The Match Out: Stocks end a cracking November on a high, Inflation more benign than expected

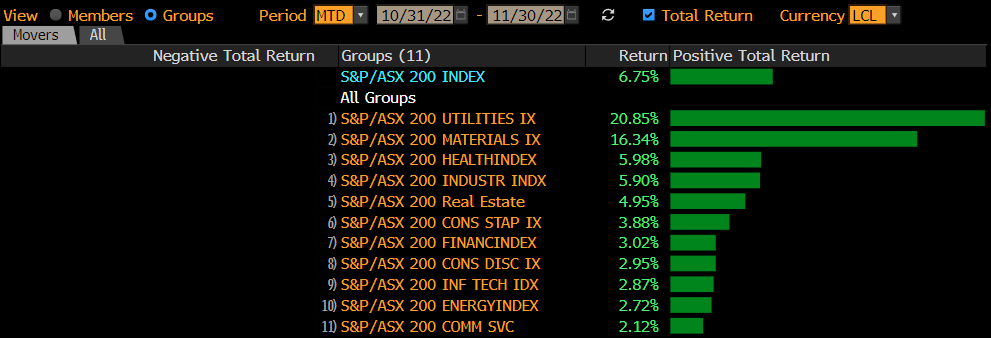

A good day for the ASX to end what has been another stellar monthly performance, the ASX 200 advancing +6.75% (incl dividends) in November led by a ~20% advance by Utilities but more importantly, a 16.3% rally in Materials. All sectors were higher in the month with the bears clearly licking their wounds – and there are plenty of them around!

Today it was more benign inflation that got the buyers going again following a soft first hour or so of trade, the ASX 200 ultimately rallying +60pts from the morning lows with Energy, Materials & Property the standouts.

- The S&P/ASX 200 added +30 points / +0.43% to close at 7284

- Energy (+1.79%), Property (+1.26%) & Materials (+1.25%) were the standouts.

- Utilities (-0.78%) fell but have had a great month, Staples (-0.66%) underperformed as did Healthcare (-0.25%).

- Lead Portfolio Manager James Gerrish was on Ausbiz this morning talking commodities, coal / copper + also MM’s view around property – a stock we discussed in this morning’s Portfolio Report being Dexus (ASX: DXS). Watch Here

- Inflation data in Australia came in lower than expected today printing 6.9% versus expectations for 7.6% and below the prior month’s read of 7.3%. This will fuel the narrative that inflation has peaked in Australia – more on that below.

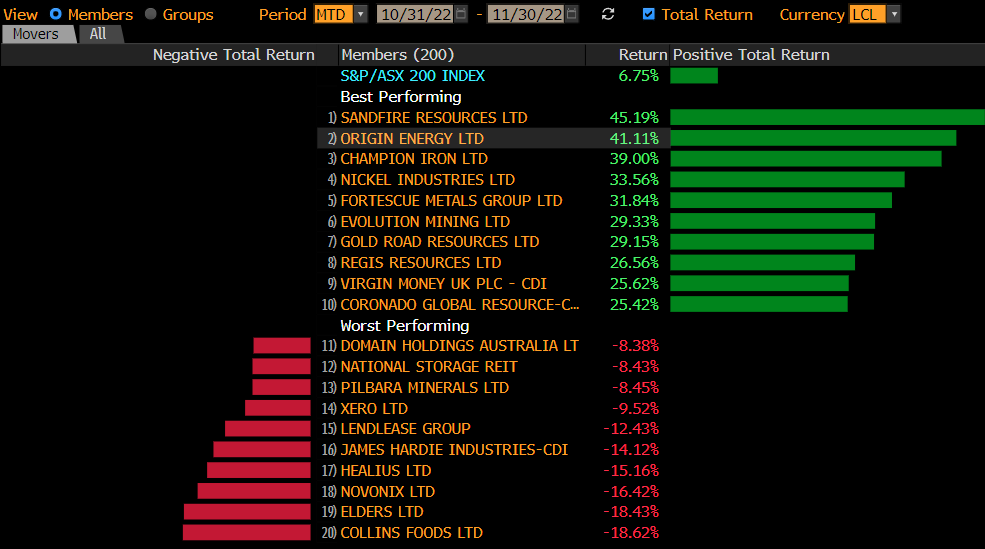

- Temple & Webster (TPW) +14.07% rallied on their AGM commentary, particularly around margins.

- Coal stocks were best on ground today as the Coal price continues to recover, Whitehaven Coal (ASX: WHC) +8.42% and New Hope (ASX: NHC) +6.82% while a smaller player we own in Bowen Coking Coal (ASX: BCB) put on +7.41%

- Overseas names were also higher last night – Peabody Energy (NYSE: BTU) +8.82% a standout and is back testing recent highs while our names are still 10-20% below their equivalents.

- Fortescue Metals (ASX: FMG) -0.41% appointed a new CEO, Fiona Hick who will handle the Iron Ore business. Great experience operationally, Ex-Woodside + also did a stint at Rio.

- Gentrack (ASX: GTK) +19.17% was strong again today following yesterday’s very good FY22 result and clear articulation of their plans for the coming years.

- We had Phil King from Regal present this morning and he is bullish on the market going into 2023 with a particular skew towards resources. No discussion on Perpetual (ASX: PPT). We recently added Regal Partners (ASX: RPL) to our Emerging Companies Portfolio. We like RPL with/without PPT.

- Pendal (ASX: PDL) +0.81% and Perpetual (PPT) +1.21% are trading very much like that tie-up will happen – the structure of the deal is worth $5.22 per PDL share versus today’s close of $5.00.

- We held a Webinar today focussing on the Resources Sector with Resource Analyst Peter O’Connor – a recording will be provided to those that registered. For any members that missed it, and would like a copy, please reach out.

- Next week we have Analysts’ Jono Higgins & James Bisinella in for round two, focussing more on mid-cap growth opportunities including their thesis on Regal Partners (RPL) – keep an eye out for registration details in the coming days.

- The Aussie Dollar was flat today around US67c.

- Gold was trading marginally higher during the Asian session ticking around $US1754/oz.

- Asian stocks were mixed, Hang Seng bounced +0.40%, the Nikkei in Japan fell -0.42%, while China put on +0.32%

- US Futures are up, circa 0.12%

ASX 200 Chart

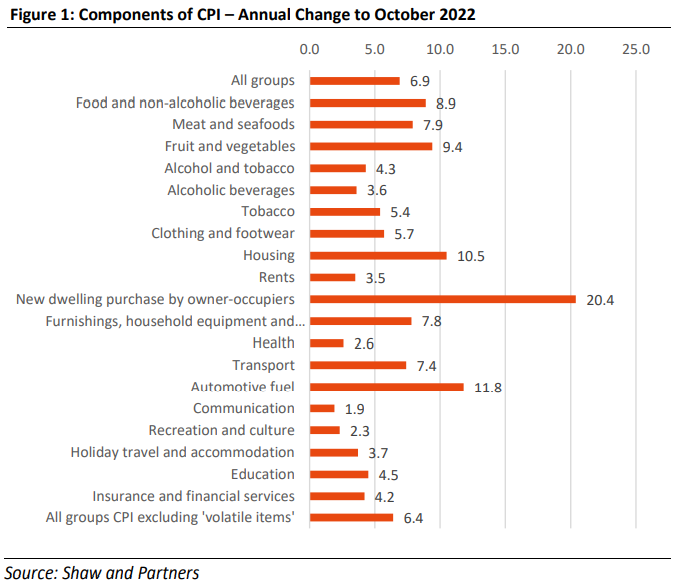

October CPI inflation a lower than expected at 6.9%

Australian Consumer Price Inflation (CPI) rose a lower-than-expected 6.9% in the 12 months to October, adding fuel to the narrative that inflation has peaked and the RBA will either hike by 25bps or as MM expect, pause altogether. Futures are now pricing in a 15bps hike at the next meeting implying the market, on balance, sees a hike but we’re not alone as the outliers expecting rates to stay stable at 2.85%. Looking further out, current pricing now implies rates will peak in October 2023 at 3.73% i.e. another 0.88% upside from here, although if today’s trend continues, this level will prove too high.

Consensus expectations for today’s print was 7.6% although some were naturally thinking it would be hotter at 7.8% and other more towards 7.3% but there was no one we saw that expecting a 6 handle. The RBA’s own expectations are that inflation will exceed 8%, so today’s lower read may see some revisions as to the level of “peak inflation” and by association we should see the RBA reduce the level of rate hikes.

Interesting to observe the components of the result today, rents at 3.5% seem low.

Components of CPI

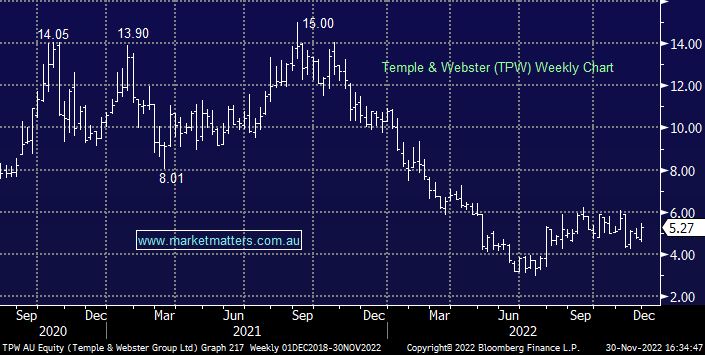

Temple & Webster (TPW) $5.27

TPW +14.07%: the furniture ecommerce business hosted its AGM today with the company saying there are signs cost pressure are starting to ease. While sales were down -14% for the FY to 27 November, revenue was up in the first 4 weeks of November. The company maintained guidance of double-digit revenue growth for the year and margins between 3-5%. The biggest positive takeaway though was signs of deflation in factory and container costs. Supply chain costs have been a major headwind in the space over the last 12 months with today’s announcement showing the heat is starting to come out - an outcome supported by the more benign CPI print at 11.30 this morning.

Sectors

Stocks

Broker Moves

- Collins Foods Cut to Neutral at Macquarie; PT A$8.20

- Woodside Energy Cut to Neutral at Jarden Securities; PT A$33

- Allkem Rated New Buy at Jarden Securities; PT A$17.71

- Liontown Resources Rated New Neutral at Jarden Securities

- Pilbara Minerals Rated New Sell at Jarden Securities; PT A$3.65

- Mineral Resources Rated New Overweight at Jarden Securities

- Leo Lithium Ltd Rated New Buy at Jarden Securities; PT A$1.19

- Core Lithium Rated New Sell at Jarden Securities

- DGL Group Rated New Add at Morgans Financial Limited; PT A$1.90

- Trajan Group Rated New Buy at Taylor Collison

- Whitehaven Raised to Buy at Bell Potter; PT A$11

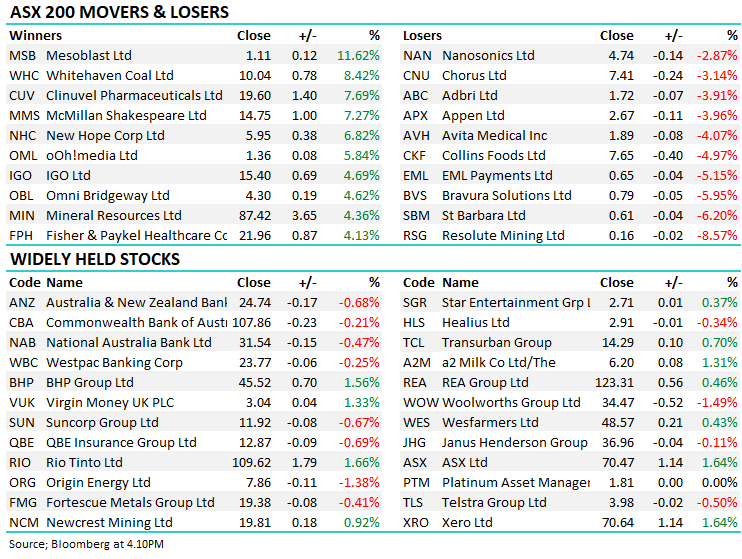

Major Movers Today

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

10 stocks mentioned