The Match Out: Stocks up but well off highs - no one wants to go home long it seems, Have a great weekend all, after a tough week!

Well….no one wanted to go home long this afternoon, with the market seeing the best of things very early on this morning following the big turnaround in the US market overnight. The ASX 200 hitting a morning high of 7045 / +55 points although a bunch of stocks traded ex-dividend so that also weighed on the cash market, SPI Futures ended around 100 points below the morning high, which is a better reflection of the afternoon weakness. Technology stocks were down around 6% yesterday, but bounced over 8% today with big moves all over the place – certainly not for the faint-hearted. While US futures fell during our time zone, it wasn’t by much + Asian markets were also generally higher.

- The S&P/ASX 200 added +7points / +0.10% to close at 6997.

- IT (+8.14%) & REITs (+1.56%) led the line while the Financials (-0.99%) and Consumer Staples (-0.84%) were the drags.

- For the week the ASX 200 has lost ~3%, it felt worse in parts with the retailers (-6.09%) and the Materials (-4.59%), however a lot of stocks in the materials space went ex-dividend.

- Russia / Ukraine dominates the news flow, but remember that markets don’t generally fall apart for long periods from events like this.

- Block (SQ2) +32% that is, the new Afterpay rallied today as they reported aftermarket in the US, numbers were very strong…BNPL maybe isn’t dead after all.

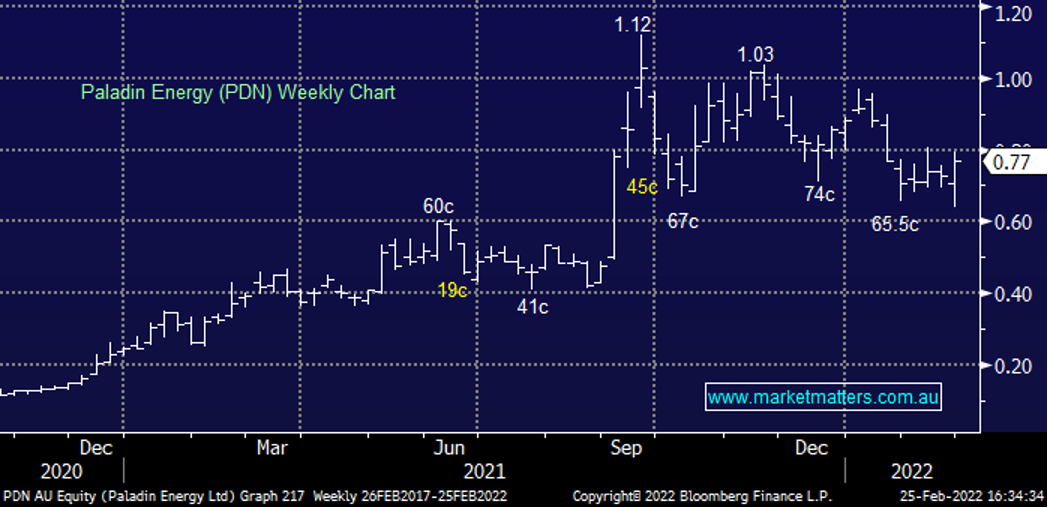

- Paladin (PDN) +12.41% released 1H22 results that were fine + Uranium stocks were up overnight – we like this space.

- Magellan (MFG) -10.11% fell after reporting fund outflows, total FUM now at around $77bn, they are down another $3.2bn since the last update in Feb.

- Life360 (360) +22% after falling -30% yesterday on a high cash burn rate – that’s some extreme volatility!

- Appen (APX) +8.67% also recovered after yesterday's 30% decline, a few downgrades flowed through this morning (outlined below)

- Shipbuilder Austal (ASB) -1.54% had a good half however FY22 guidance was a tad weak.

- Adbri (ABC) +7.64% reported solid full-year earnings and said favourable market conditions are expected to continue in the construction and resources sector.

- Iron Ore Futures -2.5% in Asia

- Gold was weak early before recovering late, settling at US$1916 at our close.

- Asian did okay, Japan up +1.85%, Hong Kong down, -0.20% & China up +1.50%.

- US Futures turned lower, S&P down -0.62%

ASX 200 chart

Sectors This Week (Source: Bloomberg)

Stocks This Week (Source: Bloomberg)

Paladin (PDN) 77c

PDN +12.41%: Reported 1H22 results this morning that confirmed they remain in a strong financial position with net cash of around US$38m (end Dec 2021 quarter). They retained their guidance FY22 cash expenditure (US$12m) and spoke to the pathway forward for production at their Langer Heinrich Uranium mine. We think PDN is the best way to play the building Uranium thematic being the premium and most liquid name in the sector. A contract price above US$50/lb over the coming period appears realistic, which will allow PDN to restart LH operations.

Paladin

Austal (ASB) $1.915

ASB -1.54%: Released their 1H22 Result that was all okay, earnings slightly better than expected despite a 14% drop in revenue but that was a result of some releases of risk contingencies so the 2H will be weaker. That said, the key for ASB is all about winning major US Navy shipbuilding contracts and they believe they are well positioned and that ‘there are a lot of opportunities out there for us to go and win’. Some patience is needed on this one.

Austal

Broker moves

- Appen Cut to Market-Weight at Wilsons; PT A$6.54

- WiseTech Raised to Buy at Blue Ocean; PT A$37

- Sims Cut to Neutral at Macquarie; PT A$19.20

- Capitol Health Raised to Overweight at Wilsons

- Ramsay Health Raised to Buy at Citi; PT A$75

- Blackmores Cut to Neutral at Credit Suisse; PT A$90

- Iluka Cut to Underperform at Credit Suisse; PT A$9

- Qube Raised to Outperform at RBC; PT A$3.30

- Ramsay Health Raised to Positive at Evans & Partners Pty Ltd

- Macmahon Raised to Buy at Argonaut Securities

- TPG Telecom Raised to Buy at Jefferies

- Appen Cut to Neutral at JPMorgan; PT A$7

- Reliance Worldwide Raised to Buy at Jefferies

- HomeCo Raised to Overweight at JPMorgan; PT A$7.40

- TPG Telecom Cut to Hold at Morgans Financial Limited; PT A$6.01

- IPD Group Rated New Buy at Bell Potter; PT A$1.80

- Panoramic Resources Raised to Add at Morgans Financial Limited

- AIC Mines Rated New Buy at Shaw and Partners

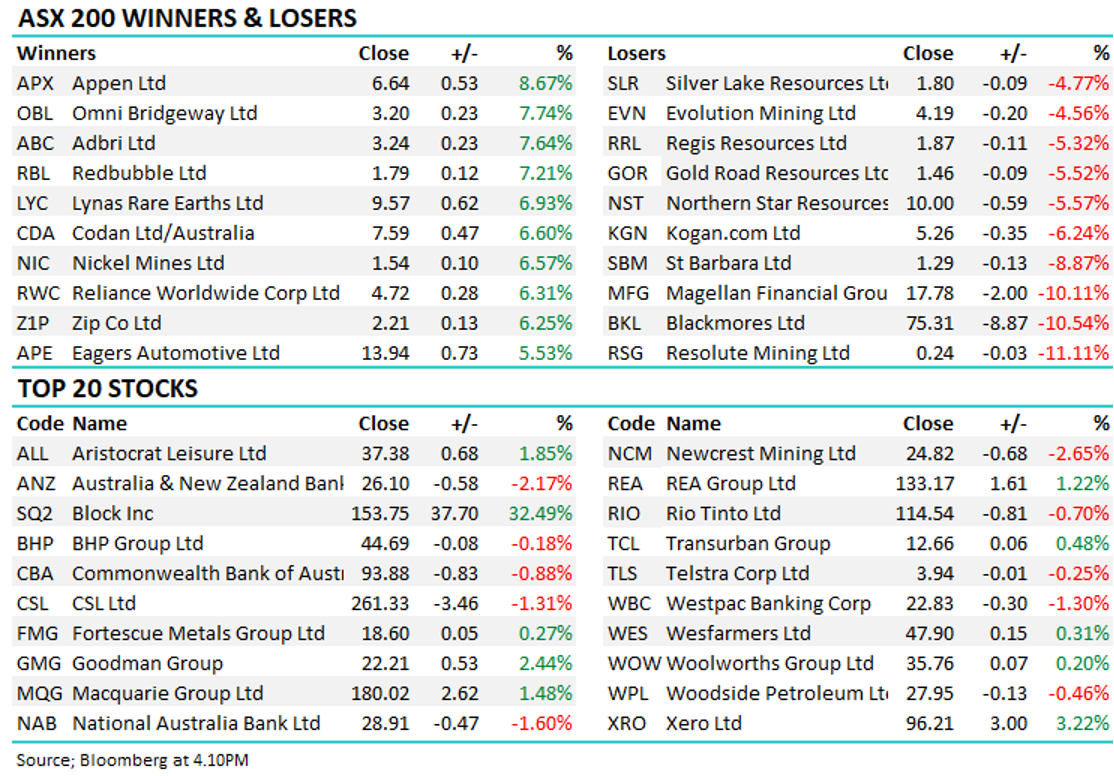

Major movers today

Enjoy your night,

The Market Matters team.

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

7 stocks mentioned