These 8 ASX stocks were just backed by Goldman Sachs at its Emerging Leaders Conference

The sessions observed some key themes including peaking goods inflation, sticky services/wages inflation, selective M&A opportunities and Australia holding up better-than-expected relative to other developed economies.

In this piece, we’ll take a look at Goldman’s fundamental outlook, price target and ratings for the 10 Emerging Leaders under its coverage – 8 of which are buy rated.

Emerging Leaders and where they sit

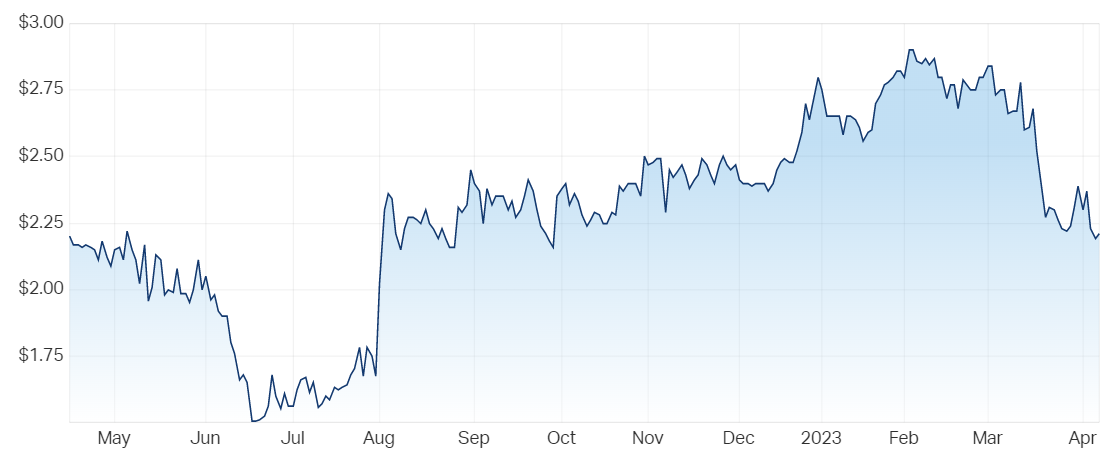

Accent Group (ASX: AX1)

- “We are BUY rated on AX1 and believe the market is underestimating the full earnings potential of the business with upside from new stores and distributed brand share gains.”

- “The business has a strong store roll-out opportunity, with incremental store opportunities to come from key footwear banners (Skechers, Platypus) and growth in apparel banners (Nude Lucy, Glue, Stylerunner).”

- “AX1 continues to perform well with sales up 16% on pcp for the first 7 weeks of the year.”

- BUY rated with a $3.10 target price

%20Share%20Price%20-%20Market%20Index.png)

Accent Group 12-month price chart (Source: Market Index)

APM Human Services International (ASX: APM)

- “We believe the market is under-appreciating APM’s ability to generate sustainable earnings growth, with our 15% EPS CAGR (FY22-25E).”

- APM operates via long-term government programs with a strong track record of re-winning work versus other contractor models which are “widely considered to have low quality earnings” via short-term, cyclical projects

- BUY rated with a $4.10 target price

%20Share%20Price%20-%20Market%20Index.png)

APM 12-month price chart (Source: Market Index)

#Data3 (ASX: DTL)

- Data#3 results have observed some softening in IT demand within small-medium customers and retail verticals but says its exposure to these markets is relatively low (less than 5%)

- “Data#3’s revenue mix has shifted to large integration projects delayed during COVID, providing DTL strong visibility into its pipeline while also supporting margins.”

- “Data#3 expects to be FCF positive for FY23, and is considering options for its excess cash as working capital unwinds (such as a special dividend).”

- BUY rated with a $9.20 target price

%20Share%20Price%20-%20Market%20Index.png)

Data#3 12-month price chart (Source: Market Index)

Johns Lyng Group (ASX: JLG)

Johns Lyng shares ran almost 500% between March 2020 lows and April 2022 highs. The run came to an abrupt end after CEO Scott Didier and COO Lindsay Barber both sold 1,000,000 shares in the company on 20 May 2022. The stock’s been on a pretty wild ride ever since.

- “We view JLG as a defensive growth business with optionality to further build its annuity-style earnings streams. We forecast a +21% EBITDA CAGR (FY22-25E).”

- JLG estimates it has a 7-8% share of the Australian insurance building and restoration services market, with an opportunity to win a growing share of insurance work

- Management has “set the blueprint to replicate the Australian growth strategy” in the US, where “organic growth will be supplemented by M&A.”

- BUY rated with a $9.25 target price

%20Share%20Price%20-%20Market%20Index.png)

Johns Lyng 12-month price chart (Source: Market Index)

Lifestyle Communities (ASX: LIC)

Lifestyle Communities experienced a post-earnings fallout – the half-year result was released on 14 February and the stock derated -17.6% by 23 March.

- “The long-term outlook for LIC is very positive — we believe outperformance of the stock will be driven by: (1) a step up in the pace of land acquisitions … (2) structural growth in demand for land lease as the sector increases its penetration among retirees; (3) fundamental valuation support for cap rates.”

- “LIC’s affordable price point (less than 80% of the median house price) continues to facilitate a compelling equity release opportunity for new residents despite a softer housing market.”

- “Management reiterated demand is still strong, especially for finished stock, with no need to lower pricing, or offer incentives”

- BUY rated with a $27.15 target price

%20Share%20Price%20-%20Market%20Index.png)

Lifestyle Communities 12-month price chart (Source: Market Index)

Objective Corporation (ASX: OCL)

- “OCL is transitioning its business model from one-off perpetual licences and services revenue to recurring subscription revenue over time and now derives ~3/4 of revenue from subscriptions (FY22).”

- “OCL noted that activity has been strong since January, notwithstanding some softness in federal government procurement.”

- Management flagged short-term headwinds to margins following decisions to reduce perpetual right-to-use revenue and ramping up travel expenditure. A turnaround is expected in FY24 as costs ease and OCL raises prices (without gouging customers)

- BUY rated with $14.80 target price

%20Share%20Price%20-%20Market%20Index.png)

Objective Corp 12-month price chart (Source: Market Index)

Qualitas (ASX: QAL)

Qualitas is viewed as a beneficiary of the “continuing shift to non-bank lenders in Australia.” The company has a less than 1% market share of the $400bn Australian Commercial Real Estate debt market, where non-banks hold an approximately 10% market share compared to the 50% in the US and Europe.

- “We believe Australia will continue to converge to these levels as a more sophisticated non-bank market develops in Australia.”

- “We view QAL as well-positioned in the context of elevated interest rates and economic uncertainty given the de-risked nature of senior debt versus equity, and the floating rate exposure from QAL’s loans.”

- "Higher base rates and widening credit spreads (~50-100bps) are seeing nominal returns improve across QAL’s private credit platform.”

- BUY rated with $3.80 target price

%20Share%20Price%20-%20Market%20Index.png)

Qualitas 12-month price chart (Source: Market Index)

Siteminder (ASX: SDR)

- “The recovery of global hotel bookings has also continued, with SiteMinder’s World Hotel Index remaining above pre-covid levels, with upside expected from the reopening of China offset by strong 2022 comps.”

- “SiteMinder sees a considerable opportunity in the coming years to extend its core channel manager product into adjacent verticals,” such as revenue management and business intelligence

- NEUTRAL rated with a $4.30 target price

%20Share%20Price%20-%20Market%20Index.png)

Siteminder 12-month price chart (Source: Market Index)

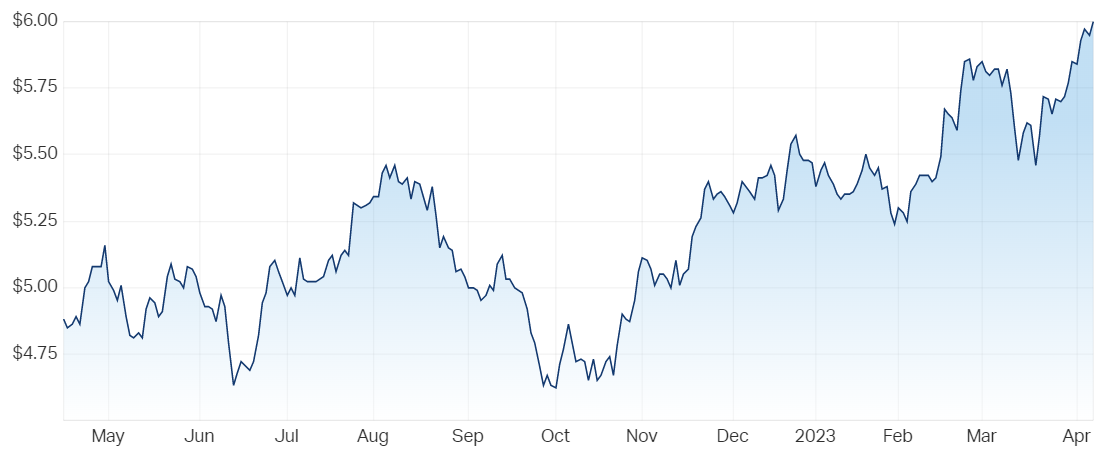

Steadfast Group (ASX: SDF)

Steadfast is the largest general insurance broker network in Australia with a focus towards commercial insurance solutions for SME clients. The stock is up 11.5% year-to-date, in-line with the strength behind the broader insurance sector and names like QBE Insurance, IAG Insurance and PSC Insurance Group.

- “SDF has a pipeline of $326m worth of acquisitions so could well exceed their $220m budget for FY23. In the coming year, SDF expects a further $300m in pipeline acquisitions.”

- “SDF flagged that they continue to review the potential for international expansion which includes their SCTP software.”

- NEUTRAL rated with a $5.74 target price

%20Share%20Price%20-%20Market%20Index.png)

Steadfast 12-month price chart (Source: Market Index)

Temple & Webster shares copped a 27% haircut on the day of its half-year results on 14 February. In summary, revenue was down 12%, profits tumbled 46.7% and sales for the first five weeks of 2H23 were down 7%. Still, Goldman thinks there’ll be better days ahead.

- “We believe the market is too cautious on the medium term revenue outlook, and expect the business to return to double digit revenue growth in FY24.”

- “We think TPW is well positioned to continue to grow market share, particularly given a long tail of small online retailers.”

- “We think TPW is best placed to be a winner in a category that favours scale players, requires a specialist approach to e-commerce and logistics, and has high barriers to entry vs. other categories.”

- BUY rated with a $6.50 target price

%20Share%20Price%20-%20Market%20Index.png)

Temple & Webster 12-month price chart (Source: Market Index)

This article was first published for Market Index on Tuesday, 11 April 2023.

2 topics

9 stocks mentioned