The most valuable strategic asset in Australia

Lithium and rare earth miners have had nothing short of an electric run over the past 12 months, with the appetite for battery material producers switching into gear in the midst of the COVID-19 crisis.

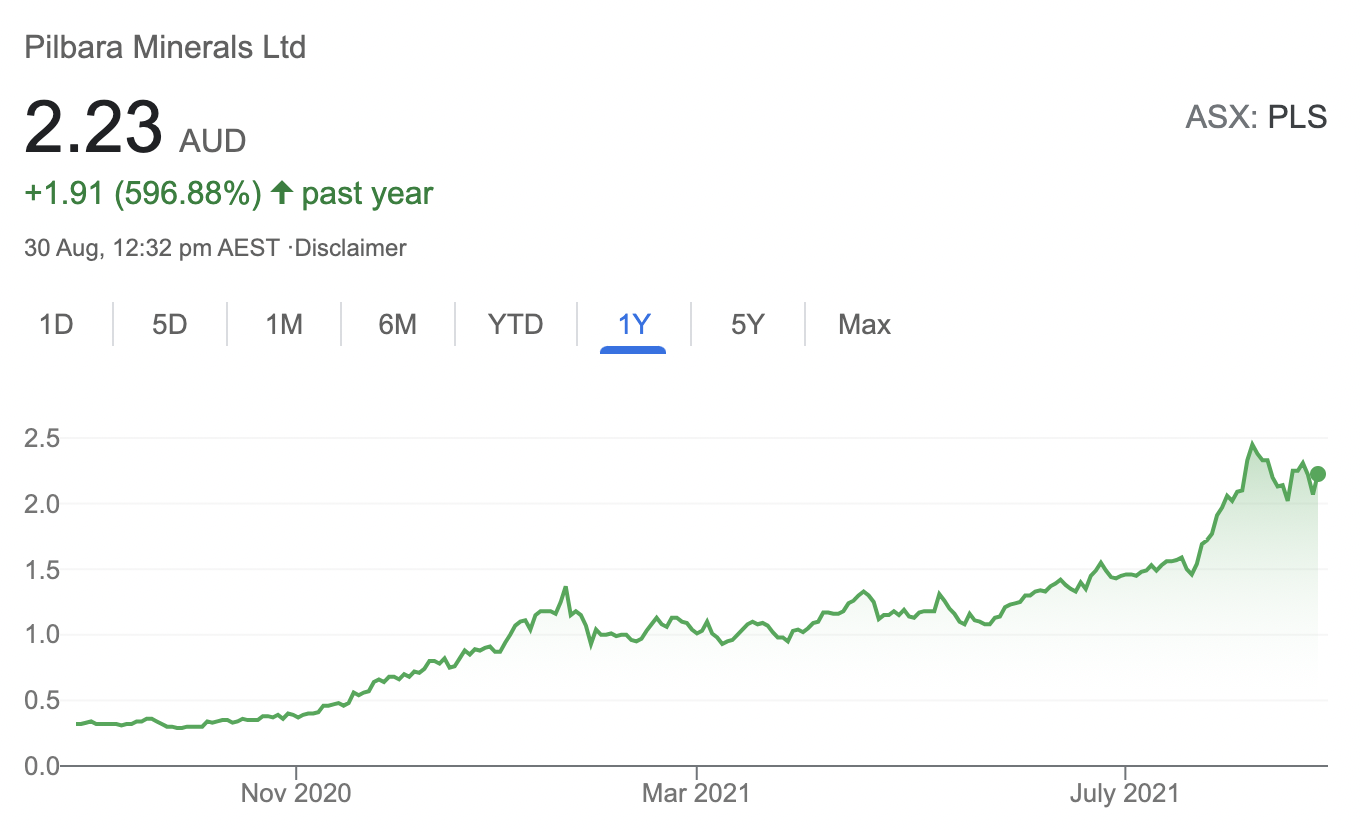

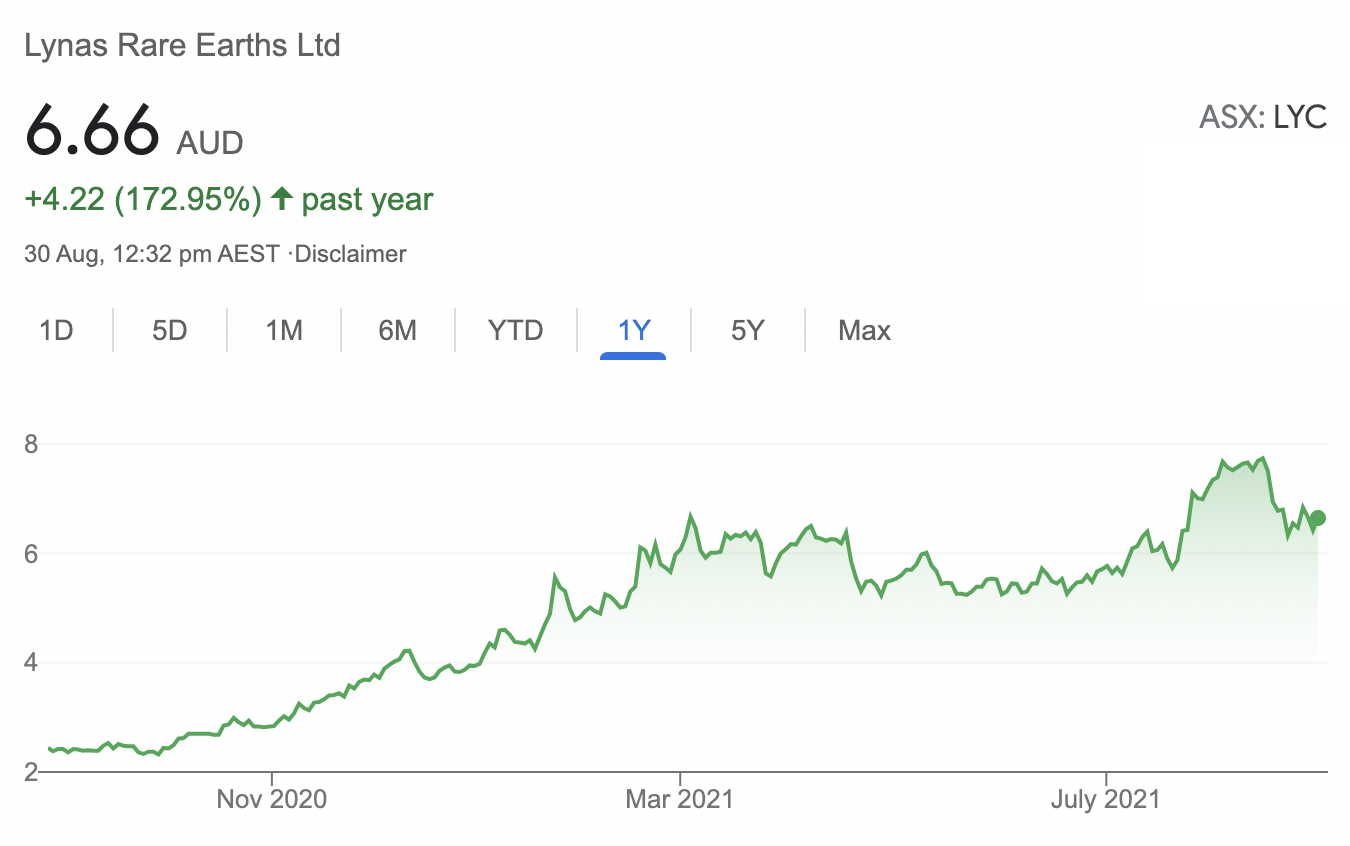

Investors in Pilbara Minerals (ASX: PLS) and Lynas Rare Earths (ASX: LYC) would be feeling particularly chuffed, with share prices charging ahead a whopping 597% and 173% respectively over the past year alone.

2021, in particular, has been especially kind to battery material producers. In March, US President Joe Biden called for $174 billion to be spent on electric vehicles (EV), including incentives for consumers and a promise to build 500,000 EV charging stations across the US.

Earlier this month, the Biden administration announced that up to half (40-50%) of new vehicles sales would be electric by 2030. Meantime, the announcement of a $1 trillion bipartisan infrastructure bill (including a lower than expected $7.5 billion in spending to build EV charging stations across the country) saw PLS and LYC's share prices storm higher.

And while the demand for lithium is expected to increase tenfold by 2030 (furthered by China's similar commitment to EV car sales by 2030), investors fear the market could face supply issues far sooner.

For an inside look at the future of these two companies and the issues that may face the lithium and rare earths market, we invited Eiger Capital's Victor Gomes to share his thoughts on their recent results. Plus, he shares why one of these companies is Australia's most valuable strategic asset.

Note: Eiger Capital invests in both LYC and PLS; they are both top-ten holdings. This interview took place on Monday 30th August 2021.

What were the key takeaways from Lynas Rare Earths' result?

VICTOR GOMES: Mining companies put out quarterly production reports, so a lot of the key data was already released at the end of July. There wasn't a lot that was new. Probably one of the highlights with Lynas is the consistency of their operations. Amanda Lacaze runs a very tight ship, she's a great CEO - one of the top CEOs in my area of coverage.

Rare earths, in particular, NdPr, which is their key product, makes magnets. These magnets are important for electric vehicles and motors that use permanent magnets. You can either use permanent magnets or electromagnets, but permanent magnets are more efficient - they're lighter, smaller and more powerful, which helps gives EVs greater range. So they are key to electric vehicles and renewables. The average 1Mw wind turbine uses 200kg of NdPr for its generator.

Malaysia has been really impacted by COVID-19, more so than Australia. So their operations have only been at 75% capacity and they haven't been able to exploit the strong pricing environment at the moment.

Despite that, EBITDA grew very strongly, cashflow was strong and you got a taste for what the business can do if they get the dynamic of good prices and they are able to double production volumes - as is their plan to do over the next five years.

What were the key takeaways from Pilbara Minerals' result?

Pilbara again pre-announced a lot of the details from the quarterly. The key lesson is that they've done the hard work.

They capitalised on the opportunity when their neighbour went broke; Altura. They bought it at basically well below replacement cost. You couldn't build that mine for what they paid for it.

When you have two mines right next to each other, you can never go right up to the boundary line because there's a fence; you have to taper your pit walls, and there's a whole lot of land in the middle that you can never access. Now they can keep going past the wall. So they were the only guys who could really capitalise on that.

They now have two mines and they can really prove out a much bigger reserve. And really, over the next two years, it's that rising production profile that we're looking forward to. Firstly, turning the Altura plant back on, but also measured CAPEX. And that's the thing that I really like about Pilbara. They have been very cautious and conservative with their capital.

LYC and PLS were both sold off on the day they reported. Why do you think this was?

It's hard to judge whether that share price response was just due to coincidence; that the day they reported was an off day for commodity prices and resource stocks. And I think it was. The market tends to buy the rumour and sell the facts. That's the other thing. It's always hard to invest on a day to day, week to week basis. But if you take the long view and that's the way we invest, it actually does become easier to pick where you think the business will be in five years time.

Lynas is going to be a much more valuable business over that timeframe because it's such a unique asset. It's the only material producer of rare earths outside of China. It's at the bottom end of the cost curve globally. It's the second biggest globally; there's only one Chinese producer that's bigger and they're a state-owned enterprise. It's got a very long life, low-cost mine in Mount Weld, and they haven't even really drilled that out significantly.

So the resource base could be much bigger than they're saying at the moment. It's going to support their expansion into the US. And this is a strategic material globally for everyone outside of China.

This is probably the most valuable strategic asset in Australia.

Pilbara's share price really fluctuates a lot. It was up almost 7% today and it was down 11% the other day. The sell-side has chased their tail on this company. It's gone from 20 cents to $2.20 over a year and a bit. And all the way through at 20 cents, most people were negative on it. And they continued to keep chasing their tails. I think they've been surprised by how quickly demand has recovered in combination with management doing a really good job.

In both cases, Pilbara and Lynas are well-positioned to exploit rising demand and will be able to increase their supply to the market.

Were there any major surprises in these results that you think investors should be aware of?

Probably the only surprise with Lynas was how their operations are still being impacted by COVID-19. I thought Amanda would say that they would be back operating at 100% over the next three to six months, and she's still saying that most of this year Lynas will be running at 75%.

On the positive, a surprise was that the government has given them an extension on their licence to relocate to Australia. Lynas is moving the initial part of their process, which is called cracking and leaching, from Malaysia to Kalgoorlie in Western Australia. They are on track to do that by 2023.

Another positive surprise is that they're probably doing better having set up their operations in the US. The US government is very keen to encourage a non-Chinese source of supply for these critical elements that go into not only renewables and EVs but also a lot of the defence sector. And as you can see at the moment, geopolitical issues are a big focus, not only for Americans but also for Europeans. And Lynas is key. That's why I believe it is one of the most strategically valuable assets listed on the ASX.

On Pilbara, I expect costs will stay elevated for a bit longer. A lot of companies have talked about wage pressures in WA, and Pilbara is not immune to that. Having said that, most of its cost pressures are from shipping; freight costs have gone through the roof - you can see it in the WiseTech (ASX: WTC) result.

But having said that the spodumene price has gone up a long way. It's gone from $400 to $900. And they're setting up what they call a battery materials exchange, or BMX, a very interesting acronym. And as they grow out Altura, and their total production to a million tonnes (including a growing amount of uncontracted production) over the next four to five years, they're going to try to sell that not on contract, but on spot. Just as you get a very liquid iron ore price, they're looking to do the same thing with battery materials. So that will give them a lot of leverage in a tight supply environment to really extract the best prices out of their growing production profile over the next few years.

Would you buy, hold or sell LYC and PLS?

It depends on the investor's time horizon. If it's a short-term horizon, it's going to be volatile. But if you can have a five-year view, I still think these businesses will continue to do well over the next five years. We are holding our positions, but if we didn't have a position we would be buying, because I think this is a sector that you want exposure to; it's one of those megatrends that will continue to have a tailwind. Both Lynas and Pilbara are in our top ten holdings.

Will they grow ten times? No, I don't think so. But I think they will give you a better than market return; all the preconditions are there. The market environment is there, they are well-positioned within their sectors, they've de-risked, their CAPEX risk is very low, they are operationally running really well.

So I think you can do much better than the market in these businesses over the next five years.

The sell-side always tends to overestimate or underestimate the tops and the bottoms. And they move in small steps, but the market doesn't do that. If supply is much tighter than demand, it tends to move a lot quicker. And that's what we've seen. So there has been really tight conditions for battery materials, in particular, lithium units out of hard rock.

Lithium units either come from salt pans or salt lakes, like Orocobre (ASX: ORE), and comes out of Chile and Argentina. That's essentially brining salt, evaporating it and scraping what's left after the sun has dried it, and there is a lot of lithium in there but you have to process it. It's a cheaper way to make low-grade lithium for carbonate and for LFP batteries, which are lower density batteries. It's a more expensive way to make lithium for high-density batteries, like the one you find in Tesla; for long-range, high nickel content batteries - you need very pure lithium. And the cheapest source of that is hard rock.

There are really only a couple of companies globally who supply hard rock lithium at the moment. We think Pilbara controls 60% of the world market.

Mineral Resources (ASX: MIN) and Galaxy Resources (ASX: GXY) have mines, but they do not have a lot of free spodumene there and they are small relative to Pilbara's capacity over the next five years. I know Rio Tinto (ASX: RIO) wants to build a mine in Serbia, and there are a lot of hopefuls out there, but the experience we have learnt from Pilbara over the last four years is that it is going to take longer, it costs more, and it is harder to build. There is all this fear that there is going to be oversupply, but I think people are underestimating how hard it's going to be.

Pilbara's already built, it's at the low end of the cost curve, and it can expand from 500,000 tonnes now to a million tonnes with the Altura plant they bought at very measured capital. So it's a brownfield expansion; it's low risk.

Pilbara is one of the best plays globally that can expand to double production at measured CAPEX over the next couple of years with this increasing demand. You haven't seen it in the results yet because the price really has only spiked in the last three months. But I think this year you'll see a much stronger cash flow result.

As for Lynas, there are not many competitors, to be honest. Mount Weld is such a unique asset, it's the highest grade rare earths mine in the world. I once heard a statistic that the second highest-grade deposit of rare earths was their tailings; the stuff that they had rejected, that was on the side. So this is a fairly unique asset. And it's built and it's operating. They went and spent $800 million perfecting their process in Malaysia over eight years - you just can't replicate that easily.

What's your outlook for LYC, PLS and the battery material sector?

Demand is so strong with the take up of EVs that I think there will still be a deficit in the market even if these competitors can establish new mines. So that's why the outlook for both Lynas and Pilbara looks very promising over the next few years.

Lynas and Pilbara are global tier-one suppliers in both their respective commodities, very well positioned, and at the low end of the cost curve. They are well managed, they have well-capitalised balance sheets, and have the ability to grow production at measured CAPEX. So these are fairly unique businesses.

We are looking to get a compound return of 10-15% over the next five years, that would be a great outcome. Whether these businesses have the potential to do that is hard to say. But if the demand environment stays where it is, I think they could.

Should investors use any short-term volatility in LYC and PLS's share price as a buying opportunity?

It depends on the reason for the weakness. If it's simply an off day in commodities globally, then yes. If it's because something's happened in the sector, whether it's a response from the Chinese government saying they're going to expand production of rare earths significantly to drop the price - then you've got to engage with what that means for Lynas, because that will hurt the commodity price and the share price.

They don't have a lot of lithium in China, so they can't do the same thing on that, but they can clamp down on subsidies for EVs. Although, I don't think they want to do that because they want to be a global leader in EVs.

But if it's just the market going through its vacillations, its daily cyclical moves, then yes, if you buy on down days you would probably do okay if you're taking that longer-term five-year view on the sector

Is the supply of battery materials falling behind demand? Is this something investors should be worried about?

The resources sector is characterised by a massive mistiming of investments. They invest at the top and when the mine is ready to come on and produce, the cycle has turned and commodity prices are at their lows and they lose lots of money - and then there is a CAPEX strike for 10 years because everyone got burnt!

I have no doubt that there is a lot of new investment going into this space. No one picked European demand for EVs taking off so quickly since COVID-19 hit. And it does feel like if you don't have a net-zero target by 2050, then you are out on a limb now. The US is aiming for a certain percentage of cars to be zero-emission. It's almost unstoppable. And it just means that demand will be very strong.

We've talked about new suppliers coming on, but we think it will be like iron ore. There was a lot of production, usually at higher costs and lower grade. And those businesses become unprofitable; they are too high cost.

If you are buying Pilbara and Lynas, you are buying the BHP and Rio iron ore equivalents in the battery materials space. They are at the bottom of the cost curve, they have the biggest resource, the lowest costs - these are companies that will survive the cycle.

So, I think Lynas and Pilbara can meet demand. And if they can't, it's a bigger bull case for both companies.

Want more content like this?

Give this wire a like if you've enjoyed the discussion and hit follow to be notified when new episodes are released.

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

4 topics

8 stocks mentioned

1 contributor mentioned