The one thing investors can't ignore in 2023, according to these 6 fund managers

2023 is going to have a lot of moving parts. What does inflation do? What will be the posture of central bankers? What happens to earnings, and will stock prices follow them?

These variables are out of the control of investors, to be sure. But interpreting them, and positioning accordingly, is not. Getting ahead of the market is the name of the game in investing. But it's noisy out there, so what should investors focus on?

For that, we marshalled six of the best fundies, representing a range of funds - from small caps to large caps, income to private credit. We asked them to discuss the one thing investors can't ignore in 2023.

Testament to the complexity investors will face, each of them responded with something different! There's even some hot stocks that help play (guard against) some of these trends.

Antipodes Partners: Jacob Mitchell

This year, you simply won’t be able to ignore valuations.

We are in a period in which starting valuations are more important than ever – and this follows a prolonged period in which many investors simply ignored valuations. Continuing to do so could be very damaging for your capital in 2023.

As we head into the new year, we have the US Federal Reserve trying to stick the perfect landing, Europe teetering on the brink of recession and China managing its exit out of COVID-zero. It’s a period in which volatility around global economic activity remains high, and this will weigh on valuations.

But it’s not all doom and gloom. After 2022 saw global equities record the worst performance in a calendar year since the 2008 financial crisis, there are now great opportunities for investors to allocate capital at attractive valuations.

So, where to find attractive valuations?

We think there’s a lot still not being priced into the US equity market, and while the economic outlook looks incrementally worse for the US, it looks better for Europe and China, where very attractively valued companies can be found.

In the US, Money supply growth has meaningfully slowed partly due to a cessation of post COVID stimulus, QT and higher rates. Our analysis suggests conditions in the US are tight enough – the Fed has largely accomplished its goal, however, while inflation remains elevated and the labour market tight the Fed is concerned about pausing prematurely. The risk of the Fed over-tightening, and dragging the US economy into a deeper recession, is rising. This is not priced into equity markets.

On top of this, there’s a disconnect between sentiment and earnings forecasts. US earnings estimates have fallen just 4% from the recent peak. However, using prior recessions as a guide, earnings estimates could fall another 10-15%. If this were to happen, and prices remain constant, the starting valuation of US equities would rise from today’s 18x to 21x forward earnings – which is a 30% premium to the historical average in the US.

Meanwhile, the worst of Europe’s energy crisis has passed, China is re-opening and stimulus has accelerated. Additionally, forecasts are further into the downgrade cycle; 13% in Europe versus 18% in prior cycles, and 12% in China which is already in-line. This takes valuations to 13x and 15x forward earnings in Europe and China - in-line with Europe’s historical average and a 10% discount in China.

With valuations at the forefront of investing decisions, being overweight Europe and China, and selective and discipled around valuations in the US, will be the way to navigate global equity markets in 2023.

Spheria Asset Management: Marcus Burns

It is arguably one of the most complex market environments investors have had to navigate for decades, so it’s imperative you get the fundamentals right. Thus, if we had to call out one thing investors shouldn’t ignore in 2023, it’s cash flow.

A handy metric to watch when it comes to cash flow, and one that’s central to the way Spheria assesses small and microcap stocks, is a company’s cash flow conversion rate.

To uncover the rate of cash flow conversion, put simply, our team takes the reported EBIT of a company, compares it to the free cash flow found in the company’s cash flow statement and adjusts for CAPEX and interest.

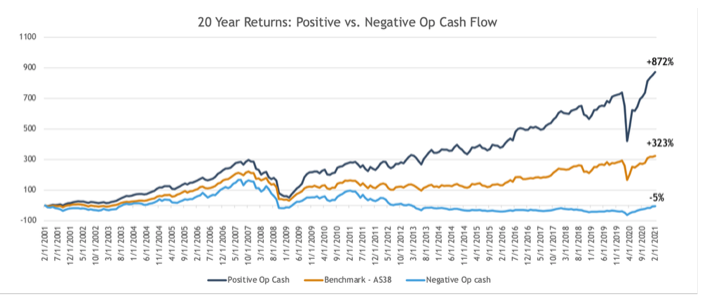

Just how important is free cash flow? The chart below speaks for itself. The dark blue line (+872%) represents a bundle of all ASX small caps stock with positive operating cash flow. The orange line (+323%) represents the index and the light blue line, a portfolio of stocks with negative operating cash flow (-5%).

So as we move into 2023, look at your own portfolio, or the companies your fund manager has selected on your behalf, and ask yourself ‘do these companies generate strong cash flow after capital expenditures and other balance sheet engineering?’

If they don’t, things can quickly turn ugly – as we’ve seen with portfolios full of unprofitable tech over the past 12 months as the cost of capital has risen, and risk has been re-priced. If they do, then we think your capital will generate strong and sustainable returns into 2023 and well beyond.

Resolution Capital: Andrew Parsons

Liquidity remains a critical issue for real estate investors as we move into 2023. Recently we have seen early signs of cracks emerging in private markets with news Blackstone, a major private equity funds manager, restricted investor redemptions from the flagship Blackstone Real Estate Income Trust, known as BREIT (BREIT is the largest open-ended non-traded/unlisted property fund in the U.S).

Soon after the BREIT redemption restriction news, Starwood Real Estate Income Trust, the second largest unlisted US real estate fund, announced that it too would limit redemptions.

Over the past 30 years of investing in real estate we have seen many periods when real estate liquidity has seized up and investors in direct and unlisted real estate funds have suffered.

Fortunately, listed REITs provide liquidity when unlisted property funds can’t. Resolution Capital has never frozen or suspended redemption for its funds, which hold global listed real estate securities.

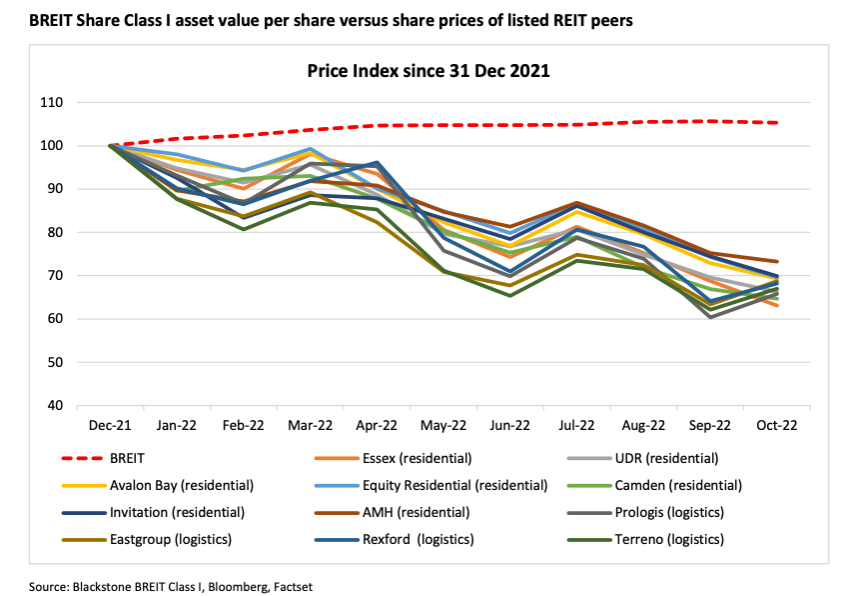

Whilst we aren’t privy to the finer details of the unlisted property fund valuations, based on easily observable market data it’s clear many high-quality listed REITs with strong balance sheets are trading at 15-30% discounts to unlisted property funds investing in similar property types.

The chart below illustrates the dichotomy between the unit price of BREIT and the share price of listed REIT peers over the past 12 months.

The unit price of BREIT, like many other unlisted real estate funds, has changed little over the past 12 months. In our view, it is likely that today’s values of the underlying real estate assets in unlisted funds have in fact been negatively impacted by the substantial rise in the cost of capital and sudden change in the investment climate this year

Making matters more challenging, some unlisted property funds have elevated levels of financial leverage. Indeed, BREIT’s Loan To Value (LTV) equated to at least 46% at 30 September 2025. We estimate the LTV for comparable US listed REITs is less than 30%.

This listed versus unlisted arbitrage opportunity, currently in favour of listed, presents a key challenge for BREIT and its peers.

Why invest in a vehicle facing significant challenges on outdated valuations when one can buy underlying comparable quality real estate, with stronger balance sheets, lower management expenses, and daily liquidity and trading at a material discount?

Metrics Credit Partners: Andrew Lockhart

Investors shouldn’t ignore the risk of stagflation, where slowing economic growth combines with inflation.

Listed equities tend to suffer in this environment, as rising costs and declining revenues squeeze corporate profits.

Inflation threatens investors because it chips away at the purchasing power of savings and investment returns. It can be particularly damaging to fixed income investments such as bonds.

Private debt is one of the few asset classes that can help investors preserve their capital and maintain a reliable income when faced with the dual challenges of inflation and economic stagnation.

Corporate loans earn their returns from fees charged to borrowers and interest that is generally charged at a floating rate. So as official interest rates rise to combat inflation, your income should also rise.

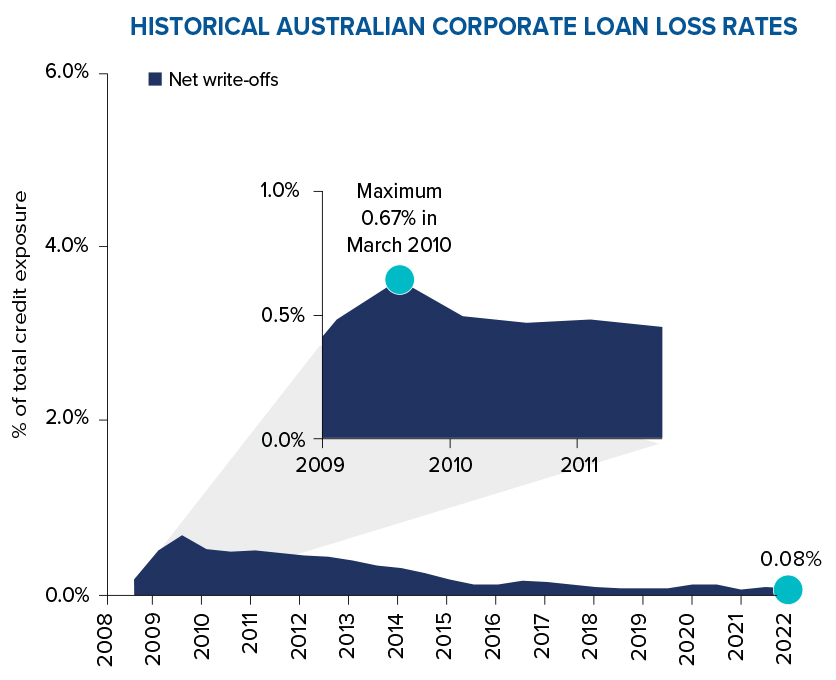

Private debt can provide capital stability through the economic cycle. Corporate debt is a lower risk investment than equity because Australian corporate insolvency laws give priority to the interests of creditors in claims over the assets of a business.

Private lenders negotiate directly with borrowers to obtain covenants and reporting obligations that provide protection and early warning of changing risks. Security held over the borrower ensures the rights and protection of capital ranks in priority to any unsecured creditors.

As a result, the corporate loan loss rates for Australian companies have been very low for many years.

The world last experienced stagflation in the 1970s. The good news for investors today is they can gain exposure to private debt (previously only available to institutional investors) via listed funds – providing capital stability and attractive returns in the most challenging scenarios.

Firetrail Investments: Patrick Hodgens

.jpg)

The one thing investors can’t ignore in 2023 is earnings!

A key investment principal at Firetrail is that ‘share prices follow earnings.’

It doesn’t matter how cheap a company looks. If it misses earnings expectations, nine times out of ten the company’s share price will fall.

And in 2023, earnings expectations are elevated!

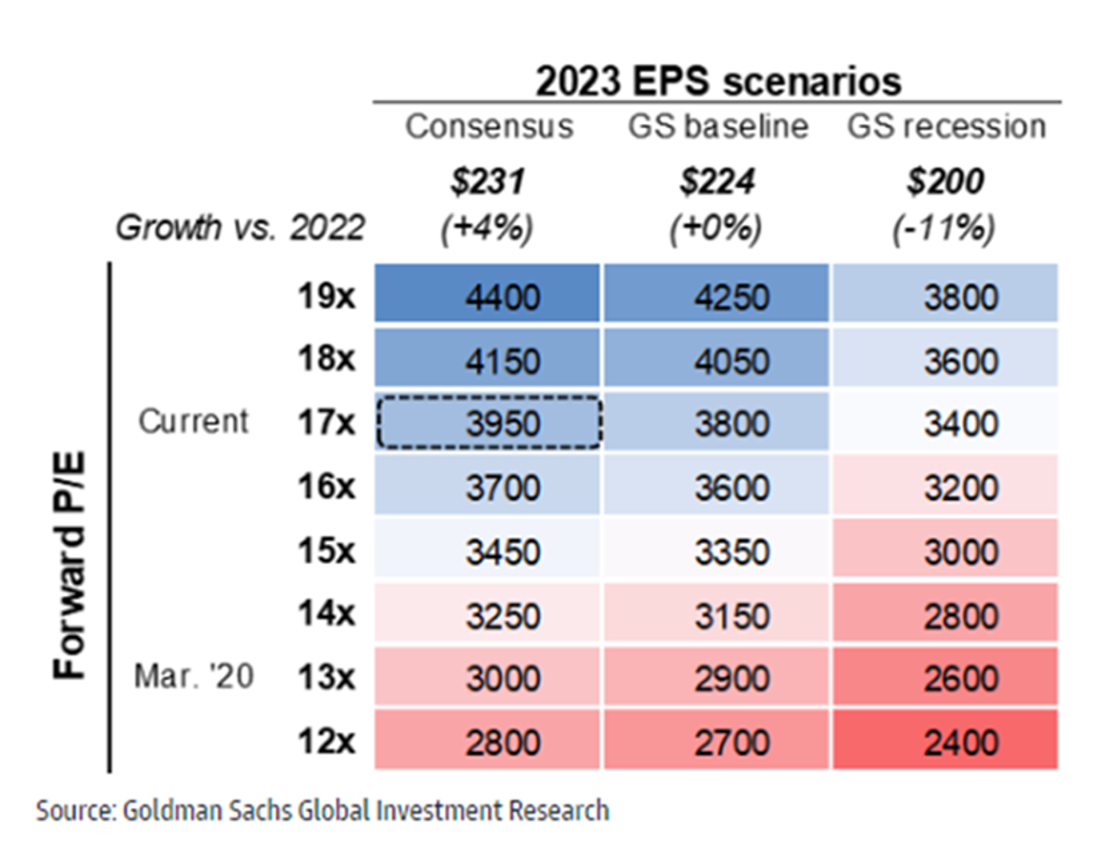

In the US, the current market consensus estimate for the S&P500 is that earnings will GROW by 4% in 2023… Despite inflation, recession risks, and corporate earnings margins sitting multi-decade highs. To put this +4% earnings growth into context, the average earnings growth for the S&P500 during a recession in the past 70 years has been negative -13%!

Should the US go into a recession in 2023, it would not be unreasonable to expect flat to declining earnings growth next year. The chart below from Goldman Sachs provides some scenario analysis into different price levels for the S&P500 under three different earnings (EPS) growth scenarios. At the current market valuation of 17x P/E, it highlights the downside risk to the US equity market should earnings growth in 2023 come in below market expectations.

Given the elevated earnings risks, Firetrail has increased our focus on identifying companies with resilient earnings in 2023.

Two examples in the Australian market (with exposure to the US) are ResMed (ASX: RMD) and CSL Limited (ASX: CSL).

Both companies have resilient end markets underpinned by structural growth in demand for healthcare products. Most importantly, we believe the market is underestimating the earnings potential for both CSL and ResMed. Based on our research, we see earnings upside potential in:

We expect ResMed to take meaningful market share in the US sleep apnoea market given its key competitor Phillips has had multiple device recalls. Allowing ResMed to increase its leading position in the US and benefit from higher earnings margins as it sells new products to its customers.

CSL is set to benefit from multiple tailwinds in its plasma business as a result of increasing collection volumes and lower cost of collections. CSL also continue to innovate with the release of a new products that we expect to be earnings accretive.

We believe both ResMed and CSL are high-quality businesses, trading on attractive valuations, with upside potential from earnings based on our fundamental research.

2023 will be a year where earnings matter! And ResMed and CSL are well positioned to deliver resilient earnings in potentially tougher economic conditions.

Plato Investment Management: Dr Don Hamson

In 2023, we’re confident equities in Australia and globally will once again be a great asset class for income-seeking investors. But amid the opportunities for strong and sustainable dividends (and franking in the Australian market), investors can’t ignore the risks.

At Plato we often say that when it comes to generating income, avoiding dividend traps (stocks with a high historic yield which subsequently cut their future dividends) is just as important as uncovering great dividend investing opportunities and our team spends a lot of time on assessing what future dividends might look like, rather than looking back on historical yields.

This is certainly something that cannot be ignored in the current market environment, where the fortunes of companies have been changing quickly. Think of COVID just two years ago when oil prices went negative, but now energy prices have soared. On the other hand, retail sales (particularly online) saw a major COVID boost, but for many businesses it wasn’t sustainable. Investors, or their asset managers, should be thinking about where the shifts might be in 2023, as the impact of rising interest rates start to bite.

There are three main factors you can use to predict dividend traps.

First, you want to wary of stocks with sky-high historical yields, particularly over 10%. This suggests the market isn’t pricing sustainable dividends into the share price. Secondly, and somewhat related to the first point is the company’s share price. If it’s falling, it causes the historical yield figure to rise and when a stock price is falling that’s generally telling you the market isn’t positive on future earnings, and thus future dividends.

We also look out for stocks with very high payout ratios – this is the dividends paid relative to income. If a payout ratio is nearing 100% or more, it’s often not sustainable.

At Plato we think a key to successful income investing is avoiding the big dividend traps.

6 stocks mentioned

9 funds mentioned

6 contributors mentioned