The Match Out: The ASX opens the week on the front foot, Retailers bounce back

A positive session for local stocks to kick off the week with a muted start before the market pushed higher into the afternoon session – a bounce back in the retailers after a period of weakness led the market today while Energy was again supportive.

- The S&P/ASX 200 added +23 points / +0.32% to close at 7417.

- Consumer Discretionary stocks (+2.19%) led the line, Energy (+1.39%) also strong while Materials (-0.96%) gave back some recent gains.

- Interesting to see the commodity stocks struggle today despite China unexpectedly cutting interest rates on some loans, plus we also had a raft of Chinese economic data out today headlined by GDP which printed above expectations.

- Morgan Stanley released an interesting/comprehensive note today on local manufacturing stocks, in essence concluding that making things locally will be supported by recent supply chains issues.

- They sighted Incitec Pivot (ASX:IPL) and Orica (ASX:ORI) as “chemicals winners”, among building materials stocks. Companies and products that compete against imports should benefit, along with names that compete against products with more challenging supply chain such as Adbri (ASX:ABC) and Boral (ASX:BLD) – while they downgraded CSR (ASX:CSR) which is a stock we own.

- In transport, they described Qantas as “the classic reopening trade” that should reflect virus disruptions and a return to normal while in domestic packaging they like Amcor (ASX:AMC) and Orora (ASX:ORA) which offer defensive qualities and attractive yield.

- They went on to upgrade a bunch of them (outlined below) while Adbri also benefitted from Alcoa extending a lime supply agreement.

- It was a relevant report given our comments in this morning’s Market Matters 2022 Outlook piece around a likely transition into more defensive style stocks with the paring back of outright growth bets as the year progresses.

- A few other things catching the eye today included JB Hi-Fi (ASX:JBH) +3.37% bouncing from the bottom of its range, a big divi due end of next month, Coal prices moving higher supporting Whitehaven Coal (ASX:WHC) +4.29%, Virgin Money (ASX:VUK) which is the stock that typifies the ‘value trade’ hitting a $3.80 high this AM having been sub $3.00 mid-December.

- We also saw a positive update from Mineral Sands hopeful Strandline (ASX:STA) +12.96% today which sits in the Emerging Companies Portfolio while the most recent addition to that portfolio, namely Whisper (ASX:WSP) +5.56%, rallied again as the market wakes up to the building momentum in their business.

- All in all, a positive day both in relative and absolute returns for the MM Portfolio’s.

- Iron Ore was down -2% in Asia which didn’t help the miners, Fortescue (ASX:FMG) -2.81%

- Gold was flat at US$1819 at our close.

- Asian markets were mixed, Japan +0.5%, Hong Kong -0.85% & China +0.82%.

- US Futures are pricing a weaker open down between -0.13% (Dow) and -0.40% (Nasdaq).

ASX 200 Chart

Broker moves

- CSR Cut to Equal-Weight at Morgan Stanley; PT A$6.60

- Boral Raised to Equal-Weight at Morgan Stanley; PT A$6.10

- Adbri Raised to Overweight at Morgan Stanley; PT A$3.30

- Allkem Raised to Outperform at Credit Suisse; PT A$13.20

- Pilbara Minerals Raised to Neutral at Credit Suisse; PT A$3.95

- Cleanaway Raised to Overweight at Morgan Stanley; PT A$3.30

- JB Hi-Fi Raised to Add at Morgans Financial Limited; PT A$54

- Santos Raised to Positive at Evans & Partners Pty Ltd; PT A$7.90

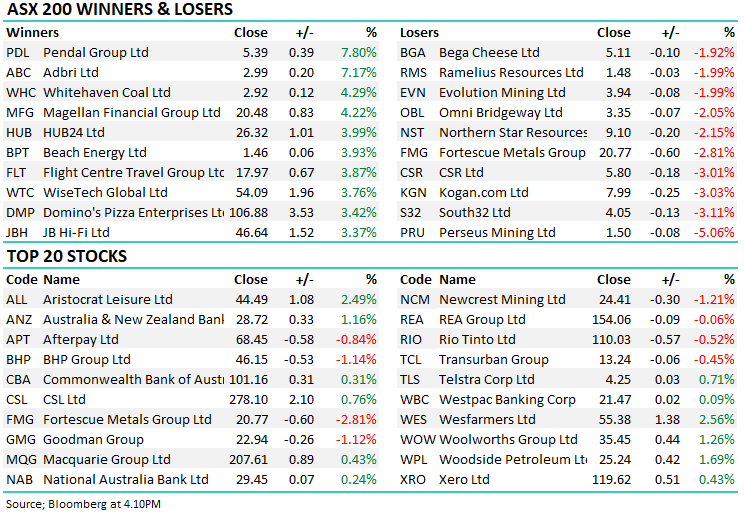

Major movers today

Enjoy your night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

James is Director & Lead Portfolio Manager at Market Partners - a collective of highly experienced investment professionals, operating independently, managing discretionary portfolios for wholesale investors.

James is also Portfolio Manager & primary author at Market Matters, a digital advice & investment platform with over 2500 members that offers real market intel & six portfolios open for investment.

2 topics

14 stocks mentioned

Comments

Comments

Sign In or Join Free to comment