Three interesting charts that caught my eye

Firetrail Investments

March 2020 will live long in the memory in investors’ minds. The unprecedented shutdown of developed and emerging market economies to halt the spread of coronavirus has wide-ranging consequences for global financial markets. Some of the ramifications of economy-wide shutdowns are now being seen in the incoming economic data, while there have been some very interesting developments in the valuations of several asset classes.

Reflecting the unusual time that we live in, here are three charts that caught my eye last week.

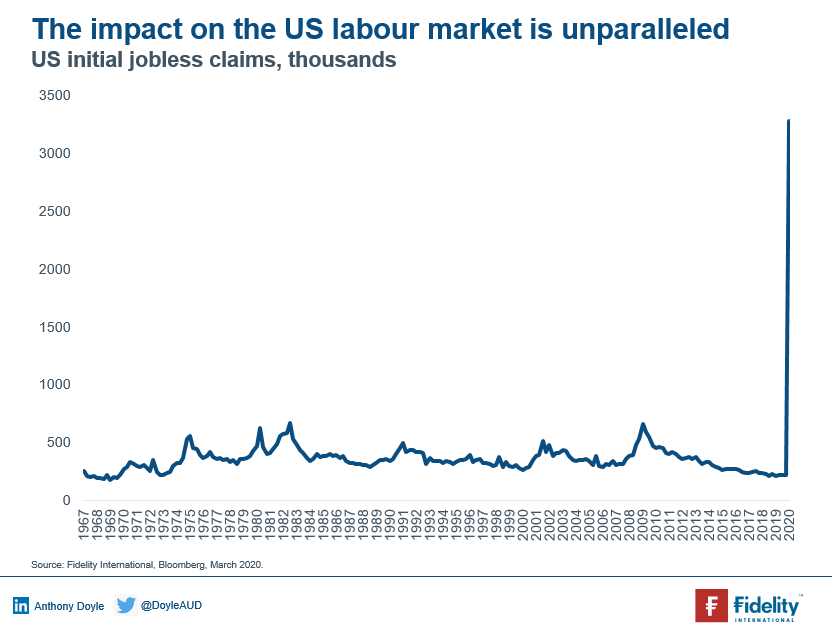

Jobless claims in the US are a measure of how many people are out of work at a given time. Initial jobless claims represent new claimants for unemployment benefits, and last week’s data was truly frightening. A record 3.28 million Americans applied for unemployment benefits, surpassing anything seen on record by a huge margin. There is even some speculation that this number underrepresents the true amount of new unemployment claims, as many states in the US have reported their systems for processing claims have crashed under the weight of unprecedented volumes. Research was also released by the Federal Reserve Bank of St. Louis suggesting that the US unemployment rate could rise from the current 50-year low of 3.5% to 32.1% in Q2. Astonishing.

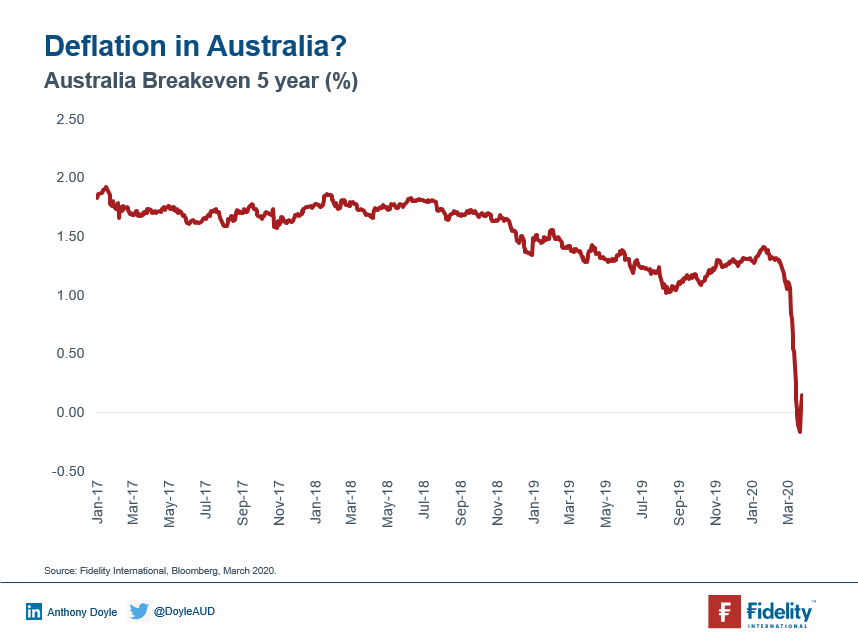

The Reserve Bank of Australia’s cash rate has hit the effective lower bound of 0.25%, it has embarked upon quantitative easing for the first time, and it has put in place a term funding facility for the banking system to improve the flow of credit to small and medium-sized businesses. Additionally, the Australian Federal Government has already passed $80 billion worth of fiscal stimulus. How did the bond market react to these measures? It began to price in deflation. The Australian 5-year breakeven rate fell to a record low of -0.16% and has since risen to 0.15%. If the bond market is right, then this suggests that interest rates will remain at their record low for the foreseeable future.

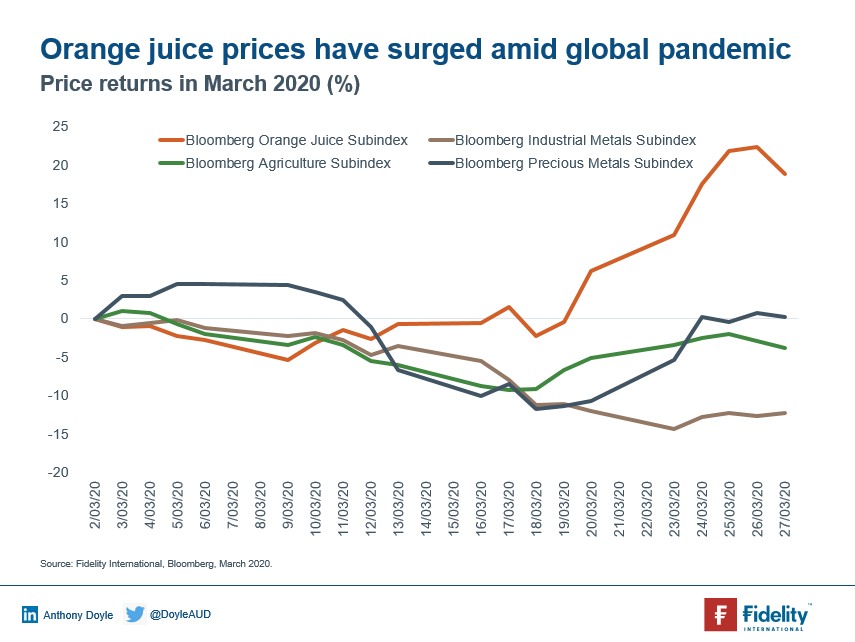

Finally, it looks like consumers fearful of contracting coronavirus have been trying to boost their immune systems by loading up on orange juice. Frozen concentrated orange juice (made famous in the 1983 film Trading Places starring Eddie Murphy and Dan Aykroyd) is the best performing of all commodities in March, up 18.9%. Whilst there is no shortage of orange juice, people have been rushing to buy it regardless. Longer-term, the outlook for orange juice isn’t as bright, with global demand declining in recent years due to consumers shifting away from sugary drinks to healthier alternatives.

Want more charts?

Get notified of my latest chart of the week post on Livewire by hitting the 'follow' button below.

3 topics

Expertise