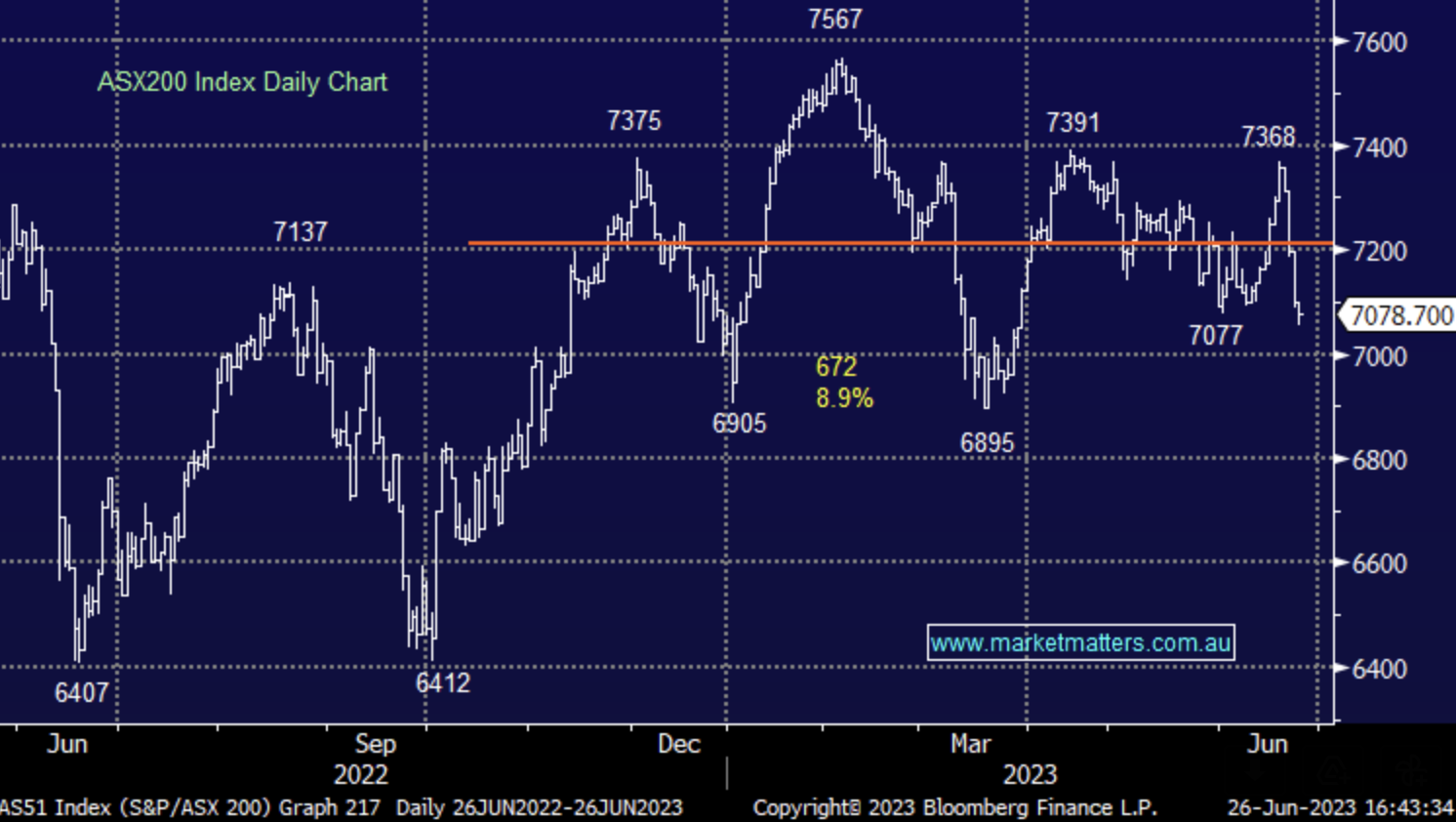

The bearish tone on the market continued today with any intra-day rallies being met with selling, though the ASX200 didn’t seem to want to travel too far south of 7100 at the same time either, finishing with a small jump on the close. No sector was down more than 1% today, though 4 sectors closed -0.5% or worse with Utilities the biggest drop but Financials weighing on the index the most. Tech and Real Estate managed gains today showing it wasn’t all a one-way street, helped by lower bond yields.

- The ASX 200 finished down -20pts/ -0.29% at 7078

- The Tech sector was best on ground (+0.88%) while the Real Estate sector (+0.07%) was the only other sector to close higher.

- Utilities (-0.59%) saw the biggest drop, followed by Healthcare (-0.58%), Staples (-0.57%) and Financials (-0.50%)

- Metcash (ASX: MTS) +4.74% FY23 results for the company were better than expected today. More on that below.

- Capricorn Metals (ASX: CMM) +4.94% the gold miner was helped by a broker upgrade today, while the company also announced it had reduced gold hedging so it could benefit from any further increase in the gold price.

- Corporate Travel (ASX: CTD) -0.83% fell despite winning a 4-year contract with the Australian Government, expected to contribute 20% of the region’s revenue from FY24 when it commences.

- Appen (ASX: APX) -12.31% CFO will depart, after taking the gig just last month. Helen Johnson will leave at the end of July for personal reasons, while the previous CFO is still with the company until 1 Sept to handle the transition. The market thinks there is something more sinister under the hood, which wouldn’t surprise given the company’s recent history.

- Lark Distilleries (ASX: LRK) -16.31% fell to 2-year lows today after reducing sales guidance and telling the market they would take a further $.4m in one-off charges for restructuring and obsolete inventory costs. Another black mark on the company that has had a number of issues in recent years.

- Iron Ore was down -1% higher in Asia today, weighing on the bulk commodity miners.

- Gold was largely flat at ~US$1923/oz in Asian trade today. Gold miners were broadly positive though with a shift to more defensive exposure.

- Asian stocks were all softer, Hong Kong down -0.41%, Japan -0.25% while China was the hardest hit, -1.35%

- US Futures are all up, around +0.15%

ASX 200 Chart

Metcash (ASX: MTS) $3.76

MTS +4.74%: Full-year results out this morning were solid, and marginally ahead of consensus expectations. Underlying profit of $307.5 million was up 2.6% YoY and above Bloomberg consensus of $299.5 million. The FY dividend of 22.5c fully franked was also better than expected (21.2c) which puts it on a yield of ~6% based a today’s close. Divisionally, the result was okay with hardware as the main driver of growth, while they said the independents are retaining the majority of customers gained in Food that were accrued during Covid, although volumes have tapered off somewhat. Sales growth has continued in the first seven weeks of FY24 with all pillars continuing to perform well.

- A solid update from MTS today which should allay some of the market’s recent concerns that have pushed shares down ~20% from their recent highs.

Broker Moves

- Megaport Cut to Equal-Weight at Morgan Stanley; PT A$8.30

- Mesoblast Cut to Hold at Jefferies; PT A$1.30

- New Hope Cut to Underperform at Macquarie; PT A$4.50

- Capricorn Metals Raised to Outperform at Macquarie; PT A$4.80

- Waypoint REIT Rated New Reduce at CLSA; PT A$2.67

- HMC Capital Raised to Overweight at JPMorgan; PT A$5.50

- Helloworld Raised to Accumulate at Ord Minnett; PT A$2.84

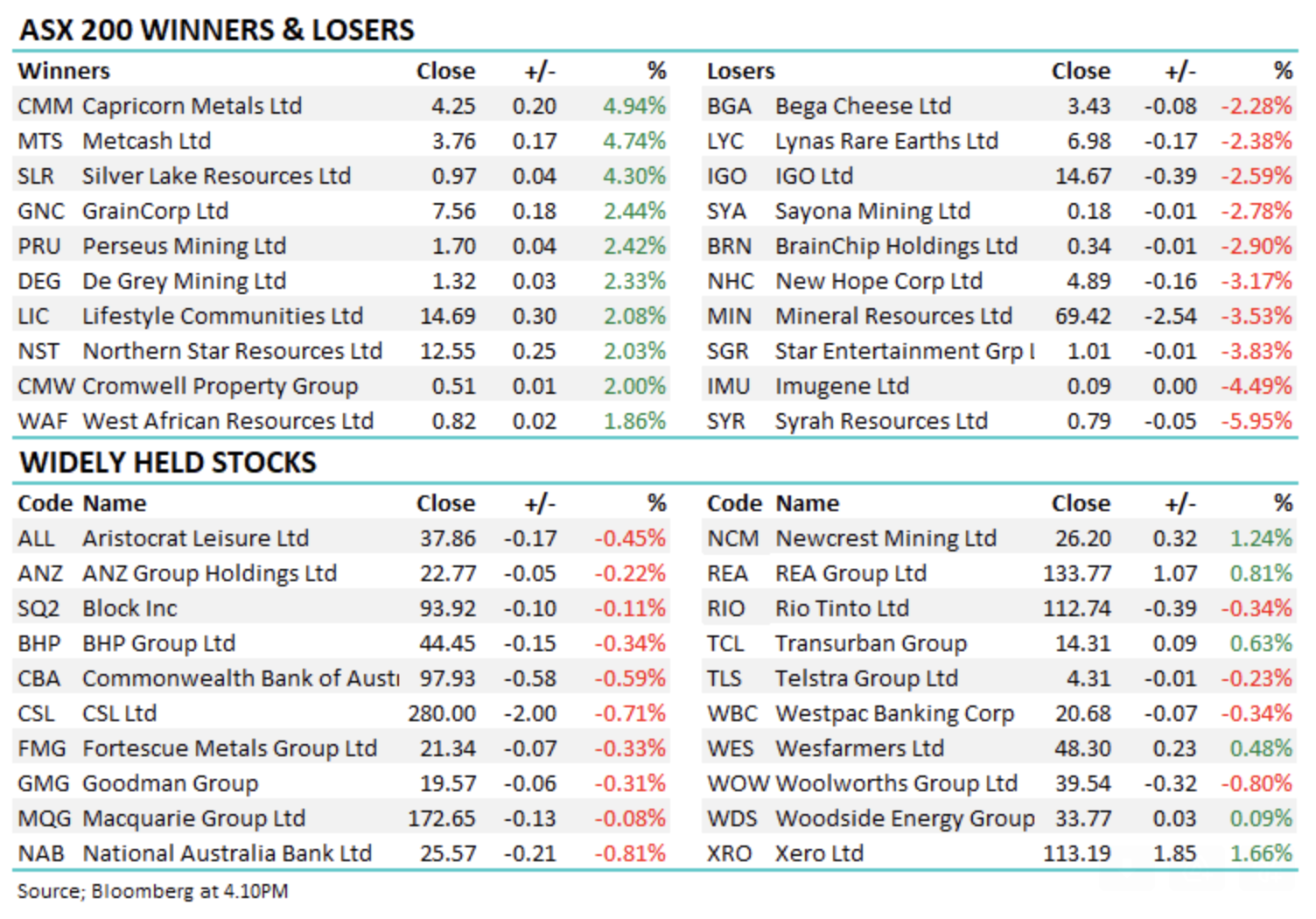

Major Movers Today

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

5 stocks mentioned