The smarter way to invest in Australian small caps

This piece was authored by Luke Sheather, Assistant Portfolio Manager at Betashares.

Australia’s sharemarket offers far more than just banks and miners. Beneath the surface sits an engine of smaller companies: firms with a market capitalisation of under $5 billion that together make up around 15% of the All Ordinaries Index.

These are the businesses still proving themselves. They’re younger, hungrier and often have longer growth runways. But with narrower product lines and more concentrated customer bases, their success hinges on expanding sales, finding new markets and scaling operations. This urgency often comes at a cost: frequent capital raisings or heavy borrowing to fuel growth.

This combination of ambition matched with fragility makes small caps a paradox. They can be the breeding ground of tomorrow’s market leaders or the cautionary tales of investors who mistimed the cycle.

Understanding Australian small cap companies

Because smaller companies are often in a phase of rapid growth, their reliance on external capital is a defining feature of their story. But capital raisings can often lead to a fall in the value of existing shares. This is why small cap companies tend to rely more heavily on debt markets to fund expansion, making them particularly sensitive to shifts in economic conditions, interest rates and investor sentiment.

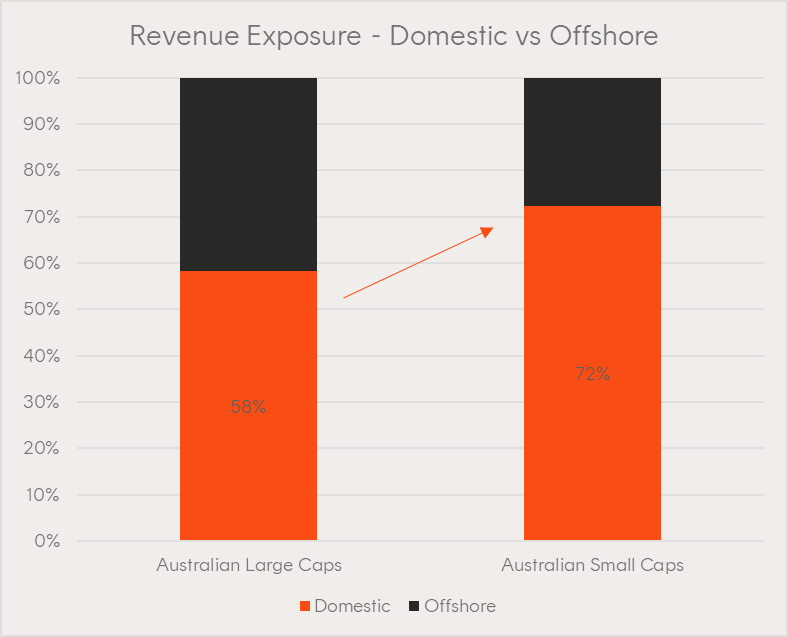

Australian small caps also tend to be more levered to the domestic economy compared to their large cap peers which typically generate significant revenue offshore. This local focus makes small cap companies particularly appealing for investors looking to gain more direct exposure to the Australian economic cycle and diversify away from the major banks and resource companies that have a high concentration in the broader Australian market.

Source: Morningstar as at February 2025. Domestic Revenue Exposure represented by Morningstar’s Australasia Region Segment.. Australian Small Caps refers to the S&P/ASX Small Ordinaries Index. Australian Large Caps refers to the S&P/ASX 100 Index

Given their dependence on debt funding and sensitivity to the domestic economy, Australian small caps tend to perform particularly well when interest rates are low or government stimulus is abundant. In these periods, smaller companies will often benefit disproportionately relative to their larger counterparts.

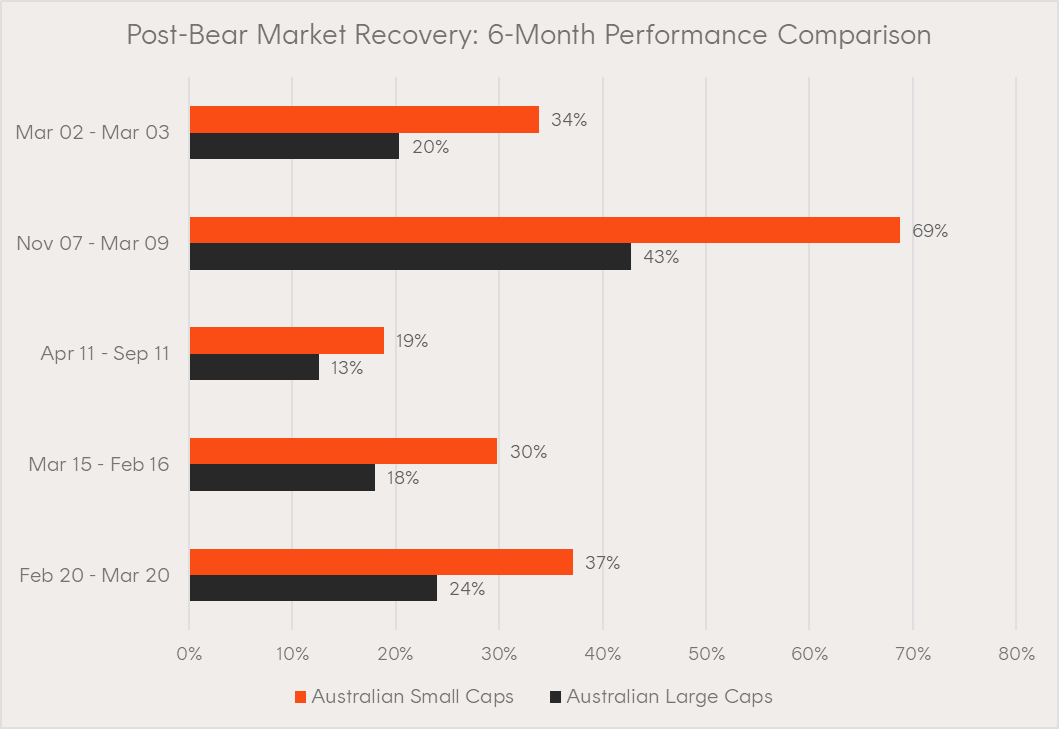

Moreover, small caps have historically shown a tendency to perform strongly in periods following bear markets – recovery periods that typically coincide with a shift toward more accommodative economic policy. The chart below illustrates how small cap companies have historically tended to outperform large caps in these periods following bear market troughs.

Source: Bloomberg. A bear market is defined as a 20% drawdown in the S&P/ASX 200 Index. Australian Small Caps refers to the S&P/ASX Small Ordinaries Accumulation Index. Australian Large Caps refers to the S&P/ASX 100 Total Return Index. Past performance is not indicative of future performance.

Two structural challenges facing Australian small caps

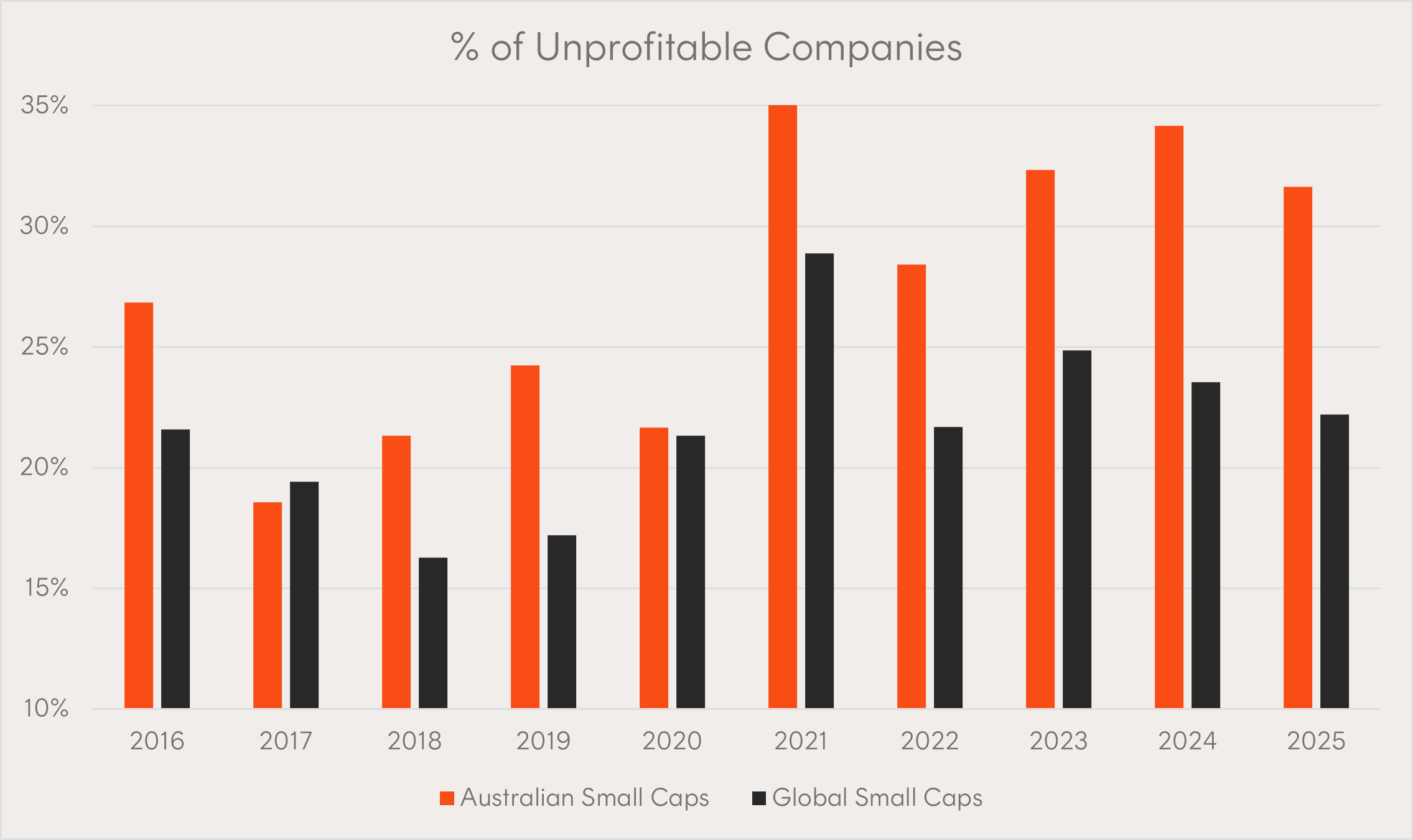

One of the most significant challenges is the composition of the Australian small cap universe, which is largely skewed towards more speculative industries like mining, energy exploration and resource development. Listing on the ASX can enable early-stage firms with unproven, and often unprofitable, business models to raise capital. While this regulatory landscape can facilitate innovation, it also introduces considerable downside risk potential for investors who are not discerning in their stock selection.

Consequently, the Australian small cap universe typically contains a much higher proportion of unprofitable companies compared to global peers. As the chart below illustrates, as many as one third of Australia’s small cap companies have been loss-making in recent years, compared to a global average of closer to 20%.

Source: Bloomberg. Global Small Caps refers to MSCI World Small Cap Index. Australian Small Caps refers to S&P/ASX Small Ordinaries Index.

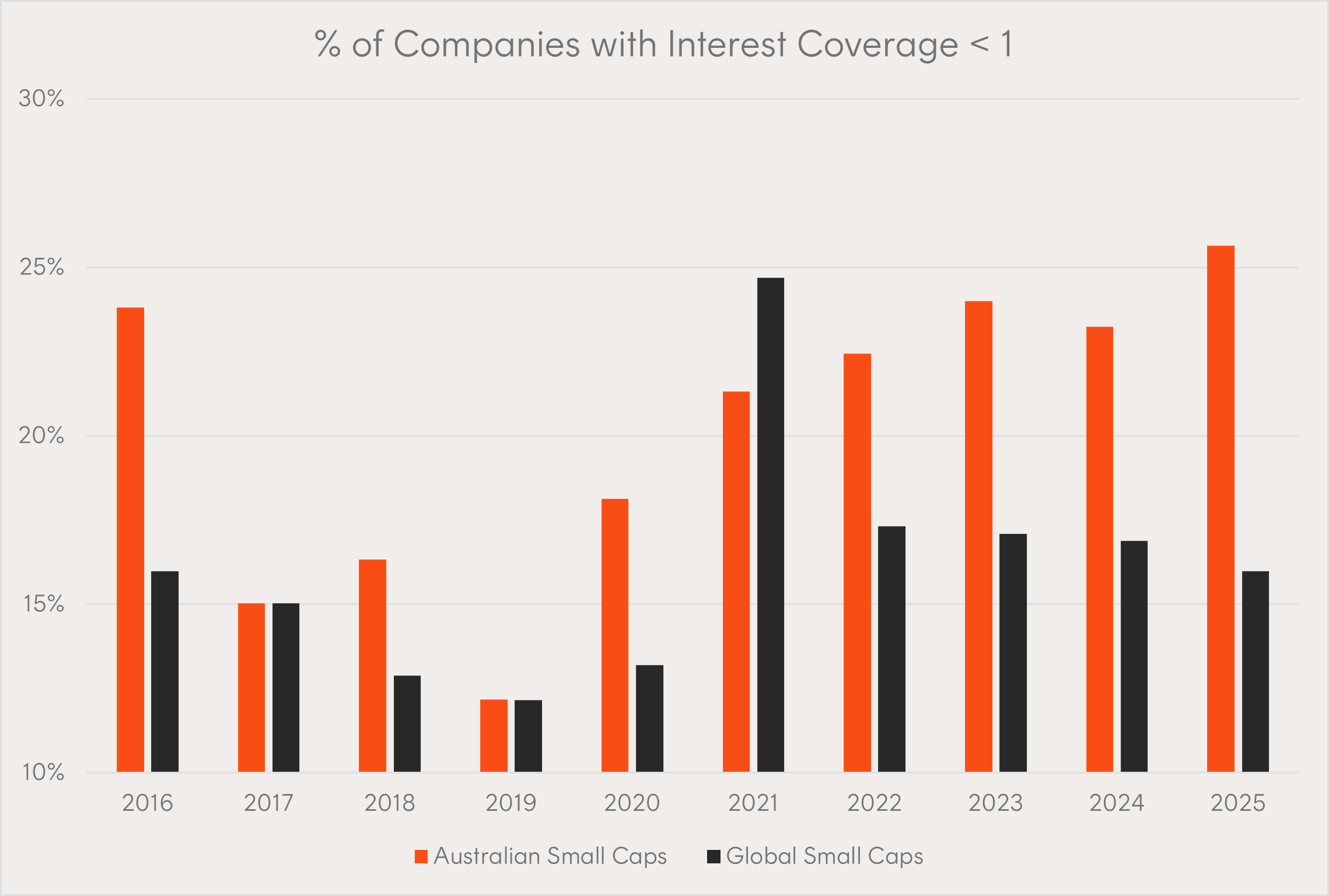

In addition, many early-stage companies may be a long way from turning a steady profit, which make them at greater risk of insolvency. One way to measure this risk is the Interest Coverage Ratio, a gauge of a company’s ability to meet interest payments from its earnings.

The chart below highlights the proportion of Australian small cap companies with an Interest Coverage Ratio below 1 – indicating they have not generated sufficient profit to cover their interest expenses over the past 12 months. Recent data shows that up to 26% of small cap companies fall into this category, highlighting the financial fragility for a significant portion of Australia’s small cap segment.

Source: Bloomberg. Global Small Caps refers to MSCI World Small Cap Index. Australian Small Caps refers to S&P/ASX Small Ordinaries Index.

These characteristics highlight the need for rigorous screening when constructing a portfolio of small cap stocks in Australia. Without doing so, investors may inadvertently overexpose themselves to more speculative and less fundamentally sound companies.

The smarter approach to small cap investing

Betashares Australian Small Companies Select ETF (ASX: SMLL), which aims to track the Nasdaq Australia Small Cap Select Index (before fees and expenses), has been designed to provide investors with exposure to the desirable attributes associated with small cap investing while addressing certain structural challenges inherent in the Australian small cap market.

SMLL’s portfolio generally holds between 60 and 90 stocks. While this is fewer than traditional small cap benchmarks, it remains broadly diversified. SMLL’s index uses screens that aim to identify companies with positive earnings and a strong ability to service debt. SMLL also includes a valuation discipline which means that it seeks to find quality companies that are trading at a reasonable price.

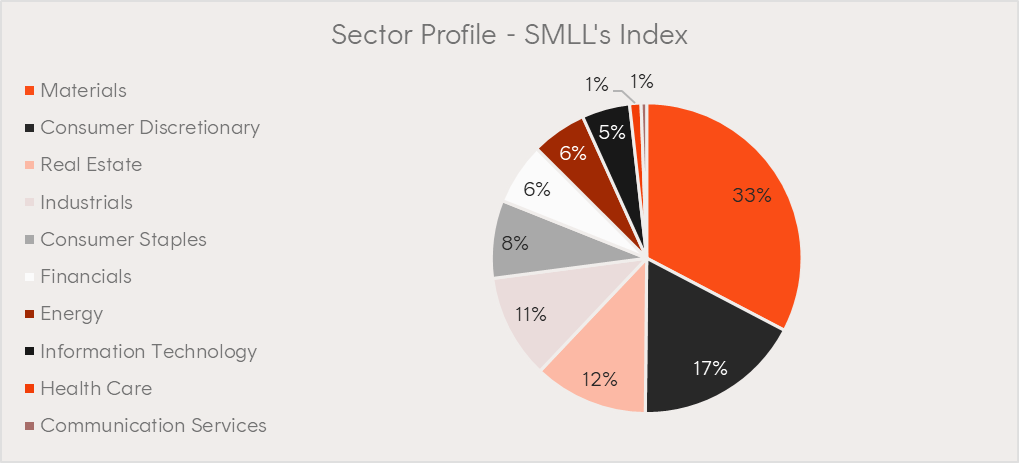

Which sectors drive the fund’s portfolio?

The portfolio’s current sector allocation includes notable overweights to Consumer Discretionary and Consumer Staples, which are typically comprised of manufacturers and retailers that exhibit positive earnings, robust margins and operational stability.

The strategy also retains an overweight exposure to the Materials sector, a key component of the Australian small cap market. However, unlike the broader small cap universe that includes speculative mining and exploration firms, SMLL favours producers, such as mid-tier gold miners, that have more established operations and stronger cash flows.

Source: Morningstar. Data as at 31 May 2025. SMLL’s Index is the Nasdaq Australia Small Cap Select Index.

Where can a small cap ETF fit in your portfolio?

The Australian small cap market presents both opportunities and challenges. While it offers meaningful growth potential and portfolio diversification, it is also burdened by structural challenges that can undermine long-term returns for investors unless you do your homework.

SMLL can be used as a long-term holding to diversify or complement an Australian equity holding, or as a tactical allocation when market conditions are favourable.

Over the past five years, SMLL’s index has returned 9.1% p.a.* (as at 29 August 2025) and 1.19% more than the benchmark S&P/ASX Small Ordinaries Index over that same time frame.

3 topics

1 stock mentioned

1 fund mentioned