The most important thing you need to understand right now

This is an edited extract of a report that went to clients earlier this week.

All I hear about is how tough a year 2022 has been.

I guess that all depends on how you were positioned at the start of the year.

Tech and growth have copped the brunt of the selling. The ASX All Technology Index is down around 36% from the November 2021 peak.

The Small Ords Index is down around 20% from the peak.

Meanwhile, the ASX 20 (top 20 stocks on the ASX) is down just 5% from its peak. Throw in dividends and the big stocks are more or less even for the year.

Energy has been the standout sector, though. From the lows of December 2021, the ASX 200 Energy Index is up around 45%. We’ve had solid exposure here and this has no doubt contributed to the portfolio’s outperformance.

That’s not a bad return given the supposedly brutal bear market we’re in.

The truth is, for Aussie investors, the bear market has been a mild one. From a headline index perspective (ASX 200) it doesn’t even pass the definition of correction (10% fall from the peak), let alone a bear market (20% decline).

So if someone is talking about how bad this market is, you can bet they were overweight tech/growth or small-cap stocks.

Everyone else should be doing OK.

But what’s been has been. The more important question is what’s ahead for 2023. And certainly, in the first few months of the year, I think it might be a tougher one for Aussie investors.

So, let’s talk about ‘the market’. That is, how is it positioned now, and where could it go over the coming months?

I’m not normally concerned about short-term moves. But over the Christmas break, you could see an increase in volatility. Given we all spend more time away from our screens at this time of year, I want you to be prepared for this possibility.

Mind the lags

Here’s the most important thing to understand right now…

Monetary policy operates with a lagged effect.

I know. That doesn’t sound all that earth-shattering, does it? But let me explain…

Following the expected 50-basis-point increase to come at the Fed’s December meeting, interest rate rises this year amount to 425 basis points. In Australia, you’re looking at 300 basis points.

That’s significant. It’s the fastest pace of tightening for the US and Australia in decades. The full effects of these rate rises won’t be felt until next year, possibly into the second half of 2023.

The deeply inverted yield curve in the US (where the two-year bond yield, at 4.22%, is way above the 10-year yield at 3.5%) is just one indicator of a looming recession.

There’s no recession signal for Australia yet, but the yield curve is flattening fast, suggesting an economic slowdown is underway here.

The reality is that monetary policy in the US is extremely tight. And the pace of the move from loose to tight has been extraordinary.

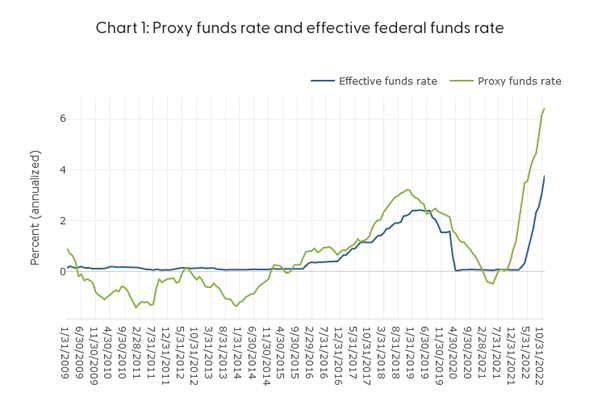

To illustrate, have a look at the chart below. It shows the ‘proxy funds rate’ as calculated by the San Francisco Federal Reserve. The proxy rate is in green, while the actual Fed funds rate is in blue.

The proxy rate attempts to incorporate the effects of quantitative easing or tightening on monetary policy, as well as the impact of ‘forward guidance’. This is where the Fed tells the market what it intends to do, with the intent of tightening or loosening financial conditions by doing so.

As you can see, the proxy rate is now nearly 6.5%, hitting a low of minus 0.5% in May 2021. In 18 months, the proxy-Fed Funds rate has soared 700 basis points!

At the start of this year, it was just 0.85%. So much of the tightening has occurred this year. And given the lags associated with monetary policy and the effect on the economy, you can expect that wall of tightening to hit in the first half of 2023.

But because the Fed is so fixated on inflation, which is a badly lagging economic indicator, it’s still tightening!

Expect a 25 basis points at the late January meeting. Along with ongoing quantitative tightening (QT) of nearly US$100 billion per month, it amounts to a massive withdrawal of liquidity.

The stock market, needless to say, is completely oblivious to this coming tsunami.

From the October low to the early December peak, the S&P 500 has rallied 16%.

Over roughly the same time frame, the ASX 200 jumped 14%.

VIX signals danger ahead

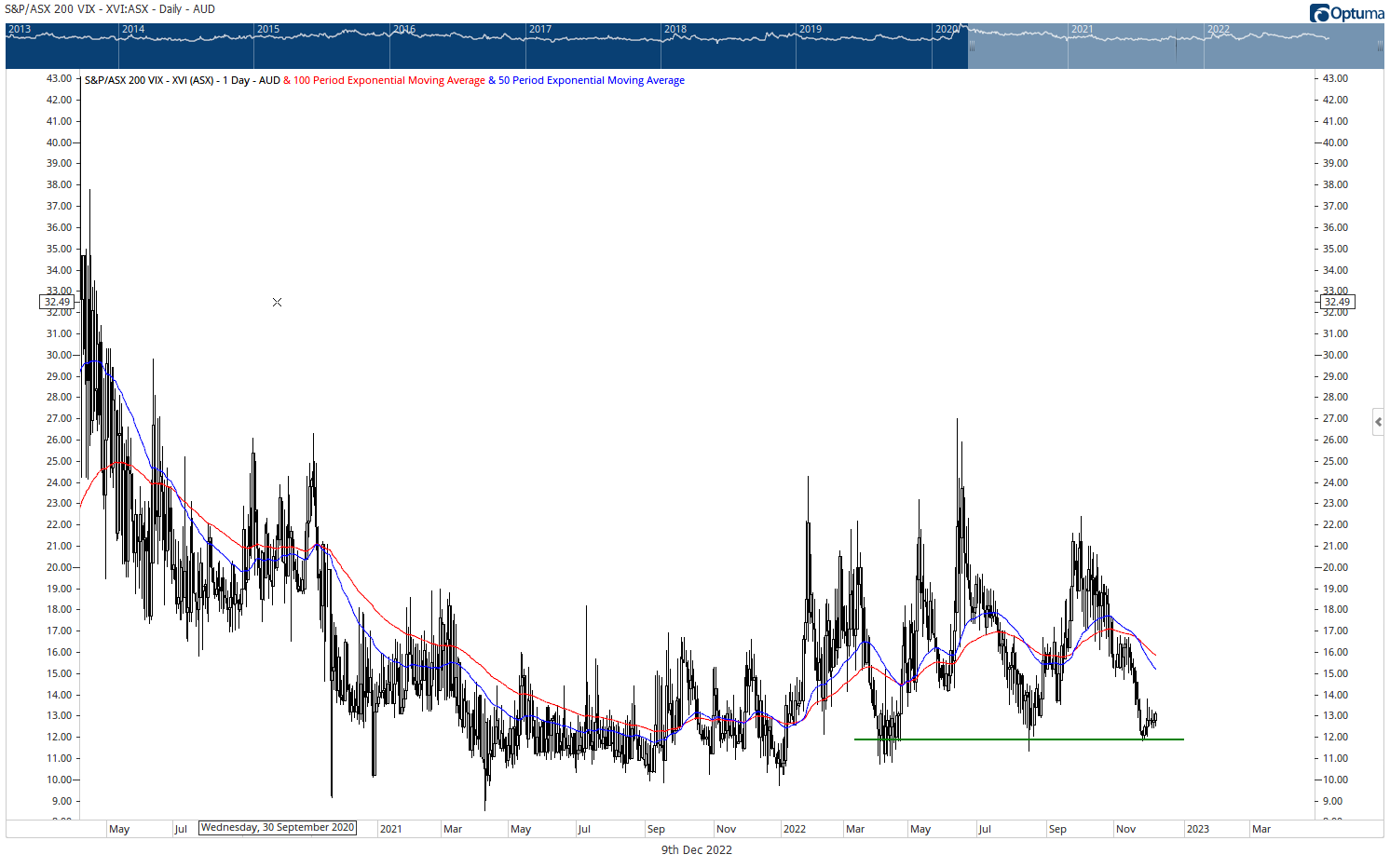

The Aussie VIX, or volatility index, which is basically a measure of the level of fear in the market, is at its lows for 2022. Clearly, investors aren’t too worried as they sit back and wait for the ‘Santa Claus rally’:

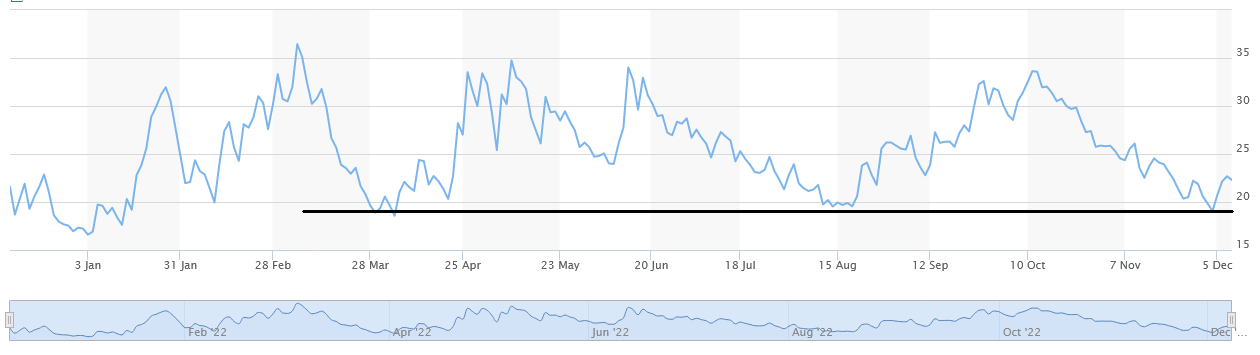

It’s the same in the US. The VIX is near the lows for 2022:

Don’t tell anyone, but each time the VIX reached these low levels (in March and August) the S&P 500 went on to fall around 20% in the following months.

The ASX 200 was more resilient, falling around 15% (from its early April high) and around 10% (from the August high).

Are we at the start of another such decline?

There are no absolutes in the market. Only probabilities. In my view, the probability of a decent correction unfolding in the months ahead is high and rising.

Of course, it really all depends on the Fed. And I’m writing this before the inflation number and the results of the Fed’s December meeting come out. But Fed boss Jerome Powell has indicated his willingness for rates to remain higher for longer and I don’t think that will change anytime soon.

I’m not sure which sectors will be hardest hit if volatility does pick up.

In Australia, it could be the turn of the banks and the big resources companies to pull back sharply. After all, they’re close to their highs for the year. They could be ripe for some profit-taking.

It’s likely to be a broad sell off, though.

The good news is that I think the next sell-off will bring us close to the end of the bear market. But that’s a story for next year.

For now, give up on the Santa Claus Rally and batten down the hatches…

2 topics