The metal you can't live without

As investors, we all look for opportunities where there is a clear, coherent and compelling rationale for investing. Ideally, the opportunity should possess strong growth characteristics, and limited downside should our thesis not eventuate after a period of time. We look at one such thematic, and three microcap exposures to it.

Large, disruptive changes within industries or sectors are generally driven by the confluence of technologies, political incentives, private enterprise and human nature. Certain commodities can experience huge changes in price depending on industry supply and demand dynamics.

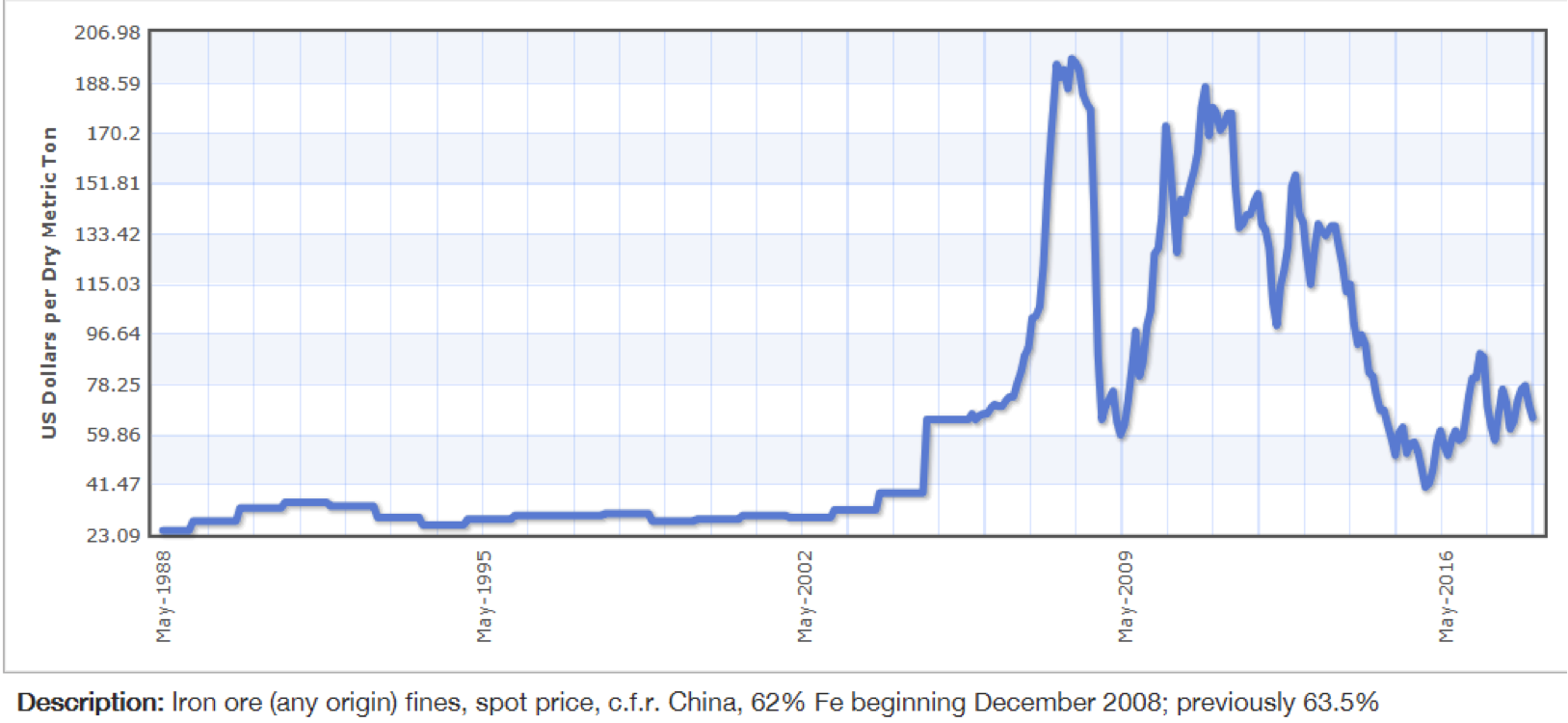

One historic example: Iron ore

A good case in point is the Iron Ore industry. This industry was typified by long-term supply contracts, no spot market, and relatively stable demand and supply dynamics. This was the case until Chinese steel production growth began to rise rapidly around 2003 from its previous incremental growth; driven by steel demand from increasing urbanisation.

Traditional sources of supply were non-existent due to long-term contracts, paving the way for the development of a rudimentary spot market and allowing new suppliers to fill the supply gap at a higher price than incumbents were receiving under their long-term contracts.

This shift in demand, changed the entire nature of the industry as can be summed up in the chart of the iron ore price below. Prices rose to multiples of its previously stable prices and fell as new production filled the supply gap.

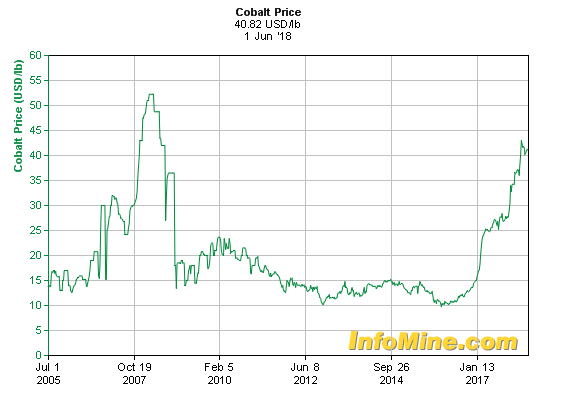

Six reasons for a higher cobalt price

A commodity which we believe is at an early stage of industry change is cobalt. Cobalt's main demand drivers are the growth of battery demand largely via the wide-scale adoption of electric vehicles which require substantial battery capacity. We consider the following six factors to be material to our hypothesis, namely:

- 65% of supply comes from the Democratic Republic of Congo ('DRC') notorious for corruption, political instability, human rights infringements and child labour. Recently, the DRC has increased its tax and royalty rates making it less attractive as a business environment to operate in due to its sovereign and supply risk.

- Industry supply is dominated by a single company, Glencore, which produces between 35-40% of annual cobalt production globally. This leaves the industry liable to supply shocks from externalities, such as the recent legal action via a freezing order brought about by a former partner of Glencore's in the DRC.

- Cobalt can only be mined as an ancillary byproduct of base metals, so supply is constrained and inelastic. As such, new supply cannot be 'turn on and off' and is largely determined by the quality of the core base metal deposit.

- Relatively small discovered reserves with total discovered reserves only equating to less than 19 years of supply. There is a large exploration and reserve gap which at this point shows no sign of being filled.

- It is a vital and non-substitutable commodity to increase energy density in battery technologies. At present, no commercially viable alternative exists within the battery technology space that can realistically supplant the use of cobalt in batteries. Assuming an alternative is developed or exists, there is typically a medium term lead time in achieving wide spread use of the alternative technology.

- Current demand is projected to grow between 12-15% per annum on the back of rising demand in electric vehicles, decentralised energy systems and portable devices. Currently electric vehicles only account for about 7-10% of demand; this is projected to rise exponentially over the next 10 years as seen below. Chinese demand in electric vehicles is being driven by substantial subsidies for consumers due to government concerns about pollution and a robust local electric vehicle manufacturing ecosystem catering specifically to the local user.

This long-term price chart for cobalt demonstrates the impact these effects have already started to have, with the price tripling over the last few years.

What investors should look for

A checklist for cobalt deposits should include:

- A shallow deposit (less than 300 metres below ground level)

- Low strip ratio (for an open pit mine) to ensure low cost. This is the amount of waste material or overburden needing to be moved to extract a given amount of ore. We consider a strip ratio of less than 3:1 to be high quality, ie. 3 tonnes of overburden removed for every 1 tonne of ore.

- Grade of ore: We consider a grade above 0.08% to be a higher-grade cobalt resource; generally the higher this figure is the better. This has to be looked at in conjunction with the grade of the main commodity being mined, generally copper or nickel.

- Mineralisation style - Generally sulphide ores are simpler and hence cheaper to process. Laterite ores typically require much higher capital expenditure (capex) per ore tonne, and so are economically robust only for large scale deposits.

- Proximity to infrastructure - If a deposit is located close to an existing mine or infrastructure this typically will reduce the amount of capex required to get the project off the ground. This is often a key hurdle for junior miners, as a great mineral resource can become 'stranded' if it is too far from existing infrastructure and required infrastructure improvements are too expensive to justify.

Preferred Exposure

Our preferred exposures to the cobalt sector listed on the ASX, based on our checklist and relative values are:

Aeon Metals - ASX:AML (Market cap: ~$220 million)

Aeon's Walford Creek project is the highest grade cobalt deposit located in Australia. Located in Western Queensland, the polymetallic sulphide deposit contains copper, zinc, lead and silver in addition to cobalt. The weighted average grade of cobalt within the project is circa 0.13%, and a large scale 30,000 metre drilling program is underway providing good potential for resource upgrades.

The polymetallic nature of the deposit will also provide some diversity in terms of mineral revenues. We would anticipate strong demand from end users to secure a source of cobalt from a relatively safe political environment and a mine not controlled by Glencore.

Ardea Resources - ASX:ARL (Market cap ~$95 million )

Ardea possesses the largest cobalt deposit in Australia. Located near Kalgoorie, WA the nickel laterite deposit is relatively low grade at 0.05% cobalt but large tonnage. We believe that there is significant scope to increase the size of the resource via exploration however, we believe it's likely to be deferred until the deposit is brought into production.

We note that Ardea has completed a pre-feasibility study and will produce both nickel and cobalt sulphates which may be attractive to a potential off-take partner; given both compounds are used in electric vehicle batteries.

Whilst long life, as with most laterite deposits we consider the main risk to be in the processing of the ore. Like many in the Australian market, we remember the BHP led Raventhorpe fiasco well, along with other failed nickel laterite projects.

Argonaut Resources - ASX:ARE (Market cap: ~$35 million )

Argonaut's Lumwana West copper-cobalt sulphide deposit is situated in the Central African Copperbelt, Zambia, in close proximity to the giant Lumwana copper mine owned by Barrick Gold. Lumwana was developed by Equinox Resources, previously listed on the ASX, before a $7.6 billion takeover by Barrick.

The area is highly prospective for lower grade, large tonnage copper deposits; with the Kansanshi and Sentinel mines operated by First Quantam nearby. We note that Lumwana West has been lightly explored historically and cobalt has not been specifically targeted in the past. The deposit is open from multiple sides and as such we consider there to be material exploration upside in the near term, with a drilling program to be conducted shortly.

We believe the market has ignored the value of the Lumwana West asset due to the emphasis on Argonaut's core Australian asset, the giant Torrens copper prospect which will be undergoing a substantial exploration program in the coming months. We consider Argonaut to be the most speculative company mentioned, albeit with the most upside overall.

Conclusion

In conclusion, the industry supply and demand dynamics make it highly likely that there will be further price rises in the commodity in the years ahead. It is likely there may be price volatility over time, but we feel the incremental cost and risk in bringing further supply online bodes well for the industry's fundamentals.

Although alternative battery technologies are progressing, we believe that wide-scale adoption and commercialisation of these technologies will not occur for at least 10 years providing some certainty around demand.

Investors should focus on the highest quality and lowest cost deposits in the best locations to provide lowest risk.

1 topic

3 stocks mentioned