Three reasons shorting can benefit your investment returns

Most investors place their bets on share prices rising. There is a lot less focus placed on shorting, the betting that share prices will decline. Shorting is done by borrowing shares for a small fee, selling them on the market, and then buying those shares back at a later date. With shorting a profit is made if the share price declines during your holding period.

Currently in the Australian equity market just 2% of the bets being made are short bets. To put this in context the dollar value of Australian shorting is $29b. A big number, but tiny when compared with the ASX200 market cap value of $1.86 trillion.

Looking at the US equity market, the level of shorts is 6% of the market. In this context of global developed equity markets, Australia is a relatively underpenetrated shorting market. Firetrail Investments believe that there is not only significant alpha that can be found by shorting stocks in Australia, but also that there are plenty of opportunities for this shorting.

1. Shorting opportunities are abundant

Even in strong years for the Australian equity market, there are many stocks that fall. The ASX200 price index rose 8.3% in the year to 30 June 2018 - not a bad return! But as can be seen in the table below – the variation of returns across the market was significant:

Source: Firetrail, Bloomberg

In the year to June 2018 there were 95 stocks that rose more than the market’s 8.3% return and 127 stocks that rose in absolute terms. But what is most interesting is those 73 stocks that fell. These are the stocks that would have generated you a return from shorting.

Understanding the reasons for these stocks falling is the first step in understanding how to pick stocks to short.

2. There are risks, but shorting can also be rewarding

Shorting can be risky, and it is by no means a “set and forget” strategy. Losses are unlimited, and your maximum upside is 100%. So why even bother shorting?

The reason shorting can be attractive is that whilst over long periods of time most stocks and equity markets rise, in the short term the story is very different. Changes in expectations will drive changes in share prices in the short term. We believe there are two catalysts that cause stocks to fall in the short term:

- The first reason is that current earnings expectations are not met. An example of this is Asaleo Care (AHY), a tissue manufacturer, which fell 49% during the month of July 2018. The company released a trading update to the market which pointed out rising input costs and increasing competition were affecting profitability. Average 2018 broker earnings forecasts for the stock fell 42% after this announcement.

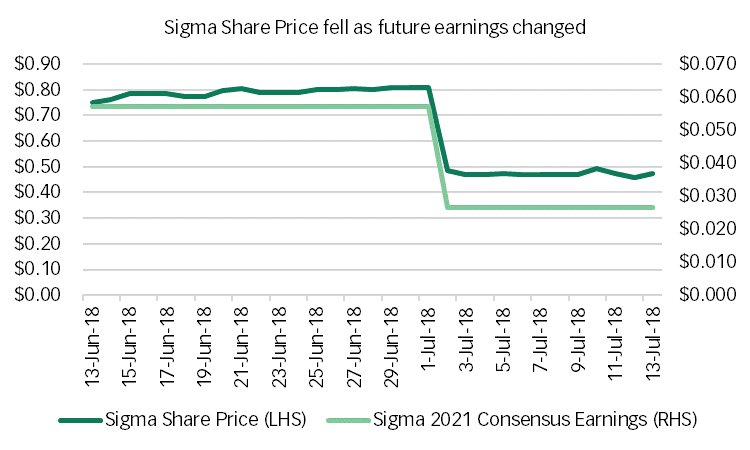

- Secondly, future earnings expectations may be downgraded. This can typically be from a change in market share, a new competitor entering an industry, or loss of a contract. Whilst earnings expectations in the short term may be met, future earnings estimates will be reduced. In our experience share prices typically capitalise this future loss immediately. Sigma Healthcare (SIG), a distributor to Australian pharmacies, announced in July that it had lost its largest customer Chemist Warehouse. This resulted in no change in the current year’s earnings – but a whopping 53% earnings downgrade for FY21. The stock fell 40% on the day this was announced.

Source: Firetrail, Factset

The way to pick these catalysts is through fundamental research of individual companies and an understanding of the industries that they operate in. Once the earnings catalyst is identified, timing is then critical. If we think a stock will downgrade current earnings when they announce earnings in August, we will be short for the August announcement. Holding on to short positions for long periods of time increases your risk of positive share price movement - for example from a takeover.

3. Shorting requires a different mind-set

As opposed to investing long, we believe valuation is not a great indicator for shorting opportunities. You need to put valuation aside when you are shorting.

Just because a stock might screen “expensive”, it doesn’t mean it is a great short opportunity. Domino’s Pizza (DMP) was arguably expensive in 2013 when it was trading at a one year forward Price to Earnings ratio of 25x. But 3 years later it was at a 55x Price to Earnings ratio. Domino’s Pizza did eventually fall, but it was due to current earnings expectations not being met.

Rather than focusing on valuation, we believe the focus should be on earnings expectations. If our research suggests that earnings expectations, either current or future, will not be met, the stock can be a short candidate.

Summary: Shorting can be a valuable addition to your portfolio

Shorting opportunities are abundant – every year there are stocks that fall, despite the return of the overall market. By researching and identifying the catalysts for these stock declines, shorting can be a significant contributor to alpha in your portfolio. The key is to understand the risks versus the rewards when shorting and acknowledging that shorting is very different to investing long!

For further insights from the team at website

2 topics