Three key lessons from 2022 (and how it will boost returns in 2023)

It is still too early to tell if 2022 will end with a bang or a thud in financial markets. But the shared pain across traditional fixed income and equity assets has resulted in the worst year for diversified portfolios since the Great Depression.

Now, as then, there are reflections to be had and lessons to be learned. In this wire, I share three key lessons from 2022, and what they may mean for portfolios in 2023.

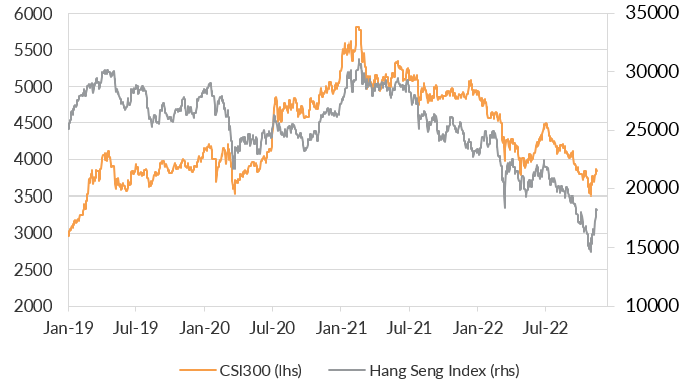

Lesson 1: Don’t write off China.

The background: China’s persistence with zero-COVID policies, its stance on the Ukraine war and the National Congress in November have left China’s equity market seemingly un-investable for developed market capital.

With a 32% decline in A-shares (Yuan denominated) and a 53% decline in H-shares (Hong Kong dollar-denominated), Western capital has moved to write off the world's second-largest economy.

The lesson: In recent months, China has shown itself committed to domestic economic growth. It has pivoted its zero-COVID policy to something more dynamic. President Xi has flown abroad. Foreign politicians have entered. Mobility is opening up between the Mainland and Hong Kong. And China’s soft diplomacy has reasserted itself at the recent G20.

The implication for 2023: China has already been in recession for most of 2022. Recent monetary, fiscal and pandemic policy has been directed at ending that recession. We expect further support for China’s private sector and ongoing (albeit gradual) reopening. China’s equity markets will rapidly move from pricing a recession that has already happened, to a reopening boost to demand through 2023.

Chart 1: China equities have discounted a LOT of economic pessimism

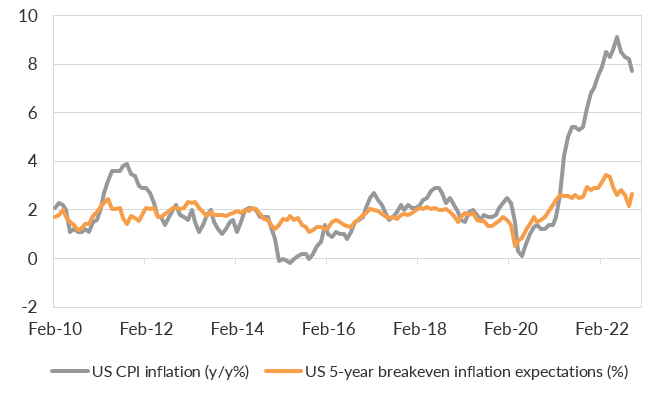

Lesson 2: It is OK to (sometimes) fight the Fed.

The background: The Fed’s commitment to inflation being “transitory” in early 2022 left it behind the curve when it came to fighting inflation. The delay in tightening early meant the Fed Funds rate was ratcheted higher at an eye-watering speed in subsequent months as the Fed fought for credibility. The Fed is now committed to a higher terminal rate for a longer period.

The lesson: The Fed’s commitment to rate hikes until inflation falls back to its target is neither credible nor necessary. Inflation expectations are well anchored, wages are not spiralling higher and now actual inflation is clearly decelerating.

The economy has slowed and the US is suffering a housing recession. Just as it was sensible to fight the Fed’s commitment to not hiking rates in early 2022, it is now sensible to fight the Fed’s commitment to continue hiking through early 2023.

The implication for 2023: We expect the data will show a compelling need to slow the pace of rate hikes in December – probably to 0.25% - before pausing from February or March. That will leave the terminal Fed Funds rate lower than markets expect, and extend the economic cycle through 2023. The consensus expectation for an early 2023 recession will probably be confounded. And that means the equity rally that began with softer October CPI could have legs through 2023.

Chart 1: Slowing inflation and contained inflation expectations will force the Fed to pause.

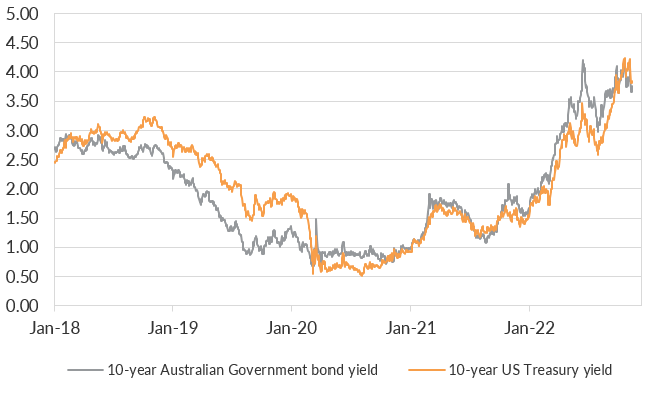

Lesson 3: Be careful with proxy hedges

The background: In late 2021, US inflation was heating up. From just 1.4% in January 2021, headline CPI surged to 7.5% a year later before peaking at 9.1% in June 2022. Through end-2021 and early 2022, gold and bitcoin were considered a proxy hedge for inflation by a broad consensus.

The lesson: Gold rallied early in 2022, but the rampant move higher in US real Treasury yields led to a more than 20% peak-to-trough drawdown in the price of gold. And, it turned out, Bitcoin was not a proxy hedge for inflation.

The implication for 2023: The risk of a Fed policy error leading to global recession is the critical risk for 2023. For many investors, the best downside risk hedge is to hold some duration through high-quality government bonds. We think US and Australian government bonds will be a very important part of diversified portfolios in 2023 – providing both a downside risk hedge and reasonable returns.

Chart 3: US and Australian government bond yields offer returns and downside protection in 2023.

Clear lessons with actionable implications.

Financial markets in 2022 have been challenging for investors. Now is an opportunity to reflect on potential lessons. The three lessons in this wire – don’t write off China, it is ok to (sometimes) fight the fed, and be careful with proxy hedges – have implications for portfolios through 2023.

We think there is a growing chance that US and Chinese equities will offer upside surprises into 2023 despite the negative consensus. At the same time, government bonds provide an attractive forward-looking return and crucial downside risk hedging. We expect acting on these could provide some welcome relief from the challenges of 2022.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

3 topics